Ukraine in January-October this year reduced imports of aluminum ores and concentrate (bauxite) in quantity terms by 2.3% compared to the same period last year, to 4.189 million tonnes.

According to statistics released by the State Customs Service, during this period, bauxite imports in monetary terms decreased by 0.1%, to $190.706 million.

At the same time, the products were imported mainly from Guinea (60.74% of supplies in monetary terms), Brazil (21.1%) and Ghana (16.18%).

In January-October 2021, Ukraine re-exported 271 tonnes of bauxite for $65,000 to Belarus (52.31%), Poland (43.08%) and Germany (4.62%), while in ten months of 2020, some 184 tonnes of bauxite were re-exported to Poland for $29,000.

Primary registrations of used cars imported from abroad in Ukraine in October exceeded 56,100 vehicles, which is 50% more than in the same month of 2020, and 3% more than in September this year, according to the Ukrautoprom association.“The larger number of registrations of imported used cars was recorded only in February 2019. Then, as now, the surge in registrations was associated with the end of the period of preferential legalization of cars with euro-number plates,” the association said on the website.As reported, preferential conditions for customs clearance will be valid until November 10, 2021 – 180 days from the date of their entry into force. For combatants, the deadline is 270 days, until February 8, 2022.According to the report, the share of used foreign cars of the total registration of passenger cars in October increased to 87.7%, i.e. new cars were registered 85.7% less.The most popular brand among the customs cleared used vehicles was Volkswagen with 10,500 registrations, Renault was second with 4,599 used cars, the third result is for Ford – 4,322 vehicles. Opel followed it in the list, the used cars of this brand were chosen by 4,290 Ukrainians, and Skoda closes the top five with 4,015 cars.In total, in January-October 2021, Ukrainian license plates received for 411,700 imported used cars – 47% more than a year earlier and almost five times more than the number of new passenger cars.In 2020, 353,400 used foreign passenger cars were registered in Ukraine, which is 4.1 times more than sales of new cars (85,500 units).

The volume of limestone imports to Ukraine in January-September 2021 increased by 21% compared to the same period last year and amounted to 107,000 tonnes, according to a study by the Ukrainian Lime Industry Association.

“After minimum supplies in 2014, there was a moderate increase in imports of limestone over the next years. 2020 was marked by a significant acceleration in the growth trend: in 12 months, imports of limestone amounted to 123,000 tonnes, which is 45% more than the previous year. 2021 continued the trend: in January-September, 107,000 tonnes were imported, which is 21% more than the last year’s level,” the association said.

According to it, for the first nine months of this year in the structure of imports, 59% of the supply of limestone falls on Russia, followed by Belarus (17%), Slovakia (12%), Poland (4%) and Moldova (4%). Over the period, the largest importer was the Russian company FELS (32%).

As indicated in the study, manufacturers of construction materials remain the main consumer of imported limestone starting from 2020 (43%), the second place is taken by the chemical industry (22%), and the third is the metallurgical industry (18%).

In terms of consumption among Ukrainian companies, the leaders are Entere Group (32% of all imports), Sumykhimprom (21%), small private enterprise Ideya (10%), and Dniprovsky Metallurgical Plant (8%).

The Ukrainian Lime Industry Association was established in December 2011. The initiators of the association were representatives of Ukrainian enterprises engaged in limestone mining and lime production, and providing services in the field of study and use of natural resources.

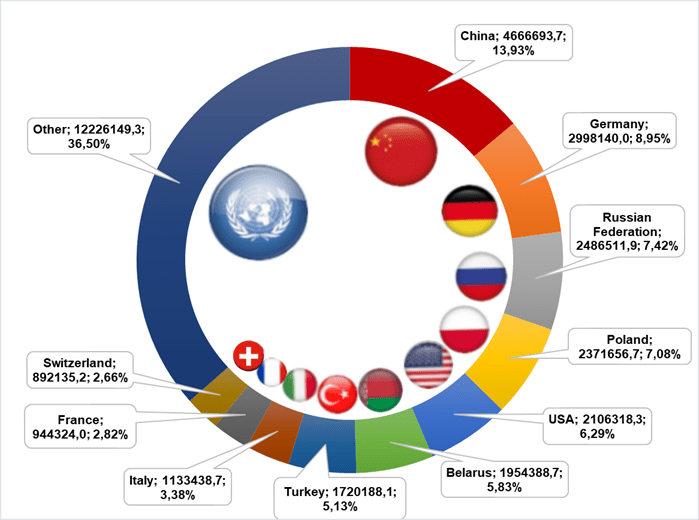

MAIN TRADE PARTNERS OF UKRAINE IN % FROM TOTAL VOLUME (IMPORT FROM OTHER COUNTRIES TO UKRAINE) JAN-JUNE 2021

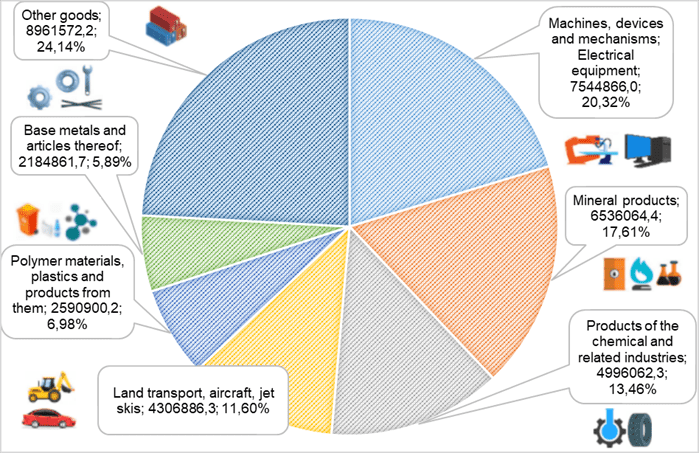

FOREIGN TRADE TURNOVER BY THE MOST IMPORTANT POSITIONS JAN-JULY 2021 (IMPORT)

The lack of production facilities in Ukraine and the import of its confectionery products into the country allows Mars Corporation to successfully conduct its business amid a crisis in the industry caused by the rise in prices for raw materials and energy resources, Chief Financial Officer (CFO) of Mars Ukraine LLC (Brovary, Kyiv region) Svitlana Hrukhal has said. “In the field of confectionery, we have everything under control. We import products, and this makes it possible to distribute the raw material base and production resources in several countries and thus compensate [for crises],” she told Interfax-Ukraine on the sidelines of the Ukrainian CFO Forum on Wednesday.

According to her, the key trend in the industry is the growth in demand in Ukraine and neighboring countries, which is most pronounced in the segment of chocolate and chewing gum. Hrukhal said that in order to meet this demand, it is necessary to increase production of confectionery products in the region, which is hindered by the rise in prices for raw materials, their shortage, as well as the lack of labor resources.

“If we talk about assessing the development of confectionery products specifically for Mars Corporation, then we have everything under control, and we hope to successfully close this year,” the company’s CFO said.

During the forum, she also said that in 2007 the company planned to build a plant in Boryspil district (Kyiv region) for production of animal feed, but due to unstable business conditions in Ukraine, it abandoned this idea. According to her, for large international companies, the presence of clear and understandable “rules of the game” in the country is a more important factor for investment than well-developed measures of state support for business.

Mars Ukraine LLC is a Ukrainian division of the large international confectionery company Mars. The company sells food and pet care products in Ukraine, produced in Russia and Hungary. Its major brands are Snickers, MARS, Twix, Bounty, Milky Way, M&M’s, Maltesers, Dove, Pedigree, Chappi, Whiskas, Kitekat, Sheba and others.