Ukrainian business has improved expectations of a slowdown in inflation over the next 12 months to 7.7% from 7.9% and the weakening of the hryvnia exchange rate to UAH 29.15/$1 from UAH 29.68/$1.

According to the results of a regular quarterly survey of business expectations of the country’s enterprises, posted on the NBU website, the business activity expectations index of enterprises increased compared to the previous quarter to 108.4% from 99.6%, returning to positive values.

According to the central bank, the improvement was mainly due to high estimates of the total sales of domestic products, the financial and economic condition of enterprises, investment costs for machinery, equipment and inventory, as well as investment costs for construction.

The survey shows that the respondents of all types of economic activity expect an improvement in their financial condition, with the exception of energy and water supply companies, which believe that their condition will not change in the next 12 months.

According to the report, the business expects an increase in product sales, including on the foreign market. Optimistic sentiments prevail in all sectors of the economy, except for energy and water supply.

For the sixth quarter in a row, the business is set to cut its employees, according to the survey. At the same time, respondents from trade and mining enterprises expect an increase in the number of their employees.

At the same time, the majority of companies (62.9%) plan to raise salaries for their employees over the next 12 months, and only 2% of companies are ready to cut salaries.

The survey shows that the share of companies planning to raise loans in Ukraine over the next 12 months dropped to 39.3% (in the previous quarter – 41.7%). The overwhelming majority of borrowers (78.7%) prefer to raise funds in the national currency. At the same time, the share of companies planning to take out loans abroad increased to 8.7% from 6.9%. It is indicated that high rates (55.9% of respondents) and excessive requirements for collateral (40.9%) were named the main obstacles to attracting new loans.

Some 687 enterprises from 22 regions of the country took part in the survey of business expectations. Among the respondents, 18.3% are processing industry companies, 16% – from wholesale trade, 15% – agriculture, 13.2% – transport and communications, 6.8% – mining industry, 4.8% – electricity and water supply, 4.5% – retail trade, 3.1% – construction, 18.2% – enterprises of other industries.

The hryvnia exchange rate, after weakening at the end of March, will strengthen in the second quarter due to increased sales of foreign currency by farmers before the start of field work, the majority of bankers polled by Interfax-Ukraine are inclined to this opinion.

“In the near future, the hryvnia will receive support from the sale of foreign currency by farmers for the spring field work, which is likely to lead to a slight strengthening of the national currency,” head of the analytical department of Alfa-Bank Oleksiy Blinov said.

In his opinion, the most probable range of exchange rate fluctuations in the second quarter is the range of UAH 27-28/$1, with a moderate vector of movement towards temporary strengthening.

Blinov added that, despite the uncertainty about the prospects for quarantine, the factor of their strengthening is unlikely to become the determining driver of the Ukrainian foreign exchange market in the second quarter.

His opinion is shared by the chief manager for macroeconomic analysis of Raiffeisen Bank Aval, Serhiy Kolodiy, who expects the seasonal strengthening of the hryvnia in the second quarter to UAH 27.0-27.5/$1 and predicts that, if possible, the NBU will try to replenish its reserves by buying out excess foreign currency supply.

“An additional positive background for the hryvnia can be created by active negotiations with the IMF regarding the first review of the current SBA program and the acceleration of the still rather slow rate of vaccination of the population,” the analyst noted.

A similar opinion was expressed by the director of the risk management department of Accordbank, Mykola Voitkiv, who predicts the revaluation of the hryvnia exchange rate with the prospect of strengthening to UAH 27.00/$1.

“Taking into account the continued high prices for the main commodity items of Ukrainian exports, the beginning of the sowing campaign (a seasonal factor in the increase in foreign currency sales on the part of agribusiness), the presence of interest in investing in government bonds from non-residents, I do not expect the rate to rise above UAH 28/$1,” he said.

In addition, the tightening of quarantine measures and low rates of vaccination in Ukraine limit the recovery of demand for currency both from the population (tourist trips) and business, especially in the field of trade, the banker noted.

Until the end of 2020, the hryvnia will remain at the level of UAH 28/$1 with further strengthening to UAH 27-27.5/$1 in the first half of 2021, Oleksandr Martynenko, the head of the ICU Investment Group’s corporate financial analysis division, says.

“At the end of this year, as we expect, the upper possible corridor of the range will be UAH 28.5/$1, but most likely, the hryvnia will be closer to the lower range of UAH 28/$1,” Martynenko said during an online conference.

Speaking about the forecast of the exchange rate for 2021, Martynenko noted expectations of UAH 27-27.5/$1 against the background of exporters’ activity in the first half of next year, however, in the future, the transition to a deficit in the payment account may put pressure on the exchange rate.

“So far, the hryvnia is showing a higher resilience than previously expected. Mainly due to the greater activity of exporters and favorable markets for iron ore and steel,” he explained.

ICU expects capital inflows to resume in 2021 through private foreign investment and official borrowing. In addition, capital outflow will stop next year, Martynenko said.

“Foreign exchange reserves will increase, somewhere, by $ 3 billion, to $ 31 billion in 2021. That is, for the first time since the crisis of 2008-2009, the reserves should exceed 100% according to the metrics of a sufficient amount, which the IMF calculates,” Martynenko added.

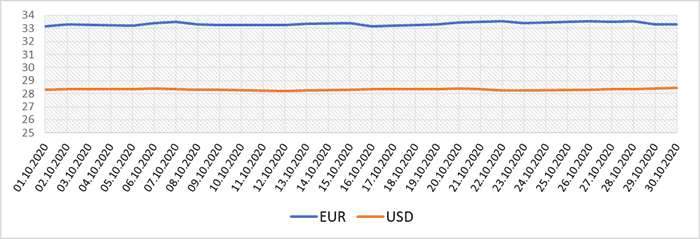

Quotes of interbank currency market of Ukraine (uah for 1 usd and 1 euro, in 01.10.2020-31.10.2020)

NBU

The volume of cash sales by the population in August 2020 exceeded the purchase volume by $151.2 million, according to the website of the National Bank of Ukraine (NBU).

According to the regulator, in August compared to July of this year, Ukrainians reduced the sale of foreign exchange by 6.2%, to $1.4 billion in equivalent, and also reduced the purchase by 1.8%, to $1.3 billion in equivalent.

In general, over the eight months of 2020, the volume of sales ($10.2 billion) of cash currency prevailed over the volume of purchases ($9 billion), the difference between which was $1.1 billion, according to the NBU data.

The National Bank of Ukraine (NBU) in April 2020 bought $723.3 million, while sold $44.5 million in the interbank foreign exchange market, while in March it spent $2.2 billion on supporting the hryvnia. According to the NBU, in the period from April 27 to April 30, the regulator bought $115.5 million at a single rate in the interbank market, which is four times more than a week earlier. This week, the central bank was only buying currency.

Most of all, in March the National Bank bought in the interbank market from April 6 to April 10 ($327.7 million), and only that week it sold foreign currency ($44.5 million).

In general, since the beginning of the year, the central bank bought $2.069 billion for reserves and sold $2.793 billion.

This week, the national currency rate in the interbank market strengthened and reached UAH 26.945/$1 on Wednesday, after which it slightly weakened on Thursday to UAH 26.955/$1. Starting from April 2, the hryvnia exchange rate did not fall below the level of UAH 27.5/$1, stabilizing after a rapid fall in March.