British-based Ferrexpo plc, which controls in Ukraine, in particular, Poltava and Yeristovo mining and processing plants (Poltava GOK and Yeristovo GOK), in January-July of this year, according to recent data, increased production of pellets by 2.9% compared to the same period last year, to 6.563 million tonnes.

A representative of the company informed Interfax-Ukraine that in July production of pellets amounted to 1 million tonnes.

According to an announcement on the London Stock Exchange, on September 17, 2021, a general meeting of shareholders will take place, the only issue at which is the re-election of Vitaliy Lisovenko to the company’s board of directors.

At the same time, it is explained that at the annual general meeting of the company on May 27, 2021, independent non-executive director Lisovenko did not receive the required number of votes for reappointment to the board of directors. In the event that the candidacy of the independent director is approved by a majority of votes of all voting shareholders at the second general meeting, the director will be re-elected before the next annual general meeting.

The second vote will take place at 11:00 on Friday, September 17, 2021, the shareholders can participate in person at the meeting or online.

As of August 23, 2021, the issued share capital of the company consisted of 588,624,142 ordinary shares with one vote each.

Ferrexpo in 2020 increased its total pellet production by 7% compared to 2019, to 11.218 million tonnes. Concentrate output increased by 5.9%, to 14 million tonnes.

Ferrexpo is an iron ore company with assets in Ukraine.

Ferrexpo owns 100% of shares in Poltava GOK, 100% in Yeristovo GOK and 99.9% in Belanovo GOK.

Ferrexpo mining company with assets in Ukraine in January-June 2021 received $661.426 million in net profit, which is 2.65 times higher than in 2020 ($249.908 million).

According to the half year report of the company posted on the London Stock Exchange on Wednesday, its revenue for the reporting period grew by 74.3%, to $1.353 billion from $775.831 million.

EBITDA jumped 2.47 times, to $868 million from $352 million in the first half of 2020.

Ferrexpo’s capital investment in the first half of this year was $142 million, up from $96 million in the first half of last year.

Interim dividends amounted to 39.6 cents per share (in the first half of 2020 they were 13.2 cents).

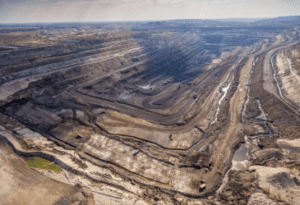

Ferrexpo, a mining company with assets in Ukraine, has launched a pilot project of a 5 MW solar battery complex at the operating industrial site of Poltava Mining and Processing Plant (Poltava GOK) without a feed-in tariff, the company said.

“This is a pilot project, after which the company will move to a full-scale replacement of conventional electricity with renewable energy from the sun as part of the program of decarbonization of manufactured products. Ferrexpo plans to build a power plant for the production of renewable energy with a capacity of 250-1,000 MW in the medium term,” the document says.

According to the report, almost 10,000 photovoltaic panel of Jinko Solar were used in the implemented project, the panels are installed on the dumps of the quarries in order to rationalize the use of the area.

The cost, according to the press release, was “several million U.S. dollars.” The company financed it without using any state compensation programs, subsidies, grants or a feed-in tariff.

“We have achieved a market return on this project without any feed-in tariffs from the state, which should be an example for other enterprises building renewable energy generation facilities,” Ferrexpo said.

According to chairman of the board of Poltava GOK Viktor Lotous, the solar plant will generate 6.5-7 million kWh of electricity per year and supply it for consumption by the group’s enterprises at the operating industrial site.

“The launch of its own generation reduces the negative consequences of monopolization of the energy market for Ferrexpo due to the restriction of competition and the risks of an increase in the tariff for electricity transmission,” he said.

Ferrexpo owns 100% of shares in Poltava GOK, 100% in Yeristovo GOK and 99.9% in Belanovo GOK.

In 2020, the company increased its net profit by 57.5%, to $ 635.3 million with an increase in revenue by 12.8%, to $ 1.700 billion. Last year, Ferrexpo increased its total production of pellets by 7%, to 11.22 million tonnes, concentrate output increased by 5.9%, to 14 million tonnes.

In the first half of this year, Ferrexpo cut pellet production by 0.6%, to 5.563 million tonnes, but total production, which also includes commercial concentrate, rose by 2%, to 5.712 million tonnes.

The Board of Directors of Ferrexpo with assets in Ukraine has approved the early repayment of its outstanding pre-export finance facility (PXF facility) the agreement on which was signed in 2018. As at December 31, 2020, the group had $257 million of debt drawn on its PXF facility.

The company said on Wednesday that repayment is to take place today, while earlier repayment was scheduled to take place quarterly between 2020 and 2022.

Early repayment of this facility reflects the strong performance of the group’s operations, including recent growth in both the group’s production volumes and product quality, following the recent completion of investments throughout the group’s operations, representing prudent cash management practice.

British-based Ferrexpo Plc, which in Ukraine, in particular, controls Poltava and Yeristovo ore mining and processing plants (Poltava GOK and Yeristovo GOK), intends to increase production of direct reduction (DR) pellets which are higher grade (67% Fe) in 2021.

In 2020, the group increased production of high grade (65% Fe or above) iron ore pellets to 99% of total output, up from 96% in 2019, according to an annual report released by the company on the London Stock Exchange on Wednesday.

In addition to this, the group has also started production of direct reduction (DR) pellets, which have a higher grade (67% Fe) and less impurities than other types of iron ore pellets.

“DR pellets are expected to represent the future of global steel production, as steelmakers transition to the production of carbon-free Green Steel, with DR pellets the primary source of virgin iron utilized in this process. The Group continues to develop its offering of DR pellets, production of which is possible through the Group’s existing production facilities, with two trial cargoes in 2020, and a further four trial cargoes planned for 2021,” the group said in the report.

The group also continues to utilize sunflower husks as a biofuel in its pelletiser, as a substitute for natural gas. This project has been in place since 2015, and usage has steadily increased as the Group optimizes the usage of husks in its pelletisers. In 2020, the Group successfully increased usage to 25% of the total energy consumed in the pelletiser (2019: 22%).

In 2020, the company increased its processing activities in the beneficiation plant increased by 4% to 30 million tonnes in 2020, following the implementation of new processing capacity in the second half of 2020.

Expectations for processing in 2021 are for a further increase as operations realize a full year at the plant’s newly expanded processing capacity. The Group is also progressing construction of its concentrate stockyard, press filtration and medium-and fine-crushing projects, which are collectively expected to provide additional operational flexibility in processing.

According to the report, the cost of production in 2020 decreased by 13%, to $41.5 per tonne from $47.8 per tonne. The decrease in costs was mainly attributable to falling commodity prices, in particular oil prices, lower electricity prices and the weakening of hryvnia.

The company’s gross debt as of December 31, 2020 was $266 million, up from $412 million at the end of 2019.

Ferrexpo sold pellets and concentrate in 2020, in particular, in Austria for $356.461 million (in 2019 for $331.964 million), in Germany for $145.311 (in 2019 for $168.875 million), in Japan for $78.786 million ($161.186 million), to China for $908.949 million ($347.892 million), to Turkey for $82.514 million ($62.717 million), to the United States for $34.236 million (there were no supplies in 2019).

The company’s annual meeting is scheduled for May 27, 2021.

Ferrexpo mining company with assets in Ukraine at the end of 2020 saw $635.292 million in net profit, which is 57.5% higher than in 2019 ($403.293 million).

According to the annual statements published by the company on the London Stock Exchange on Wednesday, its revenue grew by 12.8% last year, to $1.7 billion from $1.507 billion.

Underlying EBITDA rose by 46%, to $859 million (in 2019 it was $586 million). The company increased its net cash flow from operations by 45%, to $687 million ($473 million). Capital investment decreased 17%, to $206 million ($247 million).

Non-executive Chair of Ferrexpo Lucio Genovese said that the year 2020 was one that will be remembered as a difficult time for communities around the world. In response to the global COVID-19 pandemic, Ferrexpo acted swiftly, setting up a dedicated COVID-19 Response Fund in March 2020, approving $2.5 million for supporting local communities, in addition to taking significant measures to protect our workforce.

“Although COVID-19 caused disruption to global iron ore demand patterns, our central geographic location between Europe and Asia, coupled with flexibility our logistics capacity, enabled us to efficiently pivot towards China in 2020, as it quickly emerged from the pandemic with a strong growth focus on metals. The resultant rise in iron ore prices, coupled with the group’s increase in production and cost control, has driven the strong financial performance for the group in 2020,” he said.

Genovese said that through consistent investment and capital management, the group has once again been able to deliver strong financial performance, coupled with shareholder returns. Dividends paid during the 2020 calendar year grew by 26% to $195 million, after re-investing $206 million back into operations and $148 million of debt repayments.

“In light of the Group’s strong operational and financial performance, coupled with the group’s transition to a net cash position and continued healthy iron ore prices, the group is pleased to announce today a further special interim dividend of 39.6 U.S. cents, bringing total dividends paid in respect of 2020 to 72.6 U.S. cents (2019: 19.8 U.S. cents). The Board will consider, as appropriate, whether or not to propose a final dividend in respect of 2020, which if proposed will be put to the group’s AGM,” he said.

As reported, Ferrexpo in 2020 increased its total pellet production by 7% compared to 2019, to 11.218 million tonnes. Concentrate output grew by 5.9%, to 14 million tonnes.

Ferrexpo is an iron ore company with assets in Ukraine.

Ferrexpo owns 100% of shares in Poltava Mining, 100% in Yeristovo Mining and 99.9% in Belanovo Mining.

Ferrexpo is listed on the main floor of the London Stock Exchange.