On October 20, the National Bank of Ukraine fined IC Ekta (Kyiv) ODO for late provision of information and documents in full at the request of the regulator, according to the NBU website.

It is also noted that the insurance company must pay a fine (the amount is not specified – IF) within seven working days from the date of receipt of the relevant decision of the regulator to impose a fine.

The decision to apply the enforcement measure comes into force on October 21, 2022.

As reported, on August 19, 2022, the National Bank of Ukraine applied a measure of influence to the company in the form of a temporary suspension of licenses to carry out insurance activities for violation of mandatory financial standards (solvency, capital adequacy and risk of operations).

The regulator clarified that the violations were detected based on the results of the analysis of the reporting of the UK for the first quarter of 2022. The insurer had to eliminate the violations by September 20, 2022.

IC “EKTA” was registered in 2018 and specializes in risk insurance.

In the first half of this year, the insurer collected UAH 94.2 million of insurance payments and paid out UAH 6.5 million of insurance payments. The authorized capital is UAH 37 million.

Last week, net sales of dollars by the National Bank of Ukraine decreased extremely slightly – to $604.9 million from $608.5 million a week earlier, while in the previous two weeks they amounted to $862.0 million and $737.8 million, respectively.

According to the information of the National Bank on its website, from October 10 to October 14, it purchased $8.3 million, which corresponds to the usual purchase volumes during the war, while it sold $613.2 million compared to $615.7 million a week earlier.

In the cash market, the hryvnia strengthened by about UAH 0.3 over the week, to about UAH 40.7/$1, despite devaluation at the beginning of the week by about UAH 0.45 due to massive Russian shelling.

As reported, in September the volume of interventions of the National Bank amounted to $2.75 billion compared to $1.33 billion in August and $1.2 billion in July, but still remains much less than in June ($3.96 billion) and May ($3.3 billion). .4 billion).

In general, from the beginning of the year to October 14 inclusive, the NBU purchased $3 billion 142.2 million and EUR111.0 million on the market, and sold $20 billion 704.1 million and EUR1 billion 789.1 million.

Including since the beginning of the war, the purchase of foreign currency has reached $2 billion 485.3 million and EUR111.0 million, and the sale – $17 billion 933.9 million and EUR1 billion 789.1 million.

Ukraine’s international reserves as of October 1, 2022, according to the NBU, amounted to $23.93 billion (in equivalent), which is 5.9% less than at the beginning of September. At the same time, according to the new head of the NBU, Andriy Pyshny, as of October 7, they again exceeded $24 billion.

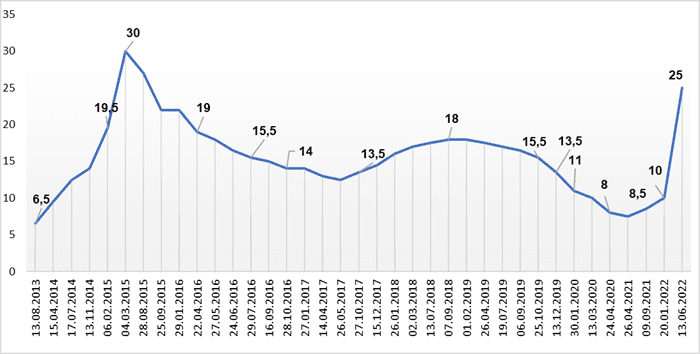

Dynamics of changes in discount rate of NBU

NBU , graphics of the Club of Experts

Bankers hope for a quick appointment of a new head of the National Bank of Ukraine (NBU) to replace Kirill Shevchenko, who announced his resignation on October 4, and expect the regulator to maintain a consistent course even after the new appointment.

This is evidenced by the bankers’ comments provided to the Interfax-Ukraine agency on Wednesday.

“I don’t think that any radical changes in the strategy of the National Bank should be expected in the conditions of war. The entire system of governing the country in the current situation is more or less subordinated to a single common goal. Under these conditions, one can hardly speak of full-fledged freedom of decision-making by individual In other words, I do not expect any “revolution”,” Ivan Svitek, head of the board of Unex Bank, said.

He believes that it is better not to delay the appointment of a new head, as this is important for the banking system and its stability, as well as for foreign partners and creditors.

“As a banker, shareholder and head of the bank, I, of course, would like to see a person from the system at the head of the NBU. He has fresh experience in a commercial bank, who understands all the complexities and problems of the system. I am sure that in addition to strategic state tasks, the regulator should remain a “friend “the market he regulates,” Switek said.

The banker added that the new head of the NBU, who has fresh practical experience in a commercial bank, is better able to provide banks, especially during the war, not only with instructions and requirements, but also with support.

“It is necessary to appoint a new head of the NBU as soon as possible, especially given the military situation in the country. But this is not a question, we will find out his name in the near future,” said Vladimir Mudry, head of OTP Bank.

According to him, if one of the members of the Shevchenko team becomes the new head, this will mean a certain continuity of the NBU policy and a greater degree of predictability of further decisions and tools to influence the market.

“Otherwise, in my opinion, it should be a macroeconomist, not only with experience in managing a commercial bank, but also with broader expertise, possibly in international organizations, government agencies, capable of bringing a new vector of development to the National Bank’s policy,” he added. banker.

Volodymyr the Wise stressed that in any case, the main thing today is the unity of all authorities, therefore the first task of the new head of the NBU is his soonest entry into the system of managing the country’s economy and financial market.

As reported, People’s Deputy Yaroslav Zheleznyak, First Deputy of the Parliamentary Committee on Finance, Tax and Customs Policy and People’s Deputy Oleksandr Dubilet claim that Andriy Pyshny will become the new head of the National Bank.

Previously, Pyshny was named as a possible candidate for the post of head of the NBU even before the start of the war, when the topic of a possible change in the head of the central bank arose several times. At the same time, the ex-head of Oschadbank was ready to compete for the post of head of Ukreximbank, but due to the war, the corresponding competition was canceled. In May of this year, Pyshny became an adviser to the head of the board of Oschadbank, and is also a member of the Yermak-McFaul sanctions group.

The current head of the National Bank of Ukraine, Kirill Shevchenko, announced his resignation on October 4 for health reasons.

The Rada appointed him to this post for a seven-year term on July 16, 2020, and before that he was the head of the board of the state-owned Ukrgasbank.

Earlier, on July 1, 2020, the head of the NBU, Yakov Smoliy, resigned due to political pressure. He has worked in this position since March 2018, and before that, since May 2017, he was acting. head of the NBU.

The National Bank of Ukraine (NBU) has increased from UAH 50,000 to UAH 100,000 (equivalent) the monthly limit on the purchase of non-cash foreign currency by citizens with subsequent placement on an irrevocable deposit for at least three months.

“Such changes will further reorient the demand of the population from foreign cash to non-cash, because transactions for the sale of non-cash currency by banks are carried out at a rate closer to the official than for the sale of cash, more convenient and safer,” the NBU website said on Friday.

As reported, with the outbreak of war on February 24, the National Bank banned the sale of non-cash currency to citizens, and on July 21 partially allowed it – up to UAH 50,000 per month on an irrevocable deposit of three months.

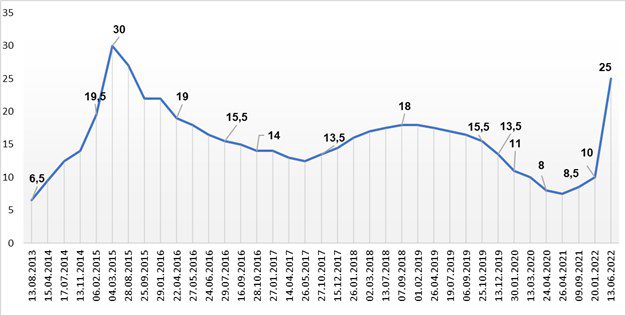

Dynamics of changes in discount rate of NBU

NBU