Vitaliy Koval, Head of the State Property Fund of Ukraine

Small-scale privatization has been systematically gaining momentum over the past 5 years (from 2019 to 2023) with some interruptions, in particular due to a full-scale invasion. Last year’s performance largely surpassed all previous results and demonstrated the effectiveness and timeliness of privatization in general.

Budget revenues

As a result of small-scale privatization in 2019, which was carried out by the State Property Fund of Ukraine, the budget received approximately UAH 561 million. The following year, this amount increased almost 5 times and exceeded UAH 2.69 billion. In 2021, the budget received UAH 3.5 billion. In 2022, when there was a break in privatization until September, the Fund transferred assets worth UAH 1.74 billion to private investors in less than six months.

Last year, proceeds from the privatization of state property amounted to UAH 2.84 billion. The state has fully resumed this process and is helping to support the state budget with funds that ensure our protection and defense against the aggressor. In total, over the past 5 years, privatization revenues, excluding large-scale privatization objects, amounted to UAH 11.34 billion.

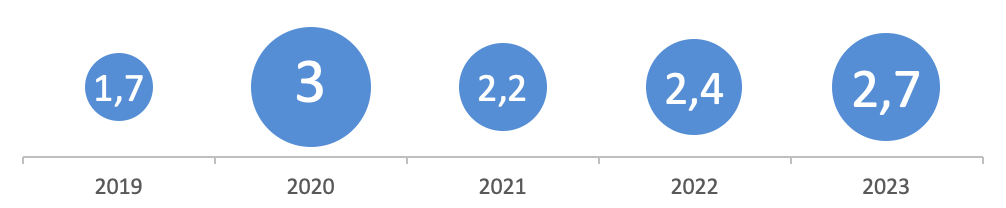

As for the price of the assets sold by the Fund, the final value of the property increased the most compared to the starting price in 2020.

Increase in the sale price of assets relative to their initial value

After the fall of this indicator in 2021, it has been growing over the past two years. Thus, in 2023, the sale price was 2.7 times higher than the initial price.

Competition in auctions

The increase in budget revenues and the growth of the final price indicate an important thing. Participants in the auctions held by the SPFU through the Prozorro.Sale system are interested in state assets and are ready to fight for them. The indicators of competitiveness in 2023 leave no doubt about this.

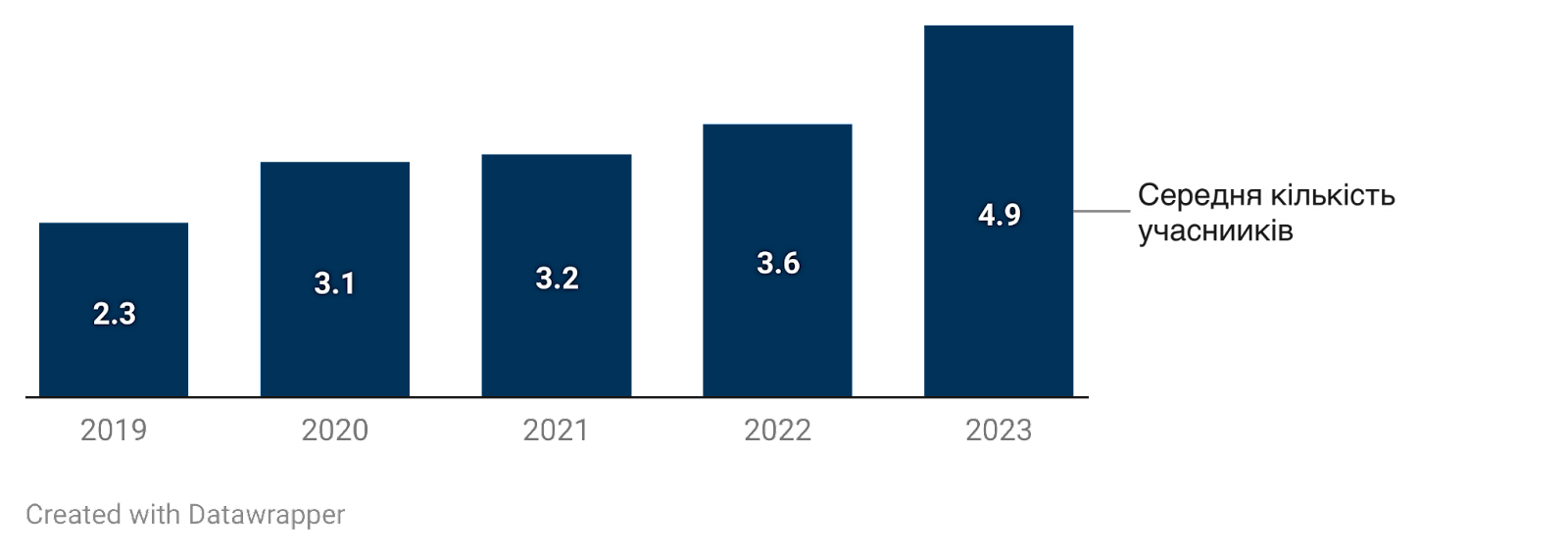

Average competition in privatization auctions

Over the past 5 years, competition in successful auctions has been growing steadily. But while from 2020 to 2022 its level was in the range of 3.1-3.6 bidders per auction, in 2023 almost 5 bidders competed for each lot on average.

This year, there is every chance of exceeding even such strong results: in the first quarter of 2024, more than 5 bidders took part in each successful auction on average.

Business interest in state assets

Business activity in privatization auctions is driven by many factors. Some companies need to relocate to regions far from the front line. Some entrepreneurs want to build a business on a ready-made material base, with the infrastructure, equipment and communications offered by the state when it sells, for example, single property complexes. Others need real estate, warehouses, workshops, garages, etc. to expand their current capacities.

So entrepreneurship in Ukraine is developing even in the face of war and other difficulties. And the government is striving to provide business with resources that will help it do so.

There are lots in which the market sees such great prospects and value that dozens of participants compete for them at once. The record was set in 2020, when 48 bidders competed for an unfinished garage for 50 cars in Kyiv. The second lot was non-residential premises in Uzhhorod. This auction, which had 47 bidders, took place in 2023.

As a result of this demand, the price of the first property in Kyiv increased almost 35 times (from just over UAH 1 million to UAH 36 million). And the cost of the second lot in Uzhhorod increased 818 times (from UAH 12.2 thousand to UAH 10 million).

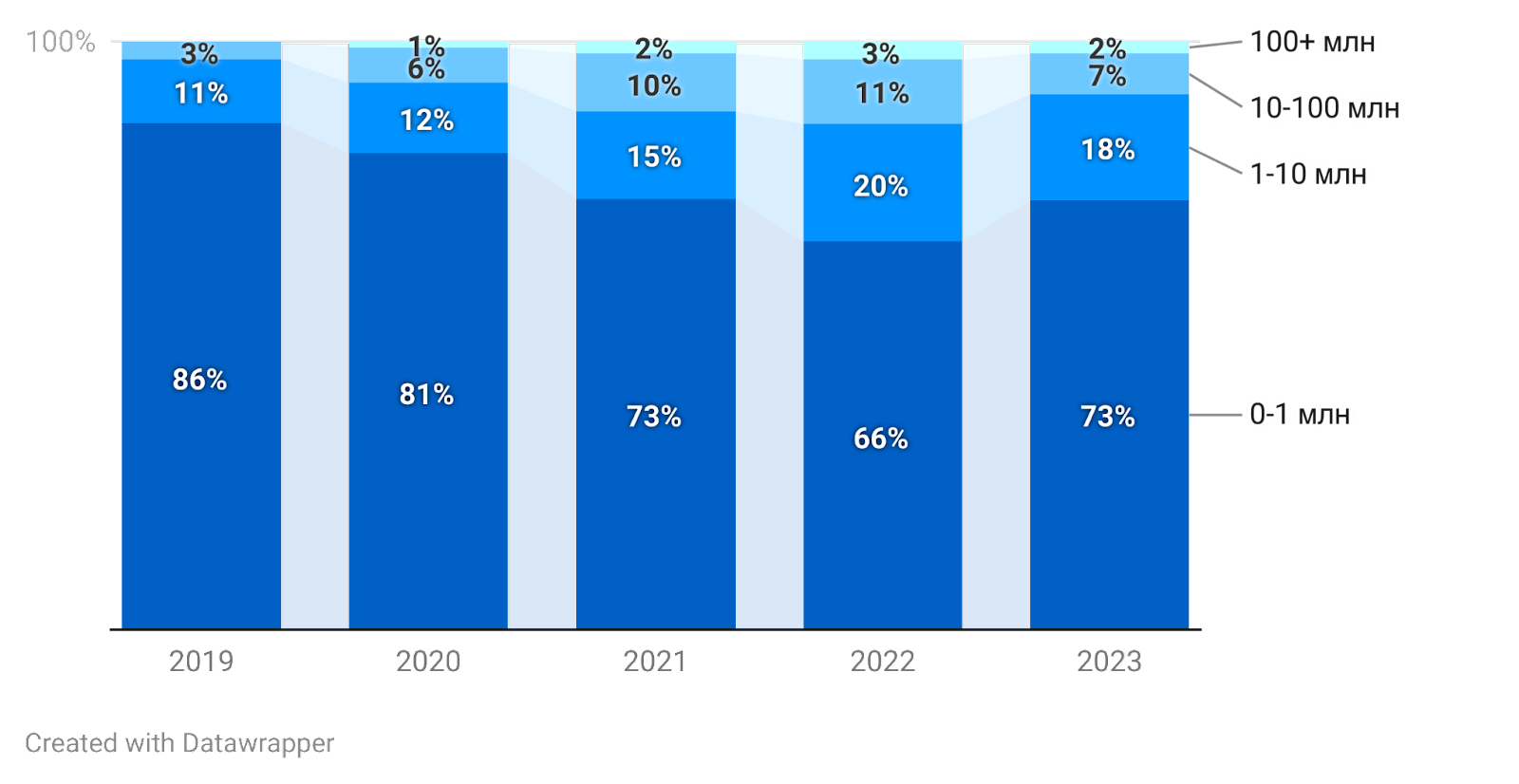

Businesses are interested in assets of different sizes, but the vast majority of lots sold through privatization cost up to UAH 1 million.

Distribution of successful auctions by the final value of the privatized object

In 2020, the share of auctions where the sale price of an asset was up to UAH 1 million reached a maximum of 86%. At the same time, in 2022, the share of auctions with the final value of the object from UAH 1 to UAH 10 million and even in the range of UAH 10-100 million increased significantly. Last year, the trend went in the opposite direction again: the number of assets sold for up to UAH 1 million began to grow.

It is also important to understand the overall economic context in Ukraine. A sharp drop in the hryvnia exchange rate, the crisis in many markets, the occupation of territories, and many other things have affected the ability of businesses to operate. This has hit small businesses particularly hard, as their already scarce material resources have been significantly depreciated and other problems have been added.

The return of demand for inexpensive, small state assets suggests that small and medium-sized businesses are resuming activity and continuing to grow after the first shocks of the full-scale invasion.

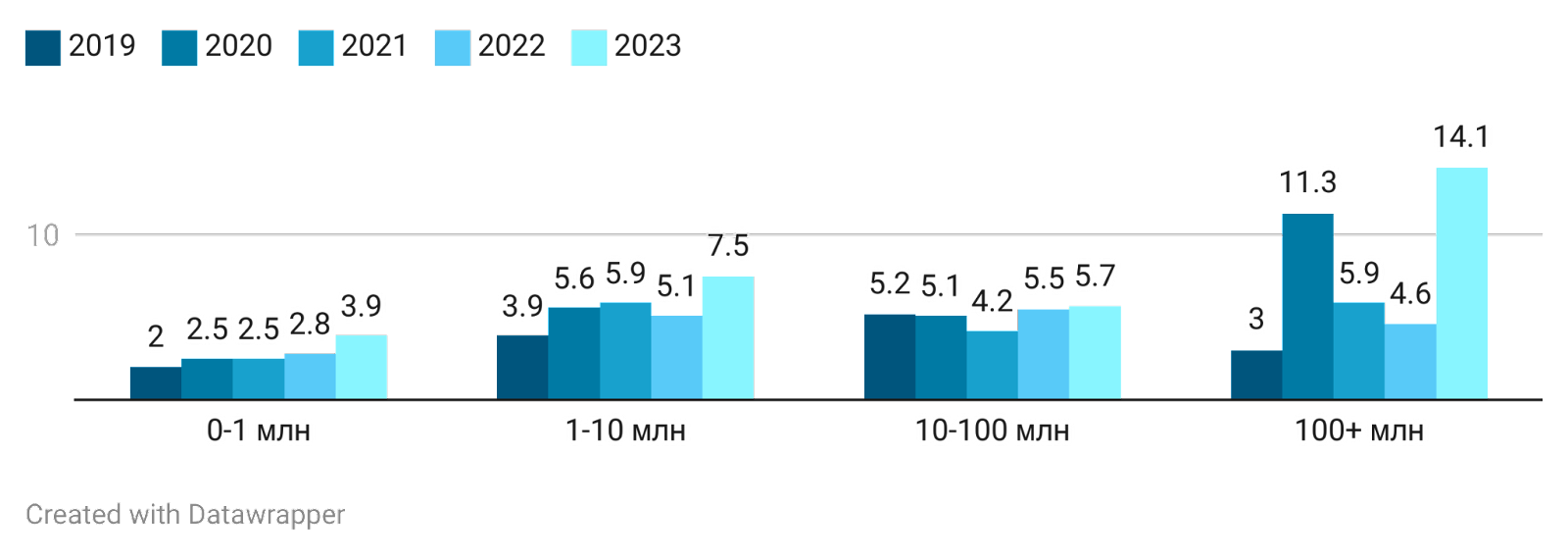

The average number of bidders in privatization auctions, relative to the final value of assets

At the same time, large market players are also interested in large state-owned assets when they come up for sale. Thus, in 2023, an average of 14.1 bidders participated in auctions with a sale price of more than UAH 100 million. At the same time, the average competition in auctions up to UAH 1 million last year amounted to 3.9 participants.

Efficiency of privatization processes

Overall, privatization auctions attracted thousands of players from different markets. The highest number of bidders, namely 2035, was in 2023. This is 3.3 times more than in 2022 and almost twice as many as in 2021. In 2020, this figure exceeded 1340 bidders. And in 2019, when privatization had just intensified, there were about 800 of them.

Legislative changes, business activity, competitive bidding, and their transparency and openness have helped to increase the efficiency of privatization processes. At the same time, the State Property Fund has also changed its approach in recent years and improved the process of preparing objects for sale. Information about the availability of state assets for privatization was disseminated through various communication channels to draw attention to these lots. In general, all information about the current lots, how to participate in the auction, and the results of privatization is collected on a separate special resource.

The Fund has developed a mechanism for sorting (triage) state assets, depending on their condition and market needs. The property that has no value or exists only on paper will be liquidated or bankrupt. Those objects that can work for the benefit of the economy in private hands will be privatized.

Effective steps taken by the SPFU and the interest of private investors have yielded results: in 2023, the share of successful auctions increased many times over compared to previous years.

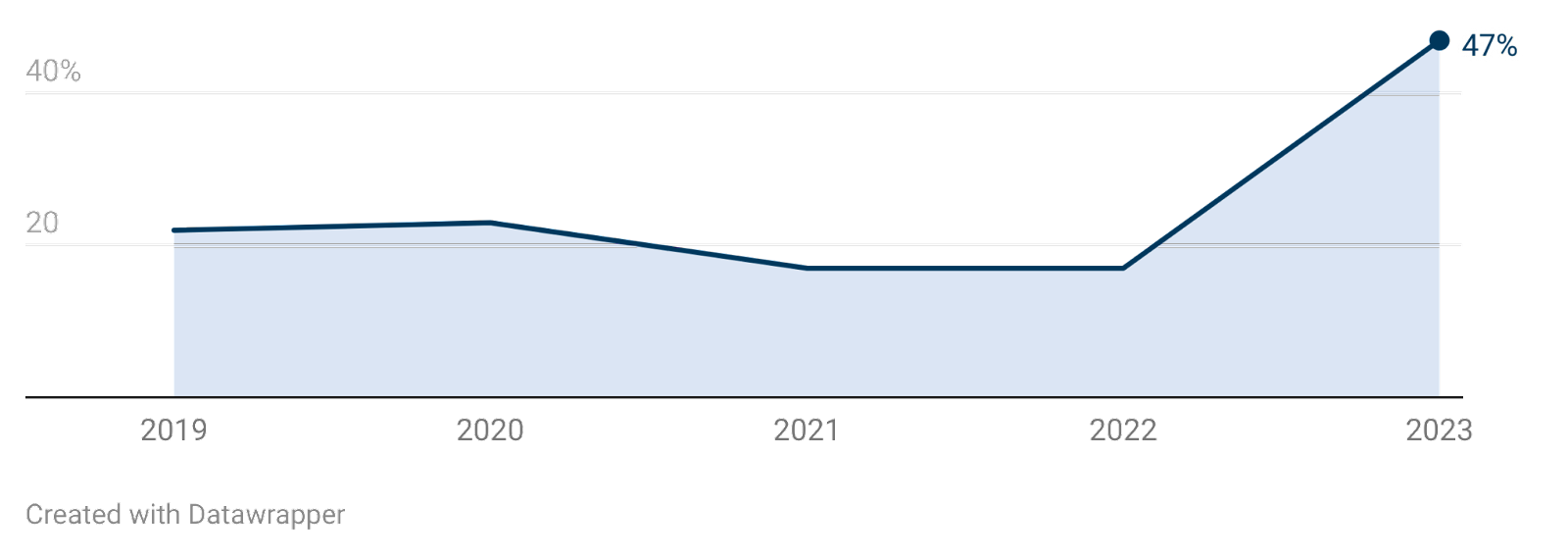

Increase in the share of successful SPFU auctions

The lowest rate of successful auctions was recorded in 2021-2022: it was 17% of all announced auctions. Therefore, the peak result of almost 47% last year is a difference of 2.8 times.

Over the past 5 years, privatization has become more efficient, increased revenue, and attracted the attention of more and more entrepreneurs. This proves the success of Ukraine’s privatization strategy, when the state, instead of subsidizing unprofitable assets, gives them a new life and helps generate funds for the state budget at a time when the survival of our country depends on these revenues.

The Cabinet of Ministers of Ukraine has included 66.65% of the authorized capital of Lybid Investment Union LLC, which owns the Ocean Plaza shopping mall in Kyiv, in the list of large-scale privatization targets.

According to Taras Melnychuk, a representative of the Cabinet of Ministers in the Verkhovna Rada, the decision was made at a government meeting on Friday.

In October 2023, the State Property Fund of Ukraine appealed to the government with an initiative to include the state-owned stake (66.65%) in the Ocean Plaza shopping mall in the list of large-scale privatization objects. The Fund recommended setting the starting price for the sale of the state-owned stake in the mall at the level of its book value for the last reporting (annual) period.

At the end of 2022, the value of the state share amounted to UAH 1.32 billion (the carrying value of the entire asset was UAH 1.98 billion). At the same time, the Fund expects the sale of the lot to be more expensive than the book value.

As reported, on June 9, 2023, the Cabinet of Ministers approved an order to transfer to the SPF a 66.65% share of the authorized capital of Lybid Investment Union LLC, which owns the mall, in the amount of 66.65%.

Previously, these corporate rights belonged to Russian businessmen Arkady and Igor Rotenberg, who are subject to sanctions, but in March 2023, the High Anti-Corruption Court ruled to recover them in favor of the state.

Ocean Plaza was opened in Kyiv in December 2012 at 176 Antonovycha Street. Its total area is 165 thousand square meters. Investments in the facility amounted to approximately $300 million. UDP and K.A.N. Development LLC were partners in the development of the project.

The mall was sold to Arkady Rotenberg’s TPS Real Estate in 2012. Later, in 2019, Ukrainian businessman Vasyl Khmelnytsky indirectly acquired a 33.5% stake in Ocean Plaza through UPD Holdings Limited. In 2021, he sold his stake to entrepreneur Andriy Ivanov. The deal was finalized in the summer of 2023.

Revenues of budgets of various levels from small-scale privatization of state and municipal property in the state electronic trading system Prozorro.Sale amounted to almost UAH 3.3 billion in 2023, according to a joint press release on Thursday.

“In total, in 2023, businesses and citizens privatized almost 914 objects across the country. 350 of them are state property sold by the State Property Fund (SPF) and its regional offices through online auctions on Prozorro.Sale, and another 560 are assets sold by communities,” said First Deputy Prime Minister and Minister of Economy Yulia Svyrydenko.

It is specified that the state budget received more than UAH 2.6 billion, while the privatization of communal facilities brought communities more than UAH 650 million, and the price of the facilities increased almost threefold as a result of electronic auctions.

“It is important that privatization is not just a one-time revenue for the state or local budgets, it is primarily about attracting investment and economic development,” emphasized Svyrydenko.

CEO of Prozorro.Sale Serhii But noted that in total, more than 3.6 thousand participants competed for the right to purchase state and municipal property in 2023.

“The business demand for small-scale privatization objects in the second year of the full-scale war remains, with an average of more than three bidders. Factories, hotels, warehouses, outpatient clinics, car dealerships – these and other objects have found a new effective owner this year thanks to online auctions,” said Booth.

Head of the SPF Vitaliy Koval added that, in addition to development and modernization, job creation and mastering new markets, another important area of privatization auctions under martial law is the search for objects for business relocation. According to him, this is especially relevant for the hospitality industry (catering, restaurant business and hotel industry), agricultural, logistics and other sectors of the economy.

“That’s why the most popular real estate objects, which is 76% of the sold property, are industrial and administrative assets. Businesses are interested in the so-called brownfields – abandoned enterprises with communications. After all, it is enough to make repairs there and you can start your own business or expand an already running production,” explained the head of the privatization agency.

He said that the SPF plans to actively involve big business in privatization.

“We are already preparing a large-scale privatization. We also plan to open a transparent agricultural land lease market and sell the aggressor’s assets at auctions to compensate for the damage caused by the war,” said Koval, who previously announced a goal of over UAH 4 billion from privatization in 2024. Among the most interesting proposals for next year’s auctions, the SPF mentioned the UMCC, Demurinsky GOK, Centrenergo, Odesa Port Plant, Ukraina Hotel, and Ocean Plaza shopping mall in Kyiv.

According to the press release, the highest price for the privatization of state-owned facilities in 2023 was paid by the winning bidders for the Hermitage Hotel in Kyiv – UAH 311 million, the unified property complex (UPC) Volyntorf – over UAH 212 million, and the UPC of the State Enterprise Ukroboronresursy – over UAH 210 million.

It is specified that among the communities that actively worked with the small-scale privatization market, Dnipro was the most active – 35 successful auctions, Lviv – 32, and Kyiv – 23. The most expensive municipal privatization objects this year are the Zhytomyr Regional Cinematography Center – UAH 40 million, non-residential premises in Lviv with an area of 550 square meters – over UAH 25 million, and non-residential premises in Zhytomyr region with an area of almost 600 square meters – over UAH 22 million.

As reported, small-scale privatization in Ukraine was suspended with the start of full-scale Russian aggression in February and resumed in September 2022. In less than the last four months of last year, more than UAH 1.4 billion was transferred to the budgets of various levels as a result of more than 200 auctions.

The State Property Fund of Ukraine (SPFU) has re-put up for privatization the Gannopil distillery in Khmelnytsky region, the press service of the agency reports.

“This is the second attempt to sell the Gannopil distillery. At the previous auction, the investor offered UAH 2.6 million, but did not pay for the lot and lost UAH 400 thousand of the guarantee fee,” the SPF reported.

The agency reminded that the alcohol industry enterprises can produce alcoholic beverages, soda, solvents for the chemical industry and bioethanol.

According to the report, the Gannopil distillery started its operations in 1928. The company could potentially produce 20 thousand liters of alcohol per day. However, the plant has not been operating since 2011.

The area of the distillery’s premises is 10,208 thousand square meters, which includes 62 buildings: administrative offices, warehouses, workshops, workshops, alcohol storage facilities and wells.

In addition to the winning bid, the new owner has to pay UAH 16.2 million in debts to employees and the budget.

The starting price of the enterprise is UAH 3.8 million.

The auction is scheduled for August 31.

Ukrainian President Volodymyr Zelensky signed law No. 8250, which will allow the State Property Fund (SPF) to resume big privatization and make state property management more efficient by improving the SPF structure.

“The law on the updated structure of the State Property Fund has been signed by the president. The document will improve the organizational structure of the fund: 12 regional branches of separate legal entities will become structural divisions of the SPF. This will create a mechanism for the establishment of market salaries and CRI in all regions and will increase the efficiency of state property management, “- wrote the head of the SPF Rustem Umerov in Facebook on Tuesday.

He recalled that the document also contains provisions for the resumption of large-scale privatization, improving the procedure for managing the sanctioned property, increasing the lease term of state property up to five years.

According to the norms of the law, by the decision of the VAKS, the sub-sanctioned property will be transferred directly to the SPF and the proceeds from the sale will be sent to the Fund for Liquidation of Consequences of Armed Aggression.

Umerov thanked the president, the government and MPs for supporting this important initiative.

Earlier, it was reported that after the mentioned law enters into force, the SPF will independently make managerial decisions on the unsanctioned property: privatization, sale, lease or management.

The law bans unsanctioned individuals and citizens of aggressor countries from holding positions as heads of state-owned companies and members of supervisory boards, and cancels the procedure for obtaining approval from local authorities for directors of state-owned companies that are managed by the SPF.

After the enactment of the law the department expects the increase of income from renting state property by 20-25%, or 100 million UAH per year, as well as the improvement of leased property.

On 30 May, the Rada supported the bill #8250 by 231 votes of people’s deputies with the required minimum of 226 votes.

The State Property Fund (SPF) will be able to resume big privatization, to lease state property for up to five years and will receive sub-sanctioned property upon the decision of the SAI and independently decide on its further fate.

According to the FGI in a press release, the relevant provisions are stipulated by law number 8250, which the Rada supported by 231 votes with the required minimum of 226 votes on May 30.

The fund specified that it will independently make management decisions on the sub-sanctioned property: privatization, sale, lease or management, and all the funds received will be directed to the Fund for liquidation of consequences of the armed aggression of the Russian Federation.

In addition, the law bans unsanctioned individuals and citizens of aggressor countries from holding positions as heads of state-owned companies and members of supervisory boards and cancels the procedure for approving local authorities for directors of state-owned companies managed by the SPF, the release said.

Regarding the lease, the Fund recalled that before the full-scale invasion, it could lease state property for up to 49 years, although the vast majority of contracts were for five years: in 2021, the share of five-year contracts was 88.8%.

At the same time, at the beginning of the war there were fears that due to low competition caused by the general uncertainty, the price of the lease may be underestimated, and from April 1, 2022 the Rada limited the validity of new contracts to the duration of martial law + 12 months after its cancellation, explained the IGF. He specified that during this time has concluded 1,153 such contracts.

“But in recent months, Ukrainian business has gradually adapted to the challenges of martial law … Term limits do not encourage entrepreneurs to participate in lease auctions, so now 38% of them do not pass due to lack of demand,” explained the Fund.

After the law enters into force, the agency expects to increase the income from renting state property by 20-25%, or 100 million hryvnias per year, as well as to improve the condition of the leased property.

According to a press release, the law also aims to improve the management structure of the IGF: the head of the Fund will have the right to appoint and dismiss deputies, 12 regional offices – separate legal entities will become structural units, and the organizational structure will be built on a functional principle. “As a consequence, a clearer and more understandable responsibility for the work of the State Property Fund and the installation of the KRI for subdivisions and market salaries for employees,” the statement said.