PJSC Yuzhkoks (Kamenskoye, Dnipropetrovsk region) last year received a net profit of UAH 1 billion 292.672 million in net profit, while the previous year there was a net loss of UAH 632.050 million.

According to the official information of the company to the agenda of the annual meeting of shareholders, scheduled for December 21, which will be held remotely, at the end of 2021 its undistributed profits amounted to 1 billion 507.635 million UAH.

According to the draft decision of the meeting, the shareholders intend to summarize the work in 2021, choose an auditing company and distribute profits.

It is suggested to leave the profit received in 2021 undistributed.

Dashuria Ltd. owns 94.9565% of the company as of the fourth quarter of 2020, according to the NDU.

Metinvest B.V. (Netherlands) reported in a 2018 report that the company acquired a 23.71% stake in Yuzhkoks for $30 million.

The authorized capital of PJSC “Evraz Yuzhkoks” – 171.918 million UAH, the par value of the share – 0.25 UAH.

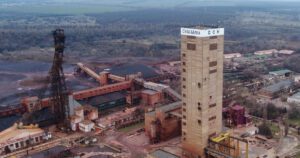

Sukhaya Balka mine (Krivoy Rog, Dnipropetrovsk region), which belongs to Oleksandr Iaroslavskyi’s DCH group, increased its net profit in 2021 by 3.62 times compared with the previous year – up to UAH 1 billion 326.460 million from UAH 366.802 million.

According to the official information of the company to the agenda of the annual meeting of shareholders, scheduled for December 22, which will be held remotely, the undistributed profits at the end of last year amounted to 3 billion 418.682 million UAH.

The shareholders intend to summarize the results of work in 2021, approve reports and approve significant transactions of the company.

The draft resolution proposes to use the profit to replenish working capital.

At the meeting, there will be considered staff issues: termination of the power of the current members of the Supervisory Board and the Audit Committee and election of new members.

As reported, the Sukhaya Balka mine in 2020 decreased its net profit by 59.7% compared to the previous year – to 366.802 million UAH from 909.636 million UAH.

DCH Group acquired the mine from Evraz Group in May 2017.

Sukhaya Balka mine is one of the leading mining companies in Ukraine. It mines iron ore using the underground method. The mine includes the Yubileynaya and Frunze mines. Frunze.

“Sukhaya Balka” specializes in the extraction and production of marketable iron ore, which includes sinter ore (iron content 56-60%) and blast furnace ore (47% – 50%).

According to the NDU for the fourth quarter of 2021, Yaroslavskyy, who is listed as a citizen of the United Kingdom and a non-resident of Ukraine, directly owns 77.4193% of the mine, and a resident individual, Artem Aleksandrov, owns 20%.

The charter capital of Sukhaya Balka is UAH 41.869m, and the par value of a share is UAH 0.05.

Agro-industrial group of companies Ovostar Union, one of the leading producers of eggs and egg products in Ukraine, in January-September 2022 received $2.39 million in net profit, down 16.1% compared to the same period in 2021.

According to the company report published on the Warsaw Stock Exchange website, Ovostar’s revenues fell 4.3% to $90.29 million in the reporting period, while its gross profit rose 41.1% to $15.46 million and operating profit rose 63.1% to $3.63 million.

At the same time, because of negative exchange differences of $27.55 million, the cumulative loss was $25.16 million, while in the first nine months of last year the exchange differences were positive – $6.74 million, which led to a cumulative profit of $9.59 million.

The report forecasts that egg production in 2022 will decline 14.1% to 1.452 billion eggs.

“Ovostar clarified that its 9-month revenue in the egg segment was down 3.5% to $62.76 million and 6.1% in the egg products segment, to $27.53 million.

At the same time, export revenues increased 31.6% to $37.5 million, including a 40% increase in the egg segment to $21.91 million and a 21.3% increase in the egg products segment to $15.59 million.

The amount of the company’s free cash flow at the end of September was $5.93 million, compared to $2.44 million at the beginning of the year and $0.62 million a year ago, while in Ukraine it has decreased from $1.96 million to $0.90 million since the beginning of the year.

The company’s loan debt stood at $10.8 million, compared to $12.88 million at the beginning of the year and $10.09 million a year ago.

According to the report, by the end of September 2022, Ovostar Union shares were owned by: Prime One Capital Limited (67.93%), controlled by Ovostar CEO Boris Belikov and Chairman Vitaly Veresenko; Generali Otwarty Fundusz Emerytalny (11.93% vs. 10.93% at the beginning of the year), Fairfax Financial Holdings Limited (9.09% vs. 10.39% at the beginning of the year), Aviva Otwarty Fundusz Emerytalny (5.02%).

Ovostar Union Group is a vertically integrated public holding company, one of the leading producers of chicken eggs and egg products in Europe. The producer has been a certified exporter to the EU since 2015.

The group’s holding company, Ovostar Union N.V., held a 25% IPO on the Warsaw Stock Exchange in mid-June 2011 and raised $33.2 million. The majority stake in the company is owned by Prime One Capital Limited, which is controlled by its CEO Boris Belikov and Chairman of the Board Vitaliy Veresenko.

“Ovostar reported a net income of $2.6 million in 2020 compared to a net loss of $20.0 million in 2019. Its revenue last year was down 5% to $98.9 million.

PJSC “Promarmatura” (Dnipro) following the results of work in 2021 received a net profit in the amount of UAH 13,212 mln. and finished the year 2020 with a net loss of UAH 3,917 mln.

According to the note to the published agenda for the annual general meeting of shareholders, which will be held remotely on December 13, 2022, the company’s undistributed profits at the end of last year amounted to 149.208 million UAH.

The shareholders intend to summarize the results of 2021 and distribute profits received last year. According to the agenda, it is proposed not to distribute profits and not to pay out dividends for 2021.

Besides, the meeting intends to preliminarily approve major transactions.

The company “Promarmatura” was founded in December 1994 and is on the market of pipeline valves.

According to the NDU as of the end of 2021, two individuals – Ukrainian citizens Igor Mezhebovsky and Alexander Chelyadin – each hold 50% of the company.

The charter capital of the company is UAH 7.218 mln.

PJSC “Ukrainian Graphite” (Ukrgraphite, Zaporizhia) in January-March of the current year received a net profit of UAH 1.649 mln, while the company finished the similar period of the last year with a net loss of UAH 111.830 mln.

According to the interim report of the company, over this period net income decreased by 7.4% – to UAH 491.581 mln.

Undistributed profits made up UAH 3 bln 528.788 mln at the end of March 22.

As it was reported, in 2021, Ukrgraphit increased its loss by 2.2 times compared to the previous year – up to UAH 317.514 mln from UAH 144.408 mln.

“Ukrgraphite is Ukraine’s leading producer of graphitized electrodes for electric steel-making, ore-thermal and other kinds of electric furnaces, commodity carbon masses for Soderberg electrodes, carbon-based lining materials for metallurgical, machine-building, chemical and other industrial complexes.

According to the National Depository of Ukraine (NDU) as of the fourth quarter of 2021, Intergraphite Holdings Company Limited (Bermuda) owns 23,9841% of PrJSC, C6 Safe Group Limited (Cyprus) – 72,0394%.

The authorized capital of PrJSC – 233,959 million UAH, nominal value of 1 share – 3,35 UAH.

In July-September 2022, the mobile operator Lifecell LLC (lifecell) increased its revenue by 9.8% – up to UAH 2 billion 370.9 million compared to UAH 2,159.2 million for the same period in 2021.

According to a statement on the website of its parent company Turkcell, the net profit of Lifecell LLC for the specified period amounted to UAH 381.6 million, which is 2.2 times more than in July-September 2020 (UAH 173.8 million). EBITDA increased by 15.8% to UAH 1 billion 417.6 million, the EBITDA margin was 59.8% (for the same period in 2021, this figure was 56.7%).

The active three-month subscriber base of lifecell in the third quarter decreased by 7.9% – to 8.2 million subscribers. At the same time, the total number of users grew by 2%, to 10.1 million subscribers.

The company’s active three-month ARPU in the third quarter of 2022 increased by 14.9% and amounted to UAH 95.4 compared to last year’s figure of UAH 83.

Lifecell’s capital investments in July-September 2022 decreased by 10.4% – to UAH 639.6 million compared to UAH 713.7 million for the same period in 2021.

According to the report, as of September 30, 2022, the network and other equipment of the company in the regions of Ukraine occupied by Russia due to hostilities and territories controlled by Ukraine, which has not been working for more than 92 days, is out of order. “As of September 30, 2022, the amount of impairment recognized in the condensed consolidated financial statements is TL 231,472 (UAH 458,000 – IF),” Turkcell said in a statement.

As reported, according to the results of 2021, lifecell received a net profit of UAH 610.9 million, which is 4.24 times less than in 2020, while the operator’s income in 2021 increased by 24.1% to UAH 8.483 billion . The total number of subscribers of the operator at the end of 2021 amounted to 10.1 million.

lifecell is the third largest mobile operator in Ukraine. Turkcell (Turkey) owns 100% shares of Lifecell LLC.