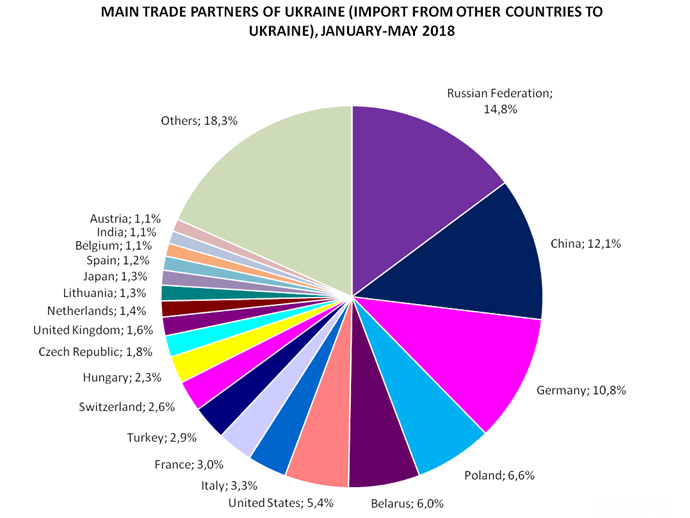

5 countries control over half of all goods imports to Ukraine. Foreign trade operations were conducted with partners from 210 countries, but Russia, China, Germany, Poland, Belarus are in top-5 among other exporters of goods to Ukraine.

According to the statistical data, Russia is the first exporter of its good to Ukraine with 14,8% of all trade volume, the second is China (12,1%). The USA is the 6-th exporter to Ukraine, the UK is on the 13-th place.

The deficit of Ukraine’s foreign trade in goods in January-May 2018 increased by 1.4 times compared with January-May 2017 and amounted to $2.055 billion, the State Statistics Service has said. According to its data, in May the deficit was $632 million, while in April some $221.6 million, in March $460 million, in February $457 million, and in January $284.1 million. In January-May 2018 exports of goods compared to January-May 2017 increased by 12.9%, amounting to $19.460 billion, imports by 15.3%, to $21.515 billion.

In May 2018 compared to the previous month, the seasonally adjusted export volumes decreased by 5.8%, imports by 13.4%. The seasonally adjusted foreign trade balance in May 2018 was negative and amounted to $946.5 million, negative indicators were also fixed in April 2018 at $570.8 million, in March at $508.2 million, in February at $411.8 million, and January at $580.5 million.

The ratio of coverage of imports by exports was 0.9.

Foreign trade operations were conducted with partners from 210 countries, a share of top-20 importers to Ukraine is more than 75% of a total volume.

Public joint-stock company United Mining-Chemical Company, managing Vilnohirsk Mining and Metallurgical Combine (Dnipropetrovsk region) and Irshansk Mining and Processing Combine (Zhytomyr region), in four years after its creation has sent over UAH 1 billion in technical re-equipment and upgrade of assets, and its charter capital grew to UAH 3 billion in 2018 from UAH 1.9 billion in 2017. Acting Board Chairman Oleksandr Hladushko said in an interview posted on the company’s corporate website that on August 12, the company will celebrate the fourth anniversary.

“Our branches were returned from the lease to the management of United Mining-Chemical Company in September 2014. And the main task that the government put at that time was to increase the payments to the national budget, which is impossible without seeing profit… We successfully coped with this task: if in 2014 the state received taxes and mandatory payments from the company at the level of UAH 16.9 million, then in 2017 it was UAH 875.7 million,” Hladushko said. At the same time, he recalled that in 2017, the company paid dividends to the state in the amount of UAH 321.8 million, this year – almost UAH 333 million.

The head of the company pointed to the technical readiness of the branches to independently perform production tasks: “If immediately after the lease, the availability of special equipment did not exceed 50%, then in 2018 it grew almost twice thanks to investments and reached 90%, especially at Vilnohirsk Mining and Metallurgical Combine.

The State Property Fund of Ukraine (SPF) has made announcements on holding tenders to select investment advisors to prepare PJSC Azovmash, OJSC Oriana, PJSC Sumykhimprom, NJSC Ukragroleasing, Kherson combined heat and power plant (CHPP), Dniprovska CHPP, PJSC Kryvy Rih CHPP and Severodonetsk CHPP for privatization.

The announcements were published in the Vidomosti Pryvatyzatsii newspaper.

The tenders will be held in two stages. The first stage is to complete on September 7.

The second stage of the tenders to select investment advisors for Azovmash (50% shares), Kherson combined heat and power plant (99.8328% of the share capital), Dniprovska CHPP (99.9277%), Kryvy Rih CHPP and Severodonetsk CHPP will take place on September 17.

The second stage of the tender to select investment advisors for Sumykhimprom (99.9952%), Oriana (99.9988%) and Ukragroleasing (100%) will take place on September 18, 2018.

State-controlled Oschadbank (Kyiv) has launched the Apple Pay payment service, chairman of the financial institution Andriy Pyshny has reported.

“Oschadbank the fastest in Europe several months ago integrated Google Pay. It has already launched Apple Pay. The future is in smartphones!” he wrote on his Facebook page.

He said Apple Pay is based on security and confidentiality.

“If you add a credit or debit card to Apple Pay, the card number itself is not stored in either the device or Apple servers. You are assigned a unique account number for the device, while it is encrypted and stored in a secure mode in the microchip “Secure Element” of your device. Each transaction is due to the generation of a unique one-time dynamic security code,” he said.

According to Pyshny, to use the possibility of paying with an iPhone, it is not necessarily to have an Oschadbank card: just call the contact center of the bank and get an instant digital prepaid card. It can be connected to Apple Pay and they you can use the application.

According to the press release of Oschadbank, one can pay with Apple Pay in stores using iPhone SE, iPhone 6 and newer models, and also with Apple Watch.

Interpipe pipe and wheel company (Dnipro) at a meeting with the creditors in London on July 17 presented a preliminary plan for restructuring its liabilities worth $1.25 billion, Concorde Capital investment company has reported, with reference to a report by Reorg Research. The debtor, in particular, proposes to convert this debt into six-year eurobonds for $310 million with a coupon of 9.35% per annum, as well as two credit tranches of $45 million to Ukrainian banks and $45 million to international ones. The rest of the debt will be written off.

Eurobond holders and international banks will also receive securities, payments on which will be tied to Interpipe’s EBITDA. Ukrainian banks will not receive the relevant securities, at the same time they will have less debt forgiveness.

The terms of restructuring also imply imposing a $40 million fine on Interpipe if it allows non-payment under new eurobonds or loans to international banks.

Interpipe intends to pay creditors a substantial commission fee if the restructuring plan for liabilities is approved.

The adviser to the debtor is Stephenson Harwood (the UK), to the creditors Alvarez & Marsal and Allen & Overy (the UK).