On September 9, the State Protection Department of Ukraine opened a tender for voluntary motor vehicle hull insurance.

According to the electronic public procurement system Prozorro, the lowest price offer was made by Ultra Alliance Insurance Company – UAH 1.897 million against the expected cost of UAH 6.6 million. In this regard, the organizer of the tender asks the company to justify the abnormally low offer by September 11.

The tender is also attended by IC Persha with an offer of UAH 5.08 million.

As reported, the tender was announced on August 9. The complaint of Ultra Alliance Insurance Company (Kyiv) was submitted to the Antimonopoly Committee of Ukraine (AMCU) for consideration on August 13. On August 26, the AMCU ordered the State Protection Department of Ukraine to amend the tender documents.

Ultra Alliance Insurance Company was registered in 2004 and specializes in risk insurance.

As of September 10, farmers in all regions of Ukraine sowed 639.9 thou hectares of winter crops, compared to 484.1 thou hectares a week earlier, the press service of the Ministry of Agrarian Policy and Food reported.

According to the report, winter wheat was sown on 101.1 thousand hectares (27.7 thousand hectares a week earlier), barley – on 3.7 thousand hectares (2.2 thousand hectares), rye – on 0.4 thousand hectares (8 thousand hectares), and rapeseed – on 534.7 thousand hectares (446.2 thousand hectares).

According to the Ministry, winter crops are being sown in Vinnytsia, Lviv and Ivano-Frankivsk regions. Winter rape is being sown in 18 regions of Ukraine. Farmers in Volyn, Rivne, and Ternopil regions have finished sowing the crop.

As of the same date a year earlier, Ukraine sowed 1155 thou hectares of winter crops, including 905.9 thou hectares of rapeseed, 228.6 thou hectares of wheat, 10.8 thou hectares of barley, and 9.5 thou hectares of rye.

In January-August 2024, Ukraine increased its foreign trade in dairy products by 7.9% to $307 compared to the same period last year, the Union of Dairy Enterprises of Ukraine (UDEP) reported on its Facebook page.

According to the report, the negative balance of exports and imports of dairy products slightly increased compared to the same period last year and amounted to -$32.6 million against -$31.2 million. At the same time, imports were 1.24 times higher than exports; in January-August 2023, this excess was 1.25 times.

According to analysts, exports in January-August 2024 increased to $137.3 million, which is 8.3% higher than in the same period last year.

The growth in exports compared to the previous year was recorded for fermented milk products (+27% in physical terms and +32% in value), whey (+43% and +38%, respectively), and cheeses of all kinds (+40% and +31%, respectively).

At the same time, exports of butter and milk fats decreased significantly (-25%), while the drop in value amounted to 9%, which is explained by a significant increase in prices for these products this year.

Experts noted that import volumes in January-August 2024 increased by 7.6% compared to the same period last year – up to $170 million. At the same time, growth is observed in the categories of butter and milk fats – 2.3 times in volume terms, twice in value terms, as well as cheeses (+8% in volume terms).

Ukraine also reduced imports (in physical terms) of milk and cream not condensed (drinking) by 3.3 times, whey by 28% and fermented milk products by 16%, the UGCC summarized.

Slobozhanshchyna Agro, a subsidiary of IMC, has raised UAH 100 million under the government’s soft loan program Affordable Loans 5-7-9% from PrivatBank (Kyiv).

“Since the beginning of the war, financing agricultural production has become a priority for us. The bank systematically supports and will continue to support Ukrainian agribusinesses operating in the frontline and de-occupied regions,” Yevhen Zaigraev, Board Member for Corporate Business and SMEs, said in a press release.

It is noted that the financing will allow Slobozhanshchyna Agro to maintain its business activities in the frontline region of the country for a year.

Zaigraiev added that the company continues to operate in the Sumy region, where there are still high military risks.

“Thanks to this, the company received a more favorable interest rate under the guarantees of the CMU (Cabinet of Ministers of Ukraine – IF-U),” the release said.

“MK is an integrated group of companies operating in Sumy, Poltava and Chernihiv regions (north and center of Ukraine) in the crop production, elevators and warehouses segments. The company’s land bank is about 120 thousand hectares in Poltava, Chernihiv and Sumy regions, with storage capacity of 554 thousand tons for the 2023 harvest of 1.002 million tons.

This year, the company purchased 140 Ukrainian-made railcars, and in early August, for the first time, it shipped its products to ports in its own grain cars. According to Privat, the company ships 60-70 thousand tons of grain to ports by rail every month.

In the first half of 2024, IMC Agro Holding increased its net profit by 2.4 times year-on-year to $21.52 million, while its revenue increased by 51% to $108.32 million, while the share of exports decreased slightly to 81.3% from 81.9% a year earlier.

According to the National Bank of Ukraine, as of August 1 this year, PrivatBank ranked first in terms of total assets (UAH 895.26 billion) among 62 banks operating in the country. The financial institution’s net profit last year amounted to UAH 37.76 billion.

In August, registrations of electric vehicles (new and used) in Ukraine amounted to 6,445 thousand, which is 68% more than in August last year and 36.6% more than in July this year, Ukravtoprom reported on its telegram channel.

As reported, in July 2024, the demand for electric vehicles increased by 38% compared to July 2023 and by 14% compared to June 2024.

As reported, market experts attribute this jump in demand for electric vehicles over the past 1.5 months to the government’s initiative to introduce a 15 percent military tax on car buyers during the first registration, including electric vehicles, which are currently not taxed in Ukraine (except for a small excise tax).

In late August, it was reported that the government had abandoned this initiative.

According to Ukravtoprom, the share of new cars in electric car registrations in August was 18%, the same as a year earlier (21% in July).

The bulk of electric vehicles registered during the month were passenger cars – 6,302 thousand units (new – 1,159 thousand, used – 5,143 thousand), and only five of 143 commercial vehicles were new.

The top five new electric cars in July were BYD Song Plus – 174 units; Honda M-NV – 169 units; Volkswagen ID.4 – 147 units; ZEEKR 001 – 107 units; Nissan Ariya – 83 units.

The top five used cars were Nissan Leaf – 658 units; Tesla Model Y – 588 units; Tesla Model 3 – 561 units; Hyundai Kona – 308 units; Volkswagen e-Golf – 289 units.

In total, in January-August, more than 35.6 thousand battery-powered vehicles were registered for the first time in Ukraine (79% more than in the same period in 2023), with new vehicles accounting for 20%.

For its part, the AUTO-Consulting information and analytical group also notes a jump in demand for electric cars based on information about military training – according to its data, 1.3 thousand new electric vehicles were sold in August, which was a monthly sales record for the entire period of observation.

“Although the market share of electric cars slightly decreased compared to previous months and amounted to 16%, the absolute number of sales was a record, despite the massive power outages,” the group’s website states.

According to experts, 8.2 thousand new electric vehicles (16.9% of the total car market) were sold in Ukraine in 8 months of 2024, which is 30% more than in the same period in 2023.

As reported, in 2023, according to Ukravtoprom, registrations of new and used electric cars in Ukraine increased 2.8 times to 37.6 thousand, with new cars accounting for 20% compared to 17% a year earlier.

Binance Research, the analytical division of the world’s leading blockchain ecosystem Binance, has published a report for August 2024 that highlights the main trends shaping the cryptocurrency market.

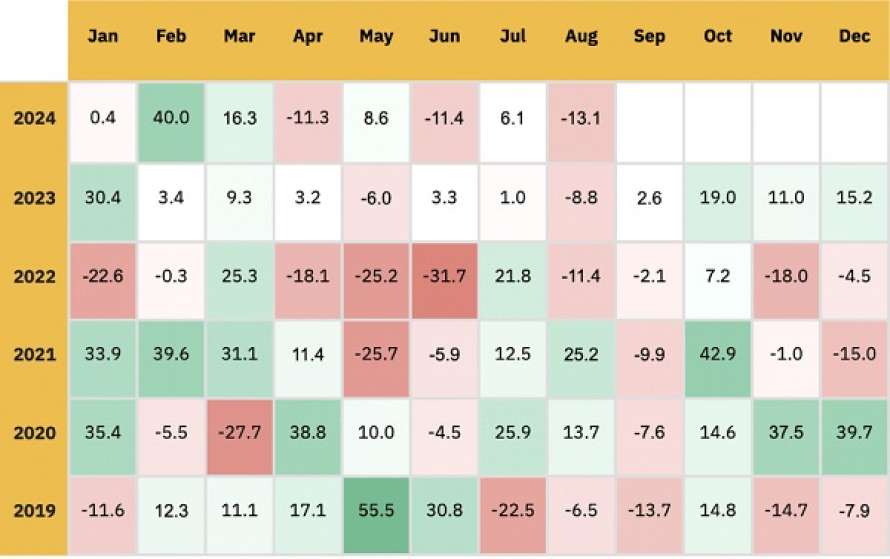

Cryptocurrency market dynamics in August 2024

In August 2024, the cryptocurrency market experienced a significant drop of 13.1% of the total market capitalization. It was triggered by global macroeconomic problems and weak unemployment in the United States, which increased fears of a recession. The Bank of Japan’s decision to raise interest rates on August 5 caused significant disruptions in global stock markets. Asian indices, such as the MSCI Asia Pacific and Japan’s Nikkei 225, were particularly affected, suffering sharp losses throughout the day. This volatility also spread to the cryptocurrency market, leading to liquidations of more than $819 million in one day.

Source: CoinMarketCapAs (as of August 31, 2024)

Despite this “quick crash,” the market began to stabilize after US Federal Reserve Chairman Jerome Powell hinted at a possible interest rate cut in September. In addition, the U.S. Bureau of Economic Analysis revised its second-quarter GDP growth rate to 3%, which exceeded expectations.

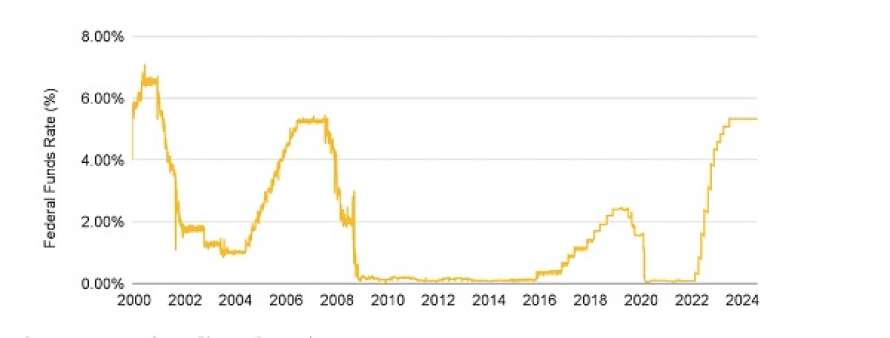

Expected rate cut: a signal for economic growth and lower unemployment

The US federal funds rate was at its highest level since 2001 after a significant rate hike cycle between March 2022 and July 2023. After holding rates steady for 8 consecutive meetings, all eyes are on a rate cut at the next meeting on September 17. -18. For context, the Fed adjusts the target federal funds rate in line with economic conditions. This is done to fulfill their dual mandate of maintaining stable prices (i.e., keeping inflation under control) and supporting maximum employment. Now that inflation in the US has come down significantly from its highs and is rapidly approaching its 2% target, the Fed has turned its attention to unemployment. The hope is that lowering the target rate (i.e., the price of credit) should lead to a new influx of money into the economy, which could lead to more hiring and improved employment figures.

Source: macrotrends.net, Binance Research (as of August 31, 2024)

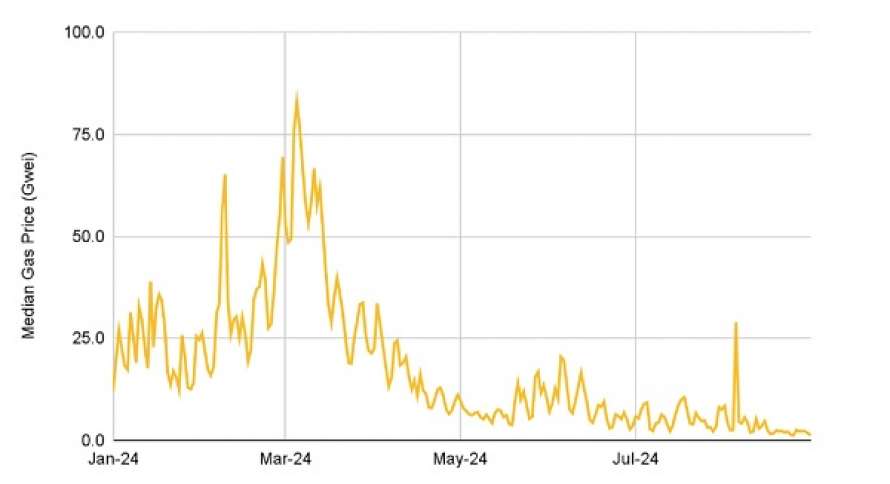

Historic decline in Ethereum fees: impact of the Dencun update and reduced network activity

Transaction and smart contract fees on the Ethereum network at the Layer-1 level have reached their lowest levels in more than five years, with several low-priority transactions costing one gwey or less in recent weeks. The decline in fees can be attributed to reduced network activity and the introduction of blobs during the Dencun update in March, which not only reduced fees at the Layer-2 level but also reduced congestion at the Ethereum Layer-1 level, thereby contributing to the overall decline in fees.

Source: Dune Analytics, Binance Research (as of August 31, 2024)

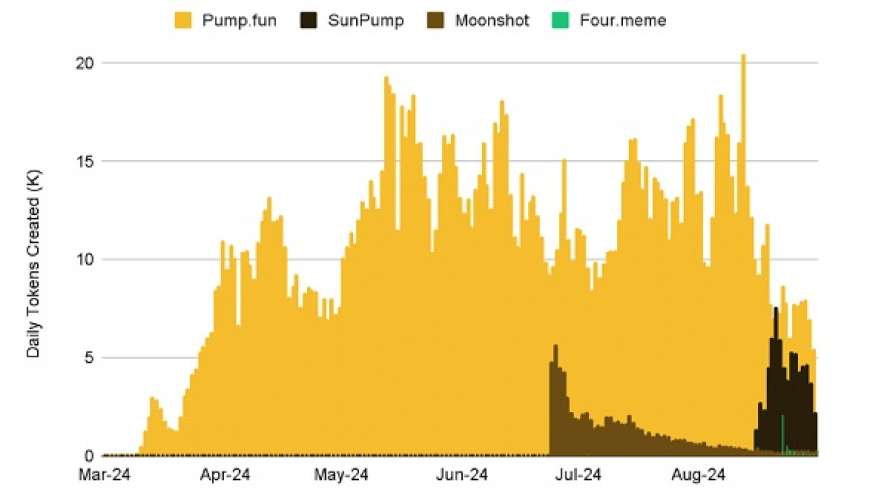

Pump.fun maintains leadership among meme coin launch platforms despite growing competition

Despite the emergence of competitive meme token platforms, Pump.fun remains the leader, setting a new record this month with more than 20 thousand tokens created in a single day. The platform has already launched nearly 2 million tokens and has been powering more than 60% of daily transactions on Solana-based decentralized exchanges since mid-August. As competition intensifies, it will be interesting to see if Pump.fun can maintain its dominant position as the leading meme token launch platform.

Source: Dune Analytics, Binance Research (as of August 31, 2024)

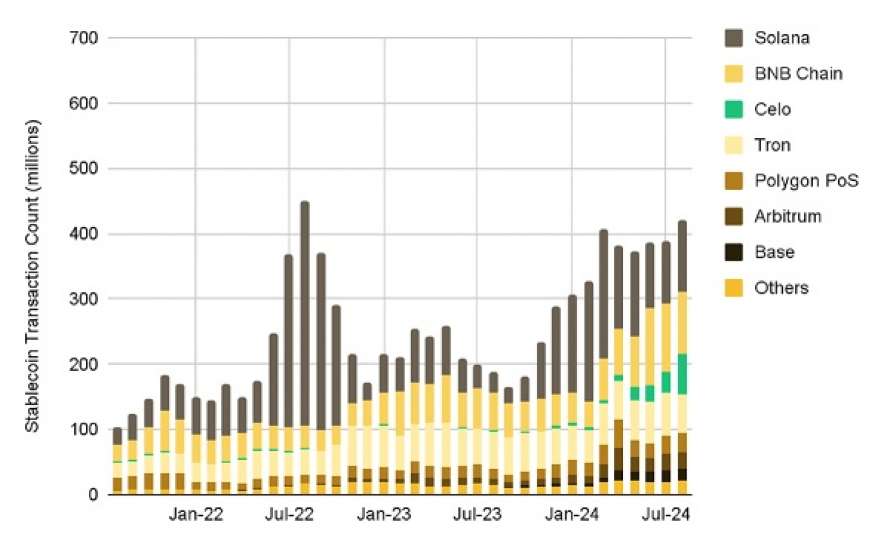

The stablecoin market continues to grow: new transaction records in the CELO and Solana ecosystems

The stablecoin market continues to grow rapidly, with the number of transactions approaching historic highs. Significant growth is observed in the CELO and Solana ecosystems. While the supply on USDT CELO has quickly reached the USD 200 million mark, Solana is leading the way in terms of transaction volume, helping PayPal’s PYUSD reach a market capitalization of USD 1 billion. As stablecoins gain popularity around the world, it is important to keep an eye on how macroeconomic factors and regulatory changes will affect the development of this sector.

Source: Binance Research (as of August 31, 2024)

The full report is available here.

About Binance

Binance is the world’s leading blockchain ecosystem and cryptocurrency infrastructure provider with a suite of financial products that includes the largest digital asset exchange by volume. Trusted by millions of people around the world, Binance’s platform aims to bring the freedom of money to users and has an unrivaled portfolio of crypto products and offerings, including: trading and finance, education, data and research, social good, investment and incubation, decentralization, infrastructure solutions, and more. For more information, please visit: https://www.binance.com.

Source: https://lenta.ua/kriptovalyutniy-rinok-u-serpni-analiz-vid-binance-research-163691/