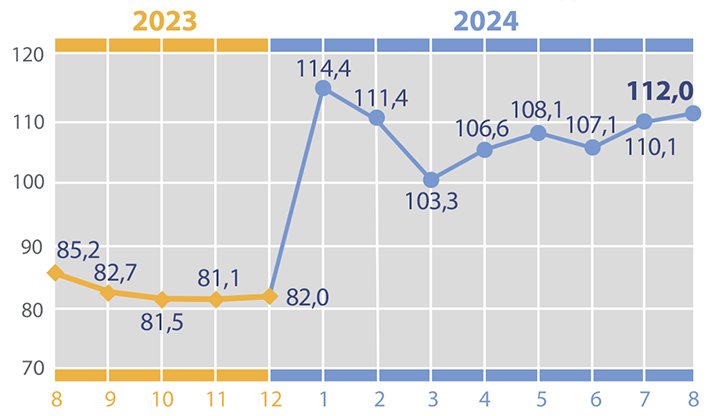

Export changes in % to previous period in 2023-2024

Open4Business.com.ua

Kernel Holding S.A. (Luxembourg), the holding company of one of the largest Ukrainian agricultural holdings, has refused to pay dividends for the 2024 fiscal year (FY, July 2023-June 2024) and will direct the received unconsolidated profit of $53.05 mln to reserves. As stated in the company’s announcement on the Warsaw Stock Exchange, such a decision was made by the shareholders’ meeting on December 10, at which the owner of 94.37% of the company’s shares Namsen Limited of the head of the board of directors and majority shareholder Andrew Werewski had 99.63% of the votes.

It is specified that 276 million 915.05 thousand votes were cast in favor of the decision, while against – 1 million 025.92 thousand. The meeting also approved the consolidated financial report of Kernel with a net profit of $167.95 million, which is 44% worse than 2023FY. The shareholders also confirmed PwC Société cooperative as independent auditor for the new fiscal year.

As reported, the agroholding’s revenue for the past FY grew by 4% to $3.581 bln, while EBITDA declined by 30% to $381 mln.

Kernel Agroholding is the world’s largest exporter of sunflower oil and one of the largest producers and sellers of bottled oil in Ukraine. In addition, it is engaged in the cultivation of agricultural products and their realization. Kernel’s net profit for 2023FY amounted to $299 mln, while the previous year the company finished with a net loss of $41 mln. The company’s revenue for 2023FY decreased by 35% to $3.455 bln, but EBITDA increased 2.5 times to $544 mln. Currently, Kernel’s shares are listed on the Warsaw Stock Exchange at the rate of 12.82 PLN (about $3.15) per unit.

Eurohold Bulgaria, represented in Ukraine by two insurance companies – “Euroins Ukraine” and “European Travel Insurance” – in January-September 2024 received a gross profit of EUR181.74 mln, which is 0.8% more than in the same period a year earlier. As reported in the information of IC “Euroins Ukraine” profit before interest taxes and amortization (EBITDA) amounted to EUR122.77 million, which is 36.6% higher than in the same period of 2023. The net financial result for the reporting period amounted to EUR16.21m. The group’s consolidated revenue amounted to around EUR1.02bn.

Eurohold’s insurance business, carried out through Euroins Insurance Group AD (EIG), showed growth and improved profitability. In the first nine months of this year, the group’s insurance revenues grew by 4% year-on-year to EUR198m, while EBITDA and the final financial result amounted to EUR8.44m and EUR1.87m.

“The segments and markets where we are active face challenges, but our results show that we are capable of overcoming them. I believe that we will conclude this year successfully, creating additional value for our shareholders and all our stakeholders,” said Eurohold CEO Assen Minchev,.

Eurohold Bulgaria is a leading energy and financial group operating in Central, Eastern and Southeastern Europe. It is listed on the Bulgarian and Warsaw Stock Exchanges.

Eurohold owns Euroinsurance Group (EIG), one of the largest insurance groups in the region. EIG provides a full range of insurance products, serves more than 4 million clients in 11 countries and employs more than 3000 people.

IC “Euroins Ukraine” is a universal non-life insurer, operating in the Ukrainian market since 1992. The company has about 100 representative offices all over the country, holds 25 licenses, 16 of them – for voluntary and 9 – for compulsory types of insurance.

IC “European Travel Insurance” has been working in the Ukrainian market since 2006 and is the only insurer in Ukraine, which specializes in travel insurance.

The company holds 8 licenses for voluntary types of insurance, works with both private individuals and corporate clients.

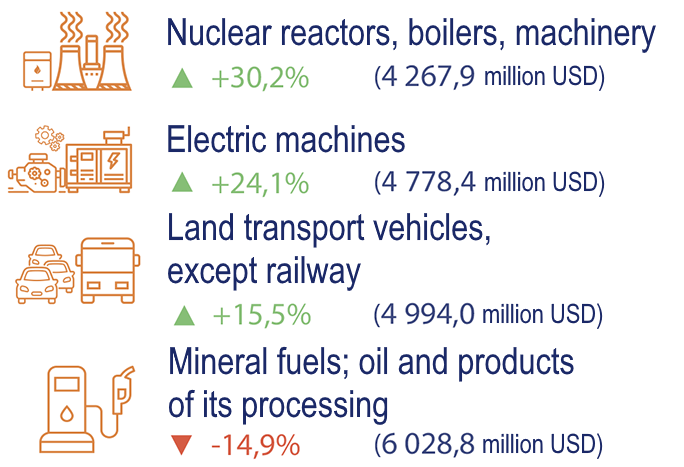

Dynamics of import of goods in january-august 2024 by the most important items in relation to the same period of 2023, %

Open4Business.com.ua

By the decision of the extraordinary general meeting of participants of ALC “Insurance Company ‘Guardian’ (Kiev) on December 5, 2024, Tatyana Shchuchieva was appointed CEO of the company, according to the information of the company. It is specified that Shchuchieva will assume her duties from December 11, 2024.

As reported, Tatiana Shchuchieva from May 2008 to October 2024 headed IC “Express Insurance”.

IC “Guardian” has been working in the insurance market since 2007. According to NBU data it is among the top 15 risky insurance companies of Ukraine by collected premiums following the results of nine months of 2024.

It is a member of the Presidium of the League of Insurance Organizations of Ukraine. Since January 2020 it has received the status of a full member of the Motor (Transport) Insurance Bureau of Ukraine (MTSBU), has the right to sell “Green Card” policies.

Dynamics of export of goods in January-August 2024 by the most important items in relation to the same period of 2023, %

Open4Business.com.ua