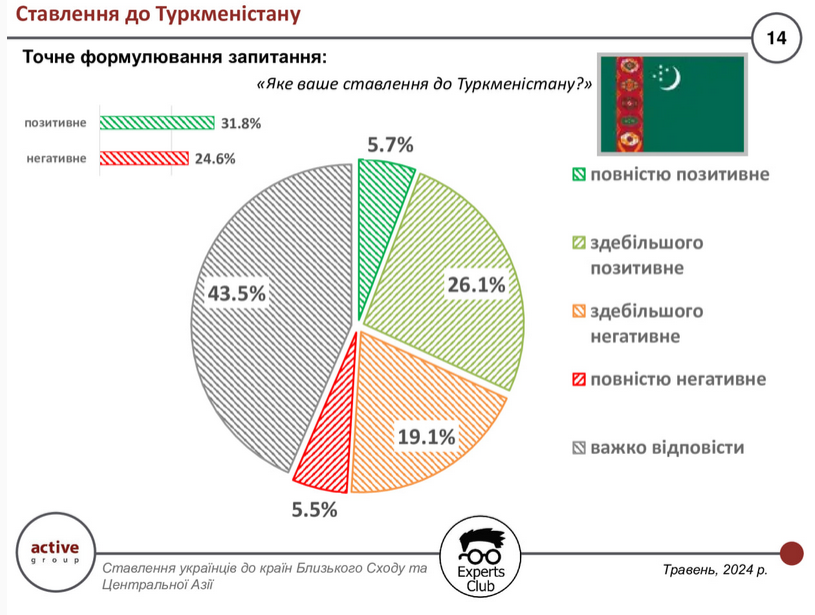

Active Group and Experts Club conducted a joint study on the attitudes of Ukrainians toward the countries of East Asia and the Middle East. The study was presented at the Interfax-Ukraine news agency in June 2024. The research was presented by Maksym Urakin and Oleksandr Poznyi. The results of the study are as follows:

The results of the survey are as follows:

Completely positive – 5.7

Mostly positive – 26.1 %.

Mostly negative – 19.1 %.

Completely negative – 5.5

Difficult to answer – 43.5%.

Positive – Negative – 7.2

On October 10, 1992, the Protocol on the Establishment of Diplomatic Relations between Ukraine and Turkmenistan was signed in Ashgabat. This day marked the beginning of diplomatic relations between the two countries. In 1995, the embassies of Ukraine and Turkmenistan were opened in Kyiv and Ashgabat.

A joint study by Active Group and Experts Club on the attitudes of Ukrainians towards East Asia and the Middle East was conducted in April-May 2024. It covers such countries as Turkey, Iran, Israel, Egypt, Jordan, Saudi Arabia, UAE, Afghanistan, Pakistan, Azerbaijan, Uzbekistan, Turkmenistan, Kyrgyzstan, Tajikistan, Kazakhstan, Georgia, Armenia, India, China, Republic of Korea, DPRK, Japan, Vietnam, Indonesia, Syria, and Iraq. Full information on the research is available on the website of the Club of Experts at

Artem Sytnik has been appointed deputy director of the “Defense Procurement Agency” (DPA) of the Ministry of Defense on security issues.

“From now on, he will be responsible for the internal security of the agency, verification of contractors and control over the proper execution of government contracts, building effective cooperation with law enforcement agencies,” AOZ said on its Facebook page.

Sytnyk headed the National Anti-Corruption Bureau in 2015-2022. Subsequently, he worked as Deputy Director of the National Anti-Corruption Agency, where he was responsible for interaction with law enforcement agencies, financial control, special inspections, prevention of conflicts of interest.

“We are very much looking forward to his work on building processes that will prevent any manifestations of corruption and ensure efficient procurement and reliable supplies of weapons to the Armed Forces,” Director of the Defense Procurement Agency Marina Bezrukova said on Facebook on Friday.

Sytnik, in turn, expressed hope that his experience “will help strengthen the Agency and minimize possible risks in its work.”

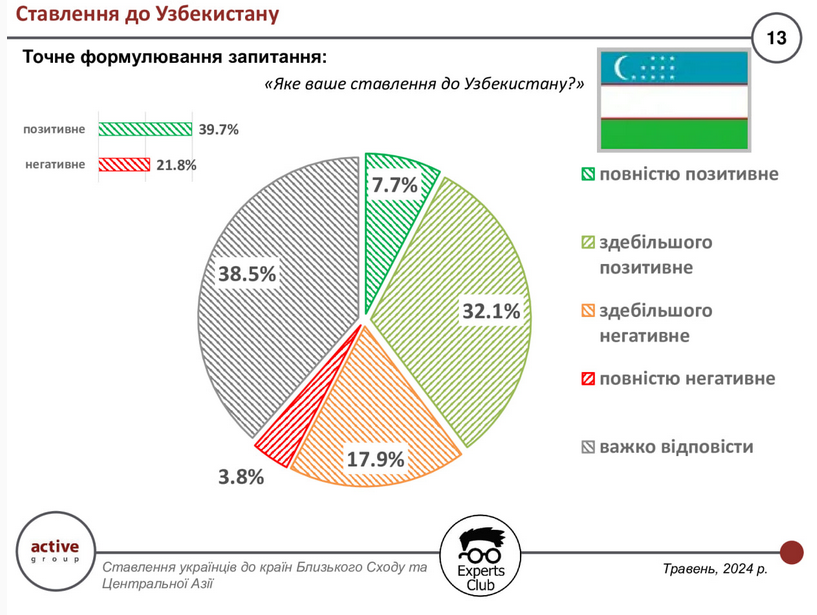

Active Group and Experts Club have conducted a joint study on the attitudes of Ukrainians towards the countries of East Asia and the Middle East. The study was presented at the Interfax-Ukraine news agency in June 2024. The research was presented by Maksym Urakin and Oleksandr Poznyi. The results of the study are as follows:

The results of the survey are as follows:

Completely positive – 7.7

Mostly positive – 32.1 %.

Mostly negative – 17.9

Completely negative – 3.8%.

Difficult to answer – 38.5%.

Positive – Negative – 17.9

Diplomatic relations between Ukraine and the Republic of Uzbekistan were established on August 14, 1992. The Embassy of Uzbekistan in Ukraine has been operating in Kyiv since April 1995.

The joint research by Active Group and Experts Club on the attitudes of Ukrainians towards the countries of East Asia and the Middle East was conducted in April-May 2024. It covers such countries as Turkey, Iran, Israel, Egypt, Jordan, Saudi Arabia, UAE, Afghanistan, Pakistan, Azerbaijan, Uzbekistan, Turkmenistan, Kyrgyzstan, Tajikistan, Kazakhstan, Georgia, Armenia, India, China, Republic of Korea, DPRK, Japan, Vietnam, Indonesia, Syria, and Iraq. Full information on the research is available on the website of the Club of Experts at

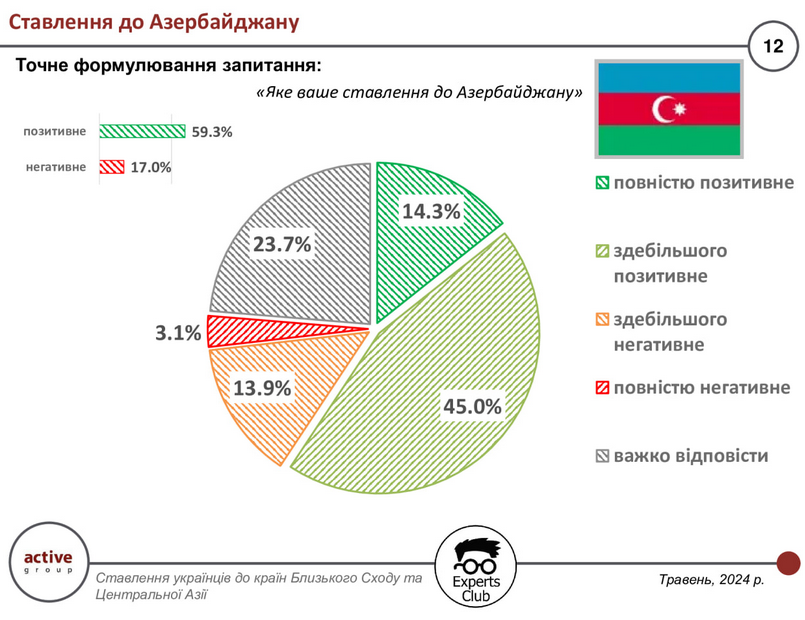

Active Group and Experts Club have conducted a joint study on the attitudes of Ukrainians towards the countries of East Asia and the Middle East. The study was presented at the Interfax-Ukraine news agency in June 2024. The research was presented by Maksym Urakin and Oleksandr Poznyi. The results of the study are as follows:

The results of the survey are as follows:

Completely positive – 14.3%.

Mostly positive – 45.0%.

Mostly negative – 13.9 %.

Completely negative – 3.1 %.

Difficult to answer – 23.7%.

Positive – Negative – 42.3

On February 06, 1992, Ukraine and Azerbaijan established diplomatic relations. The Embassy of Azerbaijan in Ukraine was opened on March 12, 1997.

The joint research by Active Group and Experts Club on the attitudes of Ukrainians towards the countries of East Asia and the Middle East was conducted in April-May 2024. It covers such countries as Turkey, Iran, Israel, Egypt, Jordan, Saudi Arabia, UAE, Afghanistan, Pakistan, Azerbaijan, Uzbekistan, Turkmenistan, Kyrgyzstan, Tajikistan, Kazakhstan, Georgia, Armenia, India, China, Republic of Korea, DPRK, Japan, Vietnam, Indonesia, Syria, and Iraq. Full information on the research is available on the website of the Club of Experts at

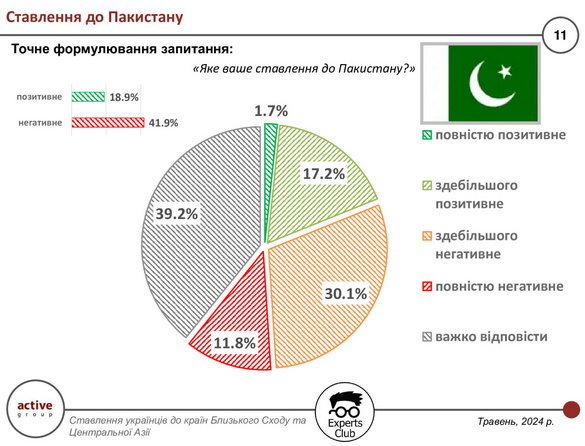

Active Group and Experts Club have conducted a joint study on the attitudes of Ukrainians towards the countries of East Asia and the Middle East. The study was presented at the Interfax-Ukraine news agency in June 2024. The research was presented by Maksym Urakin and Oleksandr Poznyi. The results of the study are as follows:

The results of the survey are as follows:

Completely positive – 1.7%.

Mostly positive – 17.2

Mostly negative – 30.1 %.

Completely negative – 11.8 %.

Difficult to answer – 39.2%.

Positive – Negative – 23.0%.

On March 16, 1992, diplomatic relations between Ukraine and Pakistan were established. The Embassy of Pakistan has been operating in Kyiv since October 1997.

The joint research by Active Group and Experts Club on the attitudes of Ukrainians towards the countries of East Asia and the Middle East was conducted in April-May 2024. It covers such countries as Turkey, Iran, Israel, Egypt, Jordan, Saudi Arabia, UAE, Afghanistan, Pakistan, Azerbaijan, Uzbekistan, Turkmenistan, Kyrgyzstan, Tajikistan, Kazakhstan, Georgia, Armenia, India, China, Republic of Korea, DPRK, Japan, Vietnam, Indonesia, Syria, and Iraq. Full information on the research is available on the website of the Club of Experts at

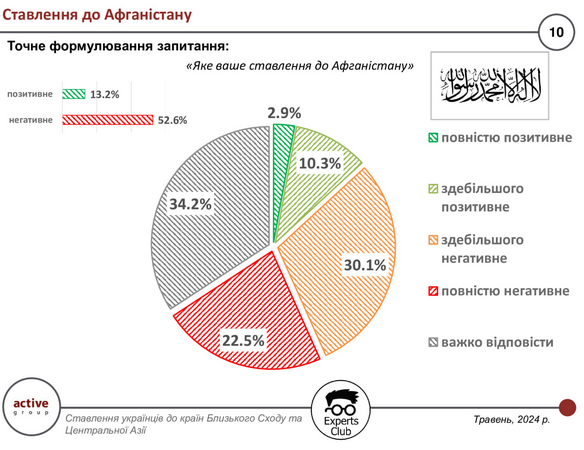

Active Group and Experts Club have conducted a joint study on the attitudes of Ukrainians towards the countries of East Asia and the Middle East. The research was presented at the Interfax-Ukraine news agency in June 2024. The research was presented by Maksym Urakin and Oleksandr Poznyi. The results of the study are as follows:

The results of the survey are as follows:

Completely positive – 2.9%.

Mostly positive – 10.3

Mostly negative – 30.1 %.

Completely negative – 22.5

Difficult to answer – 34.2%.

Positive – Negative – 39.5

On March 17, 1992, Ukraine and Afghanistan established diplomatic relations.

The joint research by Active Group and Experts Club on the attitudes of Ukrainians towards the countries of East Asia and the Middle East was conducted in April-May 2024. It covers such countries as Turkey, Iran, Israel, Egypt, Jordan, Saudi Arabia, UAE, Afghanistan, Pakistan, Azerbaijan, Uzbekistan, Turkmenistan, Kyrgyzstan, Tajikistan, Kazakhstan, Georgia, Armenia, India, China, Republic of Korea, DPRK, Japan, Vietnam, Indonesia, Syria, and Iraq. Full information on the research is available on the website of the Club of Experts at