During a working visit to the Kingdom of Saudi Arabia, Ukrainian President Volodymyr Zelensky met with the Crown Prince, Prime Minister of Saudi Arabia, Muhammad bin Salman Al Saud.

“The Ukrainian head of state emphasized the desire of Saudi Arabia to help restore a just peace in Ukraine,” the presidential press service reported.

Zelensky and Muhammad bin Salman Al Saud exchanged views on the current situation in the world and possible ways to end the war in Ukraine.

The parties discussed the realization of the Formula for Peace. The President of Ukraine thanked the Crown Prince for his valuable advice on speeding up the process of implementation of a number of its points.

“Saudi Arabia’s leadership can help to find fair solutions,” the President said.

The Head of State informed the Crown Prince about the preparation by Ukraine together with its partners of the first Global Summit of Peace at the level of leaders, which will be held in Switzerland. Volodymyr Zelensky and Muhammad bin Salman Al Saud discussed the content of the summit and possible steps to really restore security for Ukraine, all of Europe and all peoples of the world.

“We are equally interested in ensuring global stability,” the President emphasized.

The leaders also discussed specific opportunities for bilateral cooperation between Ukraine and Saudi Arabia in the economic and technological sphere.

Volodymyr Zelensky and Muhammad bin Salman Al Saud instructed the teams of the two states to work on the relevant areas discussed during the meeting.

Due to the fault of foreign drivers with a valid insurance contract “Green Card” last year in Ukraine there were 315 road accidents (RTA).

As reported in Facebook Motor (transport) Insurance Bureau of Ukraine, according to the law of Ukraine on compulsory insurance of motor liability, in such cases the damage to the injured driver is compensated at the expense of the Insurance Guarantee Fund of the MTSBU.

“Such regulatory payment is carried out on the terms and amounts established by the legislation of Ukraine and the principles of mutual settlement of damage on the territory of the member countries of the international system of automobile insurance “Green Card”, it is noted in the message.

ITSBU is the only association of insurers carrying out compulsory insurance of civil liability of owners of land vehicles for damage caused to third parties.

“Green Card” – a system of insurance protection of victims in a traffic accident regardless of the country of their residence and the country of registration of the vehicle. “Green Card” covers the territory of 45 countries in Europe, Asia and Africa.

According to the decision adopted by the General Assembly of the Council of the Bureau of the International Motor Insurance System “Green Card” in Luxembourg in May 2004, Ukraine is a full member of this system since January 1, 2005.

auto insurance, car insurance, DRIVERS, GREEN CARD, insurance bureau

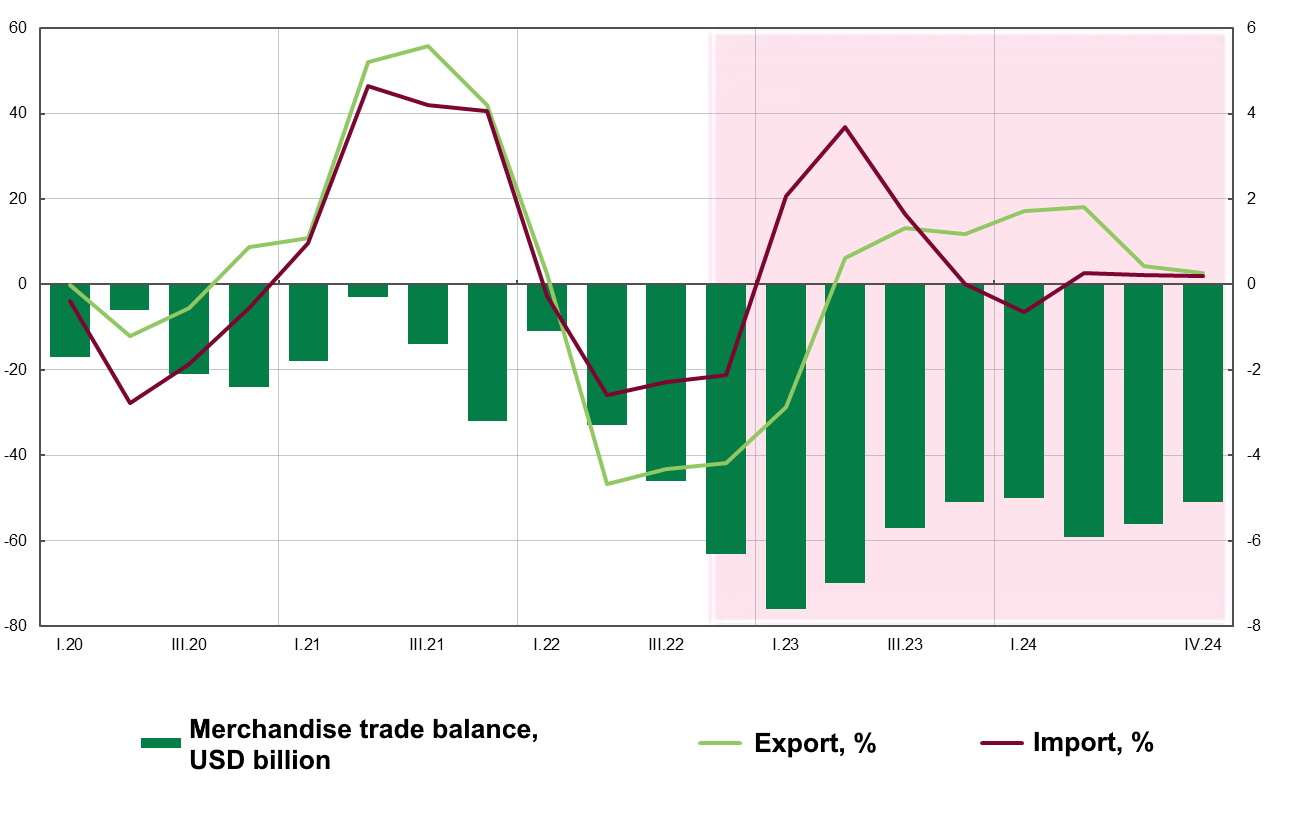

2022-2024 goods trade balance forecast (USD billion)

Source: Open4Business.com.ua and experts.news

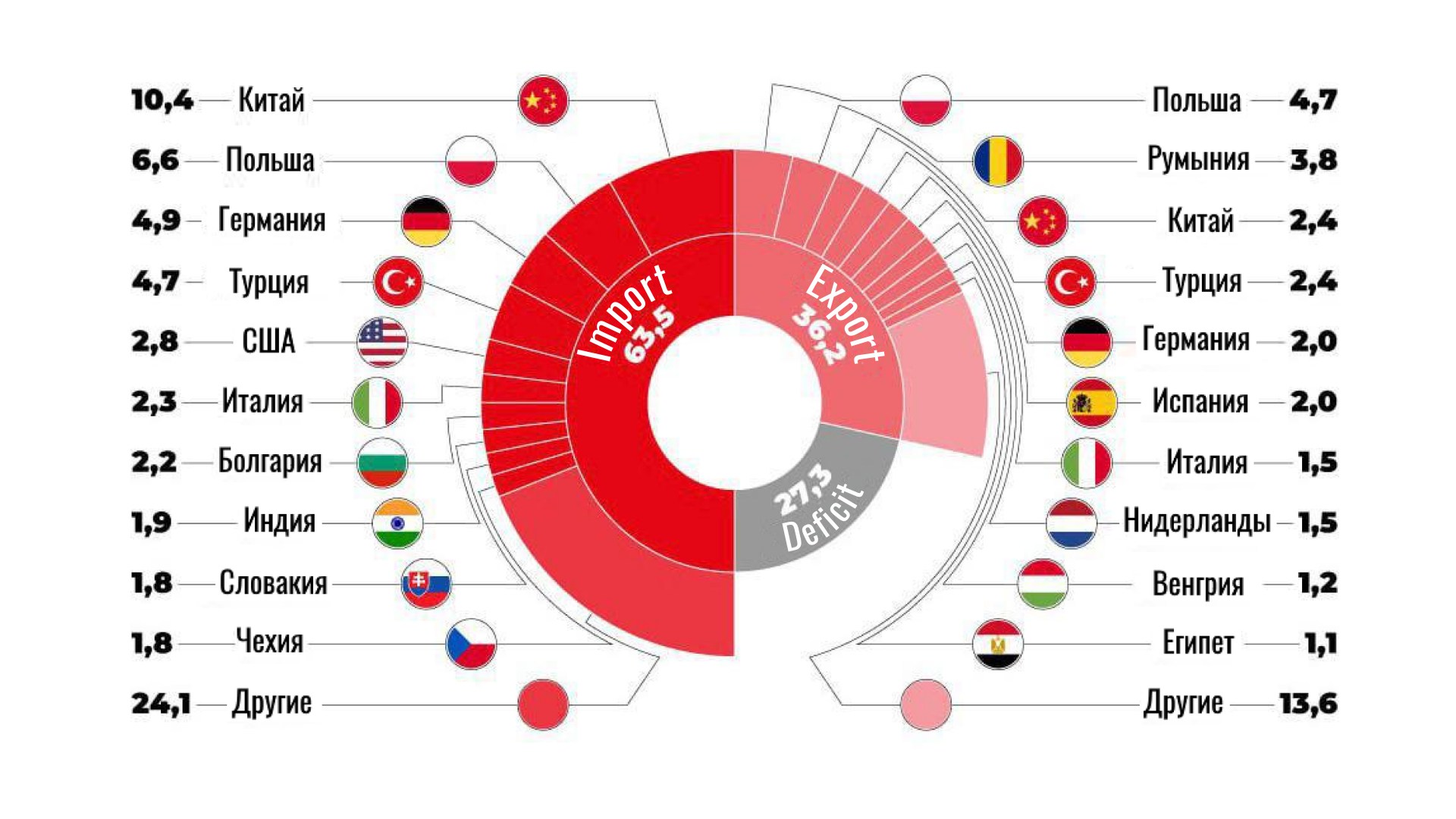

Geographic structure of Ukraine’s foreign trade in 2023

Source: Open4Business.com.ua and experts.news

Ukraine is ready to fix the level of exports of eggs, chicken meat and sugar to Poland at the level of 2022-2023, Prime Minister Denis Shmygal said.

“We have already introduced a verification and control mechanism for four groups of cereals on September 16. We are also ready to go in terms of setting the export level for eggs, chicken meat and sugar at the level of 2022-2023. These are quite large volumes. We are ready to fix them and move within these boundaries,” Shmygal said at the forum “Ukraine. Year 2024” on Sunday.

Prime Minister also said that representatives of the Ukrainian government were at the Ukrainian-Polish border on Friday and talked to Ukrainian carriers who were returning by grain carriers from Europe.

Commenting on the protests of Polish farmers on the Ukrainian-Polish border, the Prime Minister reminded that they were taking place against the background of Russia’s hybrid warfare in Europe. “This should not be forgotten. There is support for radical and pro-Russian political forces throughout the European Union, particularly in Poland. This leads to terrible things that we see when they pour out grain and act illegally,” he emphasized.

Shmygal noted that the Polish government and the police react to these violations adequately, and appropriate cases are initiated. The first violators have already been brought to court, they face up to five years in prison.

According to the prime minister, the Ukrainian government announced five steps to unblock the Ukrainian-Polish border, and also notified the European Commission about Ukraine’s proposed “plan of mutual understanding” with Poland. Now Ukraine will start implementing them jointly with the European Commission.

As reported, Ukraine on February 23 on the Ukrainian-Polish border announced five steps for the de-blockade of the border. In particular, Ukraine agreed to limit the entry of poultry meat, eggs and sugar to Poland and will export them to the EU without quotas and duties in volumes no more than the average in 2022 and 2023. In addition, Ukraine is ready to continue the mechanism of verification of exports of grain, corn, sunflower and rapeseed, which means that these four groups of goods will not enter the Polish market without Polish authorization.

The second step will be Ukraine’s appeal to the European Commission with a proposal to conduct urgent screening of clusters 4 and 5, which include agrarian policy and transportation.

The third step is a proposal to the Polish government to adopt a joint appeal to the European Commission to stop Russian agricultural exports to the EU.

The fourth step was the creation of a “Trilateral Headquarters: Ukraine, Poland, European Commission” co-chaired by the agrarian ministers of Ukraine, Poland and a representative of the European Commission.

The fifth step is to expand free passage across the border not only for ammunition and humanitarian aid, but also for Ukraine’s critically needed fuel.

Emergency rescue squad of special purpose of the State Emergency Service of Ukraine (SESU) of Cherkassy region on February 23 announced its intention to conclude with IC “Ukrainian Fire Insurance Company” a contract of compulsory insurance of civil liability, according to the system of electronic public procurement Prozorro.

According to the system of electronic public procurement “Prozorro”, with the expected cost of the purchase of services under the tender 201.448 thousand UAH, the company offered 162.6 thousand UAH.

IC “Arsenal Insurance” also took part in the tender with a price offer of UAH 162,7 th.

UICC has been working in the insurance market since 1992. The majority shareholder and the head of the supervisory board is Alexander Mikhailov.

The insurer is a member of the Motor (Transport) Insurance Bureau of Ukraine and has 60 licenses for insurance activities (21 types of voluntary and 39 types of compulsory insurance).