The UKRNAFTA chain of gas stations continues to develop multi-channel customer services and increase its performance.

“Currently, the state-owned network is among the top three networks in Ukraine in terms of sales,” said Yuriy Tkachuk, acting chairman of the board of JSC Ukrnafta. “Modernization is ongoing: modern mini-markets are opening, the product range is expanding, and equipment is being updated. I would like to thank the UKRNAFTA team for their steady development, which provides the best modern experience for our customers.”

Non-fuel sales in the first half of 2025 increased by almost 75% compared to the same period in 2024. By product group: hot and cold drinks +100%, hot dogs +50%, UKRNAFTA own brand washer fluid +80%, original AdBlue +35%.

More than 8,300 customers already use UKRNAFTA cards and vouchers. In total, since 2023, when the company’s own B2B program was launched, 170,000 cards have been issued, which can be used at 1,503 gas stations, both our own and those of our partners.

Developed and launched at the end of 2023, the UKRNAFTA app now has 1.5 million active users and is at the top of PlayMarket and AppStore. Every day, 3-4 thousand people install it.

Ukrnafta is Ukraine’s largest oil production company and operates a national network of gas stations. In March 2024, the company took over the management of Glusco’s assets and now operates a total of 545 gas stations — 461 of its own and 84 under management.

The company is implementing a comprehensive program to restore operations and upgrade the format of its network of gas stations. Since February 2023, it has been issuing its own fuel vouchers and NAFTAKarta cards, which are sold to legal entities and individuals through Ukrnafta-Postach LLC.

The largest shareholder of Ukrnafta is Naftogaz of Ukraine with a 50%+1 share.

In November 2022, the Supreme Commander-in-Chief of the Armed Forces of Ukraine decided to transfer to the state the corporate rights of the company that belonged to private owners, which is now managed by the Ministry of Defense.

The valuation of Kyivstar Group Ltd., which owns Ukraine’s largest mobile operator Kyivstar, has grown by approximately 20%, or $600-700 million, since the conclusion of the agreement with SPAC company Cohen Circle and the listing on the stock exchange, and the company has the potential to increase it, according to Alexander Komarov, president of Kyivstar Group and Kyivstar.

“I am deeply convinced that this is a significant underestimation of our business. There are two major factors. The first is the valuation of the company in a country at war, and the war will end. The second is that we are now seen more as a telecom operator, while Kyivstar is a digital services operator with a telecom license,” Komarov told reporters on August 29, when Nasdaq held an official trading opening ceremony together with Kyivstar and representatives of the Ukrainian government.

According to him, in the second quarter of 2025, the share of revenue from digital services in Uklon, Helsi, big data, cloud services, and Kyivstar TV already exceeded 10% of the company’s total revenue.

“Any business that we develop in the digital environment grows by at least 50% year-on-year. And some grow by 100+, 200% year-on-year,” said the company’s president.

He specified that Kyivstar’s current capitalization is about $2.8 billion, while the capitalization of its parent company VEON is about $4.2 billion.

As reported, on August 15, Kyivstar Group Ltd., after completing all the necessary procedures with SPAC company Cohen Circle, announced the start of trading on Nasdaq.

“It seems to me that these two weeks, during which Kyivstar has already been part of the international market, have shown that even during the war it is possible to develop, it is possible to create new services, it is possible to create value for all stakeholders, for customers, for shareholders, and thus increase the capitalization of companies,” Komarov emphasized.

He also cited two independent estimates: according to the first, the price per share will reach $14 in 12 months, and according to the second, $19.8, while at the end of the day on Friday, August 29, it was $12.43.

According to him, Kyivstar’s multiplier (revenue/EBITDA) is about 4, which corresponds to the lower level of valuation of Eastern European operators.

“Therefore, I believe that, given the current situation and the deals that have been made in Ukraine over the past few years in the telecom sector, the current situation looks quite optimistic,” Komarov concluded.

He also announced that the company has created a new expanded supervisory board of 10 members headed by VEON CEO Kaan Terzioglu.

Regarding the Kyivstar office in Dubai, which was opened in connection with the company’s IPO, the president specified that it will employ about 10 people who will deal with legal issues, among other things.

When asked by journalists how dividends would be paid to investors, Komarov reminded them that their payment for 2023-2024 is limited by the National Bank of Ukraine to EUR1 million per month, so Kyivstar will decide whether to pay or not after the relevant restrictions are lifted.

Komarov said that the company currently has approximately $400 million in its account, and this money is being used for investment.

“I will use last year’s figure, but I can say that this year’s figure will be significantly higher. We invested (in 2024) approximately 26% of our income, which is more than $200 million.”

According to Nasdaq data, on the first day of trading under the KYIV ticker, the share price fell by 7.4% to $11.52, corresponding to a capitalization of $2.437 billion.

The share of the parent company VEON in Kyivstar after the merger with SPAC decreased from 100% to 89.6%, while the deal provided $178 million in revenue, including investments from institutional partners Helikon and Clearline.

Kyivstar serves nearly 23 million mobile subscribers and over 1.1 million home internet subscribers. Its digital services portfolio includes the Helsi medical platform, the Kyivstar TV movie and television platform, and the leading ride-hailing and delivery company Uklon. Kyivstar is also a provider of solutions for corporate clients, offering cloud technology, cyber security, and artificial intelligence services. Through its Kyivstar.Tech division, the company is developing software development in Ukraine and is a partner for international technology companies such as Starlink.

Kyivstar increased its EBITDA by 32% to $06 million in the first half of 2025, while its revenue grew by 28% to $539 million.

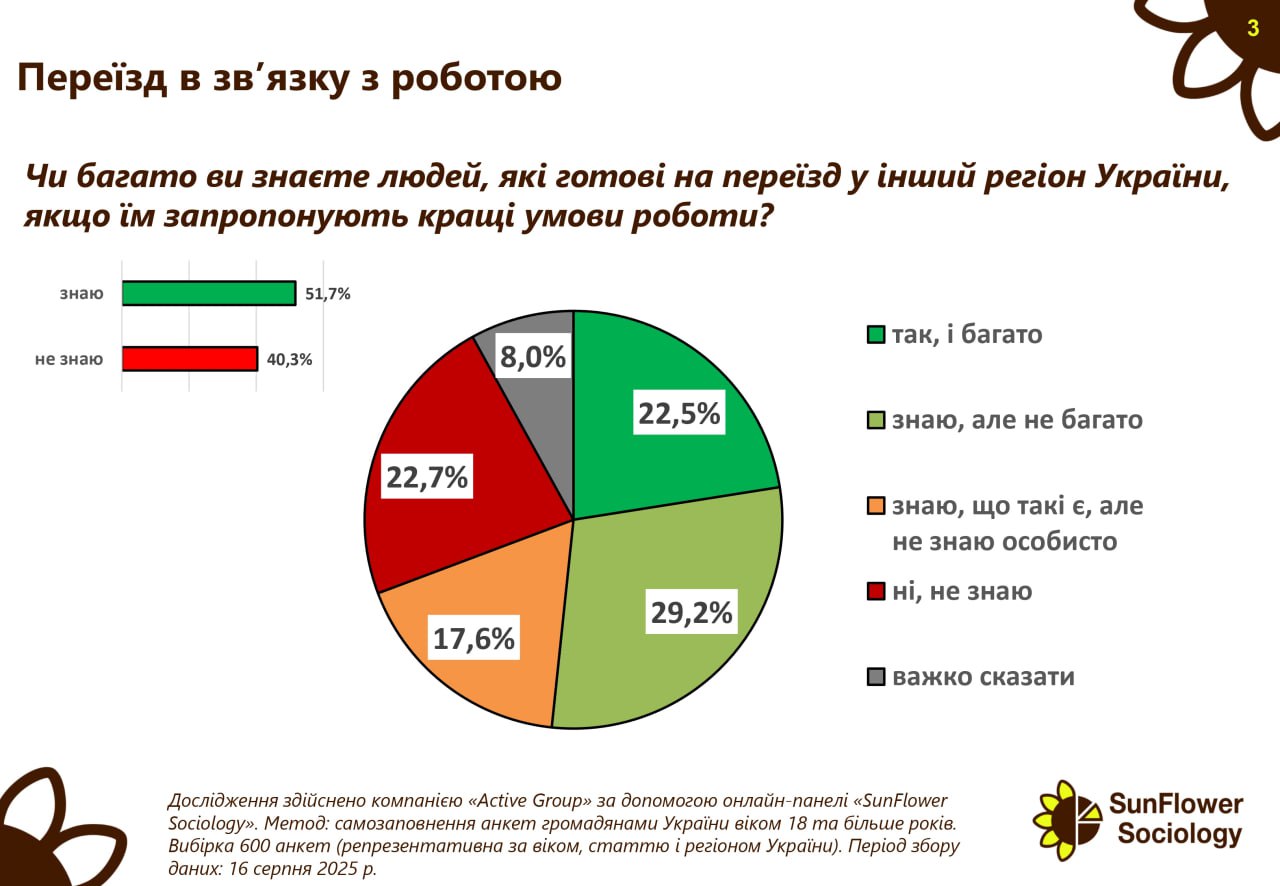

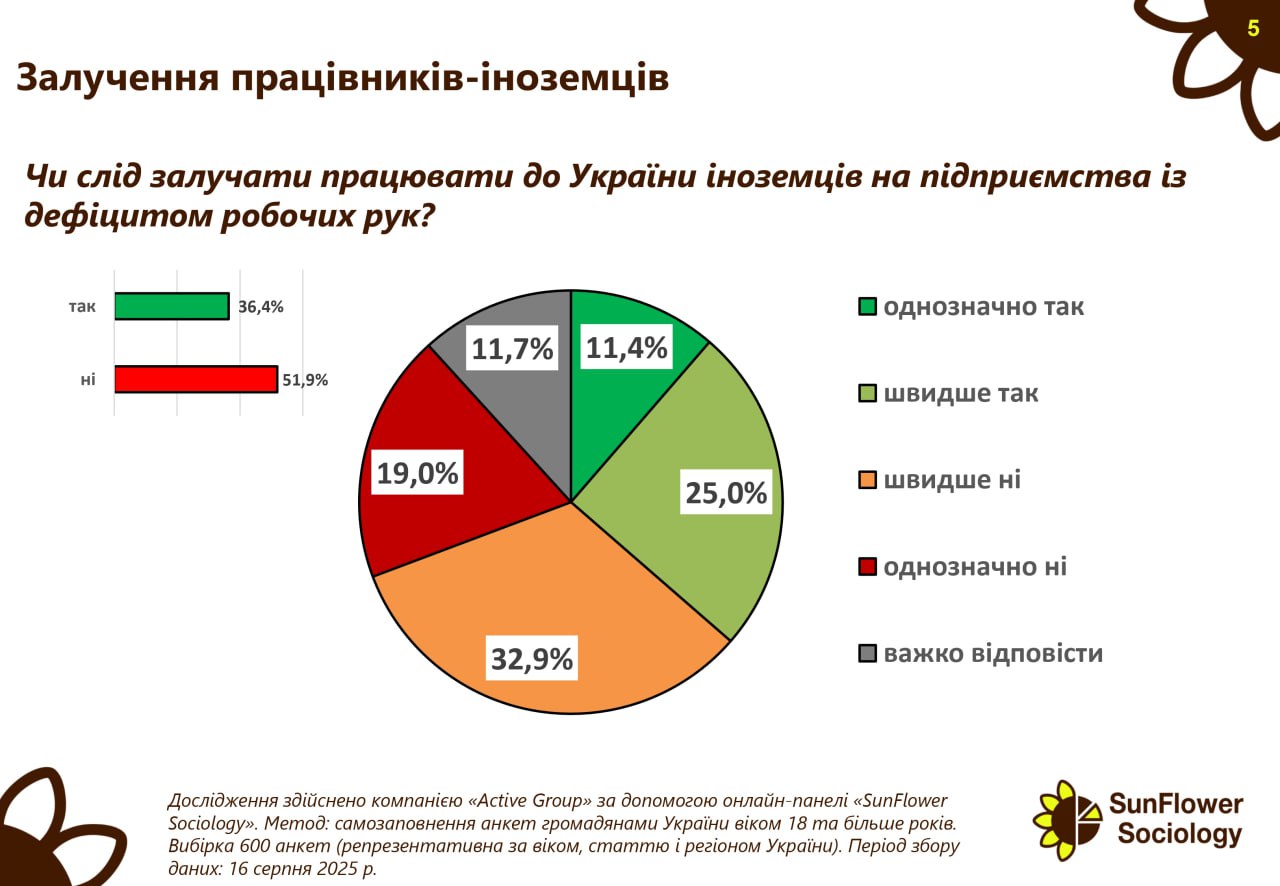

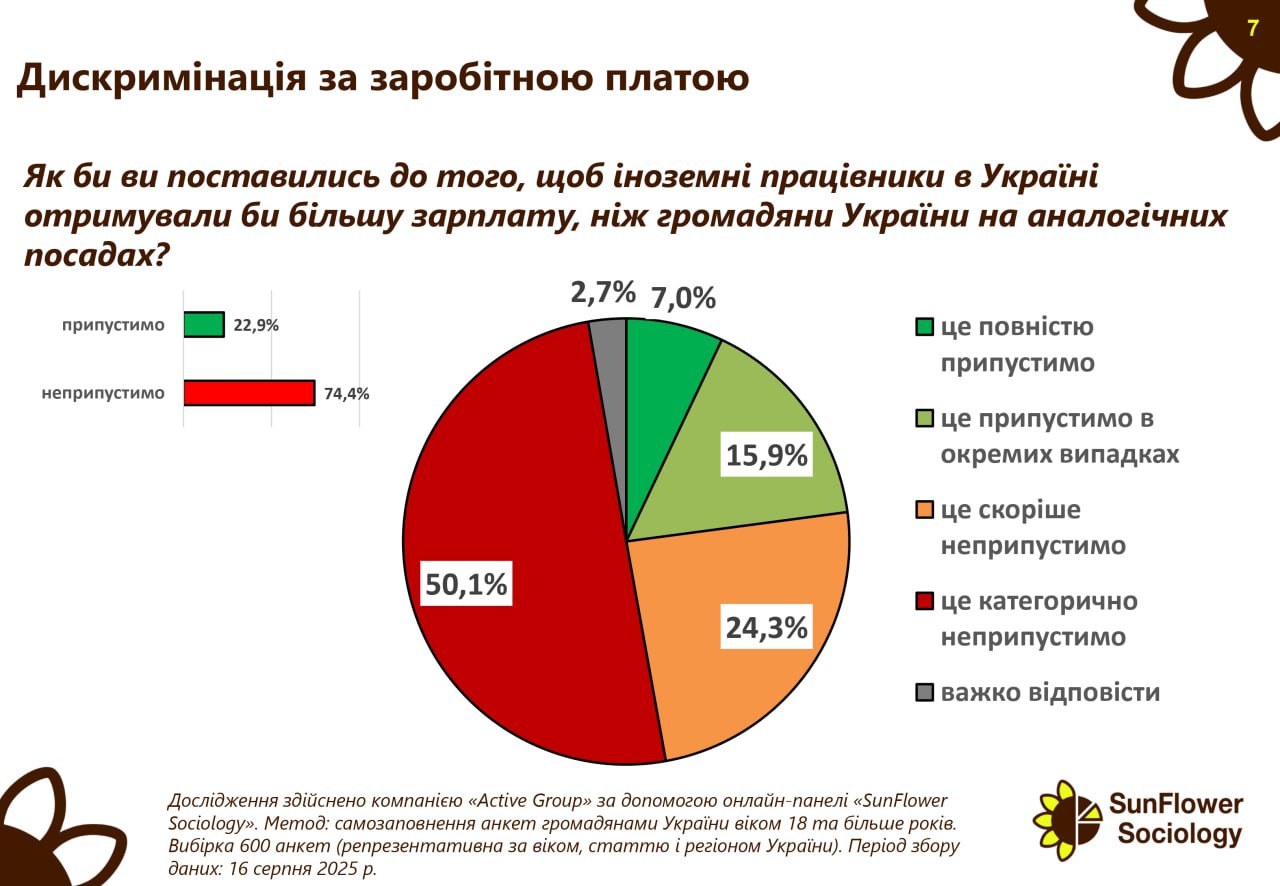

62.2% of Ukrainians believe that there is a severe labor shortage in the country. 25.4% of respondents believe that there is a shortage, but it is not serious. 6.3% do not believe that there is a problem. Another 6.1% were undecided.

These are the results of a sociological study conducted by the research company Active Group on August 16, 2025, using the SunFlower Sociology online panel.

The average salary of full-time employees in July 2025 was UAH 26,499, according to the State Statistics Service (SSS).

According to the statistics agency, the highest average salary last month was recorded in Kyiv – UAH 40,546, and the lowest in the Chernivtsi region – UAH 19,202.

The average salary in July 2025 in the field of information and telecommunications was UAH 67,222, in finance and insurance – UAH 55,994, in professional, scientific, and technical activities – UAH 34,068, in public administration and defense – UAH 33,896, in wholesale and retail trade – UAH 31,424, in industry – UAH 29,063, in transport, postal and courier services – UAH 26,612, in real estate operations – UAH 22,6987, and in construction – UAH 22,775.

The average number of full-time employees in Ukraine in July 2025 was 5.368 million people.

The wage fund for all employees in July 2025 amounted to UAH 150.361 billion, and for full-time employees – UAH 142.233 billion.

The State Statistics Service reminds that the data does not include territories temporarily occupied by the Russian Federation and parts of territories where hostilities are (were) ongoing.

Agroholding Astarta, Ukraine’s largest sugar producer, processed 123,000 tons of soybeans in January-June 2025, which is in line with last year’s figure, according to the agricultural holding’s report published on the Warsaw Stock Exchange on Friday.

According to the published data, the segment’s revenue in the first half of 2025 decreased by 6% year-on-year to EUR 55 million, with exports accounting for 91% (+5 p.p. year-on-year) of this revenue.

Gross profit in the soybean processing segment decreased by 41% year-on-year to EUR12 million. Gross profit margin was 21% in the first half of 2025, compared to 33% in the first half of 2024, which Astarta explained by an increase in the cost of sales. EBITDA for the first half of 2025 amounted to EUR7 million (-58% year-on-year), while EBITDA margin decreased from 28% to 13% in the first half of 2025.

According to the agricultural holding, the implementation of the investment project to build a soy protein concentrate production plant is proceeding according to schedule. Production is scheduled to start in 2026.

Astarta is a vertically integrated agro-industrial holding company operating in eight regions of Ukraine and is the largest sugar producer in Ukraine. It comprises six sugar factories, agricultural enterprises with a land bank of 220,000 hectares, dairy farms with 22,000 head of cattle, an oil extraction plant in Hlobyn (Poltava region), seven elevators, and a biogas complex.

In 2024, Astarta increased its net profit by 34.5% to EUR83.25 million, while its consolidated revenue decreased by 1.1% to EUR612.15 million.

In the first quarter of this year, the agricultural holding’s revenue fell by 24.9% to EUR124.58 million, while net profit fell by 28.8% to EUR6.42 million.

On June 12 this year, the shareholders’ meeting approved the payment of dividends for 2024 in the amount of EUR0.5 per share for a total of EUR12.5 million, which is in line with the figures for the previous two years.

Vodafone Ukraine (VFU), Ukraine’s second-largest mobile operator, reduced its net profit by 13% in the first half of 2025 compared to the same period last year, to UAH 1.705 billion, while its revenue grew by 15% to UAH 13.518 billion.

“The main growth factors remain the development of the fixed-line business, an increase in the volume of data services and the number of Internet users, and, accordingly, revenues from services, both mobile and fixed-line,” the company said in its financial report on Friday.

According to the report, the decrease in net profit was caused by additional expenses related to the two-year deferral of payments on Eurobonds, as well as an increase in debt servicing costs due to a 1.5-fold increase in the interest rate in accordance with the new restructuring terms.

As reported, in January-March 2025, revenue increased by 14% compared to the same period in 2024, to UAH 6.59 billion, while net profit fell by 24%, to UAH 697 million.

Vodafone Ukraine notes that OIBDA in the first half of 2025 increased by 12% compared to the first half of 2024, to UAH 7.17 billion, while the OIBDA margin decreased by 1.7 percentage points compared to the same period last year, to 53.1%.

The company emphasized that in the first half of the year, it increased its investments by 66% compared to the same period in 2024, investing more than UAH 3.5 billion in critical infrastructure, and in total, over 3.5 years of full-scale war, investments in Ukraine reached almost UAH 19 billion.

In the structure of investments in the first half of this year, 51% is accounted for by the construction and restoration of the network, as well as its preparation for operation during blackouts, 31% – network maintenance, 11% – fixed-line communications development, and 4% – the billing exchange program.

It is noted that the company’s net debt in the middle of this year amounted to UAH 13.65 billion: UAH 23.55 billion in gross debt, of which UAH 12.43 billion was in Eurobonds, against UAH 9.9 billion in free cash, including government bonds.

Vodafone Ukraine also noted that in July-August 2025, it paid dividends totaling UAH 97 million.

According to the report, in the second quarter of 2025, the number of customers decreased by 3.1% compared to the same period last year, to 15.4 million, but ARPU (average revenue per user per month) increased by 18.5% to UAH 136.

Vodafone announced that it had introduced innovative energy-saving technology Powerstar 2.0, based on artificial intelligence, and began connecting mobile base stations via passive xPON (1/10 Gigabit/s Passive Optical Network) optical networks, which should allow for a relatively quick transition to new mobile communication technologies – 5G and, in the future, 6G.

In addition, the modernization of the telecom infrastructure of the fixed-line operator Frinet, which has been part of the group since August 2023, has begun: replacement of the FTTB network with GPON, which will provide customers with up to 72 hours of autonomous operation and 10 times faster internet speed.

It is also noted that in May 2025, Vodafone Ukraine received and began using the 1940–1945/2130–2135 MHz radio frequencies, which previously belonged to the operator TriMob, which made it possible to increase the efficiency of spectrum use and strengthen network capacity.

According to the financial statements, in August 2025, the Group committed to participate in a joint project to build a new submarine cable system across the Black Sea, connecting Ukraine to the international transit route between Europe and Asia. The system will connect Bulgaria, Ukraine, Georgia, and Turkey, and is expected to be completed within five years. The total cost to the group is estimated at EUR65 million.

Vodafone Ukraine has been part of NEQSOL Holding since December 2019.