The list of specialized organizations that will procure medicines and medical products in 2021 was approved by the government at the Wednesday meeting.

According to the document, the Crown Agents British purchasing agency will procure: tests, consumables for the diagnosis of tuberculosis; immunobiological medicines for immunoprophylaxis of the population and products to ensure control of immunobiological preparations and medical devices; medicines for children with dwarfism of various origins; medical products for citizens suffering from epidermolysis bullosa; medicines for patients in the pre- and postoperative period of transplantation; consumables for determining the level of glucose in the blood, glycated hemoglobin; medicines for children with mental and behavioral disorders from the autism spectrum, with schizophrenia, affective disorders, hyperkinetic disorders and epilepsy; endoprostheses and implantation kits.

The United Nations Development Program (UNDP) will procure: medicines for citizens with viral hepatitis B and C; test systems for diagnosing HIV infection, accompanying antiretroviral therapy and monitoring the course of HIV infection in patients, determining the resistance of the virus, conducting reference studies; medicines and medical products to ensure the development of donation of blood and its components.

Delicia confectionery factory (Bucha, Kyiv region) plans to re-equip the existing production of flour products (rusks and dry biscuits, flour pastries, waffles, etc.), which will increase production capacity to 28,000 tonnes annually, according to the Unified National Environmental Impact Assessment Registry of the Ministry of Environmental Protection and Natural Resources of Ukraine.

The company plans to install new production lines in the existing production – one Gourmetback tunnel gas furnace and six similar furnaces in a new production and storage facility.

The confectionery is also considering an alternative project – the reconstruction of the existing production and the construction of a new workshop for the production of pastries with a total capacity of 40,000 tonnes per year.

According to the registry, the main positive social and economic parameters of this production are an increase in tax revenues to the budget, an increase in jobs by a third to 900, and the development of the region’s infrastructure.

According to the Unified State Register of Legal Entities and Individual Entrepreneurs, the ultimate beneficiary of the factory is Polish citizen Robert Sekera.

There are no company’s financial statements for 2020, but in 2019 its revenue increased by 4.3% compared to 2018, to UAH 510.63 million, net profit by 1.7 times, to UAH 22.83 million, retained earnings by 28%, to UAH 109.34 million, and current liabilities decreased by 8.7%, to UAH 46.28 million.

According to the data on the confectionery factory’s website, it produces more 60 kinds of sugar, butter, aerated butter biscuits, wafers and cooked gingerbreads. The products are presented in branded stores and major retail chains in Ukraine.

Delicia exports its products to more than 20 countries of the world.

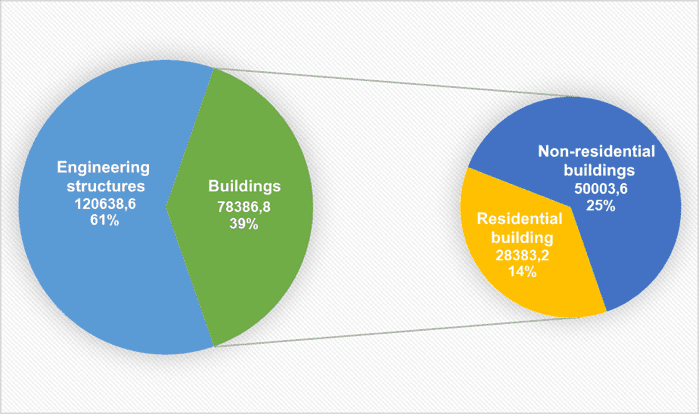

Volume of construction products produced by type in 2020 (mln uah)

The applicant for the purchase of Idea Bank (Lviv) and New Finance Service LLC (NFS, Kyiv) informed the bank and company’s parent Getin Holding S.A. (Poland) that it will not submit a binding offer to purchase them, according to a report from Getin Holding on the Warsaw Stock Exchange.

“Due to the end of the talks, the exclusivity for negotiations granted to the bidder has expired,” the holding said.

“[The Board] has decided today to continue the process of selling Idea Bank Ukraine shares and participation in NFS, while deciding to entrust Rothschild & Co with further activities aimed at selling 100% of Idea Bank Ukraine shares and 100% share in NFS, including in particular, conducting talks and negotiations with other potential investors,” Getin Holding said.

As reported, Getin Holding S.A. (Wroclaw) on February 5 signed an agreement with a Ukrainian buyer for the sale of 100% of the shares of subsidiary Idea Bank (Lviv) and 100% of the shares of NFS. According to market sources, Alfa Bank was the likely buyer of the bank, but officially this information has not been confirmed.

Idea Bank (formerly Plus Bank) was founded in 1989. According to the National Bank of Ukraine, as of January 1, 2021, Idea Bank ranked 25th in terms of total assets (UAH 7.914 billion) among 73 operating banks.

NSF is engaged in debt recovery, financial and insurance intermediation.

Earlier this week, Ukraine repaid early a short-term loan from Deutsche Bank AG London in the amount of about $350 million, attracted at the end of last year, a source in the market has told Interfax-Ukraine.

According to the source, taking into account interest, the payment reached some $354 million.

Interfax-Ukraine could not immediately reach the Ministry of Finance for confirmation of the information.

As reported, according to government resolution No. 1291 dated December 23, 2020, this is a bridge loan taken for up to six months at a rate of up to three-month LIBOR + 5.75%, which can be repaid ahead of schedule in the event of a change in the market price of Ukraine’s eurobonds or new issue on the terms determined by the loan agreement.

Early 2021, the Ministry of Finance said that in the last days of 2020 it attracted a short-term $340.7 million loan from Deutsche Bank. According to the ministry’s statistics, in December 2020, Ukraine’s debt to this creditor increased by $372.6 million, to $1.313 billion, and by the end of February 2021 it decreased to $1.272 billion.