From February 5, 2021, the Economy Ministry will start accepting applications as part of the distribution of the tariff quota for the import of raw cane sugar into Ukraine among importers.

As reported on the website of the Economy Ministry on Monday, the quota for the import of raw sugar in 2021 was set at 260,000 tonnes.

According to the State Statistics Service, in 2020, Ukraine imported 1,880 tonnes of sugar for $1.8 million, which is 39.2% and 9.8% more compared to 2019. Export of sugar from Ukraine in the past year amounted to 150,600 tonnes in quantity terms and $59.34 million in monetary terms, having decreased compared to 2019 by 30.3% and 36.4%, respectively.

According to the National Association of Sugar Producers Ukrtsukor, as of January 12, sugar production in Ukraine in the 2020/2021 marketing year amounted to 1.021 million tonnes, while the forecast for the entire marketing year was of 1.2 million tonnes, which is 15% less than in 2019/2020 marketing year. In this marketing year, 30 sugar factories operated in the country, which processed 7.7 million tonnes of sugar beet.

At a hearing on January 20, 2021, the Pechersky District Court of the Kyiv granted a petition of Ihor Kolomoisky in the case of a businessman’s claim against PrivatBank and other persons for humiliation of his honor and dignity and allowed him to demand the results of independent investigation by the detective agency Kroll Associates UK Limited from the Security Service of Ukraine (SBU) and the National Anti-Corruption Bureau (NABU).

According to a report in the unified public register of court rulings, the results include a printed report of financial forensic investigation and 15 annexes to it. The documents must be provided to the court before February 15.

Teamtrend Ltd., Trade Point Agro Ltd., Collyer Ltd., Rossyn Investing Corp., Milbert Ventures Inc. and Ukrtransitservices Ltd., which are allegedly owned or controlled by Kolomoisky and Hennadiy Boholiubov, joined the respective petition.

At the same time, the Kyiv court of appeals on January 21, 2021 overturned the decision of the Pechersky District Court of Kyiv made on August 20, 2020 to protect the honor, dignity and business reputation of Kolomoisky and refute the information disseminated by Anders Aslund, former senior fellow at the Peter G. Peterson Institute for International Economics (the United States) at the Yalta European Strategy economic forum in 2019.

The subject of the dispute, as indicated in the text of the document, was the following words: “The President should not meet with Kolomoisky. Only in court is it necessary to meet with the man who stole $5.5 billion…” and “…why is he not being tried?.. why is there no criminal case against the thief?.. because the thief stole too much?”

According to the National Bank of Ukraine, as of October 1, 2020, PrivatBank ranked first in terms of total assets (UAH 600.15 billion) among 74 banks operating in the country.

Ukraine plans to launch the remote sensing spacecraft Sich 2-30 (2-1) into Earth orbit by the end of 2021, Deputy Prime Minister, Minister for Strategic Industries of Ukraine Oleh Urusky has said.

As reported on the website of the Ministry for Strategic Industries of Ukraine, he announced this during a meeting with spacecraft developers and customers of satellite services.

“We should take all the necessary measures to ensure that this happens by the end of 2021, the year of the 30th anniversary of Ukraine’s Independence. And this is quite realistic, provided that we work as efficiently as possible and this is an urgent need,” the press service quoted Urusky.

According to him, the presence of such a spacecraft will not only help solve a wide range of problems, both in the interests of the economy and law enforcement agencies, but it will also save budget money that is being spent today on the purchase of services provided by such spacecraft abroad.

The Ministry for Strategic Industries said that organizational and technical issues were discussed during the meeting, as well as projects for the creation of a constellation of satellites from Igor Sikorsky Kyiv Polytechnic Institute and the Pivdenne (Yuzhnoye) Design Bureau were presented.

As a result of the meeting, the need to strengthen cooperation between the State Space Agency of Ukraine, Kyiv Polytechnic Institute and the Pivdenne Design Bureau on joint projects was noted, attention was focused on accumulation of all appropriate resources to solve the tasks in 2021, as well as on taking steps to launch into orbit of the third satellite PolyITAN-3, created by Kyiv Polytechnic Institute.

“There is a paradoxical situation: Ukraine has a significant scientific and technical potential and practically everything in order to have its own constellation of spacecraft in an Earth orbit, however, unfortunately, there is no such constellation. Various reasons can be given in this regard, but the situation needs to be changed,” the deputy prime minister said.

As reported, the Cabinet of Ministers of Ukraine has approved the Concept of the national target scientific and technical space program of Ukraine for 2021-2025.

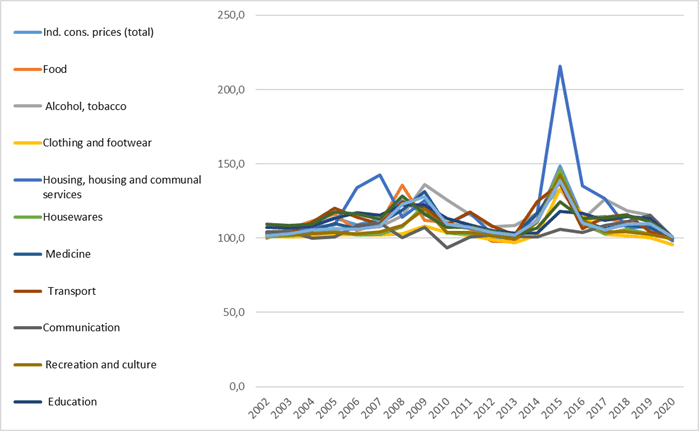

Dynamics of the consumer price index in 2002-2020, in %.

SSC of Ukraine

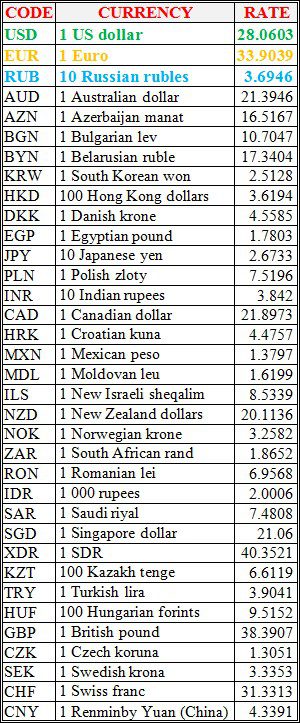

National bank of Ukraine’s official rates as of 02/02/21

Source: National Bank of Ukraine