An earthquake with a magnitude of 2.9 occurred in Lviv region on Sunday, January 10, the press service of the Main Center for Special Control of the State Space Agency of Ukraine reported.

So, on January 10, the Main Center for Special Control registered an earthquake with a magnitude (on the Richter scale) of 2.9 at 13:13.

It is noted that the source of the earthquake was located in Sambir district at a depth of 5 km. The vibrations did not pose a threat to the population; they could be felt by individuals inside the premises, especially on the upper floors.

National bank of Ukraine’s official rates as of 11/01/21

Source: National Bank of Ukraine

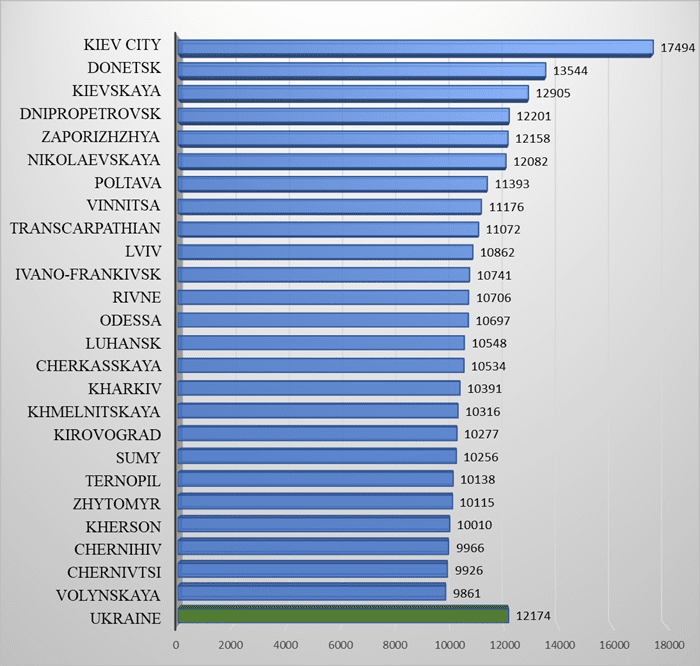

Average monthly wage by region in Oct 2020, UAH.

The energy company DTEK is creating an investment hub for the new Ukrainian energy sector in London, which is scheduled to start operating at the end of the first half of 2021, the press service of DTEK said on Friday, January 8.

“We are creating a hub to attract investments in new energy projects in Ukraine. First of all, this concerns renewable energy sources, energy storage systems and energy projects using hydrogen. Together with the increase in gas production and the development of networks, these areas are identified as priorities in our new strategy,” CEO of DTEK Maksym Tymchenko said, whose words are quoted in the release.

According to him, the specially created company DTEK International Ltd. will carry out operational activities to attract investment to Ukraine in the UK.

The message also indicates that the new DTEK office will be located in the City of London and will be aimed at working both with investors wishing to invest in Ukraine and with Ukrainian entrepreneurs developing energy projects.

As reported, according to the new strategy of DTEK 2030, the company undertook, in particular, commitments to achieve compliance with European legislation on harmful emissions by 2025 and become carbon neutral by 2040, will continue the practice of introducing a wireless Wi-Fi network at its coal mining assets, intends to expand power grid assets in Ukraine and the EU countries and its activity in green energy, including new renewable energy projects outside Ukraine, as well as trading on the markets of EU countries.

DTEK, HUB, INVESTMENT, UK

Kyiv will adhere to additional strengthened quarantine restrictions in order to save lives and prevent a possible collapse of the medical system, mayor of the capital Vitali Klitschko has said.

“Kyiv, where the incidence rate remains high, is forced – whether we like it or not – to comply with a lockdown. Yes, the economic consequences of quarantine will be disappointing. We understand how difficult it is for business now … But today the main thing is the health and life of each of us, our relatives and friends, our friends, the health and lives of Ukrainians. It is very important to prevent a possible collapse of the medical system,” Klitschko wrote on his Facebook page.

The Mayor of Kyiv recalled that many other countries had previously introduced strict restrictions, and today they have also extended them.