Romania has suspended flights with Ukraine, which is in the “yellow” lockdown zone, the State Border Guard Service of Ukraine said.

“As reported by the Digi24 Romanian television channel, the Romanian government has decided to suspend airline service with the countries of the ‘yellow’ lockdown zone, among which is Ukraine,” the State Border Service of Ukraine said in the statement on the Telegram channel on Friday.

According to the statement, an exception to the ban on flights to Romania was made for the member states of the European Union, the United Kingdom of Great Britain and Northern Ireland, the United Arab Emirates and Qatar.

Boryspil International Airport in January-September 2020 reduced passenger traffic to 4.058 million passengers, which is 65% less than in the same period in 2019.

According to the airport’s website, in September 2020 Boryspil airport served 554,485 passengers, which is 66% less than in the same period in 2019.

“The high season 2020 for the aviation industry is over. Due to the restrictions adopted by the Ukrainian government in August, not only did the September Hasidic program not take place, but at the same time the airport saw a 30% shortage of passenger traffic. The hub model has become unrealistic – we will be missing about 3 million transfer passengers The aviation industry has cut costs as much as possible to cope with the difficult times. Quarantine restrictions continue to be a stop factor for passengers. Analyzing the statistics for January-September 2020, we can more accurately predict the expected passenger traffic with which we will end the year. Passenger traffic at Boryspil airport in 2020 will fall to the level of 2009, which will lead to a multiple decrease in the income of Boryspil airport compared to 2019,” the press service of the airport said citing director general Pavlo Riabikin.

According to the published data, in the first nine months of 2019, the airport served 2.6 million transfer passengers, which is 22.4% of the total passenger traffic, and in the same period of 2020, some 418,000 passengers were served, which is 10.3% of the total passenger traffic.

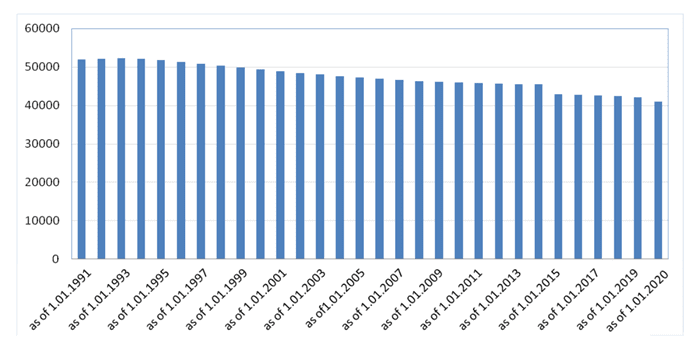

Dynamics of changes in population of Ukraine from 1991-2020.

Source: SSC of Ukraine

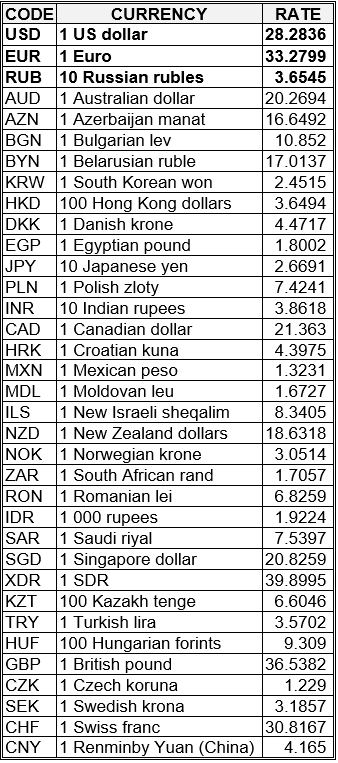

National bank of Ukraine’s official rates as of 09/10/20

Source: National Bank of Ukraine

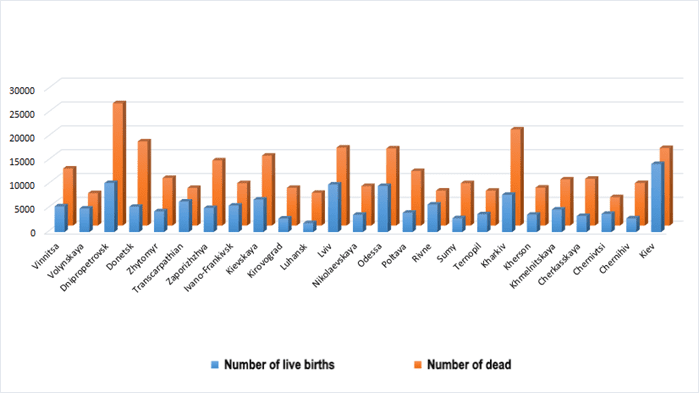

Ratio of fertility and mortality by region as of Jan-June, 2020.

Source: SSC of Ukraine