Ukrainian Sawmills LLC (Kostopil, Rivne region), which produces sawn timber, furniture panels and semifinished products, declares a critical situation in connection with the failure to deliver the full volume of logs by state-run forestry enterprises legally acquired by the company at open auctions, the company has said on its Facebook page.

“We, the newest sawmill, launched at the end of 2017, are now on the brink of survival. The most important problem is providing raw materials in full, or rather begging legally acquired raw materials from state-owned forestry enterprises. According to the results of the third quarter of 2020 (left only three days before it ends), the forestry enterprises of Zhytomyr and Volyn regions, as well as some forestry enterprises of Rivne region supplied us with less than 50% of the purchased wood,” the company said on Monday, September 28.

Ukrainian Sawmills said that they participate in all auctions for the purchase of coniferous sawlogs, since this year they decided to fully utilize the existing design capacities.

“We will demand additional supplies of logs. But who will compensate us for the forced downtime, loss of business reputation due to unshipped products to buyers and possible penalties for our failure to fulfill obligations?” the company said.

In addition, the company drew attention to the fact that some auctions are announced in such a way and at such a time that only those “for whom the auction is specially held” can learn about them.

“It turns out that we already have a system of shadow auctions so that the right raw materials go to the right people, and not to those who want to buy. Formally, everything seems to be honest: there is an official announcement and an auction is being held (print screen is attached). But the problem is the one for whom this auction is specially held, without providing for other participants, can only know about it,” the company said.

Ukrainian Sawmills appeal to the Office of the President, the Cabinet of Ministers, the State Forest Resources Agency and the regional forestry and hunting departments with questions about holding such auctions, at what prices they buy raw materials, whether there are any abuses and unlawful benefits.

Ukrainian Sawmills LLC was registered in September 2014 in Kostopil. According to the public register, 100% of the charter capital is owned by the company Ukresta Holdings Limited, registered in Cyprus.

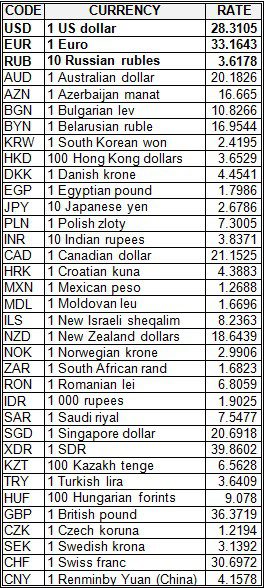

National bank of Ukraine’s official rates as of 01/10/20

Source: National Bank of Ukraine

The structure of consumption of motor fuels in Ukraine needs to be corrected in order to maximize the use of oil refining capacities, equalize the trade balance and increase tax revenues, according to the A-95 Consulting Group (Kyiv).

According to the group, the main distinguishing feature of the Ukrainian fuel market is the high share of liquefied petroleum gas (LPG), which has reached a world record 33% in the retail sales of motor fuels. In terms of the use of LPG in transport, Ukraine is one of the five largest on the planet – in 2020 the consumption of LPG will exceed 2 million tonnes.

“The Ukrainian basket of motor fuels is atypical from the point of view of world practice and gives rise to a number of serious problems. These are, first of all, the decline and quite likely disappearance of domestic oil refining, a decrease in tax revenues, an increase in imports of liquefied gas and diesel fuel from Russia and Belarus,” Director of the A-95 consulting group Serhiy Kuyun said.

In his opinion, the main reason for the disproportion in the consumption of petroleum products is unbalanced taxation. The excise tax on LPG is four times lower than on gasoline – EUR 52 against EUR 213 per 1,000 liters, which is almost half the excise tax on gasoline and the tax on diesel fuel – EUR 139.5 per 1,000 liters. This curving has led to a distortion in consumption, as fuel with low excise duty becomes more attractive to consumers: from 2013 to 2019, consumption of liquefied gas increased by 115%, diesel fuel – by 17%, while gasoline consumption fell by 43%.

“The huge demand for LPG and diesel fuel stimulates their imports, more than 70% of which comes from Russia and Belarus. Meanwhile, Ukrainian refineries operating on Ukrainian and non-Russian imported raw materials are loaded by less than 50%. They cannot sell gasoline, but refuse from its production is impossible due to technology,” Kuyun said.

At the same time, the transition of consumers to low-tax fuels also affects the national budget, since excise taxes on oil products are the main source of filling the road fund, from which the construction and repair of roads are financed.

To reach the optimal basket of petroleum products consumption, the excise rates need to be adjusted. According to the calculations of the A-95 Consulting Group, if today the excise tax on gas is 24.4% of the excise tax on gasoline, then in order to solve the problem of balanced oil product supply, this ratio should be at least 70-75%. At the same time, the excise tax on diesel fuel can be left at the current level.

The transition to a new consumption structure should be smooth, which will take at least five years. “Gasoline will become more affordable, liquefied gas will rise in price, but it will retain its price attractiveness. Refineries will receive a development perspective, the market will reduce dependence on imports, and the state will receive additional taxes,” the A-95 group said.

The volume of construction work performed in Ukraine in August 2020 increased 8.3% compared to August 2019, while in July compared to July a year earlier it decreased 1.1%.

According to the State Statistics Service, since the beginning of the year, the volume of construction work completed amounted to UAH 97.8 billion. In general, in January-August this year, this indicator decreased 2.8% compared to the same period last year.

According to the statistics department, in August the indicator increased 2.6% compared to the previous month (according to seasonally adjusted data by 3.6%), while in July compared to June this indicator increased 2.7%.

According to the State Statistics Service, in August 2020 compared to August 2019, the volume of work decreased in residential and nonresidential construction. Thus, according to unadjusted data, the decrease in volumes in residential construction was 11.9%, in the construction of nonresidential buildings it was 5.4%. At the same time, the construction of engineering structures grew by 20.2%.

The share of new construction of the total volume of completed construction work amounted to 39.8%, repairs – 33.2%, reconstruction and technical re-equipment – 27%.

The statistics are given without taking into account the occupied Crimea and the temporarily occupied territories in Donetsk and Luhansk regions.

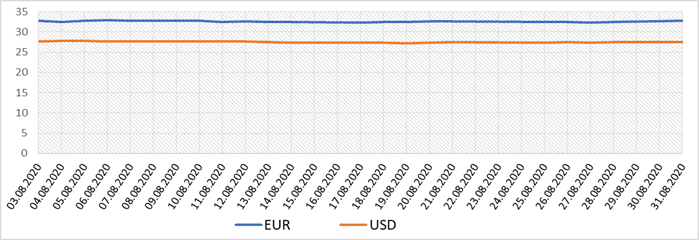

Quotes of interbank currency market of Ukraine (UAH for 1USD and 1 EURO, IN 03.08.2020-31.08.2020).