Executive Director of the Ukrainian Institute of Politics Mykola Spyrydonov has said that healthcare reform creates numerous problems with medical assistance for the population. He expressed such opinion during a discussion of a sociology survey conducted by Active Group, which was presented jointly with the Expert Club on June 22, 2020 at the press center of the Interfax-Ukraine News Agency.

“Even now, when ambulance arrives on call to take care of a child, the doctors in fact cannot do anything if the contract with a family doctor is not signed. If the contract is signed, the person is in fact a bondman,” the political expert said in a recent video on the Expert Club YouTube channel.

Therefore, according to Spyrydonov, the bureaucratic system does not allow people to receive medical services in the needed amount and in fact force them to go to private clinics.

“In fact, we are witnessing the process of destroying medicine, hindering the population from receiving medical services. Moreover, the number of hospitals and medical personnel is being reduced, thus creating additional hardships for receiving medical assistance,” the expert said.

According to the opinion poll, some 50% of Ukrainians said that the country’s healthcare system has become worse in general since the introduction of lockdown restrictions, while 22% respondents said that medical services have slightly improved, and only 3% said that they have significantly worsened.

The full video is available on the Expert Club YouTube channel:

EXPERT, EXPERT CLUB, EXPERT KITCHEN, HEALTHCARE REFORM, MEDICINE, SPYRYDONOV

Ukraine and Turkey intend to prepare a Free Trade Area (FTA) agreement for the meeting of the High Level Strategic Council of Ukraine and Turkey in 2020, Foreign Minister of Ukraine Dmytro Kuleba has said. “We are really determined to hold the next meeting of the Strategic Council of our presidents this year and want to fill it with maximum content. And, of course, the FTA agreement is one of those tasks that should already be consecrated by our leaders,” Kuleba said after a joint meeting with Turkish Foreign Minister at a press conference in Antalya on Friday.

The foreign minister said that at the moment Ukraine is waiting for a certain positional document from the Turkish side in order to continue consultations on this issue.

“Of course, the potential of our trade is phenomenal. I can sincerely tell you that Turkish goods can be found in any store of any region of Ukraine… Unfortunately, Ukrainian goods are not yet represented on the Turkish market, but we also have a lot of things, what Turkish consumers and buyers will benefit from. And we can open this potential, achieve a fair and mutually beneficial balance in trade, and bring our trade to a new horizon by signing the FTA agreement. And today, my colleague and I agreed that we will apply maximum efforts in order to positively resolve this issue,” the Ukrainian minister said.

According to him, Ukrainian and Turkish experts involved in trade will continue negotiations on this issue, but political leaders, ministers of foreign affairs and trade of both countries will be ready to take part in them to settle the issues that will seem insoluble at the expert level.

“There is political will of both sides now to resolve all issues and reach a result, I emphasize, in the interests of business and economies, both Ukrainian and Turkish,” Kuleba added.

Foreigners and stateless persons who have exceeded their terms of stay in Ukraine during the quarantine period will not be held liable for this violation, Yuriy Lysiuk, the head of the border control for the State Border Guard Service of Ukraine, has said on July 4.

“If a foreigner or stateless person has exceeded the period of stay in Ukraine before the introduction of quarantine measures aimed at preventing the spread of COVID-19 on the territory of Ukraine, then such persons will be held liable for violating the terms of their stay when crossing the state border,” Lysiuk was quoted by the service as saying.

It is noted that, according to the current legislation, foreigners and stateless persons who could not leave Ukraine or were unable to contact the territorial bodies of the State Migration Service of Ukraine with an application to extend their stay in Ukraine or to exchange a residence permit in connection with the introduction of the quarantine, administrative liability does not apply if such violations occurred during or as a result of the quarantine.

These rules apply exclusively to foreigners and stateless persons who were legally in Ukraine at the beginning of quarantine.

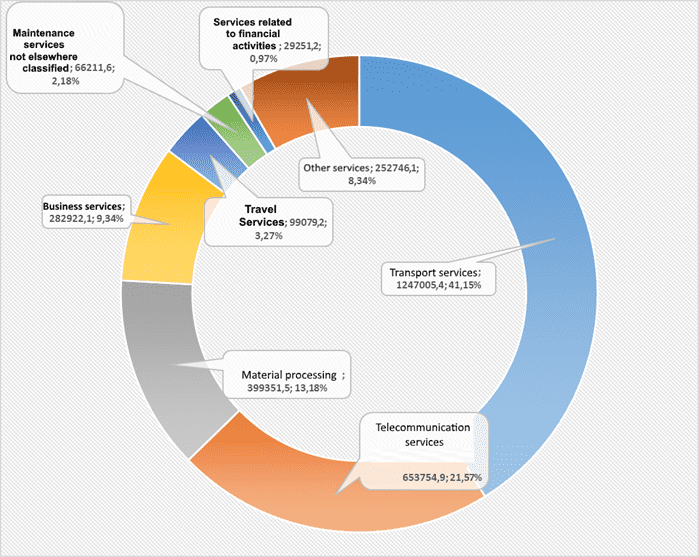

Structure of export of services in 1-st quarter of 2020 (graphically)

A tender worth UAH 452 million to repair 25 km of Kropyvnytsky’s bypass road towards Kryvy Rih on the H-23 Kropyvnytsky-Kryvy Rih-Zaporizhia highway was won by a group of road construction companies RDS, the co-founder of the company Yuriy Shumakher has told Interfax-Ukraine.

“We have already formed working brigades in full, and this Saturday [July 4] we are starting construction,” he said.

Schumacher said that the RDS group, as one of the largest players in the Ukrainian road market, understands the importance of the Big Construction project announced by the president, therefore, it is responsible for the quality and deadlines for the work performed.

Turkish Onur Construction International with the best offer of UAH 452.899 million and the Ukrainian-German company Avtostrada with the best offer of UAH 452.9 million also participated in the tender with an expected value of UAH 477.08 million.

The total volume of H-23 road repair in Kirovohrad region this year is 83 km.

RDS Group is included in the top three road construction companies of Ukraine. It includes Kyivshliakhbud and Rostdorstroy. The core business is construction, reconstruction and maintenance of roads and bridges, construction of airfield complexes.

The ultimate beneficial owners of RDS Group are Ukrainian citizens Shumakher and Yevhen Konovalov.