JSC Ukrzaliznytsia is technically ready for the resumption of passenger traffic until a predetermined date (from June 1, 2020), however, the launch date for passenger traffic on railway transport has not yet been changed.

Ukrzaliznytsia is technically ready to start passenger transporting, however, the government resolution regulates the date of June 1. The final decision will be made in the near future, based on the epidemic indicators of the regions and the decisions of the commissions on anthropogenic and environmental safety and emergency situations,” the press service of the Ministry of Infrastructure told Interfax-Ukraine.

As the agency was informed by the press service of Ukrzaliznytsia, according to Cabinet of Ministers of Ukraine resolution No. 392 dated May 20, 2020, after the decision of the regional commissions on anthropogenic and environmental safety and emergency situations on easing anti-epidemic measures in regions, the company will appoint trains in these regions, and will start selling tickets.

The Infrastructure Ministry confirmed that the sale of train tickets can be started in the near future in those regions where there will be a positive decision on easing anti-epidemic measures.

The ministry said that they plan to follow the previously developed algorithm for launching railway transportation in several stages, namely, from June 1, running up to 50% of suburban electric trains during rush hours, launching 42 pairs of trains of Intercity and Night Express categories. At the second stage, it is planned to launch all suburban electric trains during daylight hours and all passenger trains except seasonal ones. At the third stage, it is proposed to open an international railway service, as well as seasonal trains.

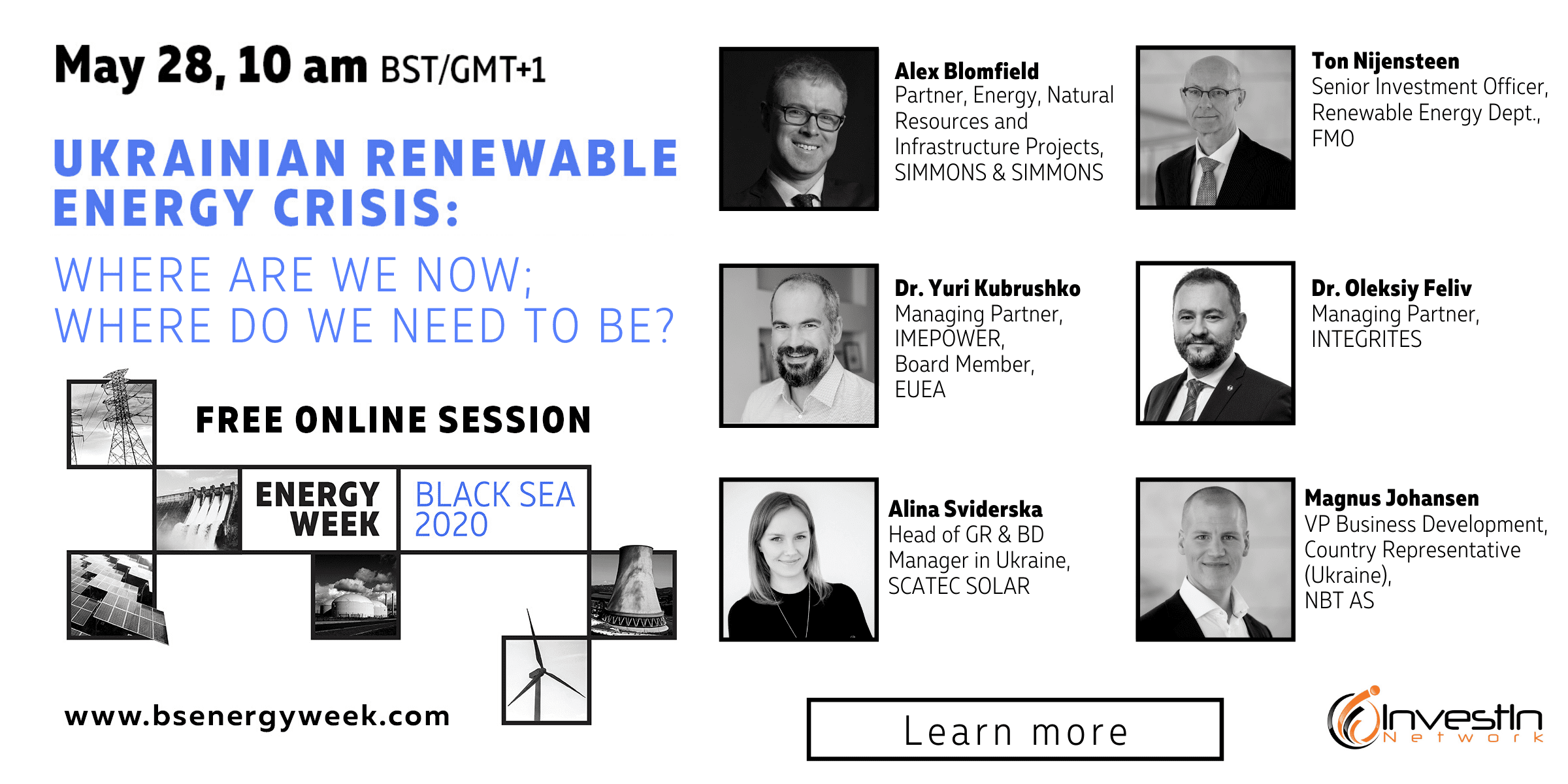

Free Online Session dedicated to the Ukrainian renewable energy crisis will be held on 28th May within the framework of Energy Week Black Sea 2020.

Due to the lucrative feed-in tariffs introduced in 2009, Ukraine has achieved remarkable progress in mobilising sizable private sector investments in the energy sector and becoming one of the fastest–growing renewables markets in Europe. In 2019, renewable energy deployment saw a record growth to 4 250 MW compared to the installed capacity of only 743 MW in 2018.

However, the recent developments, and, in particular, the initiative of the government to cut the feed-in tariff for wind and solar energy producers can change the outlook and turn the Ukrainian renewables success story into an illustration of why the state is not ready for foreign investment.

In December 2019, bill No. 2543 on improving the investment climate in the renewable energy sector was registered in Ukraine’s parliament. The bill proposes a voluntary restructuring of FIT with a simultaneous extension of the terms for their payment and a reduction in the terms of preliminary power purchase agreements (pre-PPA).

The following negotiations which have now lasted for six months failed to produce a compromise solution acceptable to both Ukrainian authorities and domestic and foreign investors. The key issues are still open, namely restructuring of power purchase agreements and feed-in tariffs, the release of capacity for wind energy investors for the benefit of future auctions, balancing responsibility and compensation for curtailments of wind and solar producers.

Online Session “Ukrainian Renewable Energy Crisis: Where Are We Now; Where Do We Need To Be?” is organised to address the situation and discuss the following questions:

What should be the state’s immediate steps in resolving the renewable energy crisis?

What are the most practical solutions and stabilisation measures acceptable for foreign investors?

How will Ukraine continue attracting investors in global competition? Are “green” auctions attractive enough?

What will be the pace of renewable energy project commissioning post-FIT?

What are the possibilities for addressing intermittency and energy security? How does the transition meet the need for continuous supply in the absence of storage? How should energy storage be supported?

Free Registration: https://www.bsenergyweek.com/online-session/

Open4business – media partner of Online Session «Ukrainian renewable energy crisis: Where are we now; where do we need to be?»

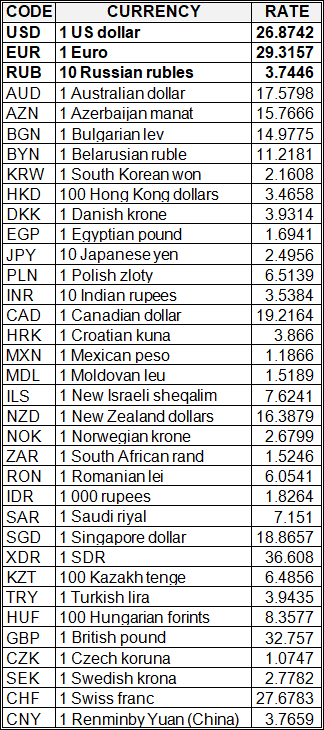

National bank of Ukraine’s official rates as of 26/05/20

Source: National Bank of Ukraine

The Infrastructure Ministry of Ukraine is preparing for building an airport in Mukachevo (Zakarpattia region), Infrastructure Minister Vladyslav Krykliy has said.

“Now it is very important to maintain and develop regional airports. After all, during the pandemic, domestic tourism will remain a priority,” he wrote on his Telegram channel.

According to him, the reconstruction of the runway at the Odesa International Airport is also currently being completed (98% readiness); the airport is being modernized in Dnipro (the new runway, international and VIP terminals); the runway at the Kherson airport is improving; installation of aeronautical equipment at the Mykolaiv airfield is nearing completion.

Astarta agroholding in the first quarter of 2020 received a net loss of EUR13.32 million, which is 2.7 times more than in the same period last year.

According to the company’s report on the Warsaw Stock Exchange, its revenue in the reporting period decreased by 9.8%, to EUR101.34 million due to lower sales in the crop segment, which accounted for 39% of consolidated sales compared to 52% in January-March 2019.

EBITDA increased by 1.7 times, to EUR27.78 million amid an increase in the share mainly in crop and sugar segments. EBITDA margin increased from 14% to 27% in the first quarter of 2020. Gross profit rose by 47.3%, to EUR29.87 million.

Crop production ranked first in the structure of consolidated revenue and amounted to 39%. The segment revenue declined by 33%, to EUR39 million, mainly due to a 17% year-on-year decline in corn sales, to 236,000 tonnes. Most of the grain and oilseed crop in 2019 was sold by the end of the first quarter of 2020. The export share increased to 96% compared with 91% in the corresponding period of 2019.

The sugar segment revenue grew by 46%, to EUR28.76 million (28% of revenue) due to an increase in sugar sales by 44%, to 78,000 tonnes in January-March 2020 and an improvement in sales prices to EUR352/tonne compared to EUR316/tonne in the first quarter of 2019. During the reporting period, Astarta exported 7,000 tonnes of sugar (at the level of January-March 2019), as world prices remained low.

The soybean processing segment generated revenue of EUR22 million, which is 6% lower than the first quarter of 2019 (22% of revenue), mainly due to lower prices for soybean meal and lower oil sales. Export brought 89% of revenue. Soybean oil sales decreased by 21.4%, to 11,000 tonnes, soybean meal remained at the same level as last year, at 47,000 tonnes. At the same time, oil prices increased by 14.1%, to EUR633/tonne, while for oilseed meal decreased by 3%, to EUR321 per tonne.