The Interdepartmental Commission on International Trade has extended the terms of the antidumping instigation into imports of stainless seamless hot-finished pipes from China.

According to a report in the Uriadovy Kurier newspaper, the investigation was extended to 13 months from the moment of its opening.

“In accordance with the law of Ukraine on the protection of national producers from dumping imports, the Interdepartmental Commission on International Trade reviewed materials submitted by the Ministry for Economic Development, Trade and Agriculture of Ukraine on the progress of the antidumping investigation regarding the import of steel seamless hot-finished pipes originating from China into Ukraine and, based on the results of the review, established that there is a need to extend the deadline for the antidumping investigation,” the commission said in the statement.

At the same time, the Commission on May 13, 2020 made a decision according to which it decided to extend the deadline for conducting this antidumping investigation, initiated on May 14, 2019, to 13 months.

As reported, the Interdepartmental Commission on International Trade initiated the antidumping investigation following the submission of a complaint by the national pipe producer Interpipe Niko Tube (Nikopol, Dnipropetrovsk region).

Windrose has announced the start of the new flight program inside Ukraine from June 15, 2020. According to a posting on Windrose’s official Facebook page, the airline plans to connect the east, west, north and south of Ukraine with a flexible flight schedule, starting flights between Kyiv, Lviv, Odesa, Kharkiv and Dnipro.

Windrose said that thanks to the new flight schedule for Ukraine, passengers will have the opportunity to choose between morning, afternoon and evening departures and visit two or three cities a day.

“In particular, one can get from Lviv to Kharkiv and return back within one day. This is a new opportunity to quickly move within the country several times a day,” the airline said.

So, Windrose plans to fly from the Boryspil international airport (Kyiv) to Dnipro, Odesa, Lviv and Kharkiv performing three flights per day. At the same time, direct flights between regions, for example Kharkiv-Lviv, are planned to be performed once or twice a week.

From July 15, the airline intends to additionally open daily flights from Kyiv to Mykolaiv using ATR72-600 and Еmbraer Е145 aircraft.

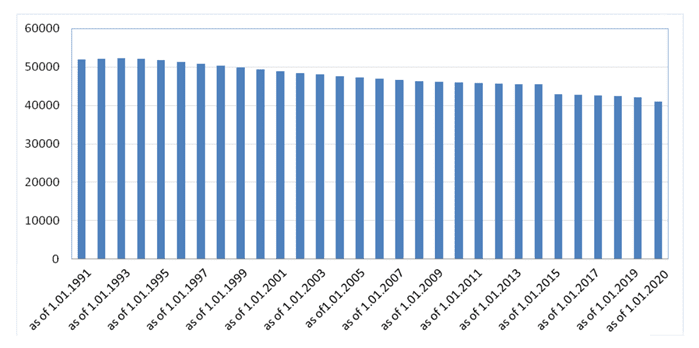

Dynamics of changes in population of Ukraine from 1991-2020

Interest rates on deposits in 2020 will continue to decline and may reach 10% in the hryvnia and 1.5% in U.S. dollars, bankers said at a roundtable of the Financial Club on Thursday, May 21. “The trend to reduce interest rates will be examined until the end of the year. Interest rates will decrease,” Board Chairman at Idea Bank Mykhailo Vlasenko said, specifying that the bank’s current interest rates at 12-14% may drop to 8-10%.In turn, Capital Markets Director at Alfa-Bank Tetiana Popovych expects interest rates not to fall below 10%.

“Rates will drop, but in the short and medium term, I still see two-digit rates,” she said.

According to Deputy Board Chairman of TAScombank Oleh Poliak, the financial institution maintains deposit rates in hryvnias at about 11%, and in U.S. dollars at 2%.

“The trend is going down, I think it will remain at the level of 10-11%, in U.S. dollars will be about 1.5-2%,” the expert said.

Chief of the retail business department at Globus Bank Dmytro Zamotayev said that the bank lowered rates last week and plans to continue to decline following the market.

“We want to see the average interest rate about 10%, the ceiling rate of 11% at the end of summer,” he said.

Zamotayev said that at the moment the ceiling passive rate of Globus Bank is 12.75%.

“The rate in hryvnias will be around 11% by the end of June, and if we talk about the currency, when we made the forecast, it will be about 1.5% in U.S. dollars,” deputy chairman of the board at Forward Bank Andriy Prusov said.

He also said that during the lockdown period, about 90% of customers began to place deposits through Internet banking.

According to financial director at Alliance Bank Taras Kravets, the rate may reach 12% by the end of 2020.

“I will support my colleagues that the cost will decrease, but how fast it will depend on how quickly the economy overcomes the effects of the virus,” he said.According to Poliak, it is very important what kind of financial institutions take the first step in lowering rates.

“I believe that these should be state-owned banks, because they have the support of the government,” he said.

The expert believes that lowering rates in the future to 7-8% will not entail the active customer attrition if they see that the bank that serves them provides the customers with a market offer.

Prusov shared his opinion, who believes that lowering rates will not be an obstacle for customers and they will continue to place deposits in hryvnias in banks.

“I would like to say in confirmation of these words that according to the statistics of the NBU, it is obvious that over the last years, customers have placed more funds in hryvnias in banks, even without interest at all. In fact, trust is growing, and there are on-demand deposits on current accounts and their amount is growing every year,” he said.

Due to the COVID-19 coronavirus pandemic, the export of agricultural products of the Myronovsky Hliboproduct (MHP) globally has not changed; the geography has slightly shifted from Europe towards Asia, the owner of the MHP, Yuriy Kosiuk, has said. “Globally, nothing has changed. Europe has slightly fallen due to lower consumption, although all of our enterprises are located there. The Arab markets, Africa have grown. Japan is a little closed, but in the near future, I think, everything will reopen. In general, the picture is unchanged. The only thing is that the geography has shifted slightly from Europe to Asia,” he said in an interview with the Novoye Vremia publication.

According to Kosiuk, the countries of the Arabian Peninsula have already made a request to support and secure them in the supply of meat.

“This issue became especially acute after the opening of markets. Many companies in these countries closed due to COVID-19 cases at production facilities. A similar situation in the United States: closures of production facilities due to outbreaks of COVID-19, shortage in the domestic market, half-empty shelves in stores. In Ukraine, thank God, this did not happen,” the owner of the company said.

At the same time, Kosiuk does not believe that, amid the coronavirus crisis, Ukrainian producers got the opportunity to gain more in the export of food products.

KSG Аgro on May 19, 2020 completed the sowing campaign 2020 launched on April 8, and sunflower, maize and sunflower, maize and sorghum were sown on 10,420 ha. More…