Despite the full-scale war, Ukrainian business continues to demonstrate high dynamics in obtaining the status of Authorized Economic Operators (AEO): over the 4 years of the program, 48 Ukrainian companies have received 50 AEO authorizations. This status gives companies the highest degree of trust and a number of simplifications in customs procedures.

This dynamics of Ukrainian companies coincides with the dynamics of most EU countries in the first 4 years of the program, and sometimes exceeds it. The biggest “jump” in AEOs occurred in the fourth year of the program, when “local simplifications” without authorizations were abolished, which was not the case in any EU country.

For comparison, the dynamics of AEO for the first 4 years of the program in the EU (2008-2011):

– more than half of the countries (17 Member States) had similar (Denmark, Ireland, Slovenia, Czech Republic) or lower (Finland, Romania, Slovakia, Bulgaria, Greece, etc.) rates of increase in AEO authorizations;

– 8 countries had a higher rate of increase in AEO authorizations, in particular, the United Kingdom*, Austria, Belgium, and Sweden;

– only 3 countries out of 28 EU countries (France, Germany, the Netherlands) increased AEOs at a much higher rate than Ukraine. These countries generally have much stricter requirements for companies to preserve and restore documents and other business processes, the reliability of which is a condition for obtaining this status. Therefore, the authorization of enterprises did not require a large number of additional requirements.

Currently, there is every reason to expect a positive trend in the number of AEO authorizations obtained by Ukrainian businesses: 31 more applications are pending at the State Customs Service. This demonstrates the interest of domestic businesses in the program.

It is worth reminding that AEO is a special status that demonstrates a high level of trust in a business entity. It provides customs simplifications and advantages in international trade, which can also compensate for a number of difficulties at the border caused by external circumstances. The AEO status opens up opportunities for enterprises to develop and compete in foreign and domestic markets.

In Ukraine, the AEO program began operating in August 2020 after the adoption of the necessary legislative changes in the process of approximation to European customs law and standards of foreign economic activity.

As reported, as of November 7, 2023, the provisions of the Customs Code of Ukraine regarding the possibility of customs clearance of goods without presenting them to the customs authorities became invalid. In order to continue to use the possibility of clearing goods at the facilities of enterprises, the State Customs Service recommended that businesses obtain the status of an authorized economic operator.

Having AEO authorization allows a company to take advantage of all the benefits of AEO and will facilitate access to the simplifications provided for by the Customs Code and the Convention on a Common Transit Procedure. In particular, the simplifications include reducing the level of risk in relation to the goods being transported, prioritizing customs formalities and releasing goods at the company’s location.

Earlier, roundtables were devoted to customs reform, where the event’s organizer and moderator Maksim Urakin stated that the State Customs Service provides 35-40% of state budget revenues, and these figures have remained stable in recent years. That is why customs reforms are so important for the country.

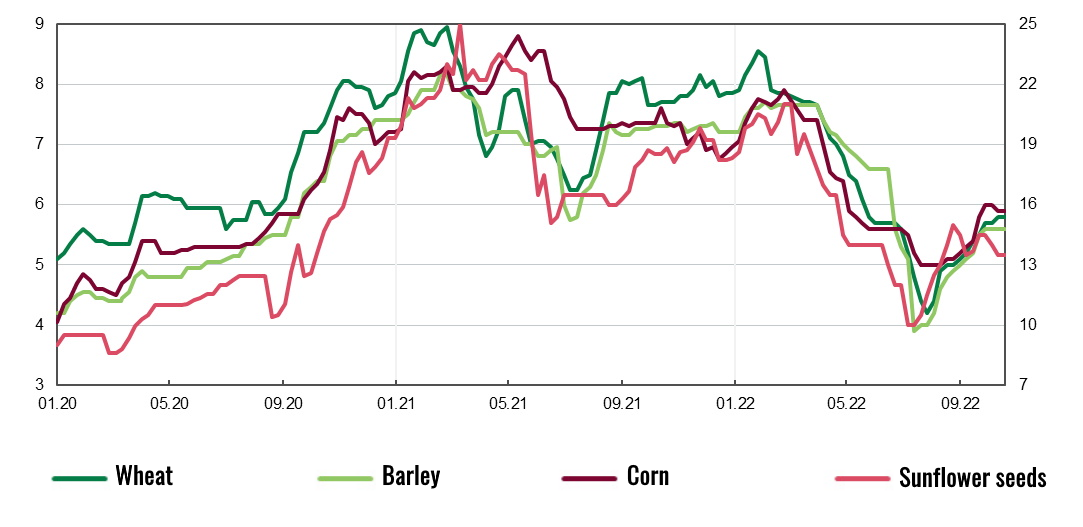

Dynamics of prices for main agricultural products in structure of Ukraine’s export in 2020-2022

Source: Open4Business.com.ua and experts.news

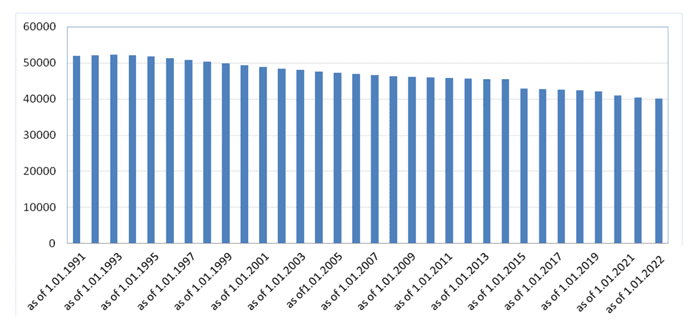

Dynamics of changes in population of Ukraine from 1991-2022

SSC of Ukraine

Quotes of futures for US stock indices do not show a single dynamics at the auction on Tuesday.

The US stock market has declined in the previous four sessions, and risk appetite remains low due to investors’ fears that the Federal Reserve’s (Fed’s) rapid tightening of monetary policy will dampen economic activity and corporate profits, Market Watch notes.

CEO of JPMorgan Chase & Co. Jamie Dimon said the day before that the S&P 500 index could fall by another 20% amid the ongoing tightening of monetary policy by the Fed. This year, the stock indicator has already lost 24%.

Dimon warned that the US economy could fall into recession in the next six to nine months.

Yields on two-year US Treasuries, which are sensitive to a hike in the base rate, rose above 4.3% on Tuesday, close to the maximum since 2007. The interest rate on ten-year US Treasury bonds rose during trading above the 4% mark.

“The 10-year US Treasuries are back above 4% and we expect the pressure on the US stock market to continue,” said Peter Garnry, head of equity strategy at Saxo Bank A/S. profits and cause disappointment in the prospects of the companies.”

S&P 500 companies’ third-quarter combined earnings are up 4.5% year-over-year, according to Refinitiv’s forecast. Profits of energy companies are expected to have grown by 6.3%, banks – have decreased by 1.6%.

Citigroup Inc., JPMorgan, Morgan Stanley and Wells Fargo & Co. will release quarterly results this week. Bank shares lost 0.2%, 0.4%, 0.3% and 0.5% respectively in early trading on Tuesday.

American Airlines Group Inc. rose by 4.3%. The airline improved its forecasts for revenue and revenue per marginal passenger turnover in the third quarter.

Shares of Delta Air Lines Inc. add 2.8% to the price. The airline said Tuesday it is investing $60 million in flying taxi developer Joby Aviation Inc. and intends to use air taxis to deliver passengers to airports in the future, bypassing traffic jams in New York and Los Angeles.

Joby shares rose 18%.

The value of the December E-mini futures for the S&P 500 fell by 0.1% to 3621.75 points by 15:50 Moscow time on Tuesday. Quotation of the December E-mini futures on the Dow Jones index increased by this time by 0.02%, to 29266 points. Futures on the Nasdaq 100 for December fell 0.14% to 10969.5 points.

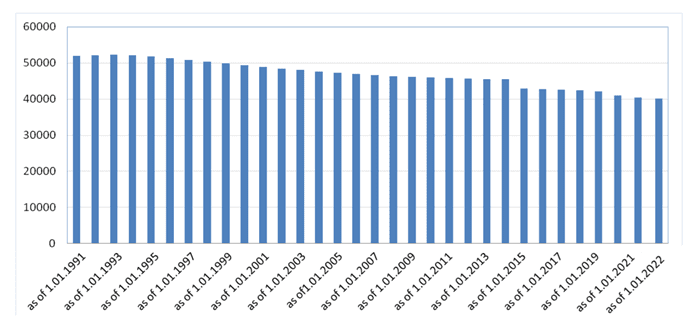

Dynamics of changes in population of ukraine from 1991-2022

SSC of Ukraine , graphics of the Club of Experts

Asian stock markets, which are traded on Monday, demonstrate multidirectional dynamics.

Exchanges in mainland China are closed due to the holidays on the occasion of the Day of the founding of the PRC, South Korea – on the occasion of the Day of the founding of the state.

The Japanese Nikkei 225 rose 0.5% by 8:26 a.m. despite weak statistics.

The Tankan Index, which assesses the level of confidence in the Japanese economy among large companies in the processing industry, fell to its lowest level in six quarters in July-September (since January-March 2021).

The value of the indicator fell to 8 points compared to 9 points in the second quarter of this year, the Bank of Japan said. A positive index value means that the percentage of respondents who consider the business environment favorable is higher than the share of those who do not.

Analysts on average predicted an increase in the indicator in the past quarter to 11 points, according to the results of surveys by Quick and Trading Economics.

The index declined for the third quarter in a row. This reflects, among other things, the growing costs of enterprises, the depreciation of the yen, as well as the restrictions imposed by China due to COVID-19.

The top three in terms of the rate of rise in quotes on Monday consists of shares of transport companies: Kawasaki Kisen Kaisha Ltd. (+4.8%), Nippon Yusen K.K. (+4.6%) and Mitsui O.S.K. Lines Ltd (-4.2%).

In addition, the price of securities of investment and technology SoftBank Group (+1.6%), consumer electronics manufacturer Sony (+1.5%), automotive Nissan Motor (+1.3%) and Toyota Motor (+3.2%) is rising. ).

The most significant decline in value shows papers of electricity producers, including Kansai Electric Power Co. (-6.5%), Chubu Electric Power Co. (-4.1%) and Tokyo Electric Power Co. (-3.9%), as well as retailer Seven & I Holdings Co. (-4.5%).

The value of the manufacturer of consoles and video games Nintendo fell by 1.1%. The company did a 10-for-1 stock split over the weekend.

The Hong Kong Hang Seng index lost 1.8% by 8:31 am KSK. It is at its lowest level in the last eleven years.

The stock prices of New World Development Co., a developer, are declining most significantly on the Hong Kong Stock Exchange. (-7.4%) and Ping An Insurance (-5.2%).

The papers of online retailer JD.com (-3.7%), HSBC bank (-3.3%), automotive BYD (-2.5%) are also getting cheaper.

The Australian S&P/ASX 200 index has decreased by 0.3% since the market opened.

In particular, the price of shares of technology companies Xero Ltd (-2.7%), Computershare (-0.9%) and Wisetech Global (-1.2%) decreased.