Brazil’s Ministry of Finance has raised its GDP growth forecast for 2025, but expects the economic upturn to slow down as a result of the country’s central bank’s tight monetary policy.

The GDP growth forecast for the current year has been raised to 2.5% from the 2.4% expected in May, and for 2026 it has been lowered to 2.4% from 2.5%.

The forecasts do not take into account the consequences of Washington’s introduction of 50% tariffs on all imports from Brazil, the Ministry of Finance notes. Earlier, US President Donald Trump announced that these tariffs would take effect on August 1.

“The tariffs are unlikely to have a significant impact on GDP growth in 2025, although certain industries may suffer quite severely,” the Ministry of Finance said in a statement.

In the first quarter of this year, Brazil’s GDP increased by 1.4% compared to the previous three months, the highest in three quarters. GDP growth in annual terms was 2.9%.

Earlier, the Experts Club information and analytical center made a video analysis of the prospects for the Ukrainian and global economies. For more details, see the video at https://youtu.be/kQsH3lUvMKo?si=F4IOLdLuVbYmEh5P

In the first half of 2025, the Ukrainian economy demonstrates fragile but positive growth, despite the difficult external environment and high dependence on international financial support. This is stated in an analytical review published by the Experts Club information and analytical center on YouTube.

“We are seeing a cautious but still positive signal: Ukraine’s economy is growing, albeit very slowly. The National Bank forecasts GDP growth of 2.5-3.1% in 2025. This is above the survival line, but not enough for a full recovery,” said Maksym Urakin, PhD in Economics and founder of Experts Club.

“Inflation remains at 12-13%, which continues to reduce the purchasing power of the population. Despite the NBU’s moderate monetary policy, the pressure on households remains,” the economist explained.

The situation in foreign trade also remains alarming. In May 2025, the trade deficit in goods and services reached $4.1 billion. Imports amounted to $7 billion, while exports were only $3.4 billion. Trade in services also has a negative balance – $1.8 billion against $1.3 billion.

“The structure of exports shows changes. Supplies of pharmaceuticals, wood and live animals are growing, but grain exports have fallen by almost a quarter. And this is even before the loss of possible EUR 3.5 billion in revenues due to the end of EU customs privileges,” emphasizes Urakin.

At the same time, Ukraine’s international reserves have increased – as of June 1, they amounted to $44.54 billion. This is more than at the end of 2024, although it is 4.6% less than in April. But the public debt, according to Urakin, remains critically high – $179.2 billion (about 94% of GDP), of which more than $134 billion are external liabilities.

“The reserves are currently sufficient to stabilize the exchange rate and payments. But this is a resource that cannot be exhausted indefinitely. Ukraine remains critically dependent on international assistance – from the IMF, the EU and other partners,” he emphasized.

The global economy, according to the IMF and the World Bank, is expected to show the slowest growth in the last decade in 2025, at 2.3-2.8%. Inflationary pressures, trade disputes, and geopolitical instability are limiting the potential for global recovery. The Bank for International Settlements describes the situation as a “turning point” due to protectionism, declining productivity, and demographic risks.

The United States recorded its first decline in GDP since 2022, down 0.5% year-on-year in the first quarter. The main reasons are weakening consumer demand and declining exports. However, the Atlanta Fed predicts a recovery – 2.5% growth in the second quarter. PCE inflation is 3.1%, core inflation is 2.6%, and the Fed’s key policy rate remains at 5.25-5.5%.

In China, the economy grew by 5.4% in the first quarter. However, the official PMI in June remained below the 50 mark (49.7), indicating instability in the industry. Meanwhile, the private Caixin PMI exceeded 50 for the first time in several months.

The Eurozone is showing signs of stabilization: in the first quarter, GDP grew by 0.6% y-o-y, inflation in June was exactly 2%, i.e. within the ECB’s target. Manufacturing indices are also improving. Germany is still feeling the effects of the last recession. The GDP growth forecast is only 0.3-0.4%, although the manufacturing PMI has exceeded 50 for the first time since 2022. Retail trade, however, remains weak.

The UK surprised with positive dynamics – 0.7% growth in the first quarter, the highest among the G7. Inflation in May was 3.4%, with the Bank of England’s key policy rate at 4.25%.

India continues to lead the way in terms of growth – 7.4% in the first quarter. Inflation was only 2.82%. The central bank cut its key policy rate to 5.5% in response to lower inflationary pressures.

Brazil is expected to grow at 2.1-2.4%, but inflation in May was 5.32%. This forced the regulator to maintain the high Selic rate of 15%.

Japan is showing the first signs of recovery. The PMI in industry reached 50.1, and the composite PMI – 51.4. Inflation in services is 3.3%, and the Bank of Japan may raise rates as early as 2026.

“The global economy is in a turning point. The US and Europe are stagnating, while China is recovering cautiously. Germany and the UK are showing weak but stable growth. India remains the engine of global development. For Ukraine, the main thing is not to lose momentum, maintain access to international financing and adapt to the new conditions of global trade,” summarized Maksym Urakin.

The material was prepared based on the analytical review by Experts Club. Watch the video for more details at the link: https://www.youtube.com/watch?v=kQsH3lUvMKo&t

You can subscribe to the Experts Club YouTube channel here: https://www.youtube.com/@ExpertsClub

Over the past three decades, pig farming has remained one of the most important components of global agricultural production. It has played a key role in providing the population with animal protein, shaping export flows in Asia and Europe, while remaining vulnerable to global epidemiological risks. Experts Club analysts have studied changes in the global pig population between 1990 and 2023.

“Pig farming is an industry where economics is closely intertwined with biological risks. It is extremely profitable in stable conditions, but it instantly suffers from any disruptions in the veterinary or logistics chain,” said Maxim Urakin, PhD in Economics and founder of the Experts Club information and analytical center.

In the early 1990s, the total number of pigs in the world grew steadily, especially in China, which became the largest producer and consumer of pork. Mass industrial production, urbanization, and high demand for meat in the Asia-Pacific region stimulated capacity expansion. By the mid-2010s, the industry was at its peak: in some years, the number of pigs in the world exceeded one billion. This dynamic reflected the successful commercialization of the industry in China, Vietnam, Brazil, the United States, Germany, and Spain.

However, after 2018, the global pig industry faced one of the most significant challenges in recent decades — the African swine fever (ASF) pandemic. The epizootic, which began in China, spread to dozens of countries and led to a massive reduction in livestock numbers. In China alone, it is estimated that more than 100 million pigs were destroyed. This caused a meat shortage in the global market, price increases, a crisis in feed chains, and a reorientation of international trade.

“After the ASF outbreak, China began to actively reform the structure of pig farming, moving from small farms to large biosecure complexes. This also affected the global market, as demand for safe and controlled meat rose sharply,” Urakin explained.

Europe, in turn, found itself under pressure from environmental legislation and growing animal welfare requirements. In the Netherlands, Denmark, and Germany, the industry declined not only due to disease but also due to political decisions to reduce methane and nitrate emissions. In North America, the situation remained stable, although it was affected by tariff wars, especially in US-China relations.

Today, the global pig industry has partially recovered but remains in a phase of restructuring. China is gradually restoring its livestock population, but on new principles — with strict control of biosecurity, genetics, and investment in innovation. At the same time, more and more countries are investing in alternative proteins — cultured meat and plant-based pork substitutes — which poses long-term risks to the traditional industry.

“The future of pig farming is a symbiosis of biotechnology, sustainable management, and veterinary reliability. Those who cannot adapt will lose the market,” concluded Maxim Urakin.

A detailed analysis of the situation on the pork market and a visualization of global trends can be found in a special video review on the Experts Club YouTube channel.

AGRICULTURAL MARKET, ANIMAL HUSBANDRY, EXPERTS_CLUB, PIG FARMING, URAKIN

On June 12-13, Uman hosted a key industry event – theBread Industry 2025 business forum. More than 200 participants from all over Ukraine – business owners, technologists, analysts, government representatives, specialized associations and suppliers – gathered to outline a common vision of the future of the baking, flour milling and grain processing industries.

The event was organized by the All-Ukrainian Bakers Association, the Union of Millers of Ukraine and Agro Marketing Agency. This year’s event was hospitably hosted by Uman National University, one of the key agricultural universities in the country.

Lesaffre Ukraine was the general partner, SocTrade was the quality control partner, Uni Blend was a special partner, Umankhleb and Umanpyvo were regional partners, Baker’s Bistro was the banquet partner, and Experts Club was the official information and analytical partner of the forum. The forum was supported by Cherkasy Regional State Administration, OLIS, TM “Voloshkove Pole”, Cherkasy Bread, Wine of Ukraine, Food & Drinks, Ukrvinprom, Agro 2 Food, World Food Ukraine, Ukrkondprom. Interfax-Ukrainewas the official media partner.

The forum combined three thematic sessions, an industry discussion, practical insight sessions, master classes, and a solutions exhibition – the event was designed as a platform for the exchange of ideas, cases, and analytics that already affect business efficiency and sustainability.

Government position: dialog, support, forecasts

The first day of the forum was opened with a session on government policy and its impact on the processing industry. Taras Vysotskyi, First Deputy Minister of Agrarian Policy, presented an updated harvest forecast for 2025, as well as state support mechanisms available to processors. The focus was on the ministry’s openness to a systematic dialogue with the market, in particular to adapt programs to the real needs of enterprises.

Roman Kropyvnytskyi, Director of the relevant department at the Ministry of Economic Development and Trade, emphasized the importance of effective use of existing state support instruments, called on businesses to provide active feedback and stressed that strategic changes are possible only if all players in the chain cooperate.

Oleksandr Ignatov, Director of the Department of the State Labor Service of Ukraine, spoke about the upcoming updates to labor legislation, which should take into account the real labor relations between employers and employees. The topic aroused keen interest in the audience as it is directly related to the work of manufacturing companies.

There were constructive signals from the agrarian market: Andrii Dykun, Head of the UAC, focused on price risks and uneven margins in 2025 for wheat producers, and Oleksandra Avramenko, UCAB analyst, pointed out the challenges associated with the harmonization of Ukrainian legislation with EU standards.

Flour milling industry: export pressure and struggle for raw materials

The key focus was on the availability of milling wheat and the stability of the domestic flour market. Rodion Rybchynsky, Director of the Union of Millers of Ukraine, noted that with the beginning of full-scale armed aggression in Ukraine, flour production has significantly decreased and the structure of its exports has changed. Two issues are critical for the industry today: the availability of raw materials due to active wheat exports and the return of quotas on exports to the EU, which have become a key market for Ukrainian flour over the past three years.

In turn, Maksym Rychlovsky (Newsfera) drew attention to the loss of the domestic rye market – the crop has virtually ceased to be grown, which leads to import dependence in the production of rye flour and the risk of complete disappearance of the corresponding bread varieties.

Maksym Urakin (Experts Club, Interfax-Ukraine) analyzed the macroeconomic impact on bread production and consumption trends. He noted that in 2025, key macroeconomic indicators will again come to the fore. Inflation, projected at 12%, raises questions about the impact of costs on consumption. Changes in prices for certain products are noticeable in the country’s economy and can significantly change business models. At the same time, according to M. Urakin, the projected GDP growth of 2.9% opens up new prospects, but it is also necessary to take into account variations in the discount rate and the hryvnia exchange rate, which may aggravate the situation in the coming years.

Olena Lapshova (Lesaffre Ukraine) presented the international context: consumers expect not only environmental friendliness, but also confirmed evidence of quality, simplicity, and benefit from a product. These global trends will continue to influence the development of the Ukrainian industry, so today they should be taken as a benchmark for business development. Natalia Savosina (SocTrade) focused on full quality control – from field to shelf. Her presentation was devoted to technological solutions that ensure accuracy and safety at all stages of flour and bakery production.

Technology, marketing and new development priorities

The third session of the forum was dedicated to modern technological solutions and marketing approaches that shape the future of the bread industry. The session was moderated by Yuriy Duchenko, First Vice President of the UBA, Director of Kyivkhlib LLC. Opening the session, he noted that the quality of Ukrainian flour is not only a guarantee of stable domestic consumption, but also a key to success in foreign markets. The Ukrainian industry already has the potential to meet the highest standards, but it needs a unified vision and investment in quality stability and traceability.

Prof. Dmytro Zhygunov identified the main challenges related to the state of Ukrainian wheat, particularly in the context of baking properties. He noted that the industry needs a systematic analysis of the raw material base and a rethinking of the grain selection criteria, taking into account the intended use of flour.

Svitlana Shynkarenko, Head of Technology at Lesaffre Ukraine, PhD, in her speech described how freezing technologies not only optimize logistics or facilitate production forecasting, but also become a driver for creating an emotional product that meets the expectations of modern consumers. She paid special attention to the control of fermentation in freezing conditions, preservation of organoleptic properties and the role of yeast solutions in shaping the taste.

Sergiy Tsekhmistrenko, Director of Uni Blend, spoke about targeted technological solutions as an element of increasing the efficiency of bakery production. His report contained specific cases, such as the introduction of adaptive mixes to meet the requirements of a particular enterprise, modification of recipes to improve the stability of baked goods, and examples where the introduction of mixes reduced production losses and increased the yield of finished products.

Oleksandr Vereshchynskyi, Doctor of Technical Sciences, co-founder of OLIS, delivered a report that became a concentrate of strategic advice for owners and engineers of manufacturing enterprises: how to avoid common design mistakes, which components require the most careful attention, how to combine energy efficiency with grinding accuracy. He also emphasized the importance of integrating laboratory control into the real mill production cycle as a tool for sustainability and savings.

Olena Sinitsyna, founder of Favorite Food & Drinks, provided a practical guide to negotiating with foreign retailers: new requirements for documentation, logistics, recipes, price indexation and compliance with local regulations. She noted that Ukrainian producers have a good chance of securing contracts, provided they are flexible and professionally trained.

Bohdan Shapoval (Ukrainian Food Association) concluded the session by adding information on Private Label trends in the EU, the role of Ukrainian industry associations in promoting products, and the barriers that still need to be removed for sustainable exports. He emphasized that the new stage of cooperation with European networks is a challenge but also an opportunity for Ukrainian companies to become part of the global supply chain.

This block of the forum clearly demonstrated that technology and marketing are increasingly integrated. The future of the bread industry lies in personalized solutions, precise investments, flexible production and a systematic marketing presence in the market.

A game-changing discussion

The public discussion between bakers and retailers was a separate block. It was frank, dynamic, and sometimes conflicting – it was the culmination of the first day. The moderator was Lyudmyla Khomychak (Ministry of Agrarian Policy). The discussion centered on pricing, logistics, specifics of contracts and quality requirements. The participants agreed that this conversation should be regular and result in a revision of the procurement policy in terms of predictability and fairness of conditions for both parties.

Lesaffre intensive and Uni Blend master class

The second day of the forum was opened with an insight session by Lesaffre Ukraine. The participants worked in depth on optimizing dough preparation, innovations in fermentation, and efficiency in freezing bread products. After the session, the Uni Blend team held a practical master class at Uman National University, where they presented modern mixes, baking technologies and approaches to recipe adaptation.

The Forum “Bread Industry – 2025” has become an event that not only captures the problems, but also offers solutions – strategic, tactical and applied. It identified challenges, gathered the market on one platform, and launched important processes – from revising the procurement policy to updating technological approaches. A challenging marketing season, new trade rules with the EU and the fight for consumers lie ahead. But after the Bread Industry 2025, the industry will come out with new benchmarks. The next meeting will be held in 2026. And, given the dynamics, it will be even more ambitious.

Interfax-Ukraine is a media partner

Karol Nawrocki, candidate from the Law and Justice party, has won the second round of the presidential election in Poland, according to Gazeta Wyborcza.

According to the Polish National Electoral Commission, after 100% of the votes were counted, he received 50.89%.

It is noted that his opponent, Warsaw Mayor Rafal Trzaskowski, received 49.1% of the vote.

A week before the election, Polish Prime Minister Donald Tusk called presidential candidate Nawrocki’s statement that Poland would never support Ukraine’s accession to NATO treason.

Earlier, the Experts Club think tank released a video analysis dedicated to the most important elections in the world in 2025. For more details, see here — https://youtu.be/u1NMbFCCRx0?si=6L76qeuNamxg6py1

ECONOMY, EXPERTS_CLUB, Karol Navrotsky, POLITICS, PRESIDENT OF POLAND, URAKIN

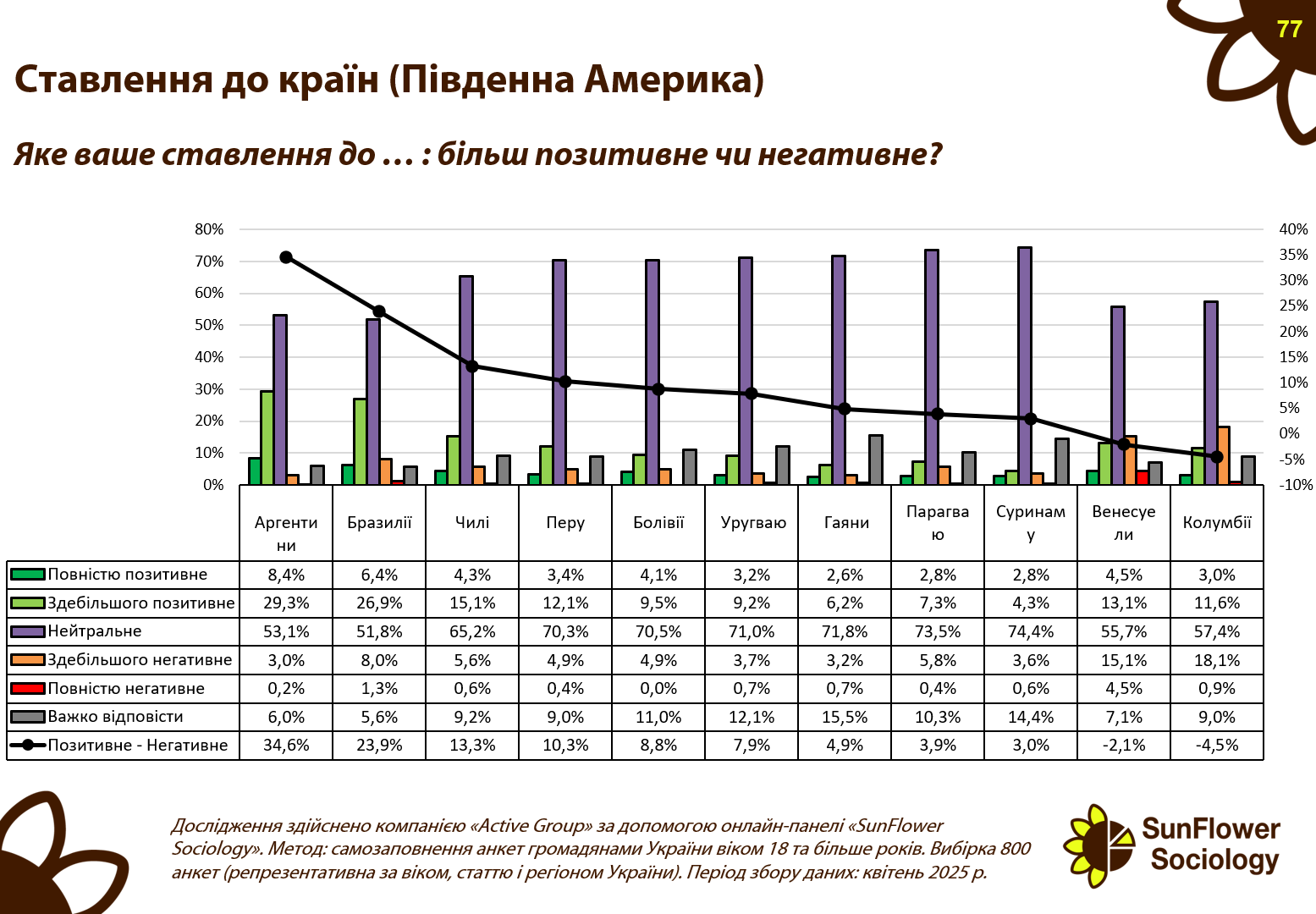

A survey conducted by Active Group in partnership with Experts Club found that among South American countries, Ukrainians have the highest level of sympathy for Argentina. According to data published in April 2025, 8.4% of respondents expressed a completely positive attitude toward this country, and another 29.3% expressed a mostly positive attitude. Thus, Argentina has the highest positive balance in the region — 34.6%.

Brazil came in second place in terms of support, with a total of 33.3% positive ratings (6.4% completely positive, 26.9% mostly positive) and a balance of 23.9%. Chile shows rather restrained sympathy: 4.3% of respondents were completely positive, 15.1% mostly positive, giving a balance of 13.3%. Peru, Bolivia, and Uruguay were at or slightly above 10% positive balance.

It is particularly noteworthy that for Bolivia this figure is 8.6%, despite a fairly high level of neutral attitudes — 70.5%.

The situation is much worse for Colombia, which has the lowest balance in the region — minus 4.5%. 18.1% of respondents expressed a mostly negative opinion, which significantly outweighs the total 14.6% of positive perceptions. Venezuela also has a negative balance of minus 2.1%, mainly due to political instability and negative associations in the media.

Most South American countries are perceived by Ukrainians as mostly neutral. In Paraguay, Suriname, Guyana, and Uruguay, the level of neutrality ranges from 71% to 74%. This indicates weak emotional contact and insufficient presence of these countries in Ukraine’s information space.

“Latin American countries remain largely outside the scope of active Ukrainian interest, which creates both challenges and opportunities. Where the level of neutrality is high, there is room for diplomacy, cultural exchange, and building a positive image,” comments Maxim Urakin, PhD in Economics and founder of Experts Club.