Experts Club has analyzed the brick market in Ukraine and made a number of conclusions and forecasts. The brick market in Ukraine is gradually recovering from the destruction and recession caused by the full-scale war in 2022. In 2024, there was an increase in construction activity, especially in the residential and infrastructure construction segment, which provoked an increase in demand for bricks.

At the end of 2024, the market showed an increase in capacity by 18.5%. In the first half of 2024, production reached ~249 million bricks, up 20.4% compared to the same period in 2023. The annual production volume in 2024 was estimated at 500-520 million bricks, and in 2025 – 535-555 million bricks with a forecast growth of 7%.

The largest Ukrainian producers are concentrated in the central and western regions of the country. Due to the hostilities in 2022-2023, refractory brick factories in the east, such as Bilokamianske and Zymohirske, were destroyed or decommissioned.

However, a large part of traditional brick production managed to maintain or resume operations by 2024.

Imports.

Due to the destruction of production facilities and rising demand, Ukraine is increasing its brick imports. The main supplier countries are: Poland

Imported products are mainly sent to the western and central regions and are used in high-budget construction and decoration.

Market shares: imports vs. domestic production

Based on estimates for 2025:

This makes it possible to compensate for the shortage in some regions and support construction during the reconstruction period.

Prices.

Experts Club ‘s forecasts are as follows:

Brick factories operating in the government-controlled areas

There are more than 30 brick factories operating in the government-controlled areas, including ceramic, silicate and clinker. Among the largest are:

Currently, the products of these plants cover more than 70% of domestic demand for bricks in construction.

Major brick importers to Ukraine

To compensate for the deficit and ensure high quality in some market segments (refractory, clinker, facing), Ukraine imports products from

In 2024, the Ukrainian brick market entered a phase of active recovery. Domestic production provides the bulk of the output, but the share of imports remains significant and is growing. Restoration of the destroyed infrastructure, support from the government and international funds will continue to stimulate the market, and prices will stabilize closer to 2026.

Source: https://expertsclub.eu/rynok-czegly-v-ukrayini-v-2024-2025-rokah-korotkyj-oglyad-vid-experts-club/

Ukraine is preparing to announce a tender for the development of the Dobra lithium deposit, which could become the first project within the framework of cooperation with the US, according to the head of the President’s Office, Andriy Yermak.

“Ukraine is preparing to announce a tender for the development of the Dobra lithium deposit in the Kirovohrad region. This could be the first project within the framework of cooperation with the US. I am glad to see that the process is moving forward and that the results of our meetings in Washington a week ago are turning into concrete actions,” Yermak wrote on Telegram on Wednesday.

For more details on the prospects for rare earth element mining in Ukraine, see the video from the Experts Club analytical center – https://www.youtube.com/watch?v=UHeBfpywpQc&t

Ukraine’s negative foreign trade balance in goods in January-April 2025 increased by 48.5% compared to the same period in 2024, reaching $11.512 billion from $7.755 billion, according to the State Statistics Service (Gosstat).

According to its data, exports of goods from Ukraine during the specified period compared to January-April 2024 decreased by 6.9% to $13.312 billion, while imports increased by 12.6% to $24.824 billion.

The statistics agency specified that in April 2025, compared to March 2025, seasonally adjusted exports decreased by 4.4% to $3.369 billion, and imports decreased by 2.3% to $6.529 billion.

The seasonally adjusted foreign trade balance in April 2025 was negative at $3.161 billion, as it was in the previous month at $3.163 billion.

The export-to-import coverage ratio in January-February 2025 was 0.54 (in January-April 2024, it was 0.65).

The State Statistics Service reported that foreign trade operations were conducted with partners from 217 countries around the world.

Earlier, the Experts Club information and analytical center released a video analysis of the Ukrainian and global economies, more details here –

https://youtu.be/LT0sE3ymMnQ?si=0Cstf1AY9xZ4Dxxx

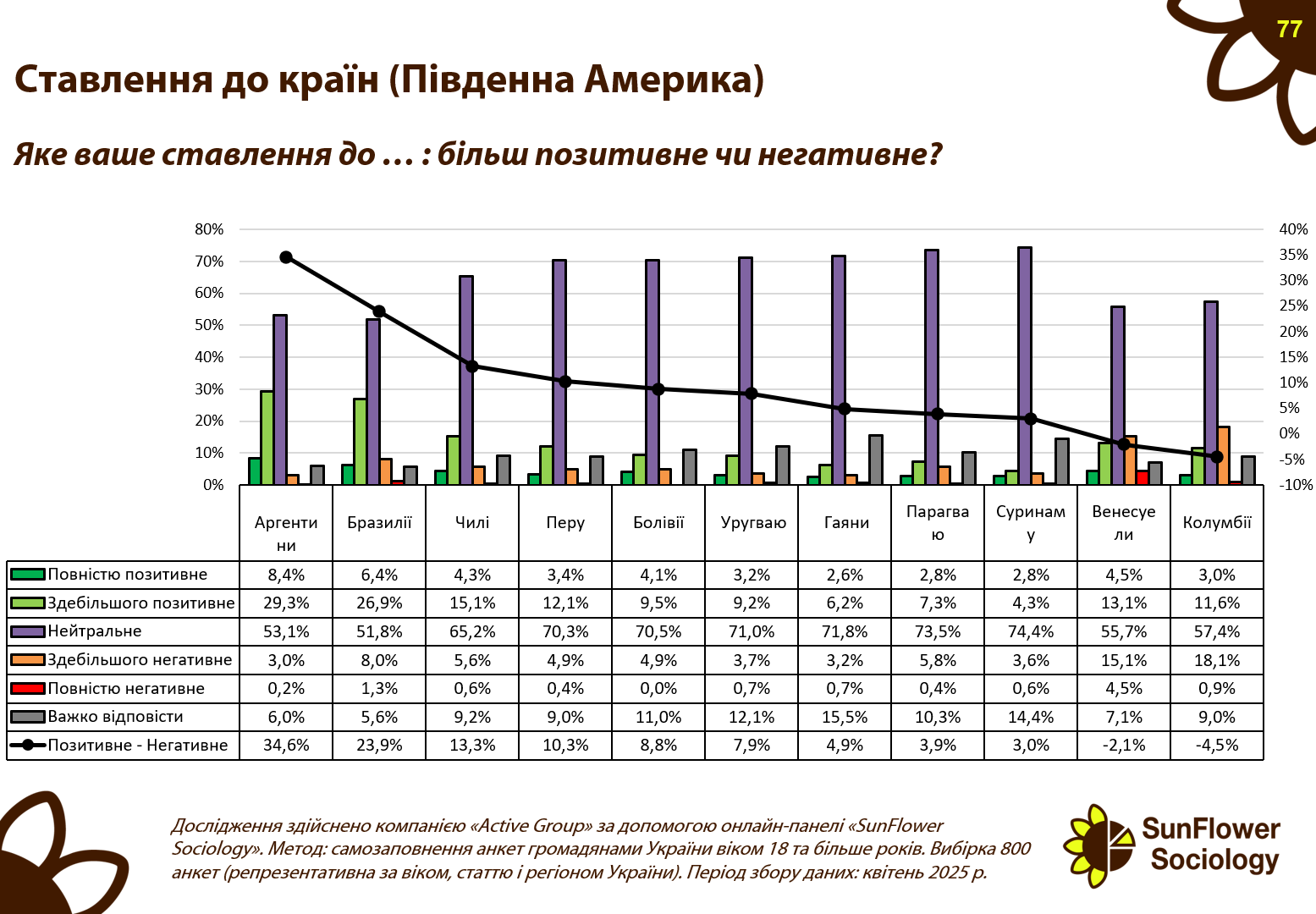

A survey conducted by Active Group in partnership with Experts Club found that among South American countries, Ukrainians have the highest level of sympathy for Argentina. According to data published in April 2025, 8.4% of respondents expressed a completely positive attitude toward this country, and another 29.3% expressed a mostly positive attitude. Thus, Argentina has the highest positive balance in the region — 34.6%.

Brazil came in second place in terms of support, with a total of 33.3% positive ratings (6.4% completely positive, 26.9% mostly positive) and a balance of 23.9%. Chile shows rather restrained sympathy: 4.3% of respondents were completely positive, 15.1% mostly positive, giving a balance of 13.3%. Peru, Bolivia, and Uruguay were at or slightly above 10% positive balance.

It is particularly noteworthy that for Bolivia this figure is 8.6%, despite a fairly high level of neutral attitudes — 70.5%.

The situation is much worse for Colombia, which has the lowest balance in the region — minus 4.5%. 18.1% of respondents expressed a mostly negative opinion, which significantly outweighs the total 14.6% of positive perceptions. Venezuela also has a negative balance of minus 2.1%, mainly due to political instability and negative associations in the media.

Most South American countries are perceived by Ukrainians as mostly neutral. In Paraguay, Suriname, Guyana, and Uruguay, the level of neutrality ranges from 71% to 74%. This indicates weak emotional contact and insufficient presence of these countries in Ukraine’s information space.

“Latin American countries remain largely outside the scope of active Ukrainian interest, which creates both challenges and opportunities. Where the level of neutrality is high, there is room for diplomacy, cultural exchange, and building a positive image,” comments Maxim Urakin, PhD in Economics and founder of Experts Club.

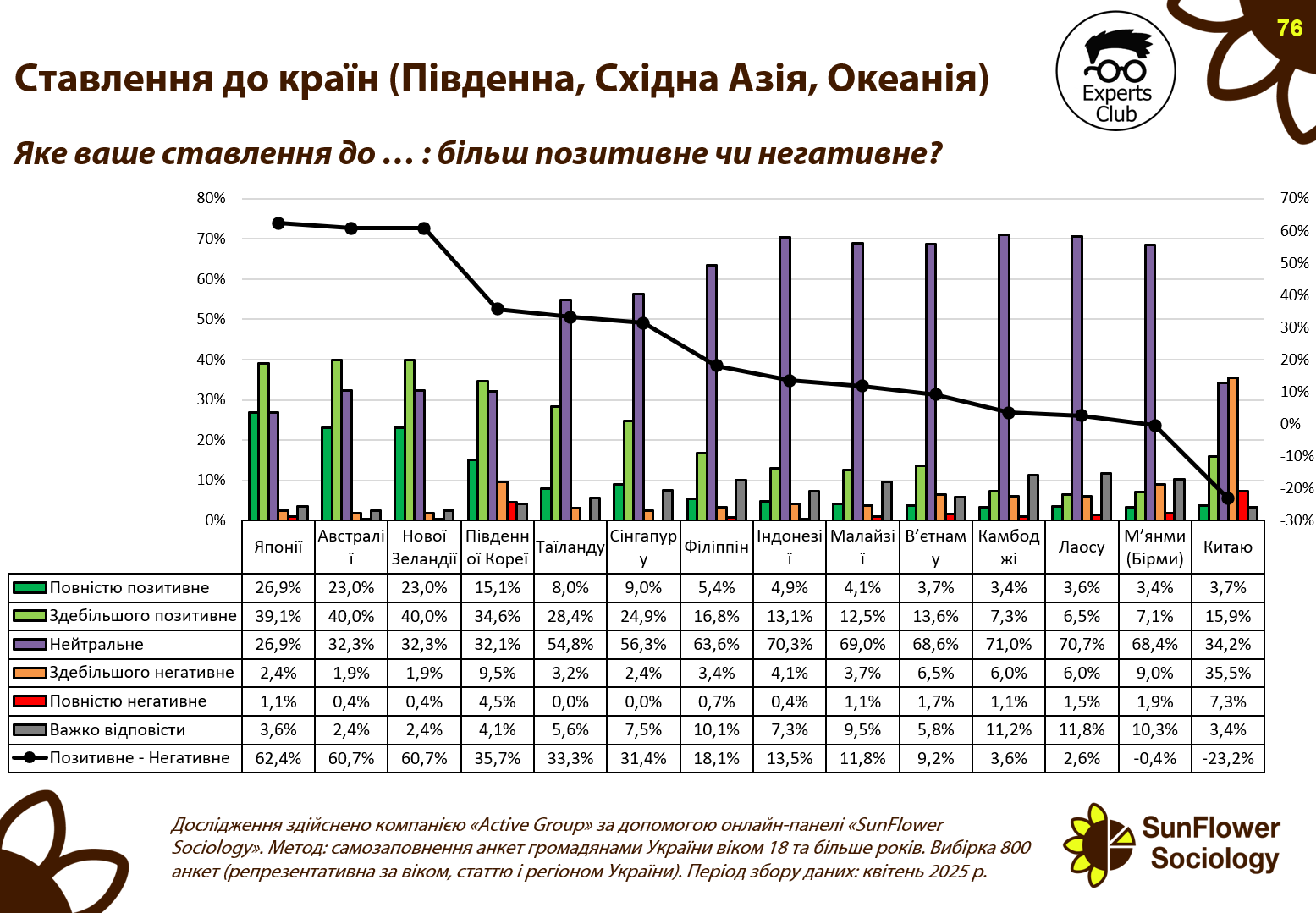

According to new sociological data published by Active Group in collaboration with Experts Club in April 2025, Ukrainian public opinion on South and East Asian countries and Oceania varies significantly. Japan, Australia, and New Zealand are in favor, while China and some countries in Southeast Asia show either a negative or neutral balance.

Japan received the highest positive rating among the countries in the region, with 62.4% of Ukrainians having a positive attitude towards it, including 26.9% who are completely positive and 39.1% who are mostly positive. It is followed by Australia and New Zealand with an identical net balance of 60.7%. In Australia, 23% of respondents chose the completely positive option, in New Zealand — the same, while more than 40% in each country gave a “mostly positive” rating.

South Korea, with 15.1% completely positive ratings and 34.6% mostly positive, has a respectable balance of 35.7%, although lower than the leaders. Thailand (36.4% positive perception) and Singapore (33.8%) also hold relatively high positions thanks to their stable image associated with tourism and development.

In contrast, countries such as Indonesia, Malaysia, Vietnam, Cambodia, Laos, and Myanmar are dominated by neutral assessments — over 60% — indicating limited awareness or an information vacuum. In all these countries, the positive balance does not exceed 10%.

Despite its economic weight, China has one of the worst images among Ukrainians in the region: 15.9% expressed a mostly positive opinion, but 35.5% rated China neutrally, and the negative balance was -23.2%. This reflects a certain distrust that has formed against the backdrop of geopolitical events and the information background.

“It is particularly interesting that even Ukraine’s economically important partners, such as China (its largest trading partner), receive low support ratings among Ukrainians. This indicates that Ukrainian society values moral support above real trade and does not recognize “neutrality” if it is not accompanied by humanitarian gestures,” comments Maxim Urakin, PhD in Economics and founder of Experts Club.

Thus, the results indicate that there is significant potential for countries in the region, particularly Southeast Asia, to improve their image in Ukraine through cultural diplomacy, tourism marketing, and economic cooperation.

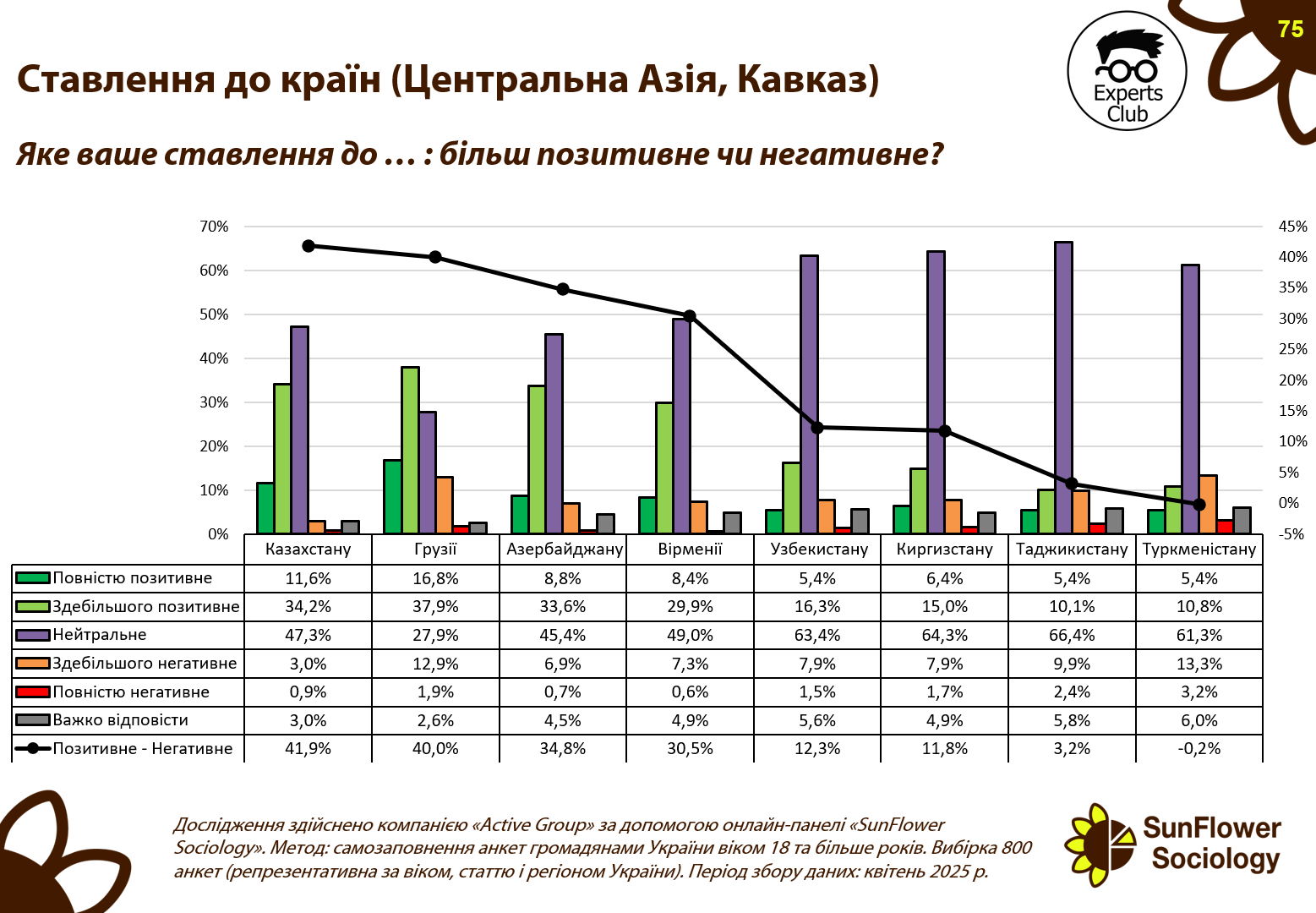

In April 2025, Active Group, in collaboration with the Experts Club think tank and the SunFlower Sociology platform, conducted a survey on the attitudes of Ukrainian citizens toward Central Asian and Caucasian countries. The results show a predominantly neutral or moderately positive perception of the region, with Georgia and Kazakhstan as clear leaders in terms of favorability.

Georgia received the largest share of positive ratings: 16.8% of Ukrainians said they had a completely positive attitude, and another 37.0% said they were mostly positive. Together, this forms a positive balance of 40%. Kazakhstan has a similar level of sympathy: 11.6% completely positive, 34.2% mostly positive, with a net balance of 41.9%. Azerbaijan ranks third with a total positive rating of 42.4%, although neutral assessments significantly prevail there — 45.4%.

In contrast, the countries of Central Asia are dominated by neutral responses: 63.4%, 64.3%, 66.4%, and 61.3% in Uzbekistan, Kyrgyzstan, Tajikistan, and Turkmenistan, respectively. All of them have a balance of sympathy below 12%, and Turkmenistan even shows zero support (-0.2%), mainly due to low awareness.

On the other hand, 8.4% have a completely positive attitude towards Armenia and 29.9% have a mostly positive attitude, putting it in fourth place with a balance of 35.5%.

“Despite their shared Soviet heritage, Ukrainian society views Central Asian countries mostly through the prism of caution or indifference. At the same time, the examples of Georgia and Kazakhstan demonstrate that close intergovernmental ties and a positive media presence can significantly influence public opinion,” comments Maxim Urakin, PhD in Economics and founder of Experts Club.

Thus, the study’s conclusions indicate that in a region with potential for interaction with Ukraine, the key factor is not only historical memory, but also contemporary diplomatic and cultural activity.