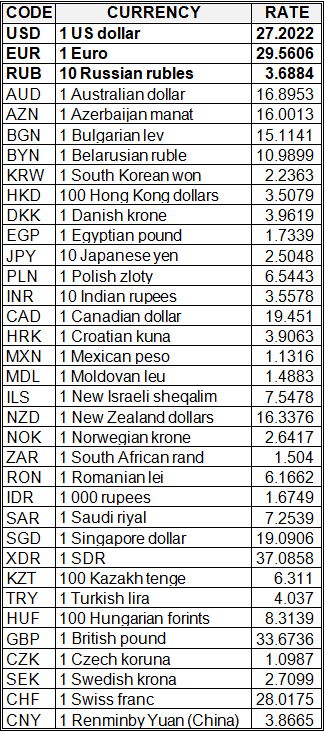

National bank of Ukraine’s official rates as of 13/04/20

Source: National Bank of Ukraine

Ukraine’s GDP in January 2020 decreased 0.5%, the Ministry of Economic Development, Trade and Agriculture has said based on information from the State Statistics Service.

The international rating agency Standard&Poors has affirmed Ukraine’s long-term foreign and national currency ratings at “B” level, short-term “B” ratings and ratings on the national scale “uaA,” the outlook on them is “stable.”

The deficit of the national budget of Ukraine in 2020 could increase from 2.09% to 7% of GDP, Yulia Kovaliv, the deputy head of the President’s Office, has said.

Analysts from Bank of America (BofA) at the end of last week worsened the assessment of prospects for the Ukrainian economy in 2020 and expect a decrease in the country’s GDP by 1.1% due to the increased interruptions in its work.

The deficit of Ukraine’s national budget in January-February 2020 was UAH 21.5 billion, including a deficit of UAH 26.13 billion for the general fund, with the target being UAH 30 billion, according to the State Treasury Service.

According to the agency, borrowings for the specified period amounted to UAH 65 billion with the target standing at UAH 85 billion, repayment to UAH 51 billion with a plan of UAH 59 billion.

Ukraine’s GDP could fall by over 0.5% in February 2020, Deputy Economic Development, Trade and Agriculture Minister of Ukraine, Taras Kachka, who is also the Trade Representative of Ukraine, has said.

The Ministry of Economic Development, Trade and Agriculture of Ukraine intends to worsen its macroeconomic forecast for 2020-2023 over the weakening of the pace of growth of the Ukrainian economy compared with the document approved in October 2019, the ministry has told Interfax-Ukraine.

The international rating agency Standard&Poors has affirmed Ukraine’s long-term foreign and national currency ratings at “B” level, short-term “B” ratings and ratings on the national scale “uaA,” the outlook on them is “stable.”

The National Bank of Ukraine (NBU) is counting on financing the national budget deficit that has grown due to coronavirus (COVID-19) outbreak at the expense of the International Monetary Fund (IMF), central bank governor Yakiv Smolii has said.

Ukraine’s GDP will decline by 4% if quarantine lasts up to three months and by 9% if it lasts longer, Head of Dragon Capital investment company Tomas Fiala has said.

Ukraine’s economy is better prepared for the crisis and its decline will be at the level of other countries, Deputy Governor of the National Bank of Ukraine (NBU) Dmytro Sologub has said.

Analysts of J.P. Morgan forecast an economic fall in Ukraine at 2.6% of GDP in 2020, calling the condition for such a relatively small reduction the signing of an agreement with the IMF and expecting it in the second quarter of this year.

The macroeconomic forecast, on which the amendments to the national budget were based, implies a drop in the economy in 2020 by 4.8% of GDP, Prime Minister of Ukraine Denys Shmyhal has said.

JSC Ukrposhta will sign financial lease contracts for the purchase of 500 cars from Ukrlada LLC for the implementation of the Mobile Offices project on April 10, the company’s press service said on Thursday, April 9.

The contracts signing will be hold online with the participation of Director General of Ukrposhta Igor Smelyansky, Minister of Infrastructure of Ukraine Vladyslav Krykliy, Director of Ukrlada Hanna Bilozerova and chairman of the board of FUIB Serhiy Chernenko.

According to ProZorro, the following companies took part in the tender for the purchase of 500 passenger cars for organizing mobile offices: Arma Motors LLC, Ukrlada Trading House, Europa Plus LLC and Vidi Avenue LLC. The winner was Ukrlada, which offered the lot value in EUR 8.445 million that is 5.11% lower than the expected purchase price.

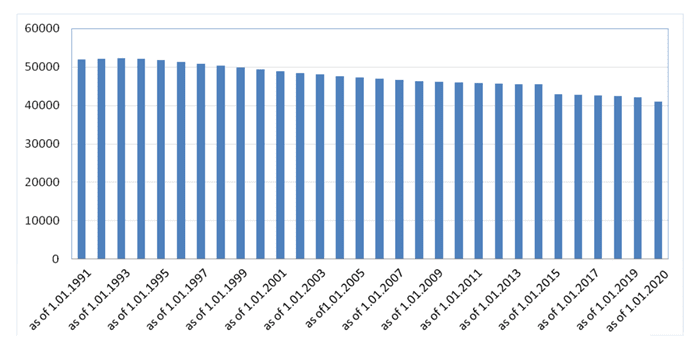

Dynamics of changes in population of Ukraine from 1991-2020

The State Automobile Roads Agency of Ukraine (Ukravtodor) starts building a road to Stanytsia Luhanska, Head of Ukravtodor Oleksandr Kubrakov said during an online briefing on Thursday, April 9. “The main thing that starts this week is the road to Stanytsia Luhanska. There are several road sections, but the total length will be 130 kilometers and we are starting to construct this road today,” he said.

According to Kubrakov, there are plans to finish this road construction until mid-July.

The head of Ukravtodor also said that the H-31 Dnipro-Reshetylivka and H-30 Vasylivka-Berdiansk roads are currently under active construction.

“H-31 road is fully in operation. There are 29 kilometers along which no work is underway, because the feasibility study is being developed, but we understand that the president’s task is to complete this road this year, thus we are following the plan. As for H-30 Vasylivka-Berdiansk, some roads are already being commissioned. We hope that when the quarantine ends and the tourist season comes, this road will be opened,” Kubrakov said.

Ukraine in January-March 2020 exported 1,210 tonnes of cheese, which is 26.5% less than in the same period in 2019.

According to the State Customs Service, in monetary terms exports decreased by 20.3% and amounted to $4.67 million.

The import of cheese in the first quarter of 2020 grew by 2.5 times, to 10,210 tonnes, in monetary terms 2.4 times, to $45.2 million.

Export of Ukrainian butter decreased by 47.4%, to 3,100 tonnes, in money terms by 39.3%, to $14.48 million. Import of the products in the reporting period amounted to 2,790 tonnes ($12.03 million) compared to 211 tonnes ($1.44 million) for the first quarter of 2019.

According to the service, the export of milk and cream (condensed) decreased by 25.3%, to 4,450 tonnes in the first three months of 2020. Ukraine supplied condensed milk and cream for a total of $10 million, which is 11.8% lower than in January-March 2019. Imports of the goods grew by 2.2 times, to 1,030 tonnes, in money terms 2.5 times, to $2.39 million.