Ukrainian insurance companies in 2019 collected UAH 169.113 million in premiums under contracts signed via resident agents, which is 53.9% more compared with 2018 (UAH 109.837 million), the National Commission for Financial Service Markets Regulation has reported.

According to the regulator’s website, the number of contracts concluded through resident agents for the year increased 3.5 times, to 24,745.

Of the total amount of collected premiums, premiums from personal insurance amounted to UAH 116.558 million (1,996 contracts), UAH 31.9 million for property insurance (231), UAH 13.509 million for mandatory insurance (22,200), UAH 3.325 million life insurance (33), and UAH 3.997 million for liability insurance (279).

The amount of remuneration for the provision of such intermediary services last year increased 1.9%, to UAH 28.145 million.

According to the regulator, insurance payments received by nonresident insurers under insurance contracts amounted to UAH 9.774 million, which is 3.7 times more than in 2018. The remuneration for 36 concluded agreements amounted to UAH 771,000 (UAH 580,000 in 2018). At the same time, the regulator said that in 2019, payments under the above agreements were not made.

Nonresident reinsurers through brokers were given UAH 920.7 million for reinsurance under 258 contracts, which is 17% less than a year earlier (UAH 1.111 billion). At the same time, payments were made in the amount of UAH 146.316 million, which is 62% less than in 2018. The remuneration of brokers in 2019 amounted to UAH 34.618 million (a rise of 17.5%).

The Verkhovna Rada vote for the law on land sale is supported by 26% of Ukrainians, while 60% are against the law adoption, the results of the social survey assessing the success of the government and society’s response to the coronavirus disease (COVID-19) epidemic and political events in the country, conducted by Kyiv International Institute of Sociology (KIIS) on April 7-11.

“If a national referendum on the sale of agricultural land was held in the next week, 26% of those who are to participate in the referendum would vote in favor of the sale of land, and 74% against the sale of land,” KIIS said in a press release.

Some 32% of respondents believe that it is better now for Ukraine to cooperate with the International Monetary Fund (IMF) receiving new loans; 46% hold another opinion and said that it is now better not to cooperate with IMF and not to receive new loans.

The survey was conducted using the CATI method (computer-assisted telephone interviews) based on a random sampling of mobile phone numbers. During the survey, some 2,000 interviews were conducted in all regions of Ukraine, controlled by the government. The sample is representative for the adult population (18 years of age and older). The statistical sampling error (with a probability of 0.95 and taking into account the design effect of 1.1) does not exceed 2.2% for indicators close to 50%, 2.1% for indicators close to 25%, 1.4% for indicators close to 10%.

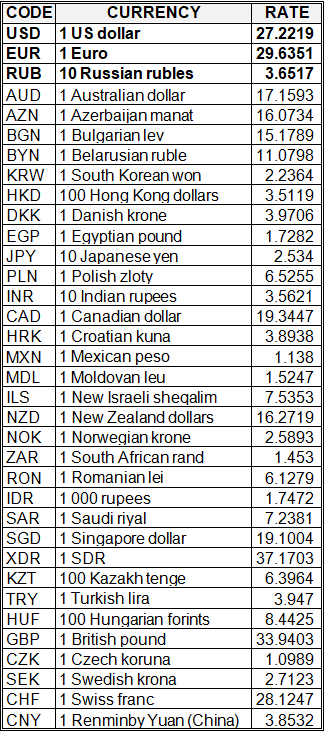

National bank of Ukraine’s official rates as of 16/04/20

Source: National Bank of Ukraine

Astarta agricultural holding, major sugar producer in Ukraine, increased its sugar sales by 44% in January-March 2020 compared to the same period in 2019, to 77,560 tonnes, the company said at the Warsaw Stock Exchange on Tuesday, April 14.

According to the data, sales of wheat for the indicated period decreased by 68%, to 3,400 tonnes, corn by 17%, to 236,000 tonnes, sunflower oil by 99%, to 69 tonnes, soybean oil by 22%, to 11,140 tonnes, milk by 9%, to 23,640 tonnes.

Sales of soybean meal last year remained at the level of 2019 and were 46,860 tonnes.

According to the agricultural holding, average prices for sugar during the period decreased by 1%, wheat by 22%, corn by 6%, sunflower by 7%, soybean meal by 14%.

Average prices for milk increased by 9%, soybean oil by 1%.

Astarta is a vertically integrated agroindustrial holding operating in eight regions of Ukraine.

DTEK energy holding intends to implement a pilot project to construct the Energy Storage system at Zaporizhia thermal power plant (TPP) by the end of 2020, DTEK CEO Maksym Tymchenko has said.

“Now, we have actually started the pilot project on energy storage at Zaporizhia TPP. Even despite of the current crisis, we believe that this is a very important direction. I hope that this project will be implemented by the end of the year and we will develop energy storage technologies,” he said during an online briefing on Wednesday.

Tymchenko said that containerized solutions for gas power generation based on DTEK’s TPPs are also being considered, which will be able to meet the needs of balancing.