National bank of Ukraine’s official rates as of 04/10/19

Source: National Bank of Ukraine

Antidumping duties on clinker and Portland cement from Russia, Belarus and Moldova introduced by Ukraine in the summer of 2019 served as an incentive to increase the load and production volumes of Ukrainian cement plants, market participants surveyed by the Interfax-Ukraine agency have said.

“We regard this step as positive, which allowed us to increase the load of enterprises and output of marketable products. Now our capacities are 90% loaded,” Mykola Kruts, the chairman of the board of PrJSC Ivano-Frankivskcement, told Interfax-Ukraine.

PrJSC Dyckerhoff Cement Ukraine agrees with his opinion. The company is witnessing the revival of market relations, the restoration of healthy competition and par prices for cement in the market, which creates conditions for further stable doing business.

“We consider the decision to impose duties on import of cement from the countries at dumping prices to be absolutely correct. This decision helped maintain a stable market position for Ukrainian producers, which, in turn, by developing their production, are able to satisfy the demand of all consumers in Ukraine. Otherwise, the dumping position of cement imported from Russia, Belarus, and Moldova could significantly worsen the financial results of PrJSC Dyckerhoff Cement Ukraine and lead to significant financial losses,” the company said.

In the eight months of 2019, the enterprise overfulfilled its plan for the growth of production volume by 17%, increasing the figure by 25% compared to the same period in 2018.

The growth of the company’s budget indicators this year is associated with cement supplies to various construction projects.

“In addition to deliveries to such a traditional sector as housing and commercial real estate construction, PrJSC Dyckerhoff Cement Ukraine also supplies cement for the construction of infrastructure facilities of national importance,” the company said.

In particular, the matter concerns the construction of a number of roads, a runway in Odesa, the reconstruction of the runway at Zaporizhia airport, the construction of wind power farms in Kherson and Mykolaiv regions, grain terminals, the development of berths in seaports, etc.

According to PrJSC HeidelbergCement Ukraine, in connection with the growth in cement sales, its production over the eight months of 2019 at Kryvy Rih plant rose by 14.7% compared to the same period in 2018 and amounted to 526,300 tonnes.

At the same time, the company notes that the production capacity is still low.

“Protection of Ukrainian producers against cement and clinker of Belarusian and Russian producers allowed to stabilize cement prices in the domestic market, but over the last three months, cement from Turkey aggressively entered the cement market, which, like Belarusian, is sold at low prices in the south and east of Ukraine. The state is obliged to protect domestic producers in the key sectors of the economy, this will allow enterprises to focus on the development of production, maintain jobs, improve work efficiency,” the company said.

According to HeidelbergCement Ukraine’s forecasts, cement production growth in Ukraine next year could reach 5-7%, provided that antidumping duties are maintained.

“The current political course of the country and the statements of the country’s leadership give hope for the development of the economy and, as a result, the construction market as a whole. As a result, we predict that the market growth in the next years will be 5-7%, which opens up the possibility of loading production capacities by 90-95%,” the company noted.

According to the company, there are currently ten cement plants operating in the Ukrainian market, the production capacities of which are 65% loaded, therefore each enterprise seeks to increase production, which significantly toughens competition.

“This year, the production capacities of PrJSC Dyckerhoff Cement Ukraine are 60% loaded of their design capacity. If there is demand in the market, the company is ready to increase production to the full utilization of design capacities,” the report says.

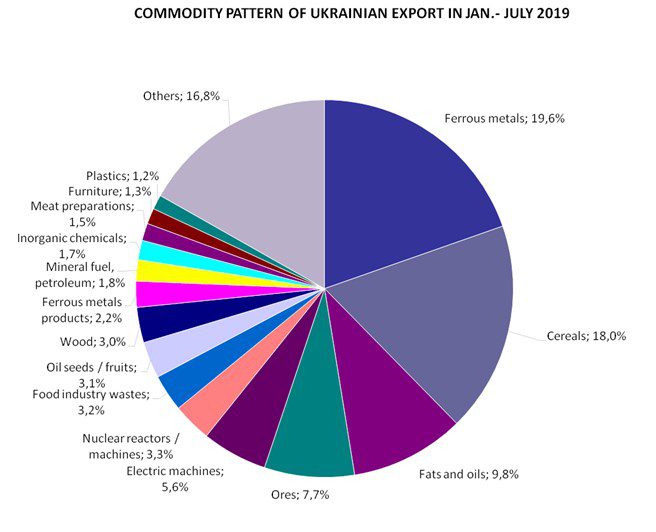

Commodity pattern of Ukrainian export in Jan-July 2019

The National Commission for Energy, Housing and Utilities Services Regulation (NCER) has set a feed-in tariff for the ETG Solar 5 LLC solar plant with a capacity of 11.1 MW (Zhovti Vody, Dnipropetrovsk region) at a rate of 15.03 euro cents per kWh.

According to the NCER’s website, the commission made such a decision at a meeting on October 3.

The validity of the tariff is until January 1, 2030.

The commission also provided tariff for Dniproukrenergo LLC station with a capacity of 6.2 MW (Nova Kakhovka, Kherson region). The company is owned by Logos Firm LLC and Mykyta Hostev, who is the director of Dniproukrenergo.

In addition, feed-in tariff was given to Sunny City LLC with a capacity of 8.3 MW (Ivano-Frankivsk region). The company is owned by Sansolar LLC, Andromeda Industry LLC and Yevhen Yaremenko. The ultimate beneficiary is Andriy Havryliv.

The NCER also set the tariff for the second stage of Ternovytsia Solar LLC with a capacity of 15.5 MW (Ternovytsia, Lviv region). The company is owned by Vydobutok Plus LLC and Greenville closed non-diversified venture corporate investment fund. The ultimate beneficiary is Ivan Torsky.

ETG Solar 5 LLC is owned by Energy Trade Group LLC, the largest private gas supplier to Ukraine. The ultimate beneficiary is Oleksiy Bondarenko. The number of clients of Energy Trade Group at the beginning of 2019 exceeded 2,500 companies.

ETG, GAS, SOLAR PLANT, TARIFF, TRADER

The Antimonopoly Committee of Ukraine (AMC) is considering the issue of permits to Devisal Limited (Nicosia, Cyprus), owned by Ukrainian businessman Sergiy Tigipko, to buy shares in Wesla Investments Limited (the British Virgin Islands).

According to the AMC’s agenda, the deal will provide Devisal Limited with over 50% of the voting shares on the board of Wesla Investments.

According to the unified state register, Wesla Investments Limited is the only participant with a 100% share in the charter capital of Veon Plus LLC (Kyiv), which is the owner of Radisson Blu Hotel in Podil. The ultimate beneficiary of the company as of October 3 is Moldovan citizen Victor Garaba.

Until June 2016, according to the state register, the ultimate beneficiary of Veon Plus LLC was Russian citizen Sergey Kovalev.

As reported, with reference to the CMS legal group, the transaction for the purchase of Radisson Blu Hotel in Podil by Sergiy Tigipko was completed in 2016, its cost amounted to EUR 9.2 million.

Pivdenny seaport in September 2019 handled 1.628 million tonnes of cargo, which exceeds the target by 75.1% and 59% more (604,000 tonnes) than in September 2018.

According to the press service of the port, the enterprise handled 1.213 million tonnes of ore, while imports of coking coal amounted to 195,400 tonnes, steam coal some 110,700 tonnes.

In addition, the stevedore transshipped 55,100 tonnes of pig iron and 32,000 tonnes of imported mineral fertilizers.

The berths operated by the company accepted 21 vessels and 18,400 high-sided wagons.

“At the end of October, we plan to fulfill the annual plan. However, there is no time to stop. In October, we are preparing to accept about 1.5 million tonnes of cargo,” acting director of the port Anatoliy Yablunivsky said.

Pivdenny port was founded in 1978. It is the deepest one in Ukraine. The total length of the berths is about 2.6 km.