The Kametstal plant, part of the Metinvest mining and metallurgical group (Kamenskoye, Dnipropetrovsk region), has completed the first stage of reconstruction of continuous casting machine No. 1 in the converter shop, upgrading key electrical equipment and the automated control system.

According to a press release, CCSS-1 is the plant’s leading machine, performing important tasks in the production of commercial steel billets, including those of enhanced quality. It was here that casting using stop mechanisms was mastered, and a team of specialists is systematically expanding the CCSS product range for customers in the domestic and European markets.

To improve the reliability of key equipment, a phased reconstruction of the LMP No. 1 began this year. The first stage was completed in June, which included an investment project to replace important electrical equipment and automated process control systems.

Hot testing of the continuous casting machine No. 1, taking into account the operation of the new equipment, has already been completed. However, work continues under the supervision of Primetals Technologies, a partner in the investment project, and all requests from the technical staff aimed at improving the software are being implemented in the operating mode. At the same time, the company is training electrical service and automated process control specialists to operate the modern equipment efficiently.

“Our goal is to upgrade the key equipment of the MLF-1 in line with modern standards, but the difficult conditions of wartime do not allow us to implement all our ambitious plans at once. Therefore, with the support of the Metinvest Group, we are reconstructing the first machine step by step, and thanks to the teamwork of all departments and services of the converter shop and specialists from the capital construction and investment department, we have successfully completed the tasks of the first stage,” said Alexander Degtyarenko, lead engineer for the converter shop reconstruction, whose words are quoted in the press release.

He noted that efforts are focused primarily on minimizing downtime associated with malfunctioning outdated electrical equipment.

“Modern software that provides online technological information improves the capabilities of electrical repair personnel by expanding the scope of diagnostics and also partially increases the accuracy of continuous casting, which is one of the main tasks we will perform at each stage of the reconstruction of the MLZ-1,” he said.

Primetals Technologies, headquartered in London, is a global leader in the development of engineering, plant construction, and services for the metallurgical industry.

Kametstal is part of the Metinvest Group.

KNUBA presented the best of 300 architectural concepts for the Medvynska community in the Kyiv region, ranging from the renovation of existing buildings to visions for future public spaces. The work was carried out by students under the guidance of Tetyana Ladan, associate professor at the Department of Fundamentals of Architecture and Architectural Design at KNUBA. This was announced by Rector Oleksii Dniprov.

“Each of the concepts presented is part of a comprehensive spatial strategy, executed in a unified style and logic. I am convinced that these projects can be implemented in practice. This confirms one of our key missions – to participate in the reconstruction of Ukraine in cooperation with communities,” said Oleksii Dniprov.

He added that the projects were the result of a partnership between the university and the community, which was formalized in a memorandum.

The conceptual projects presented relate to both new architectural solutions and the transformation of existing facilities. Some of them were presented in VR format.

“300 conceptual projects are a significant contribution to the development of the Medvyn community’s development strategy and spatial planning. I am grateful to the students, teachers, and everyone who participated in this process. The Medvyn community is open to change, and we are ready to move forward together,” said Ignatius Sergienko, head of the Medvyn community.

Below are five concepts that reflect the implementation of the community’s urgent needs.

Modular medical facility in the village of Medvyn – the “Beehive” concept

The concept provides for a convenient modular layout with compact rooms for doctor consultations, physiotherapy procedures, and a day hospital. An X-ray room, laboratories, and other necessary facilities are also provided.

The penthouses have mezzanines and skylights in the pyramid roofs. The rooms also have open terraces with pergolas for sun protection.

The roof has space for a café-restaurant, connected to open terraces and therapeutic gardens.

The residential blocks are designed for 1 or 2 visitors and can be used to accommodate doctors invited to consult with community residents.

The basement can accommodate 50 people and can be converted into a multipurpose space that can also be used as a shelter. The site has parking and convenient access to emergency medical services.

Modular outpatient clinic on Oleksandra Vasylenka Street in the village of Medvyn

1 – new general family medicine clinic, 2 – renovation of the old clinic into a rehabilitation center, 3 – Sunday school, 4 – visitor parking, 5 – ambulance parking.

Authors: architects, associate professors at KNUBA – Tetiana Ladan, Iryna Novosad, with the participation of Vladyslava Shevtsova, a student at the Department of Fundamentals of Architecture and Architectural Design.

Reconstruction of a school in the village of Shcherbashyntsi into a rehabilitation center – the “P’yatitsvit” concept

The concept involves insulating the facades, redesigning the premises for residential use, and dividing the master plan into five zones, like five petals: a playground, an area for active games (volleyball, tennis), a quiet area for elderly people to relax with tables for board games, a cherry orchard, barrier-free vegetable gardens accessible to people in wheelchairs. An amphitheater, a hairdresser’s, gazebos, and an apiary complete the cozy ecosystem for restoring strength and energy.

Schematic plan of the school’s reconstruction into a rehabilitation center at 1 Kvitneva Street in the village of Shcherbashyntsi

1 – rehabilitation center, 2 – hairdresser, 3 – parking lot, 4 – turning area for vehicles, 5 – symbolic place, 6 – gazebo, 7 – barrier-free vegetable gardens, 8 – young cherry orchard, 9 – volleyball and tennis court, 10 – playground, 11 – flower garden, 12 – sports ground with exercise equipment; 13 – common area, 14 – place for walking animals, 15 – amphitheater, 16 – old tree garden, 17 – area with tables for board games, 18 – apiary.

Authors: Tetiana Ladan, student of the Department of Theory of Architecture and Architectural Design, Artem Tmenov.

Stele at the entrance to the village of Huta and transport stops – concept “Perekotypole”

The stele attracts tourists to a quest – “find the letters of the alphabet.” The structure is kinetic, and the movement mechanism is powered by a solar panel.

Authors: Tetiana Ladan, student of the Department of Architectural Environment Design Anton Fesik.

The letters “Г”, “У”, ‘Т’, and “А” form the basis of the three-dimensional composition of the village bus stops. Uniform designs were used, which, with partial replacement of elements or reversal, can look like different objects. Lighting is powered by solar energy, and there is a possibility to charge gadgets. The roofs of the stops are proposed to be used for green gardens and the installation of solar panels.

Transport stops in the village of Huta

1 – kinetic stele at the entrance to the village of Huta, 2 – stop in the shape of the letter “G”, 3 – stop in the shape of the letter “U”, 4 – stop in the shape of the letter ‘T’, 5 – stop in the shape of the letter “A”, 6 – string transport track

Authors: Tetiana Ladan, students of the Department of Architectural Design of Civil Buildings and Structures Maria Korf, Polina Lomachuk, Viktoria Yermolaieva, Yelyzaveta Chepurna, student of the Department of Fundamentals of Architecture and Architectural Design Ksenia Taran.

Recreation area, festival venue, and health complex in the village of Medvyn – concept “Parade of Planets”

Near the Medvyn House of Culture, there are plans to build a terrace, a wave-shaped ramp, a terrace park with an alley of fountains, an open-air amphitheater, a playground, and a footbridge.

Recreation area on Shevchenko Street in the village of Medvyn

1 – cultural center, 2 – municipality, 3 – observation terrace, 4 – playground, 5 – footbridge, 6 – terrace park with an alley of fountains, 7 – amphitheater, 8 – skate park

Authors: Tetiana Ladan, student of the Department of Theory of Architecture and Architectural Design Alona Starostenko.

Below the relief, there is a fairground, a park for festivals and sports venues, a motel or themed houses on the slopes, integrated into the landscape with observation terraces.

Festival area on Shevchenko Street in the village of Medvyn

1 – main alley, 2 – house-note for musicians, 3 – creative house for artists, 4 – house-shuttlecock for coaches, 5 – gazebo, 6 – mini stadium, 7 – sports grounds, 8 – fountain, 9 – motel, 10 – shopping arcade, 11 – stage

Authors: Tetiana Ladan, students of the Department of Urban Planning – Polina Nechai, Yelyzaveta Voloshchuk.

The concept also includes the creation of a health complex in the village of Medvina, with a waterfall, a water channel with bridges, a spa complex, resort terrace houses with swimming pools and sports grounds, which can be reached along the channel by winding ramps.

Health complex in the direction of Mount Totokha and the Totokhavud tourist complex in the village of Medvina

1 – resort house, 2 – spa complex, 3 – sports area, 4 – water canal, 5 – park area, 6 – waterfall, 7 – parking, 8 – shelter.

Authors: Tetiana Ladan, students of the Department of Urban Planning Anastasia Haidaienko, Eva Kazakova, Vladislav Yakunin, Oleksandra Rozumna.

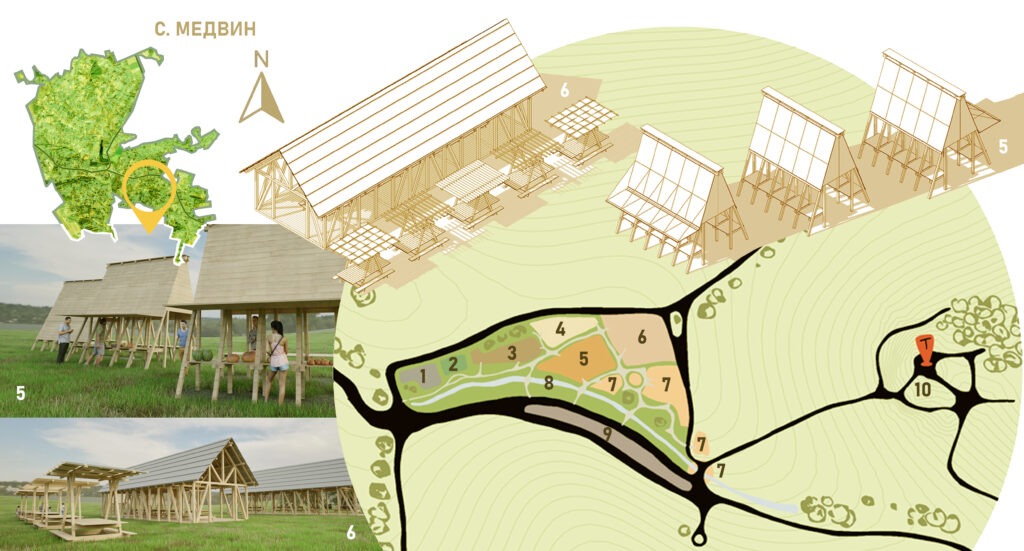

Tourist complex in the village of Medvini – the “Totohavud” concept

A location for festivals, fairs, and other events. Located near a local landmark – Totohava Mountain. The pavilions consist of lightweight modular structures that blend harmoniously into the natural environment.

There is a utility area, public restrooms, an open-air cinema, venues for special events, a pavilion-café, photo zones, a water canal, and parking. The pavilions are designed to resemble male and female silhouettes performing folk rituals such as round dances, spring songs, and haymaking.

Zoning of the territory near Mount Totokha:

1 – utility area, 2 – public restroom area, 3 – open-air cinema area, 4 – area for special events, 5 – area for food and souvenir pavilions, 6 – café pavilions, 7 – photo zones and recreation areas, 8 – water channel area, 9 – parking area, 10 – Mount Totokha area.

Authors: Tetiana Ladan, students of the Department of Architectural Environment Design Dmytro Ryabets, Nataliia Demchenko, with the participation of Aliona Starostenko, a student of the Department of Theory of Architecture and Architectural Design.

Information and graphic materials for the publication were kindly provided by the authors’ teams led by Tetiana Ladan.

The anchor tenant of the capital’s Ocean Mall shopping center, Silpo supermarket, is preparing to open, the retailer’s press service told Interfax-Ukraine.

“We plan to open a new Silpo store in Ocean Mall, with a floor space of up to 5,000 square meters. The concept and design are currently being finalized,” the press release said.

Silpo is one of the largest supermarket chains in Ukraine, founded in 1998. It is part of the Fozzy Group, a trade and industrial group. As of July 2025, the chain has 309 supermarkets in 62 cities.

Ocean Mall is a retail resort shopping center. It has a total area of 300,000 square meters and parking for 4,000 cars. The shopping center will combine 800 stores and 50 restaurants. Among the largest tenants are the Silpo grocery supermarket and flagship stores of the world’s largest retailers in the fashion, sports, and home goods segments. Over 30,000 square meters of the Ocean Mall shopping and entertainment center is dedicated to entertainment, including the Galaxy amusement park for the whole family and a 7-screen Multiplex cinema.

A repeat auction for the privatization of 50%+1 share of PJSC Rivne Radio Technical Plant, which has not been operating since 2013 and has been declared bankrupt, will take place on July 14 at half the initial price of UAH 60.78 million.

According to data in the Prozorro.Prozazhi system, the initial auction scheduled for July 4 did not take place due to a lack of bids. The sale price of the controlling stake (22,423,190 shares) was UAH 121.56 million.

The plant is located 4 km from the M-06 Kyiv-Chop international highway. The balance sheet of the company, which manufactured communications equipment, includes seven real estate properties with a total area of 68,795 square meters. The real estate properties owned by the PJSC are located on a land plot with a total area of 11.38 hectares and are owned by the municipality.

“Among the additional advantages of the asset are its connection to all necessary utilities and the absence of any restrictions on its use. This makes the property an ideal platform for relocation or expansion of existing production,” according to the FGI.

The buyer is obliged to pay off wage arrears and debts to the budget (as of the date of transfer of ownership) within six months, as well as to prevent the dismissal of employees.

According to the FGI, as of March 30, 2025, the company’s overdue accounts payable amounted to UAH 55.21 million, including UAH 12.66 million in wages, UAH 1.9 million in taxes, and UAH 1.17 million in insurance. According to the National Securities and Stock Market Commission (NSSMC), as of the first quarter of 2025, apart from the state, the list of shareholders owning more than 5% of the LLC’s charter capital includes Oleg Maryanchik (5.43% of shares).

The Rivne Radio Technical Plant was once one of the largest enterprises in the region.

The Russian Federation has officially recognized the Taliban government — the Islamic Emirate of Afghanistan — becoming the first country to do so since it came to power in August 2021. Representatives of the Russian Foreign Ministry confirmed that the credentials of Afghan Ambassador Gul Hassan Hassan had been accepted, after which the official flag of the Islamic Emirate was raised over the embassy in Moscow for the first time. This became possible after the Russian Supreme Court lifted the ban on the

Taliban as a terrorist organization in April 2025.

the Russian Supreme Court lifted the ban on the Taliban as a terrorist organization.

The Islamic Emirate of Afghanistan is the name of the state proclaimed after the Taliban seized power in August 2021. Previously, the Taliban was not recognized by most countries and was officially considered a terrorist organization in Russia until April 2025.

Oschadbank has signed an investment loan agreement worth EUR 10.8 million with Helios Strategia Group’s subsidiary, Elio Luchky LLC, to finance the construction of a solar power plant with an installed capacity of 22.35 MW, inverter capacity of 16 MW and an energy storage facility (ESF) with a capacity of 33.44 MWh.

According to the bank’s press release on Monday, the solar power plant and energy storage facility will be located in the Mukachevo district of Zakarpattia region, with commissioning scheduled for January 2026.

“Our agreement with Helios Luchky is a 7-year project financing deal. These are the same “long-term” funds for new construction that are needed for economic development. I am glad that more and more such investment projects are being implemented,” commented Yuriy Katsion, Deputy Chairman of the Management Board of Oschadbank, responsible for corporate business.

According to him, this project is significant in terms of combining technologies that will ensure maximum profitability when selling electricity on the day-ahead market.

In his opinion, this is a good example of a balanced approach to the development of the country’s decentralized energy system.

“This project is not only a step towards a new decentralized energy sector, but also a demonstration of the technological readiness of Ukrainian companies to implement complex infrastructure solutions. We are grateful to the Oschadbank team for their partnership and belief in high-quality projects for a new energy future,” said Olena Skrypnyk, founder of Helios Strategia.

The release states that the international engineering group Helios Strategia specializes in EPC projects for solar energy and the implementation of renewable energy solutions for the industrial and commercial sectors. The total capacity of solar power plant projects in which the group has participated reaches 1.2 GW. The group’s other facilities are located mainly in the Dnipropetrovsk region, as well as in the Odesa and Mykolaiv regions.

As reported at the end of June, according to Yevhen Myachyn, Director of the Corporate Business Development and Support Department at Oschadbank, since the beginning of 2025, the volume of energy loan agreements concluded by Oschadbank with corporate clients has increased to EUR93 million, of which approximately 45% are energy storage facilities (ESF), 43% are wind farms, and 12% are ESF together with solar power plants.