In January-April of this year, Ukraine reduced exports of titanium-containing ores and concentrates in physical terms by 91.4% compared to the same period last year, to 277 tons.

According to statistics released by the State Customs Service (SCS) on Friday, in monetary terms, exports of titanium-containing ores and concentrates decreased by 90.6% to $496 thousand.

The main exports went to Uzbekistan (35.61% of shipments in monetary terms), Turkey (35.01%), and Egypt (29.38%).

In the first five months of 2025, Ukraine imported 24 tons of titanium-containing ore worth $39,000 from China (94.87%, deliveries took place in January) and Uzbekistan (5.13%, deliveries took place in May).

In addition, in the first five months of 2025, Ukraine exported 1,099 tons of niobium, tantalum, vanadium, and zirconium ores and concentrates worth $1.704 million to Spain (61.22%), Italy (17.65%), and Germany (11.17%). to Spain ($1.704 million, 61.22%), Italy ($1.06 million, 17.65%), and Germany ($100,000, 11.17%). At the same time, the country imported 104 tons of such ores worth $258 thousand from Spain (55.17%), China (28.66%), and the Czech Republic (11.85%).

As reported, in 2024, Ukraine reduced exports of titanium-containing ores in physical terms by 37.5% compared to the previous year, to 7,284 tons. In monetary terms, exports of titanium-containing ores and concentrates decreased by 40% to $11.654 million. The main exports were to Turkey (62.82% of shipments in monetary terms), Egypt (7.38%), and Poland (6.93%).

In 2024, Ukraine imported 314 tons of titanium-containing ore worth $492 thousand from China (87.78%), Vietnam (6.11%), and Senegal (also 6.11%).

At the same time, experts pointed to discrepancies in statistics on exports of titanium-containing ores.

However, in response to a request from Interfax-Ukraine, the State Customs Service (SCS) of Ukraine reported that complete data on exports of titanium raw materials is not provided due to restrictions on the volume of export and import operations with military and dual-use goods, which are reflected in aggregate form under “Other goods.”

They explained that, in particular, deliveries of titanium-containing ores from companies differ from the SCS data.

“We would like to inform you that these deliveries are included in the statistical exports from Ukraine, but are not reflected in the foreign trade statistics published by the State Customs Service (…) under commodity code 2614 ”Titanium ores and concentrates” in view of the following (…) In accordance with the provisions (…) when protecting data for confidentiality purposes, any information considered confidential shall be reported in full at the next higher level of product data aggregation,” the State Customs Service explained in its response to the agency.

It was clarified that information on customs clearance and movement across the customs border of Ukraine of goods subject to export control is included in the list of information containing official information in the State Customs Service, in accordance with the relevant order.

In Ukraine, titanium-containing ores are currently mined mainly by PJSC United Mining and Chemical Company (OGHK), which manages the Vilnohirsk Mining and Metallurgical Plant (VGMK, Dnipropetrovsk region) and the Irshansk Mining and Processing Plant (IGZK, Zhytomyr region), as well as LLC “Mezhirichensky GZK” and LLC “Valky-Ilmenit” (both LLCs are located in Irshansk, Zhytomyr region). In addition, the production and commercial firm Velta (Dnipro) built a mining and processing plant at the Birzulivskoye deposit with a capacity of 240,000 tons of ilmenite concentrate per year.

In January-May of this year, Ukraine increased imports of aluminum ore and concentrate (bauxite) in physical terms by 3.88 times compared to the same period last year, to 13,564 thousand tons from 3,501 tons.

According to statistics released by the State Customs Service (SCS) on Friday, during this period, imports of bauxite in monetary terms increased 2.8 times, to $1.532 million from $550 thousand.

At the same time, imports came mainly from Turkey (79.23% of supplies in monetary terms) and China (20.77%).

Ukraine did not re-export bauxite in 2025, as in 2024 and 2023.

As reported, in 2024, Ukraine increased its imports of bauxite in physical terms by 77.4% compared to 2023, to 35,173 tons, and in monetary terms by 74%, to $4.107 million. Imports came mainly from Turkey (78.48% of supplies in monetary terms), China (19.48%), and Spain (1.9%).

In 2023, Ukraine imported 19,830 tons of bauxite worth $2.360 million.

In 2022, Ukraine reduced imports of aluminum ores and concentrates (bauxite) in physical terms by 81.5% compared to the previous year, to 945,396 tons. Imports of bauxite in monetary terms decreased by 79.6% to $48.166 million. Imports came mainly from Guinea (58.90% of supplies in monetary terms), Brazil (27.19%), and Ghana (7.48%).

Bauxite is an aluminum ore used as a raw material for the production of alumina, which is then used to produce aluminum. It is also used as a flux in ferrous metallurgy.

Bauxite is imported into Ukraine by the Mykolaiv Alumina Plant (MAP).

G7 countries have agreed with the United States to exempt American and British companies from additional taxes, Reuters reported on Saturday.

In particular, the group has created a “side-by-side” system in response to the US administration’s agreement to withdraw its proposal to introduce a tax in response to Section 899 of President Donald Trump’s tax and spending bill, according to a statement from Canada, which chairs the G7.

The US Treasury Department also said that the “parallel system” agreed with the G7 could preserve important achievements within an inclusive framework in the fight against tax base erosion and profit shifting.

“Today’s agreement provides much-needed certainty and stability for these companies after they expressed their concerns,” said Finance Minister Rachel Reeves, adding that work must continue to combat aggressive tax planning and tax avoidance.

Ukrgazvydobuvannya, part of the Naftogaz Group, plans to conduct 3D seismic surveys covering an area of 230 square kilometers in western Ukraine, according to Serhiy Koretsky, chairman of the board of Naftogaz Ukraine.

Serhiy Koretsky.

“We are starting a new phase of 3D seismic surveys in western Ukraine. We plan that this year Ukrgazvydobuvannya will cover 230 square kilometers,” Koretsky wrote on Facebook on Friday.

According to him, this region has not been in focus for a long time due to depleted reserves – compared to the eastern part of Ukraine, it was considered less promising. However, as Koretsky noted, modern seismic exploration opens up new opportunities: it allows for more accurate detection of gas where it was previously impossible.

“We expect that the results of new research will allow us to start drilling new wells as early as 2026-2027,” the head of Naftogaz shared his plans.

The Naftogaz press release states that between 2019 and 2023, the company has already processed approximately 1,600 square kilometers of 3D seismic data in the western region, which has allowed for the drilling of more than 10 new wells. Four of them yielded initial production rates of 80 to 270 thousand cubic meters of gas per day. These figures were described as significant for the region, where gas production began in 1912.

Over the past five years, Ukrgazvydobuvannya has increased reserves in the region by 2.4 billion cubic meters, according to the release.

Less than two weeks remain until the start of interviews for veterans, defenders, and their children who wish to obtain or continue higher education at Ukrainian universities. This year, as part of the Veterans Institute’s “Architecture of Resilience” initiative, additional opportunities for state-funded education have been opened, including part-time and distance learning.

“As long as part-time and distance learning options are available, this is a unique opportunity for our veterans and their families to get an education without interrupting their service, volunteer work, or employment. And just as important, there are still spots available for free tuition. We accompany everyone from the application stage to employment,” emphasized Artem Goncharenko, head of the Architecture of Resilience Veterans Institute.

– Education for veterans, defenders, and their children — at Ukrainian universities!

The Veterans Institute opens doors to over 30 specialties and over 100 educational programs:

– Free education*

– Retraining, courses, second higher education, master’s degree, postgraduate studies

– Psychological support and rehabilitation

– Participation in projects for the restoration of Ukraine

– Partnership programs with employers (Axor, Barks, Google, Microsoft, Cisco, etc.)

– Formats: full-time, part-time, online

– We work throughout Ukraine — in communities, universities, and rehabilitation centers

– Individual support from the moment of application to employment

– We invite everyone to online or offline meetings with our team. We will tell you:

▪ how to apply

▪ what benefits veterans and their children are entitled to

▪ how to receive compensation for education

▪ what educational programs are needed to rebuild the country

Program details: www.Veterano.info

Applications: center@uvc.in.net | veterano@knuba.edu.ua

Contact

+38 073 94 96 179

+38 050 22 35 182

+38 067 49 81 098

Head: Artem Goncharenko — +38 073 177 72 73

Partner universities:

Kyiv National University of Construction and Architecture

National University of Physical Education and Sports of Ukraine (NUPESU)

Western Ukrainian National University

National University “Poltava Polytechnic named after Yuri Kondratyuk”

Vasyl Stefanyk Precarpathian National University

National University of Life and Environmental Sciences of Ukraine

Drohobych National Pedagogical University

*Participation in state compensation programs, grants, scholarships, and support from businesses makes it possible to study free of charge.

It’s time to act. Decisions change the future. Start with education — right now.

Ukrainian marketplace for verified real estate DIM.RIA conducted a survey of its audience, in which more than 1,500 Ukrainians took part. The aim of the study was to find out the plans, priorities, and budgets of Ukrainians in the field of buying and renting housing. The results showed that in 2025, the average budget for purchasing real estate decreased, while tenants, on the contrary, are willing to spend more.

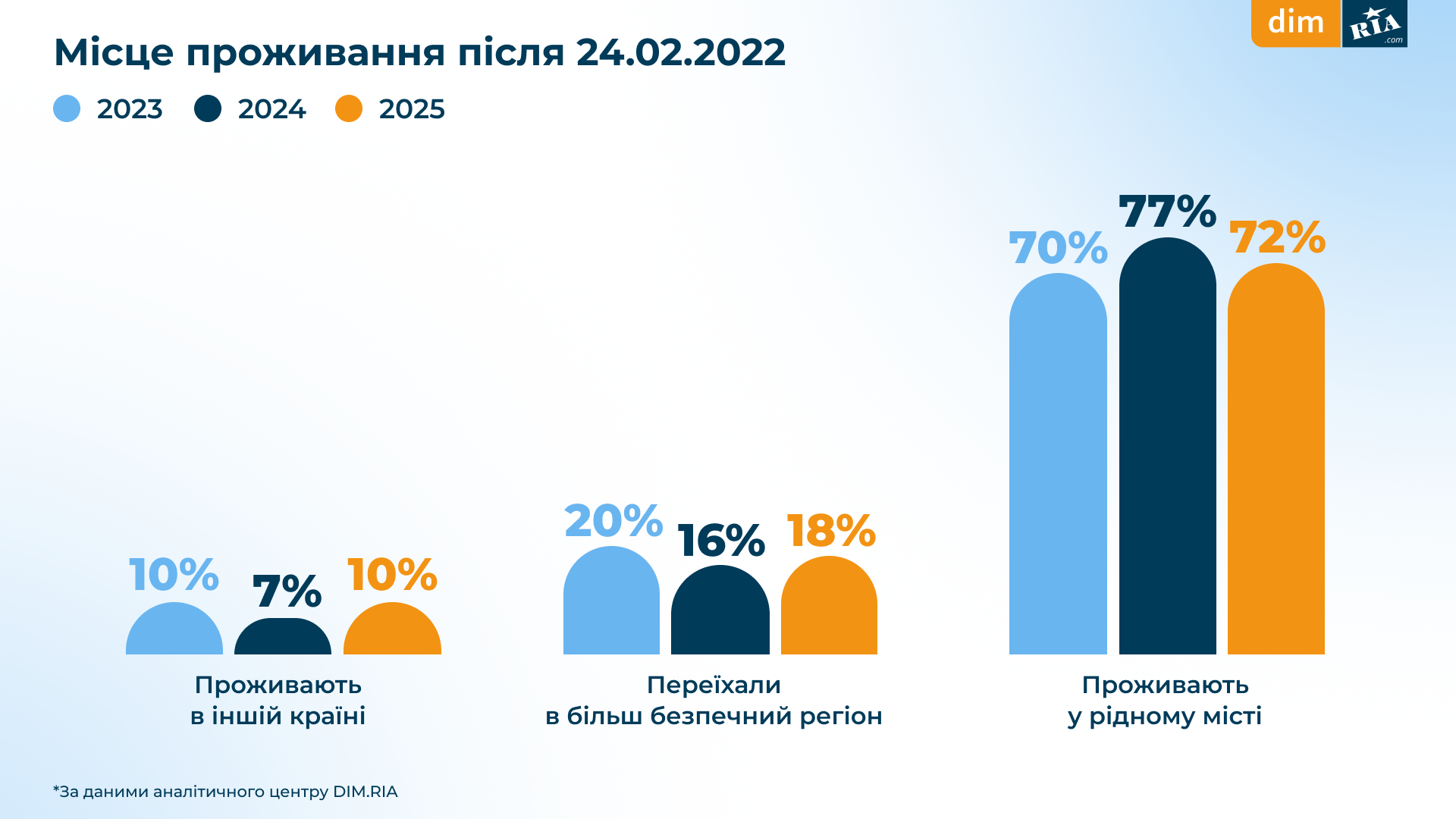

In 2025, most Ukrainians will continue to live in their hometowns. However, the proportion of those moving to safer regions and abroad has increased compared to 2024.

The two most common reasons for buying a home among the marketplace users surveyed were to move from rented accommodation to their own home (42%) and to change their place of residence (33%). Apartments on the secondary market are in the highest demand. Users are also considering private houses from owners. New buildings (both apartments and houses) rank third and fourth in popularity. Smart apartments are the least interesting.

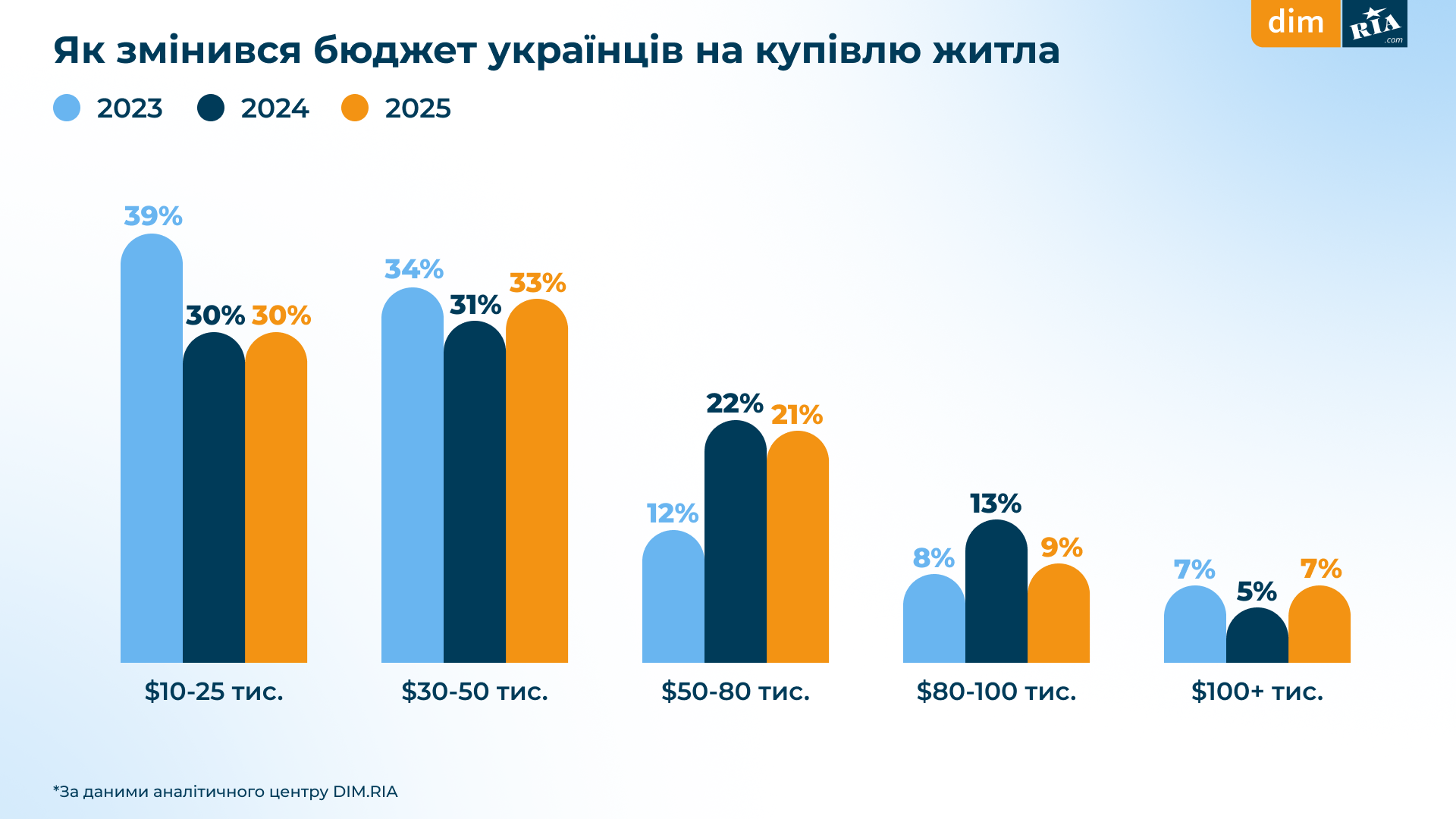

The average budget that Ukrainians are willing to spend on buying a home in 2025 has either remained at the previous year’s level or decreased slightly. Currently, the largest share is those who plan to spend between $30,000 and $50,000. Over the past year, the number of people planning to buy a home for more than $50,000 has decreased.

The main reason for looking for rental housing is a change of city or neighborhood. Rental preferences coincide with purchase plans: apartments on the secondary market are the most popular. Next among the options are new buildings and smart apartments.

Most respondents are looking for housing costing up to $10,000 per month. However, a significant proportion have increased their rental budget to $15,000. At the same time, 67% of respondents say that it is difficult to find housing within their desired budget.

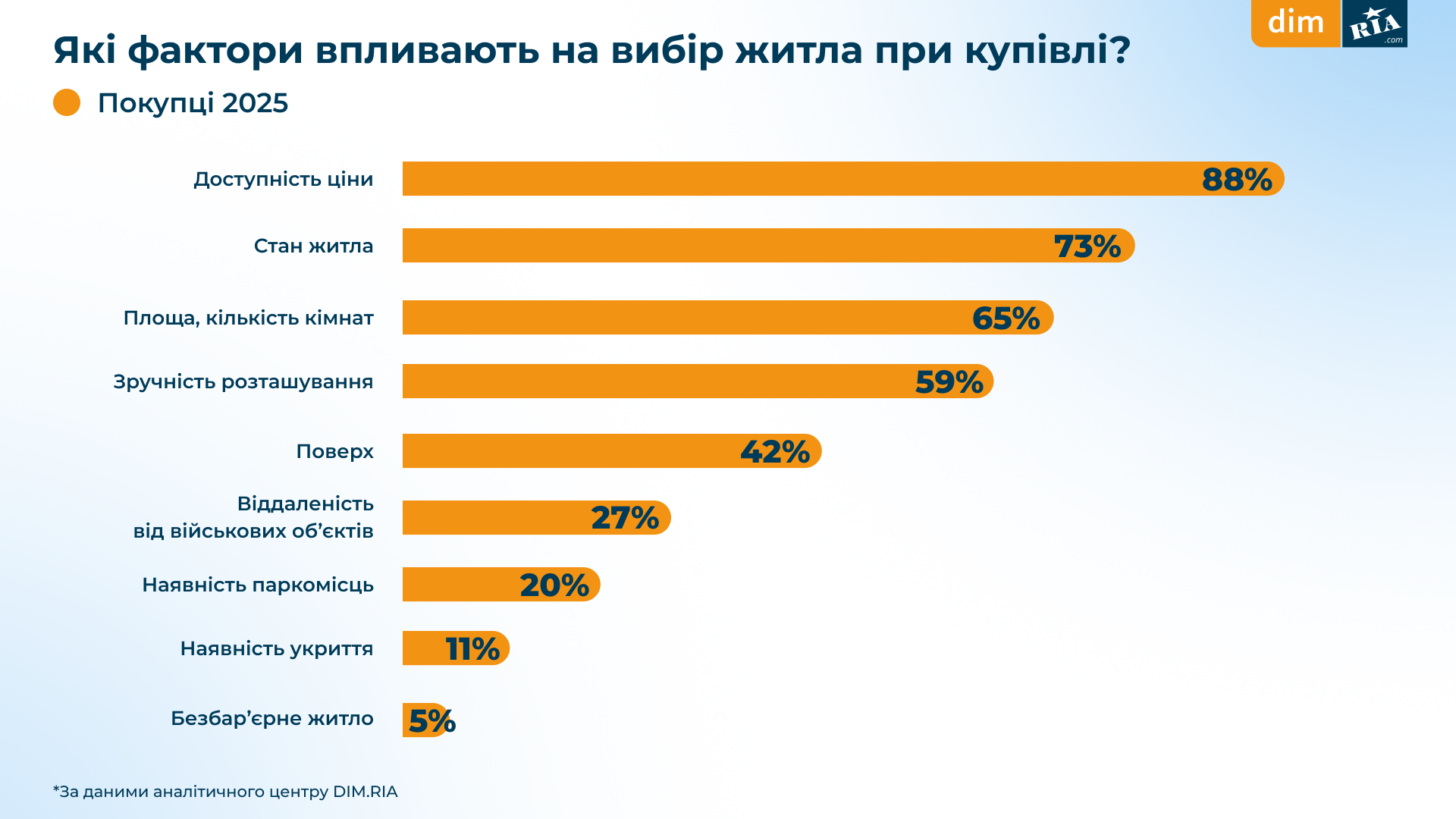

Among the priorities that Ukrainians consider when choosing a home to buy, the most important are affordable price, condition, size, and convenient location.

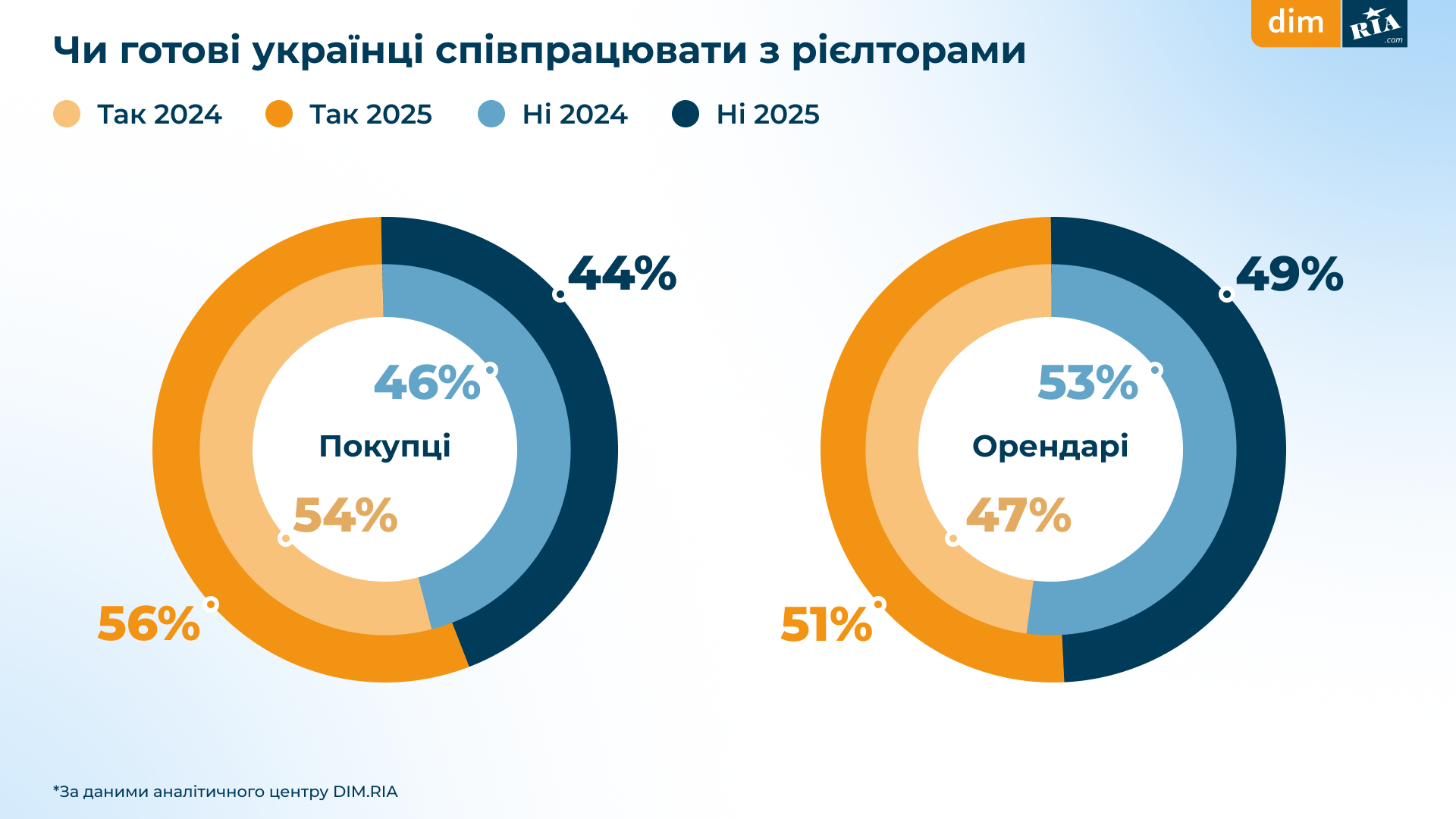

Willingness to work with real estate agents in 2025 has increased. This is especially true for home buyers, who are more likely to hire professionals to assist with the transaction. Tenants, on the other hand, tend to look for housing on their own.

DIM.RIA is a marketplace for buying and renting verified housing. It is a product of the Ukrainian IT company RIA.com. Currently, the marketplace has a website and apps for iOS and Android devices.