Growth in capital investment in Ukraine in January-June 2025 slowed to 30.6% from 32.5% in the same period of 2024, according to the State Statistics Service.

According to the State Statistics Service, UAH 280.18 billion in capital investment was spent in the first half of this year.

The main source of financing for capital investments in the first six months of 2025 remains the own funds of enterprises and organizations, which accounted for 73.7% of the total volume.

The agency specifies that the share of the state budget was 5.4%, funds from the population for housing construction – 5.9%, local budgets – 3.8%, bank and other loan financing – 4.8%, funds from foreign investors – only 0.2%.

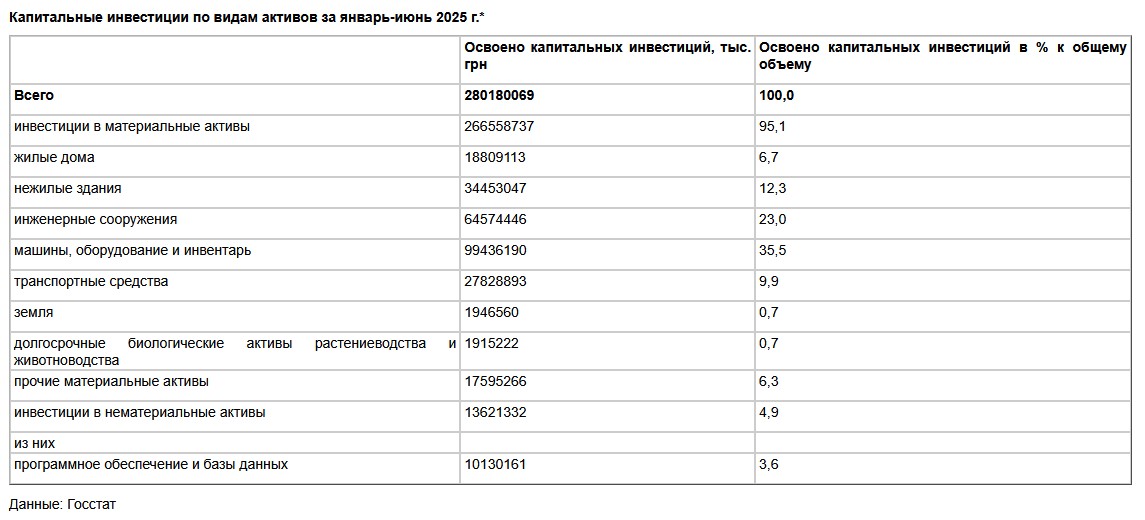

A significant share of capital investments was spent on machinery and equipment (35.5%), engineering structures (23%), non-residential buildings (12.3%), transport vehicles (9.9%), and residential buildings (6.7%) of all investments.

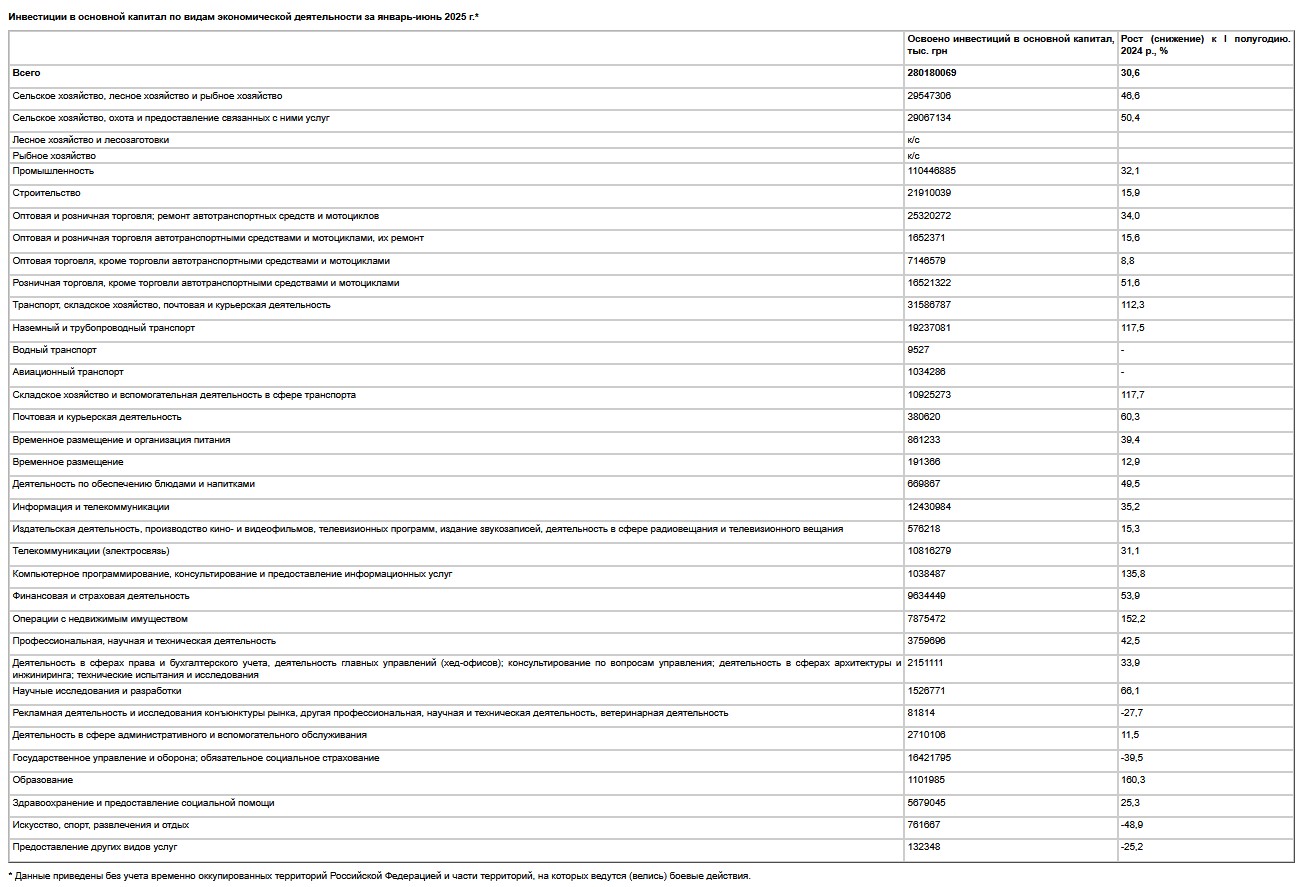

According to State Statistics Service data, in the first half of 2025, capital investments grew the most in agriculture – by 46.6%, to UAH 29.55 billion, industry – by 32.1%, to UAH 110.45 billion, and in transport, warehousing, postal and courier activities – by 12.3%, to UAH 31.59 billion.

In wholesale and retail trade, capital investment increased by 34% to UAH 25.32 billion, in construction by 15.9% to UAH 21.91 billion, in information and telecommunications by 35.2% to UAH 12.43 billion, in real estate transactions by 2.5 times, to UAH 7.88 billion.

The agency notes that in the field of professional, scientific, and technical activities, growth amounted to 42.5%, to UAH 3.76 billion, in financial and insurance activities – 53.9%, to UAH 9.63 billion, in education – 2.6 times, to UAH 1.1 billion, in healthcare – 25.3%, to UAH 5.68 billion, in the field of law and accounting – by 33.9%, to UAH 2.15 billion.

At the same time, capital investments in public administration and defense decreased by 39.5% to UAH 16.42 billion, in the field of arts, sports, entertainment, and recreation – by 48.9% to UAH 0.76 billion.

According to the statistics office, capital investments in Ukraine in 2024 increased by 35.1% compared to 2023 and amounted to UAH 534.4 billion.

India becomes Ukraine’s top diesel supplier in July as Trump slaps punitive tariffs on Delhi over Russian oil imports

India has overtaken other suppliers to become Ukraine’s largest source of diesel in July 2025, accounting for 15.5 per cent of imports. According to NaftoRynok, a Ukrainian oil market analytics firm, daily shipments averaged 2,700 tonnes, among India’s highest monthly export figures this year. The sharp rise marks a dramatic shift from July 2024, when India supplied just 1.9 per cent of Ukraine’s diesel needs.

The development comes at a politically charged moment. Washington recently imposed steep 50 per cent tariffs on Indian goods, citing New Delhi’s continued purchase of Russian oil. The irony is striking. While the US punishes India for its energy ties with Moscow, Indian fuel is simultaneously helping to sustain Kyiv’s wartime economy.

Indian-origin diesel is reaching Ukraine through multiple channels. A significant portion arrives via tanker deliveries along the Danube from Romania. Additionally, cargo is routed through the OPET terminal in Turkey’s Marmara Ereğlisi port, a pathway that continues to operate despite partial sanctions. These routes have enabled India to establish itself as a reliable supplier even under complex geopolitical conditions.

From January to July 2025, India supplied 10.2 per cent of Ukraine’s diesel imports, a fivefold increase from 1.9 per cent during the same period last year. While India’s share is now higher than that of several European partners, its physical export volumes still trail behind those from Greece and Turkey. Nevertheless, July’s figures place India ahead of all competitors in proportional terms.

Despite India topping the charts in July, other suppliers remain important. Diesel from Greece and Turkey remained substantial, though Slovakian deliveries outpaced both. Supplies from Poland and Lithuania’s Orlen Group together accounted for about 20 per cent of total imports. Meanwhile, Swedish exports from Preem’s facilities, routed via Poland and Denmark, hit record levels since the onset of Russia’s full-scale invasion, contributing 4 per cent of July’s imports.

The volume of freight transportation in January-July 2025 fell by 12.6% compared to the same period in 2024, to 181.2 million tons, according to preliminary data reported on the website of the State Statistics Service (Derzhstat).

It is noted that freight turnover for the reporting period decreased more sharply, by 13.5%, to 94.37 billion tonne*km, and while in terms of cargo volume in July it was possible to slightly catch up with last year’s figures – by 0.8 percentage points (pp), in terms of freight turnover it increased by 0.8 pp.

Rail transport remains the leader in terms of freight volume, with 92.5 million tons, which is 11% worse than the figure for the first seven months of last year.

Rail freight turnover for the reporting period amounted to 59.66 billion tonne*km, which is 11.8% less than for the same period in 2024. Ukrzaliznytsia explains the decline in freight turnover by the larger share of shorter shipments to ports.

According to the State Statistics Service, road transport carried 66.7 million tons of cargo in the first seven months of this year, which is 11% worse than the figure for the first seven months of last year, although the gap in freight turnover is smaller – only 4%, which indicates an increase in the distance of road transport.

Pipeline transport amounted to 21.5 million tons, a drop of 21.6%, and its cargo turnover fell by 29.2%.

Water transport accounted for a small volume in January-July – 0.5 million tons, or only 45.3% of the volume in January-July 2024, while air transport remains negligible due to the closure of the sky – 0.02 million tons, which is 19.8% less than in the same period last year.

As reported, freight traffic in 2024 increased by 7.8%, and freight turnover by 13%, to 184.58 billion tons/km.

In January-June 2025, the PZU Group generated gross insurance income of PLN 15.2 billion across all markets, including over PLN 1.5 billion in Lithuania, Latvia, Estonia, and Ukraine, which is 6.5% higher than in the same period last year, according to the PZU website.

Net profit attributable to shareholders of the parent company in the first half of this year increased to PLN 3.23 billion (+32.1%), and in the second quarter amounted to PLN 1.47 billion (+23.3% compared to the corresponding period of 2024). Adjusted return on equity (aROE) for the first half of the year was 21.2%, which is 3.8 percentage points (pp) more than last year (in the second quarter it was 18.7%, +2.1 pp).

“We had a successful six months. We expanded our business, generating nearly PLN 1 billion in gross insurance income on an annualized basis for the first half of the year. At the same time, we significantly improved profitability in property and life insurance by several percentage points. All this led to an increase in insurance income of PLN 555 million, or almost 35% compared to the first half of the previous year. It is important to note that more than a third of this growth is due to improved insurance income in the motor third-party liability insurance segment,” commented Tomasz Tarkowski, member of the Management Board and current CEO of PZU.

At the same time, he emphasized that such good results were achieved despite the fact that PZU recorded an almost equally significant negative impact of mass insurance claims related to weather conditions, estimated at approximately PLN 240 million. After the first two quarters of this year, the value of insurance payments and insurance compensation paid by the PZU Group, together with the development of the insurance payment reserve for previous years, amounted to PLN 8.4 billion (+4.3% more than a year ago).

The PZU Group is one of the largest financial institutions in Poland and Central and Eastern Europe. The group is headed by Powszechny Zakład Ubezpieczeń SA (PZU), a company listed on the Warsaw Stock Exchange (GPW). The PZU brand’s traditions date back to 1803, when the first insurance company in Poland was founded.

In Ukraine, it is represented by the insurance companies PZU Ukraine and PZU Ukraine Life Insurance.

The number of passengers carried in January-July 2025 amounted to 1 billion 261.8 million, which is 0.4% more than in the same period of 2024, according to the State Statistics Service website.

According to its data, passenger traffic grew more significantly, by 5.3%, to 26.24 billion passenger-kilometers.

The State Statistics Service notes that the dynamics of passenger traffic compared to last year has been improving for the fifth month in a row, while passenger traffic has been improving for the third month in a row.

In terms of modes of transport, urban electric transport remains the main mode in terms of volume – 688.1 million (+0.3% compared to the first seven months of last year) and road transport – 536 million (+0.9%).

The growth in urban electric transport was driven by the metro, which showed an increase of 5.6% to 189.8 million, while the volume of trolleybus transport decreased by 0.1% to 317.7 million, and tram transport by 4.3% to 180.6 million.

Rail transport, including urban electric trains, carried 37.3 million passengers in the first seven months of this year, which is 4.9% less than in the first seven months of last year. At the same time, passenger traffic on rail transport during this period decreased by only 0.1%, while road transport increased by 7.6%.

It should be noted that road transport accounts for 42% of passenger traffic, rail transport for 37%, and urban electric transport for 16.8% due to short travel distances.

The agency also reports 0.4 million air transport passengers, which is 57% more than during the same period last year, and passenger traffic by this mode of transport jumped by 78.4% and exceeded tram passenger traffic.

JYSK Ukraine plans to open 10 new stores and reopen 12 stores in the modern Store Concept 3.0 and Compact formats in the new financial year, which starts on September 1.

According to the company’s press service, five new JYSK stores are planned to open by the end of the calendar year: in the A1 shopping center in Odesa, the OBRIY retail park (Tatariv) and Peretyn (Melechiv in the Lviv region), in the Bukowyna Mall (Chernivtsi) and the Lavky Park shopping center (Mukachevo).

The company emphasized that in terms of network size, JYSK in Ukraine plans to surpass JYSK’s home country of Denmark in the 2026 financial year. Another important event will be the celebration of JYSK’s 1,000th employee in Ukraine. These steps are part of the global Customers’ First Choice strategy, which will be launched this year in all countries where the company operates. Its goal is to make JYSK the first choice for both customers and employees.

“This year will be special for us. We are growing as a team and as a chain, while remaining true to our values of strong teams and dedicated work. It is thanks to our people that we continue to develop, and we believe that JYSK will become the first choice for both customers and employees,” comments Yevgen Ivanitsa, CEO of JYSK in Ukraine.

Since the beginning of the full-scale war, JYSK has supported the Ukrainian network. This time, on the occasion of Independence Day and the new financial year, representatives of top management from Denmark visited Ukraine — JYSK CEO Rami Jensen and Executive Vice President of Retail Micael Nielsen. In particular, they visited the JYSK store in Chernivtsi, which last year became the chain’s 100th store in Ukraine.

“We are impressed by the resilience of our Ukrainian colleagues during the war. I hope that our visit was a sign of our commitment and support for them,” says JYSK President and CEO Rami Jensen.

Today, there are 109 JYSK stores in 37 cities in Ukraine, as well as the online store jysk.ua. The company employs over 800 people in Ukraine.

JYSK is part of the family-owned Lars Larsen Group, which has more than 3,500 stores in 50 countries.

JYSK’s revenue in the 2023/24 financial year was EUR5.6 billion.