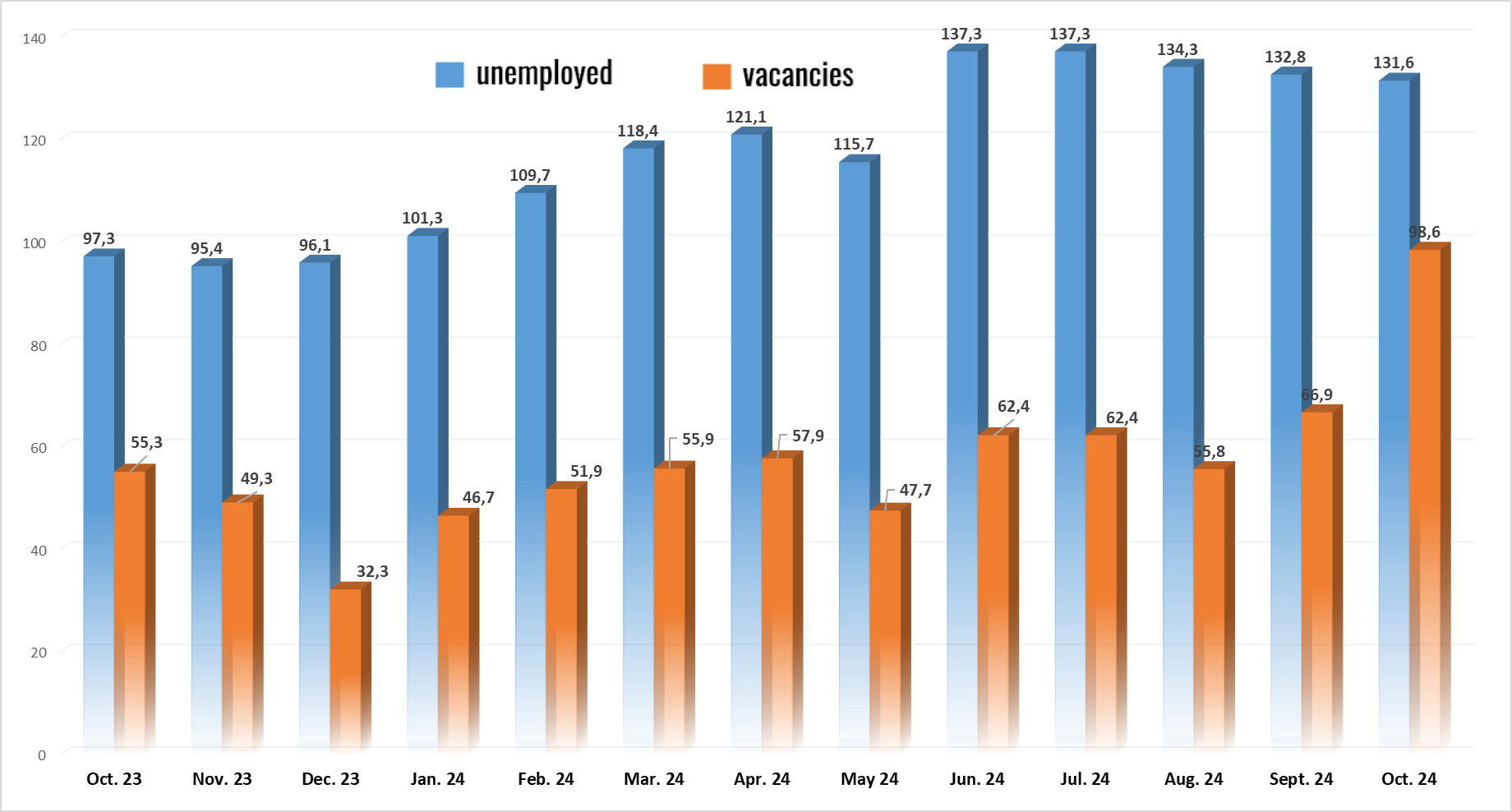

Number of unemployed in Ukraine and job opportunities, 2023-2024

Source: Open4Business.com.ua

UN Secretary-General António Guterres, on the third anniversary of Russia’s full-scale invasion of Ukraine, emphasized the need for a just peace.

“At a time of this tragic event, I reaffirm the urgent need for a just, sustainable and comprehensive peace – one that fully upholds Ukraine’s sovereignty, independence and territorial integrity within its internationally recognized borders, in accordance with the UN Charter, international law and General Assembly resolutions,” Guterres wrote on social media X on Sunday.

He emphasized that from the very first day of the war, the UN has shown full solidarity with the people of Ukraine, providing vital humanitarian assistance and supporting long-term recovery and reconstruction efforts.

“The war in Ukraine poses a serious threat not only to the peace and security of Europe, but also to the very foundations and basic principles of the UN. Enough is enough. After three years of death and destruction, I call again for urgent de-escalation and an immediate cessation of hostilities. I welcome all efforts to achieve a just and inclusive peace. The UN stands ready to support such efforts,” he summarized.

On Monday, February 24, in the center of Kiev will temporarily restrict traffic and parking, and public transport will change routes, reports the Kiev city state administration.

“In particular, the Maidan Nezalezhnosti metro station will not work for entry and exit for passengers from 7:00 to 11:00. At the same time, the interchange junction “Maidan Nezalezhnosti” – “Khreshchatyk” will work in the usual mode”, – is indicated in the message in the telegram channel.

Also from the beginning of the movement and tentatively until 19:00 ground passenger transport will run with temporary changes. Thus, trolleybus № 6 will move from Minsk massif to Lukyanivska metro station, trolleybus № 18 – from Soshenko Street to Vozdukhoflotsky overpass, buses № 110, 111, 114 – respectively from Miloslavskaya Street and Darnitskaya Square to European Square, bus № 62 – on the sites Kontraktova Square – European Square and Botanical Garden – Bessarabskaya Square.

“According to the National Police of Ukraine, temporary restrictions on traffic and parking will be in effect in the central part of the city in Pechersk and Shevchenko districts. Temporary changes are associated with the state-level celebration of the third anniversary of the beginning of the full-scale invasion of Russia on the territory of Ukraine”, – added in the KSCA.

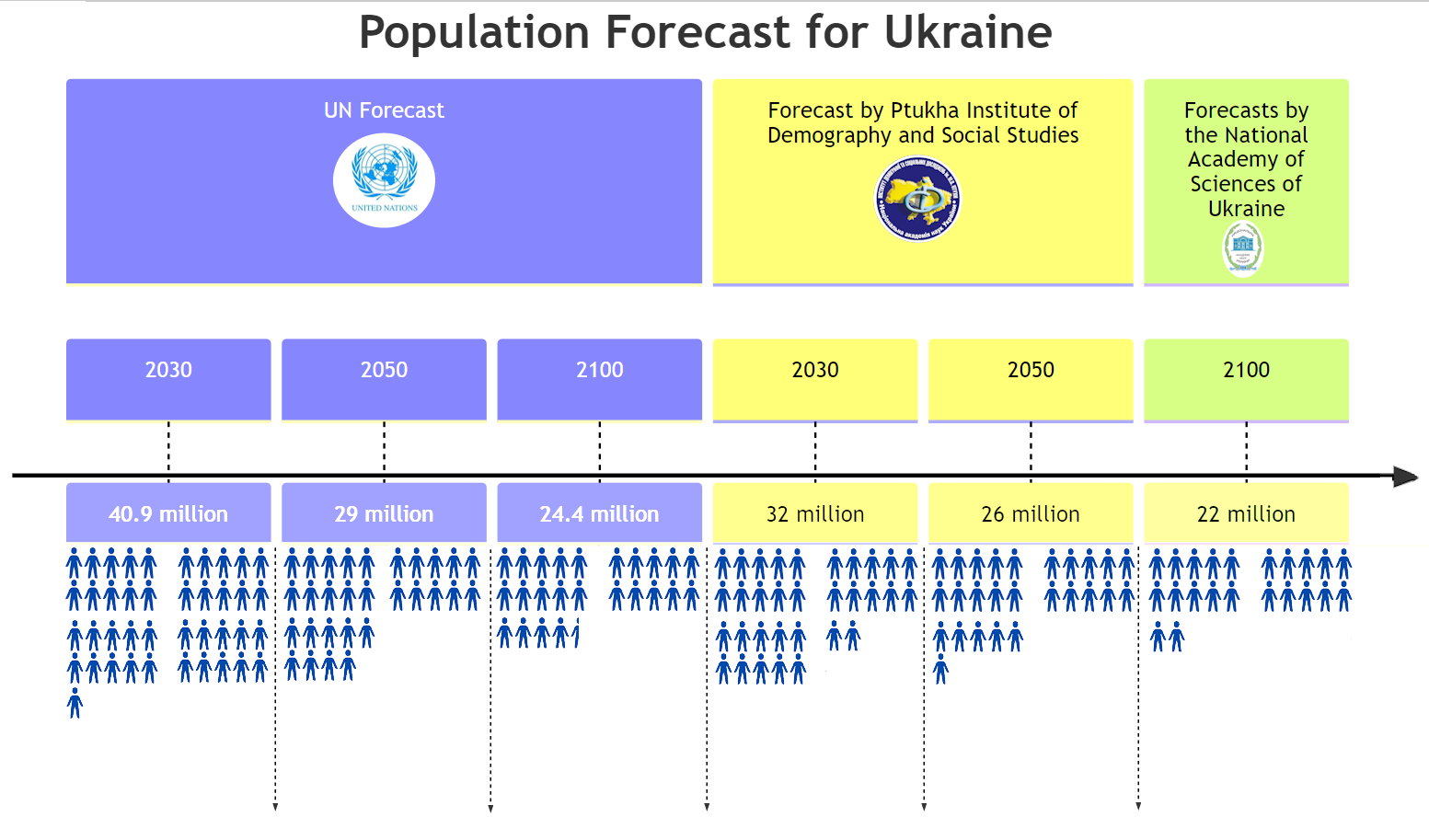

Population forecast for Ukraine in 2030-2100

Source: Open4Business.com.ua

PJSC “European Insurance Alliance” has renewed the reinsurance program for 2025, the main partner of which remained Hannover Re (Hannover Ruck SE, Germany) – one of the leading global reinsurers, which has a high international reliability rating A+ (Superior) from A.M. Best.

According to the press-release of the insurer, the combined obligatory reinsurance contract is prolonged on terms of risk excedent of loss. It covers all losses under contracts of insurance or facultative reinsurance of property, engineering risks, cargo risks, liability risks and hull insurance.

The program covers both commercial and private insurance objects in accordance with the general terms and conditions of insurance products and original insurance contracts.

Risks that are not covered by the aforementioned obligatory contract are reinsured on a facultative basis.

“The prolongation of the obligatory program with a reputable European reinsurer is a step towards further strengthening our position in the market. Long-term and fruitful cooperation with Hannover Re is a sign of stability and mutual trust”, – said Marina Voronyanskaya, Chairman of the Board of IC ‘European Insurance Alliance’.

PJSC “European Insurance Alliance” has been working in the insurance market of Ukraine since 1994, is a member of the Motor (Transport) Insurance Bureau of Ukraine, League of Insurance Organizations of Ukraine and Nuclear Insurance Pool of Ukraine.

The company has the NBU License for 16 classes of insurance, in particular, property insurance, land transport, liability, health insurance, etc.

Over the last two years, since 2022, the number of roaming subscribers of Ukraine’s largest mobile operator Kyivstar has grown by 31% to 2.9 million in 2024, 48.2% higher than the average in 2023.

“In 2024, 2.9 million Kyivstar subscribers used the Roaming as Home service, which allows them to stay connected abroad on favorable terms. During the year, the company expanded the list of countries, increased the volume of mobile Internet and added new convenient features, providing comfortable conditions for users,” the operator said in a statement on Friday.

The most active users of the “Roaming as at Home” service were subscribers who were in Poland, Germany, Czech Republic, Romania and Hungary. On average, they used 5 GB of mobile Internet per month and made more than 170 minutes of calls, 85% of them – in the network of Kyivstar, said the press service of the operator.

In 2022, the number of subscribers who used the roaming service was about 2 million, the report said.

In September 2024, at the conference Global Outlook: Fostering unity, organized by the European Business Association (EBA), CEO of Kyivstar Oleksandr Komarov said that the number of users in roaming operator in July of that year increased by 21% compared to the same period in 2023 – up to 1.9 million active subscribers. According to him, more than half of the subscribers using Kyivstar roaming are men. They owned 70% of conditional new sim-cards, which “flashed” in roaming. CEO of the operator expressed hope that over time the number of subscribers in roaming will decrease, but is unlikely to return to the average level of 2023 – 1.4-1.5 million.