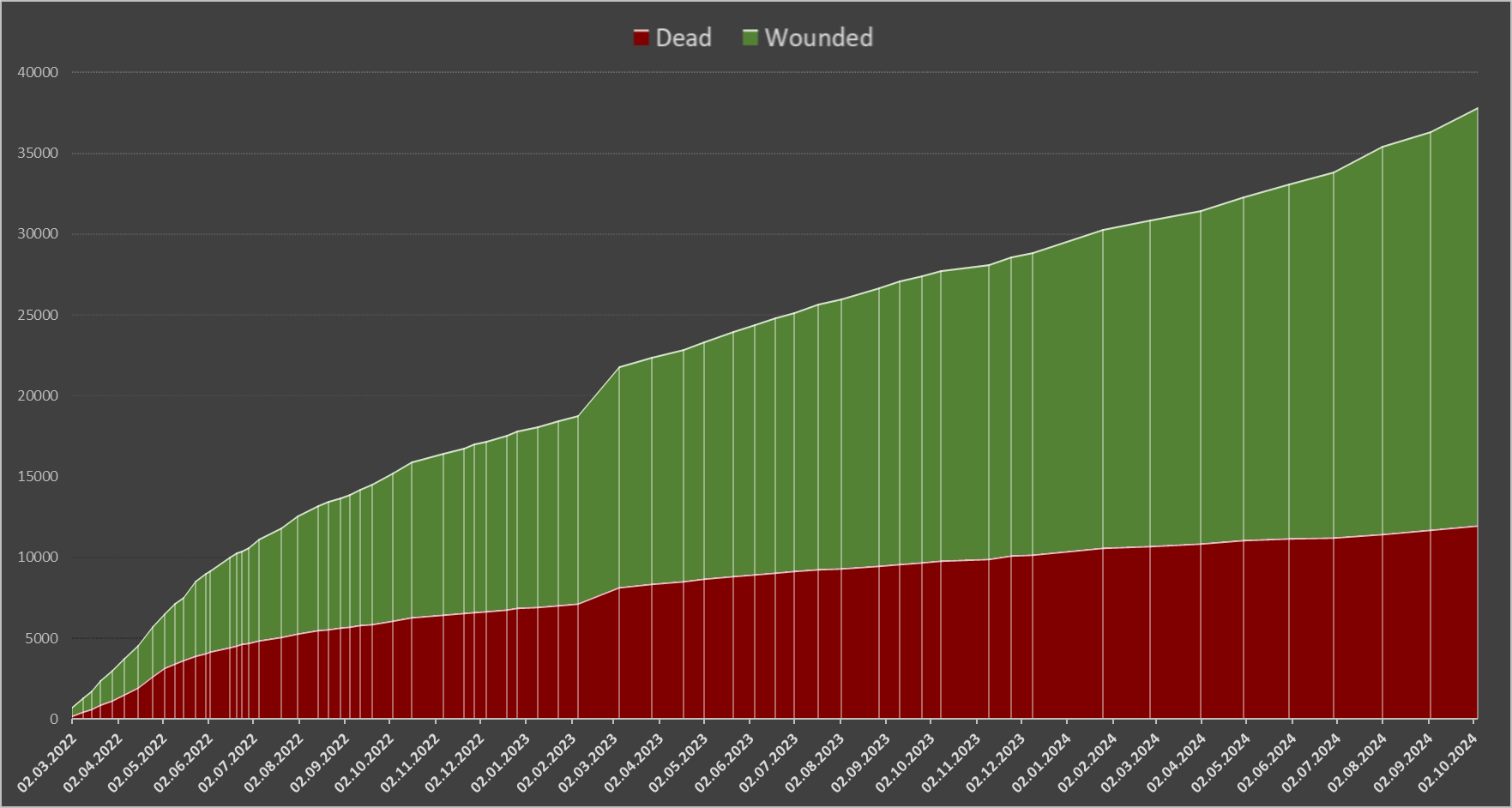

Number of dead and wounded civilians in Ukraine from 24.02.2022 till 31.10.2024 un data

Source: Open4Business.com.ua

KP “Vinnitsa transport company” on February 17 announced a tender for insurance services on automobile and urban electric transport (carrier’s liability for damage caused to passengers and luggage).

According to the message in the system of electronic public procurement ProZorro, the expected cost of the purchase of services is UAH 6.421 million. The deadline for submission of bids is February 27.

The National Bank of Ukraine (NBU) has strengthened the official hryvnia exchange rate against the U.S. dollar by 17 kopecks on Friday, after the official hryvnia exchange rate was raised by another 7 kopecks at the end of trading on Monday – to 41.5554 UAH/$1, according to the data on the regulator’s website.

The NBU set the reference rate at 41.5959 UAH/$1 at 12:00 p.m. Monday against 41.6644 UAH/$1 on Friday.

“The dollar exchange rate may fluctuate in the range of 41.8-42.5 UAH/$1. The NBU continues to actively restrain sharp fluctuations, as evidenced by the sale of currency from reserves, and large inflationary risks are not expected in the coming month,” analysts at currency exchange market operator KYT Group shared their expectations for the coming weeks in a February review.

However, among the current risks they name further growth of dollar rate in case of change of policy of the Federal Reserve System (FRS), or sharp fluctuations on external markets, as well as the probability of short-term “jumps” of the rate, as a response to any news about the delay of international aid.

Analysts expect a gradual weakening of the hryvnia to 44 UAH/$1 during the first half of the year, which may be due to increased import purchases in the spring, worsening inflation expectations, and as a consequence, an accelerated weakening of the national currency.

Among other factors of such a forecast is a greater demand for currency in Ukraine due to the expected transition of the Federal Reserve System to a softer interest rate policy. Additional risks, according to KYT Group experts, may be the deterioration of the economic situation, or a shortage of financial aid.

“If the current macroeconomic picture persists, the dollar exchange rate may reach UAH 45/$1 before the end of the year, although this scenario depends entirely on the success of the government’s economic policy and the stability and sufficiency of the inflow of external financing,” the analysts summarized.

As reported, the Cabinet of Ministers has set the annual average of the official exchange rate of the hryvnia to the U.S. dollar in the state budget of 2025 at the level of 45 UAH/$1.

In the 2024 budget, the government budgeted an annual average of 40.7 UAH/$1, and at the end of the year – 42.1 UAH/$1. The hryvnia weakened by 10.6%, or by UAH 4.02 to UAH 42.0390/$1 at the official exchange rate last year.

Ukraine’s international reserves as of February 1, 2025, according to preliminary data, amounted to $43 billion 3.1 million, in January they decreased by 1.8%, or $785 million, and net international reserves (NIR) – by $0.79 billion, or 2.7% – to $28.313 billion.

Source: https://interfax.com.ua/news/projects/1047722.html

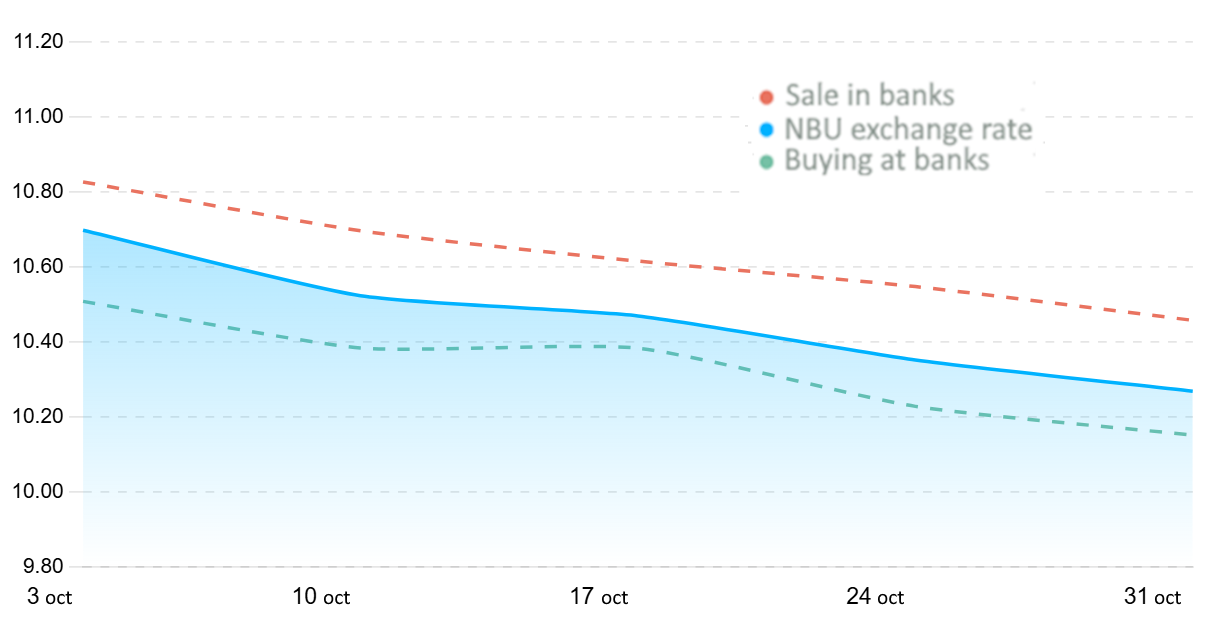

Quotes of interbank currency market of Ukraine (UAH for 1 pln, in 01.10.2024-31.10.2024)

Source: Open4Business.com.ua

President Volodymyr Zelensky during a meeting with businesses in Rivne region on Thursday instructed the government to develop a program to compensate for the construction of dairy farms, according to the President’s website.

“During the meeting they discussed regulation of the timber market, efficient use of land and development of dairy farming. The President instructed officials to elaborate and solve these issues, as well as to develop a program of compensation for the construction of dairy farms,” – noted on the website of the Office of the President.

As reported, the Cabinet of Ministers at a meeting on February 3 approved the concept of the state targeted economic program for the development of livestock farming for the period up to 2033. According to the concept, the state targeted economic program of livestock development should meet the needs of the domestic market in safe and quality food products of animal origin; create progressive forms of entrepreneurial activity and organizational and economic conditions for the motivated development of the livestock industry.

It will, in particular, promote the development of farming, which will ensure further integration into the infrastructure of the agrarian market (increasing the share of livestock products production from farms in the category of enterprises up to 10%). In addition, the program will stimulate the development of capacities for processing of livestock products by increasing the volume of dairy raw materials for industrial processing up to 6 million tons.

It is expected that the set of measures proposed by the government will contribute to the stabilization and increase in the number of farm animals, in particular, by providing the livestock industry with pedigree (genetic) resources of Ukrainian origin: cattle – up to 50%, pigs – up to 50%, horses – up to 70%, sheep – up to 80%, goats – up to 50%, poultry – up to 50%, bees – up to 100%).

The concept of the state program is aimed at ensuring stable veterinary and sanitary condition, biological, infectious and invasive safety of livestock facilities and prevention of negative environmental consequences of production activities of livestock enterprises for handling animal by-products not intended for human consumption.

It also provides for the promotion of exports of livestock food products and the opening of new markets.

The concept envisages support for small and medium-sized producers, stimulating the consolidation and development on cooperative basis of farms and personal peasant farms, which can be the main ones for handicraft processing activities and organic production of products using direct channels of product sales.

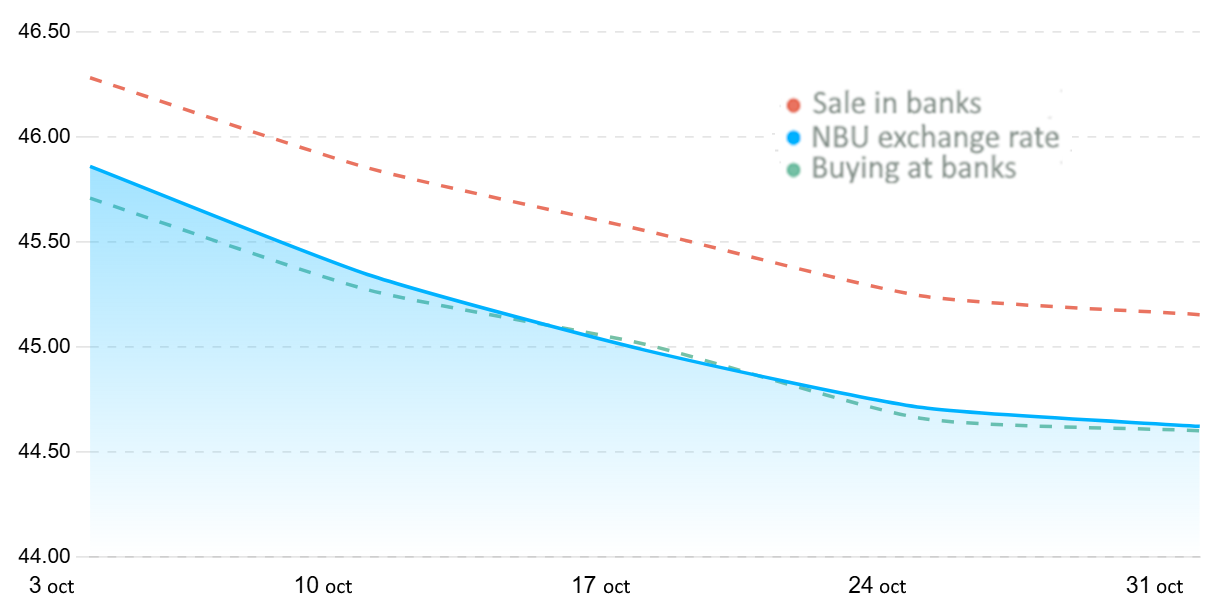

Quotes of interbank currency market of Ukraine (UAH for €1, in 01.10.2024-31.10.2024)

Source: Open4Business.com.ua