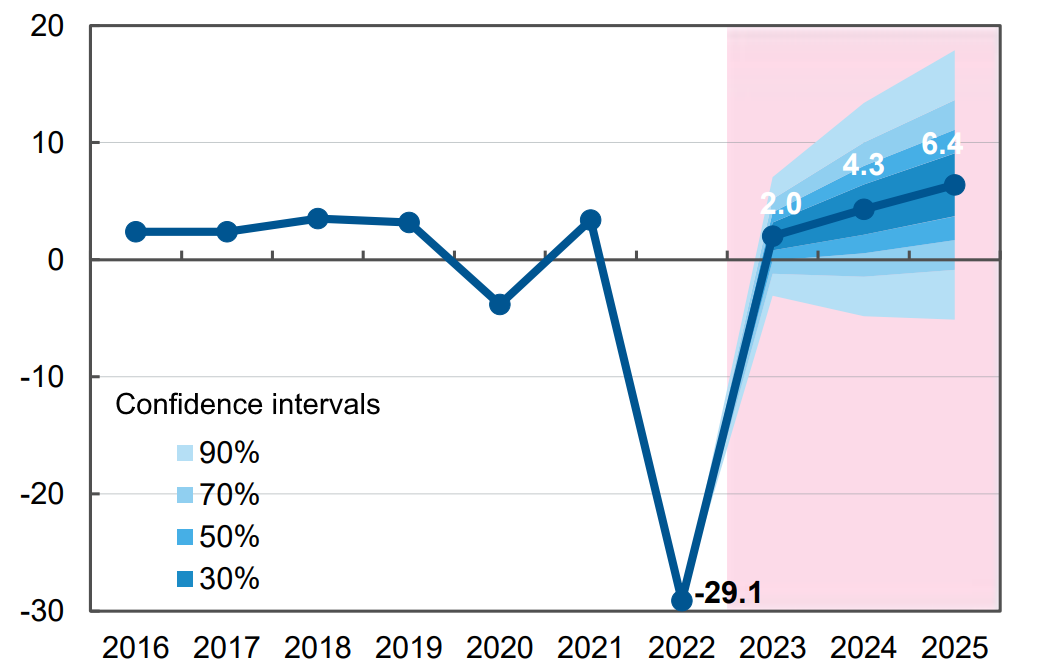

Forecast of dynamics of changes in Ukrainian GDP in % for 2022-2025 in relation to previous period

Open4Business.com.ua

The National Commission for State Regulation in the Spheres of Energy and Public Utilities (NKREKU) plans to set from January 1, 2025 the tariff of Ukrenergo for electricity transmission in the amount of 678.58 UAH/MWh (hereinafter without VAT). The corresponding draft resolution of the NERCU was submitted to its meeting on Wednesday, December 10.

Thus, the transmission tariff, if approved, will be 28.4% higher than the current one in 2024 (528.57 UAH/MW*h) and 2% higher than the one approved at the meeting on November 13 (665.26 UAH/MW*h).

According to the justification of the new project, the expenses for NEC’s fulfillment of special obligations to pay for “green” electricity, which occupy the largest share in the tariff, have been increased by almost UAH 1.5 bln. If in the project approved in November, UAH 23.7 billion was allocated to support industrial renewable energy generation, in the updated version – UAH 25.1 billion. As explained by the regulator, the updated forecasted volume of electricity supply by producers under the feed in tariff mechanism introduced in 2024 along with the feed in premium mechanism is taken into account.

The volume of payment for electricity from domestic SES remained at the previously approved level – UAH 6.98 bln. For comparison: in 2024 these figures amounted to 12.3 billion UAH and 3.93 billion UAH, respectively.

Also, the justification, in particular, indicates that the recalculation of the tariff is based on the performance of the NEC for 9 months of 2024, and not half a year, as was done earlier.

Nevertheless, the tariff planned for consideration on Tuesday is 13% less than the one initially proposed by Ukrenergo (UAH 780.41/MWh).

In addition, at Tuesday’s meeting, the energy regulator plans to set the tariff for electricity transmission for green metallurgy at 351.90 UAH/MWh, which is almost at the level of the approved one, as well as the tariff for dispatching at 92.26 UAH/MWh, which is 3% lower than the approved one.

As reported, on November 13, the regulator approved the reduction of Ukrenergo’s tariff for electricity transmission for 2025 for green metallurgy by 3.3% compared to the current one – to 352.73 UAH/MW*h (now 364.7 UAH/MW*h), as well as the tariff for dispatching by 9%, to 95.07 UAH/MW*h (now 104.57 UAH/MW*h).

In a blitz interview with Energoreforma in early October, the head of Ukrenergo, Oleksiy Brekht, said that the NEC proposes a tariff for electricity transmission for 2025 in the amount of 780.41 UAH/MWh, and expressed hope that the system operator and the national regulator will be able to reach an agreement on its establishment in order to be able to pay for electricity from industrial RES plants, which is underfunded in the tariff by about half.

At that time Brecht noted that “our task for the next year is to reach a break-even tariff, with the possibility for the company to ensure its tasks on the electricity market in full”. At the same time, he admitted that “discussion with the regulator will reduce the tariff a bit.”

The industry traditionally opposes an increase in the transmission tariff.

A new promotion for the winter holidays for Mastercard cardholders from JSC OTP BANK. Buy gifts for your family and friends, goodies for the New Year’s table and many other goods in the Rozetka online store or mobile application with a 7% discount when paying with a Mastercard from OTP BANK.

In order to take advantage of the offer and purchase goods at a discount, you need to pay for your purchases on the website rozetka.com.ua or in the Rozetka application with any Mastercard from OTP Bank.

Buy goods from the Rozetka seller with a special mark and choose the payment method “-7% discount when paying with a Mastercard from OTP Bank”. The discount will be credited automatically upon payment.

The promotion is valid from December 6 to 22, 2024.

For more details, please follow the link: https://www.otpbank.com.ua/action/rozetka-per7/

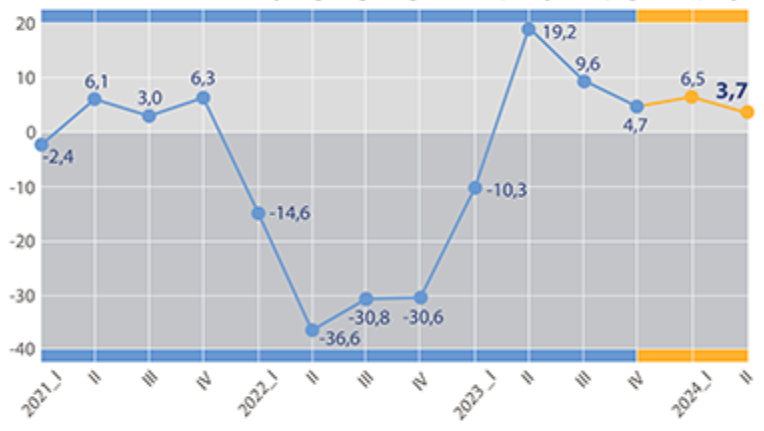

Real GDP percentage changes over previous period in 2014-2024

Open4Business.com.ua

The eurozone economy grew by 0.4% in the third quarter of 2024 compared to the previous three months, according to a report by the European Union Statistical Office (Eurostat).

This is the highest quarterly increase in two years. The consensus forecast of experts surveyed by Trading Economics also assumed that GDP growth would remain at 0.4%.

In annualized terms, the eurozone’s GDP grew by 0.9% in July-September, which also coincided with market expectations. In the second quarter, the euro area economy grew by 0.2% quarter-on-quarter and 0.5% year-on-year. In the third quarter, consumer spending in the euro area increased by 0.7% compared to the previous three months, government spending by 0.5%, and gross fixed investment by 2%. Exports decreased by 1.5%, while imports increased by 0.2%.

Germany’s GDP in the third quarter increased by 0.1% compared to the previous quarter and decreased by 0.3% in annual terms, France’s increased by 0.4% and 1.2% respectively, Italy’s remained unchanged quarter-on-quarter and increased by 0.4% in annual terms.

The EU economy in July-September grew by 0.4% compared to the second quarter and by 1% compared to the same period last year.

Earlier, the Experts Club think tank released a video analysis of the economies of Ukraine, Europe, and the world, see the video on the Experts Club YouTube channel for more details: https://www.youtube.com/watch?v=grE5wjPaItI

http://relocation.com.ua/ekonomika-ievrozony-v-tretomu-kvartali-2024-roku-zrosla-na-0-4/