The total ratio of taxes and social contributions to GDP in the European Union in 2023 was 40%, down from 40.7% in the previous year, according to the EU Statistical Office.

In the euro area, this figure also decreased to 40.6% last year, compared to 41.4% in 2022.

In absolute terms, in 2023, revenues from taxes and social contributions in the EU increased by €308 billion to €6.883 trillion.

The tax-to-GDP ratio varies significantly by country, with the highest shares recorded in France (45.6%), Belgium (44.8%), and Denmark (44.1%). The lowest rates are in Ireland (22.7%), Romania (27.0%), and Malta (27.1%).

Last year, 11 EU countries saw an increase in the indicator, with the most significant growth in Cyprus (to 38.8% from 35.9% in 2022) and Luxembourg (to 42.8% from 40.2%). In 12 countries, a decrease was recorded, the most significant in Greece (to 40.7% from 42.8%) and France (to 45.6% from 47.6%).

http://relocation.com.ua/podatky-stanovyly-40-vvp-v-ievropejskomu-soiuzi-v-2023-rotsi/

The Food and Agriculture Organization of the United Nations (FAO), together with the Ministry of Agrarian Policy and Food of Ukraine and the Ministry of Education and Science of Ukraine, announce the launch of an open call for proposals for the development of online training courses. This initiative is funded by Ireland through the EBRD Small Business Support Facility and FAO, SEEDSwrites .

The purpose of the competition is to develop online training courses to overcome the shortage of professional knowledge and skills in the agricultural sector, food and processing industry with a focus on small and medium-sized businesses (SMEs) in Ukraine. The courses cover a wide range of topics, from livestock and crop production to processing and marketing technologies.

Applications are open to scientific, educational, and non-governmental organizations that can create a complete training product, including videos and tests to test knowledge. Priority will be given to applicants with proven cooperation with businesses in the industry.

Before filling out the application, potential participants should familiarize themselves with the courses already published on the AgriAcademy educational platform(https://agriacademy.org/courses-catalog/) to avoid possible duplication of topics and materials.

The main application criteria and requirements for creating training courses can be found on the official website of the AgriAcademy platform

The application deadline is January 5, 2025.

All applications must be submitted online through the application form.

The best proposals will receive funding of up to USD 15,000 to create course materials.

As part of the online meeting, the organizing team will make a brief presentation of the competition and will be available to answer questions from participants. The workshop is scheduled for 16:00 Kyiv time on November 20, 2024. To participate in the seminar, you need to pre-register here.

This competition opens up new opportunities for educational and research institutions, contributing to the development of Ukrainian agribusiness and the integration of best practices into SME training programs.

Readmore about the competition and terms of participation on the official website of AgriAcademy

Prices for greenhouse cucumbers in Ukraine continue to rise rapidly for the fifth week in a row, according to analysts of the EastFruit project. The fixed positive price trend is associated with a further reduction in the supply of local products due to the seasonal factor, against the background of stable demand from retail and wholesale buyers.

According to the weekly monitoring of the project, today the majority of large greenhouse plants in Ukraine have already announced the actual end of the season of sales of cucumbers of the last turnover. At the moment, only a few farms are selling, and the quality of the offered products is often very low.

As of today, wholesale batches of greenhouse cucumbers in Ukraine go on sale at UAH 100-125/kg ($2.42-3.02/kg), which is on average 11% more expensive than a week earlier. According to market operators, the supply of imported vegetables at the moment cannot fully cover all the requests of buyers, which does not contribute to stabilization of the price situation in this segment.

It should be noted that at the moment Ukrainian factories already manage to ship cucumbers on average 72% more expensive than in the same period last year. At the same time, market participants are confident that the price growth in this segment may continue in the near future, as only new volume supplies of imported greenhouse vegetables to the domestic market can lead to a change in the current situation.

You can get more detailed information about the development of the market of greenhouse cucumbers and other horticultural products in Ukraine by subscribing to the analytical weekly EastFruit Ukraine Weekly Pro. Detailed information about the product can be found here.

https://east-fruit.com/novosti/pyat-nedel-podryad-v-ukraine-dorozhayut-ogurtsy/

In Ukraine, prices for potatoes have started to gradually decline, analysts of the EastFruit project report. It should be noted that a week earlier sellers managed to keep selling prices at a fairly high level, but the activity of trade gradually decreased. It became obvious to producers that at the established price level it will be extremely difficult to realize the volumes of potatoes, especially those that are not suitable for further storage, before the onset of frost. As a result, most of them by the middle of this week began to synchronously reduce selling prices, trying to revive the interest of wholesalers to their goods.

Thus, at the moment farmers in the main regions of production are ready to ship quality potatoes at 18-28 UAH/kg ($0.43-0.68/kg), depending on the volume and quality of products offered, which is on average 10% cheaper than at the end of last week.

At the same time, wholesale companies, many of which succumbed to the hype in this segment, and having in stock volumes of expensive potatoes purchased on the external market earlier, are currently selling excessive quantities at a loss.

At the same time, owners of quality potatoes today prefer not to hurry with the realization of available volumes of their products, waiting for the improvement of the price situation in the market. It should be added that under the current conditions, potato prices in the Ukrainian market at the moment are still on average 2.3 times higher than in early November last year.

More detailed information about the development of the market of potatoes and other horticultural products in Ukraine you can get by subscribing to the operative analytical weekly – EastFruit Ukraine Weekly Pro. Detailed information about the product can be found here.

https://east-fruit.com/novosti/v-ukraine-desheveet-kartofel-2/

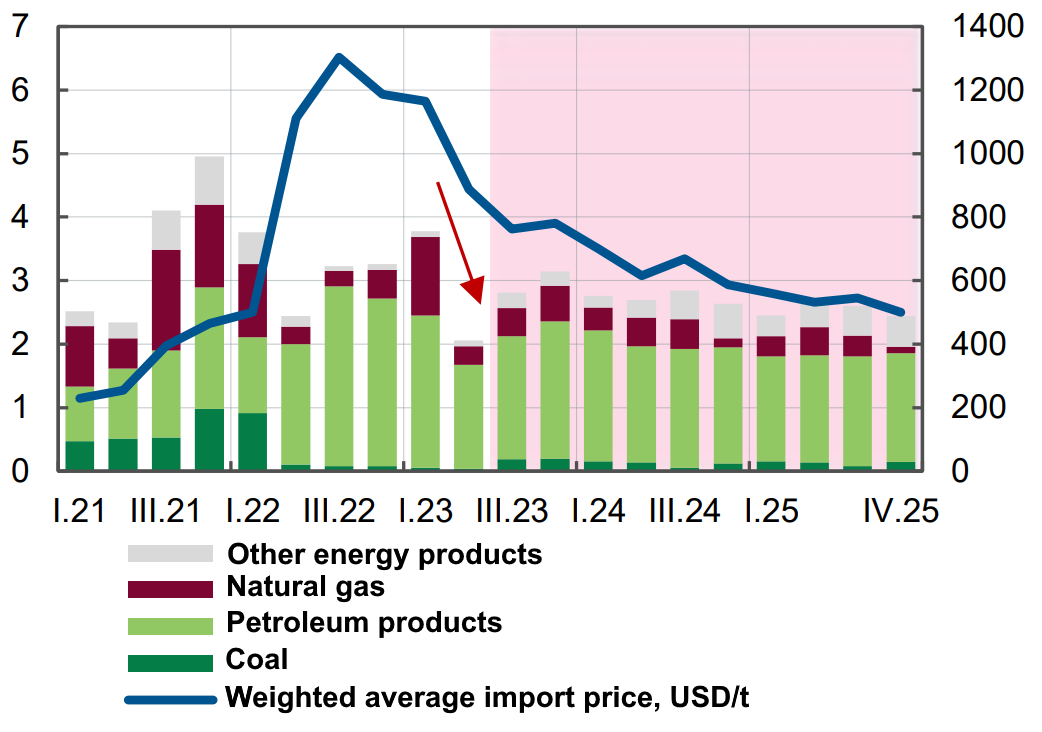

Energy imports, forecast, billion dollars

Open4Business.com.ua

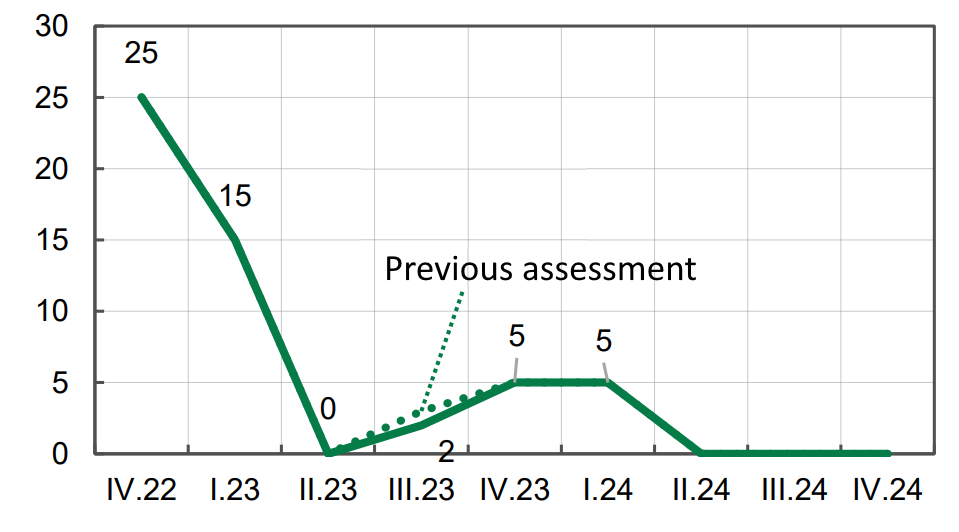

Forecast of power system capacity deficit, %

Open4Business.com.ua