Almost half of Ukrainians (44%) note that when buying food they more often try to buy the cheapest products, less because of their quality, according to the results of a sociological survey conducted by the sociological service of the Razumkov Center on September 20-26 and presented at a press conference at the Interfax-Ukraine agency on Wednesday.

At the same time, the same number of those who more often allow themselves to buy better quality products, even if they are more expensive (45%). The remaining 11% of respondents found it difficult to answer.

“After the beginning of full-scale aggression compared to June 2021, both the share of citizens answering that they make ends meet, there is not enough money even for necessary products (from 9% to 12% in September 2024. ), as well as the share of those who answered that they live well, but are not yet able to make some purchases (apartment, car) (from 6% to 9%), while the share of those who answered that their family in general has enough to live on, but the purchase of durable goods, such as furniture, refrigerator, TV, is already causing difficulties (from 44% to 41%)”, – noted in the results of the study.

Compared to 2005, from 38% to 54% increased the share of citizens who receive the main part of their livelihood from wages, and from 38% to 29% decreased the share of those who live mainly from pensions, scholarships, financial aid or alimony. From 7% to 2.5%, the share of those living from stocks or income from subsidiary farms, land plots, from 5% to 3% – from side jobs, from 3% to 2% – from income from entrepreneurship decreased.

The face-to-face survey was conducted in all territories controlled by the Government of Ukraine and where no hostilities are taking place, among 2016 respondents aged 18 years and older. The sample structure reproduces the demographic structure of the adult population of the territories where the survey was conducted as of the beginning of 2022 (by age, gender, type of settlement). The theoretical sampling error does not exceed 2.3%. Additional systematic sample deviations may be due to the consequences of Russian Federation aggression.

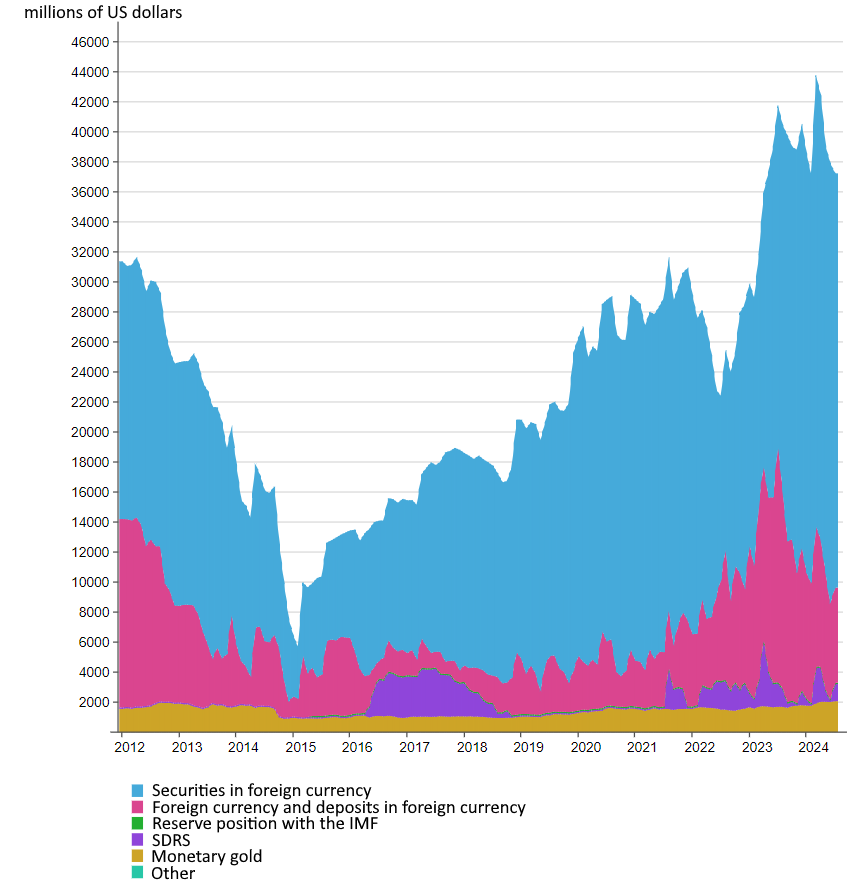

Dynamics of reserves of Ukraine from 2012 to 2024, million USD

Open4Business.com.ua

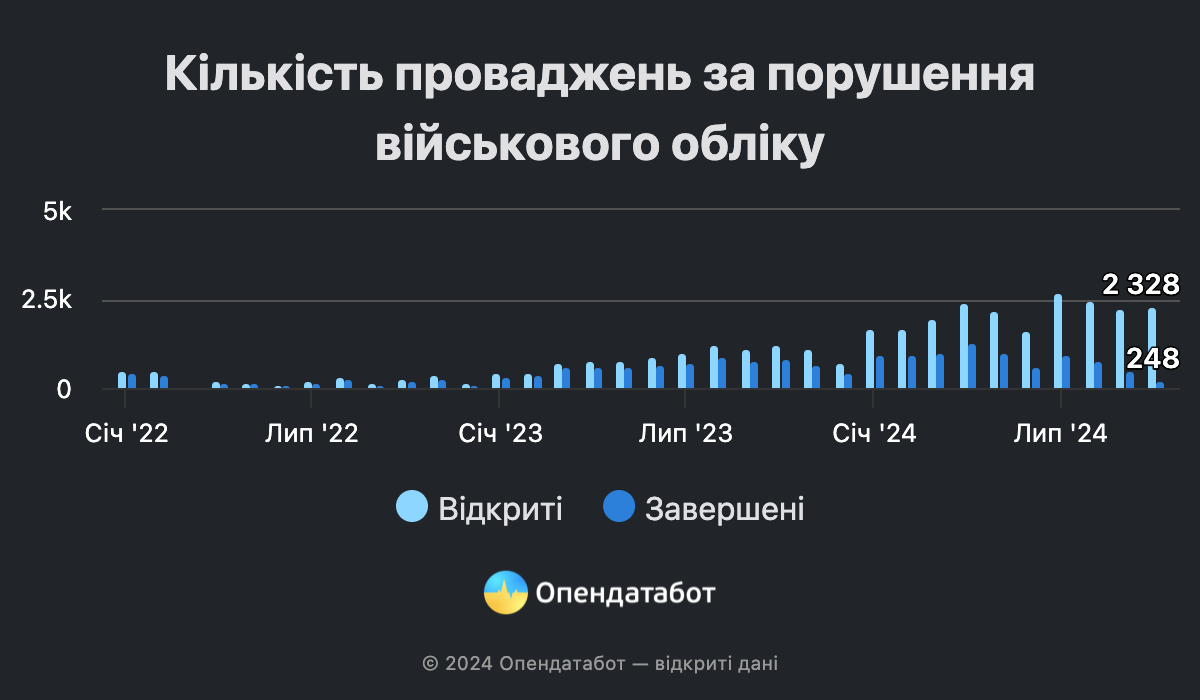

Only 39% of overdue fines have been paid this year

The number of debts for fines issued due to violations of military registration rules is growing in Ukraine. According to the Ministry of Justice, more than 21 thousand proceedings for violation of military registration were recorded in Ukraine in 10 months of 2024. This is already 2 times more than in the whole of 2023. Only one in three overdue fines has been paid this year. The vast majority of debts are owed by men, but there are currently more fines for women.

21,336 debts for fines due to violations of military registration rules were opened in Ukraine this year. This is 2 times more than for the whole of last year: 10,542 proceedings were registered in the Register then.

You cancheck the fines from the Transfer Pricing Commission that have been enforced in the Opendatabot.

Only one in three proceedings was closed this year, which means that the fine was paid. For comparison, out of 10,542 debts for fines from the TCC last year, 72% of cases were closed.

The overwhelming majority of debts are registered against men – 21,161 proceedings, or 99%. However, there are more women who have fines for violating the rules of military registration. Over the year, the number of proceedings against women increased 1.4 times: from 121 last year to 175 this year.

As a reminder, on October 1, 2023, military registration became mandatory in Ukraine for women in certain professions aged 18 to 60. To avoid a fine, women had to register by July 17, 2024.

It should be noted that debtors are subject to a number of restrictions, such as opening new bank accounts, blocking current ones, inability to register various transactions through notaries, etc. At the same time, such penalties also have image implications, as the register is public, and therefore the information in it can be checked, in particular, by employers when hiring.

https://opendatabot.ua/analytics/tck-fines-11-2024

The State Specialized Economic Enterprise “Forests of Ukraine” on November 5 announced a tender for compulsory insurance of motor civil liability of owners of land vehicles (OSAGO).

As reported in the electronic public procurement system Prozorro, the expected cost of purchasing insurance services is UAH 9.534 million.

The deadline for submitting bids for the tender is November 13.

Global Build Engineering (Ternopil), Spets-Bud Standard (Ternopil region) and Uniontransbuilding (Lutsk) have received permission from the Antimonopoly Committee of Ukraine to create a consortium called Global Roads Group. The relevant decision on granting permission for concerted actions of the companies was made by the Antimonopoly Committee of Ukraine on October 31.

According to Opendatabot, the owner and beneficiary of Global Build Engineering LLC is Serhiy Tolstikov. The company is engaged in the construction of residential and non-residential buildings, roads and highways.

According to the financial results for 2023, “Global Build Engineering” reduced net income by 32% – to UAH 45 million, while increasing net profit threefold – to UAH 340 thousand.

Petr Zemba is the owner and ultimate beneficiary of Spets-Bud Standard LLC. The main type of activity is road construction. According to the results of 2023, the net income of the company increased by 24% – to UAH 67 million, while net profit decreased 11 times – to UAH 14.2 thousand.

The owner of Uniontransbuilding LLC is listed as Andriy Podosovsky. The company is also engaged in the construction of buildings. According to the results of 2023, the company increased net income 3.8 times – up to UAH 186 million, net profit – four times, up to UAH 2.7 million.

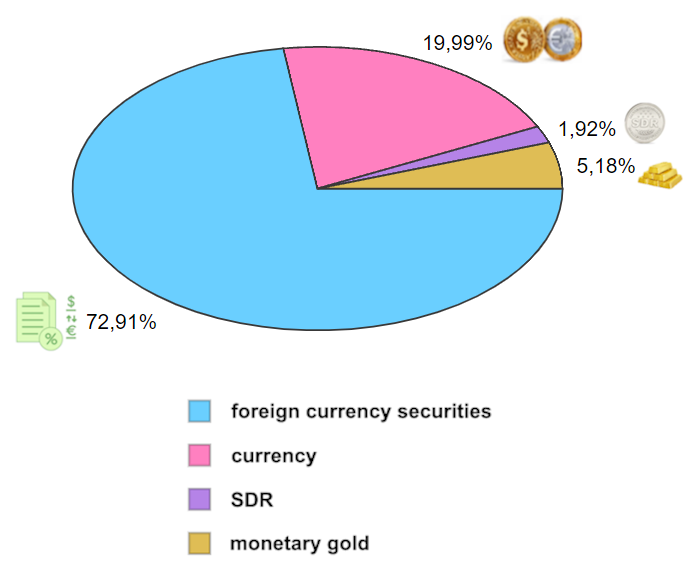

Structure of foreign exchange reserves as of 31.07.2024

Open4Business.com.ua