The price of Bitcoin (BTC) remained unchanged due to the event and surpassed the $68,000 mark for the first time since late July.

Italian Deputy Finance Minister Maurizio LEO said the government will raise taxes on capital gains in cryptocurrencies such as Bitcoin from 26% to 42%, Reuters and Bloomberg reported.

According to Bloomberg, the Italian cabinet made the decision because “this phenomenon is spreading,” the LEO said of Bitcoin during a conference call on Wednesday.

The move comes in the wake of Italy’s decision to strengthen its tax on digital services as part of plans to boost revenue in its 2025 budget.

The price of Bitcoin (BTC) was unchanged, posting a weekly gain of more than 12%, surpassing the $68,000 mark for the first time since late July.

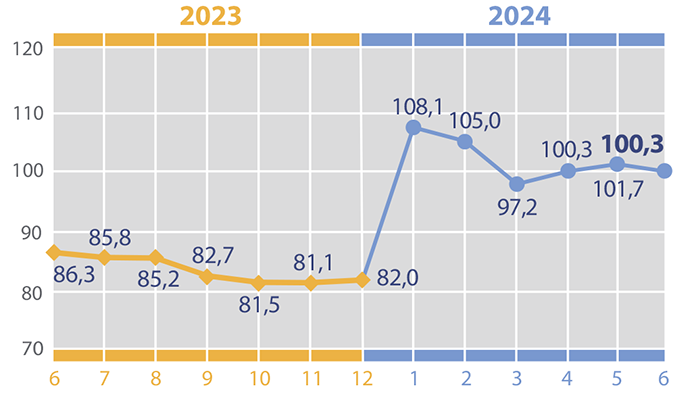

Export changes in % to previous period in 2023-2024

Open4Business.com.ua

China has approved a list of investment projects worth a total of 200 billion yuan ($28 billion) planned for next year, a spokesman for China’s State Committee for Development and Reform told Xinhua news agency.

He said there are 647 projects on the list, which covers such areas as construction of urban underground pipelines, programs to support the needy through employment, strengthening emergency water reservoirs, environmental protection and restoration, transportation infrastructure, key public infrastructure including educational, medical and cultural institutions, and key agricultural storage facilities.

The department intends to promote the launch and implementation of the projects as soon as possible and make efforts to make practical progress in their implementation as early as this year, so as to provide strong support for economic growth in the fourth quarter.

In addition, a representative of the state committee noted that there is a strong enough foundation to achieve the country’s 2024 economic growth targets of about 5%.

As reported, China’s GDP grew by 4.8% in January-September. Last year, the economy grew by 5.2%.

Ukrainian State Postal Service Enterprise (USPS) “Ukrposhta” announced on October 23 its intention to conclude a contract with IC “European Insurance Alliance” (both – Kiev) for services of compulsory insurance of civil liability of owners of motor vehicles (OSAGO).

As reported in the system of electronic public procurement “Prozorro”, the expected cost of the service amounted to UAH 1.162 million, the company’s price offer – UAH 345,105 thousand.

The tender was also attended by insurance companies “Guardian” with an offer of UAH 350.799 thousand, “Inter-Policy” – UAH 350.8 thousand, “Kraina” – UAH 553.8 thousand, “Euroins Ukraine” – UAH 569.9 thousand.

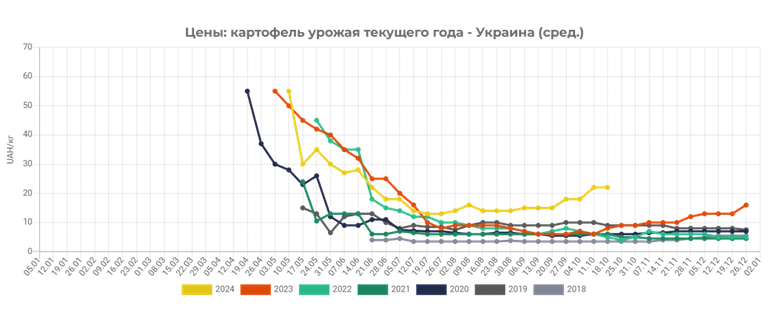

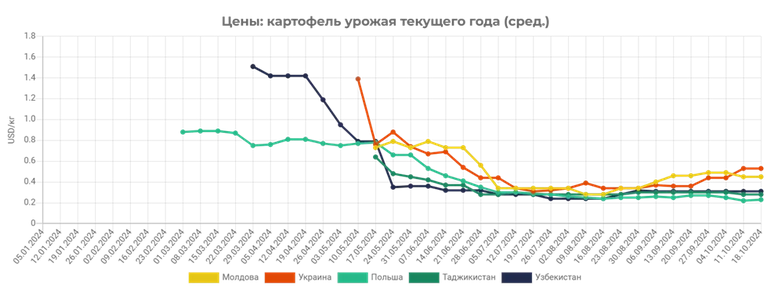

The growth of potato prices in Ukraine continues, analysts of the EastFruit project report. According to regular monitoring, positive price trends have been recorded for more than a month, starting from the last decade of September this year. Traditionally, prices for potatoes in Ukraine during the first autumn month do not increase, as there is an active harvesting and the market receives large volumes of products, which farmers are trying to sell in the shortest possible time. During this period, both medium and low quality potatoes, which are not subject to long-term storage, and high-quality products, which the producer does not plan to store or does not have such an opportunity, are sold. As a result, this season on the potato market in Ukraine has already become exceptional.

Thus, today in the main regions of production potatoes are offered for sale at UAH 20-30/kg ($0.48-0.73/kg), depending on the variety, quality and volume of offered batches of products, which is on average 18% more expensive than at the end of the last working week. It can be stated that potato prices continue to set new price records of the last decade.

According to key market players, the positive price trend in this segment is due to several factors at once. Thus, this week the majority of Ukrainian farmers reported about the completion of potato shipment directly from the field, so the farms offered for sale this product from storage, the prices for which are traditionally higher. Even more confident support for prices continues to be provided by limited supply of potatoes on the market due to a significant decrease in yields of this crop in the current season. Recall, the maximum damage to the future crop, according to producers, caused by dry and hot weather in Ukraine throughout July this year.

Potato prices in Ukraine remain the highest among all countries in the project monitoring region. This fact allows to make forecasts that the domestic market will receive significant volumes of imported products in the first half of the current season. According to experts, it is with the beginning of mass imports price situation on the potato market in Ukraine may stabilize.

It should be noted that today the price of potatoes in Ukraine is already on average 2.9 times higher than at the end of October 2023. At the same time, major market players are not in a hurry to sell the main volumes of potatoes, as they expect further price growth in this segment.

For more detailed information on the development of the market of potatoes and other horticultural products in Ukraine you can get by subscribing to the operative analytical weekly – EastFruit Ukraine Weekly Pro. Detailed product information is available here.

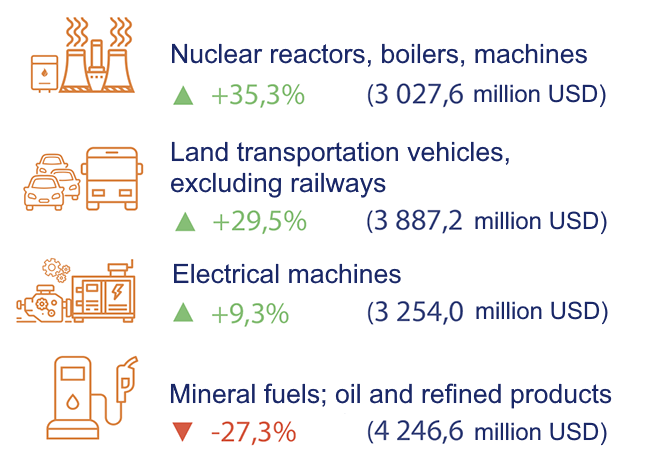

Dynamics of import of goods in Jan-June 2024 by the most important items in relation to the same period of 2023, %

Open4Business.com.ua