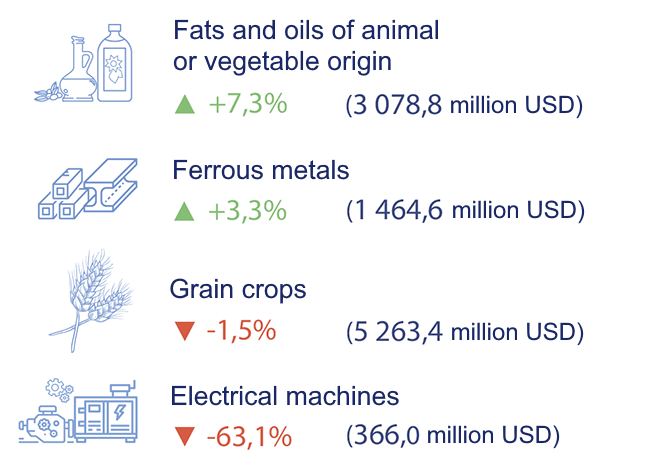

Dynamics of export of goods in jan-june 2024 by the most important items in relation to the same period of 2023, %

Open4Business.com.ua

Ukrainian enterprises in January-August of this year exported zinc for $201 thousand (in August – $79 thousand), while in January-August 2023 the indicators amounted to $88 thousand.

Ukraine in 2023 increased imports of zinc and zinc products – by 18.8%, up to $45.966 mln. Zinc was supplied abroad in 2023 for $130 thousand against $1.331 mln in 2022.

Pure metallic zinc is used to restore noble metals, used to protect steel from corrosion and for other purposes.

Ukrainian enterprises in January-August of this year increased imports of tin and tin products by 7.8% – up to $1.842 mln (in August – $307 thousand).

Exports of tin and products amounted to $344 thousand ($2 thousand in August) against $53 thousand in the same period a year earlier.

Tin is used primarily as a safe, non-toxic coating in pure form or in alloys with other metals. The main industrial applications of tin are in white tinplate (tin-plated iron) for food containers, in solder for electronics, in house piping, in bearing alloys and in coatings made of tin and its alloys. The most important alloy of tin is bronze (with copper). Another well-known alloy – pewter – is used for the manufacture of tableware.

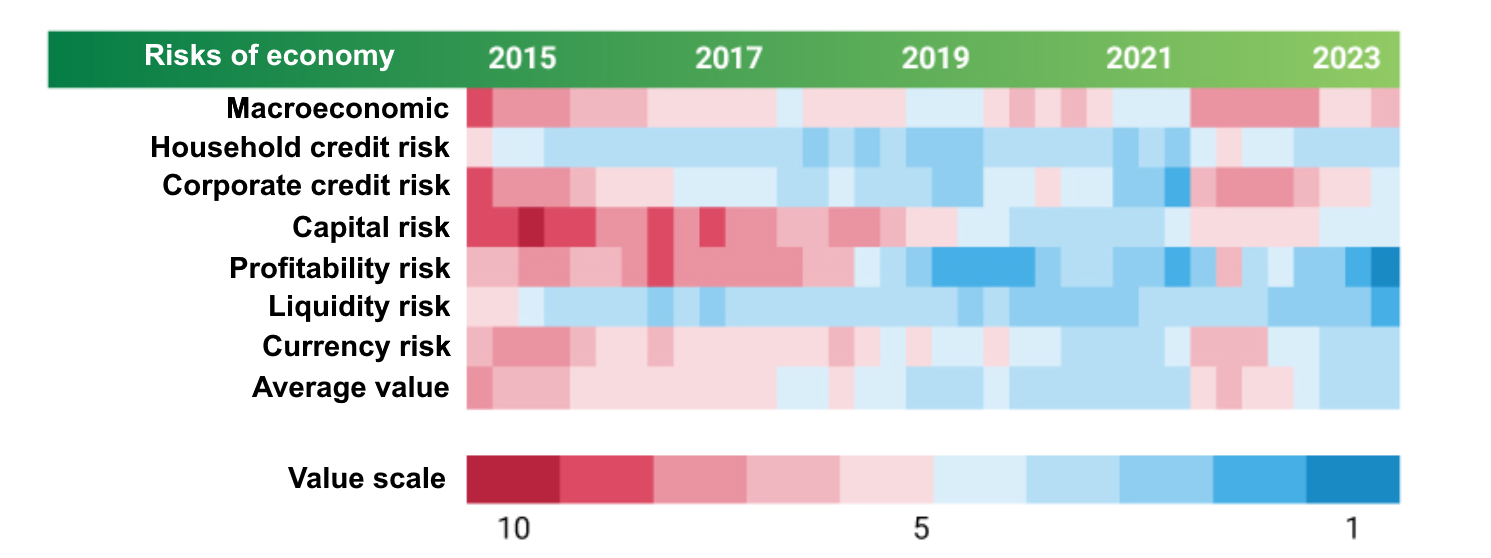

Heat map of risks for the financial sector of Ukraine

Open4Business.com.ua

Ukrainian enterprises in January-August this year increased imports of aluminum and aluminum products – by 20%, up to $292.701 million (in August – $42.649 million).

Exports of aluminum and aluminum products for the first eight months of 2024 increased by 31.1% compared to the comparable period a year earlier – to $82.966 million (in August – $11.901 million).

Ukraine’s imports of aluminum and aluminum products in 2023 increased by 7.7% to $366.463 million, while exports of aluminum and aluminum products in 2023 increased by 0.7% compared to 2022 to $97.616 million.

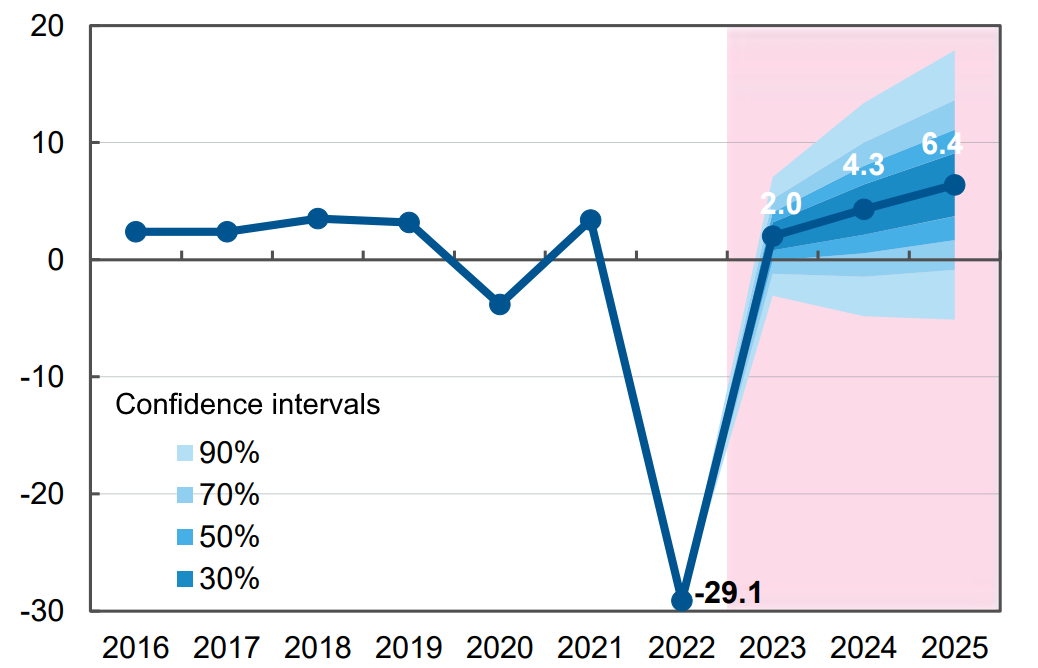

Forecast of dynamics of changes in Ukrainian GDP in % for 2022-2025 in relation to previous period

Open4Business.com.ua