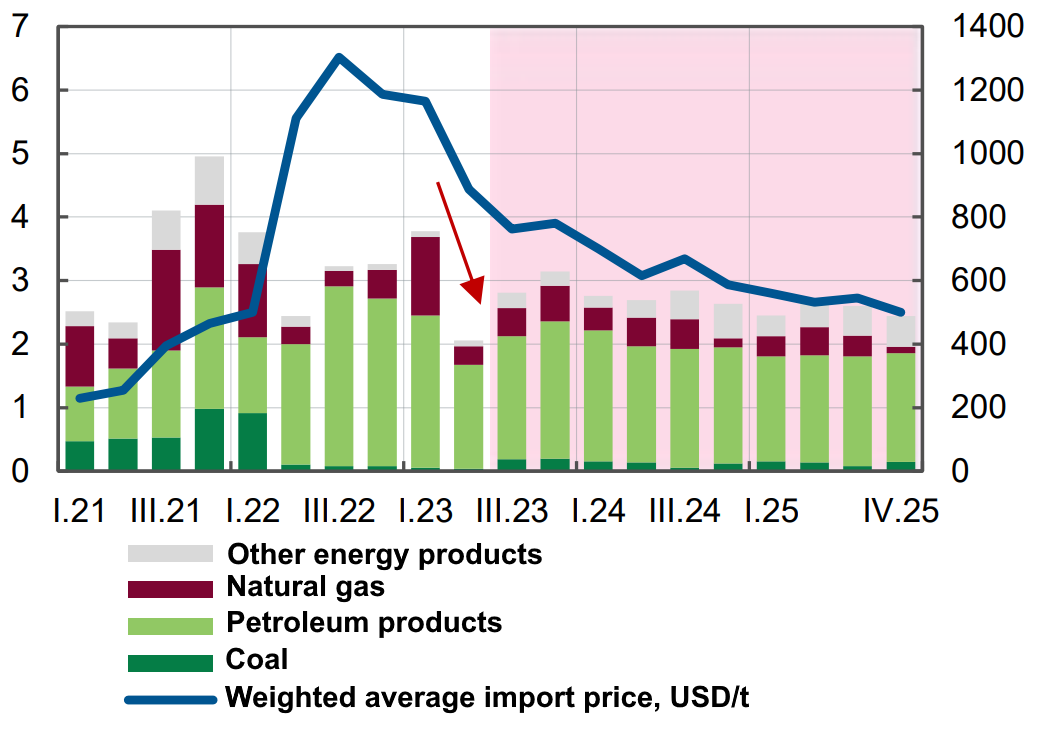

Energy imports, forecast, billion dollars

Source: Open4Business.com.ua

The government has authorized foreign companies operating on the territory of Ukraine through separate subdivisions and representative offices to obtain the right to conduct construction of objects with medium (CC2) and significant (CC3) categories of consequences, the press service of the Ministry of Reintegration of Temporarily Occupied Territories reported.

According to the message, the right to construction activity foreign companies will be able to obtain by free submission to the licensing authorities of the declaration of economic activity. In this case, there is no need to obtain a license for construction, the Ministry notes.

Such changes, introduced in Government Decree No. 314 of March 13, 2022, will be valid for the duration of martial law.

“The adoption of this act will improve the legal regulation of the activities of foreign companies in Ukraine, in particular, will allow representative offices of Polish companies in Ukraine to carry out work on the equipment of checkpoints on the Ukrainian-Polish border,” – stated in the message of the Ministry of Regional Integration.

It is noted that works on the construction of checkpoints are planned within the framework of the implementation of the agreement between the Ukrainian and Polish governments on the provision of a loan on the terms of tied aid from September 9, 2015.

DL SOLUTION is proud to announce the appointment of Vladyslav Labazov as a director of the company effective August 2, 2024. This appointment is the result of a thorough search process.

“We are delighted to welcome Vladyslav Labazov to DL SOLUTION. I know him as a dynamic leader with a deep knowledge of the tobacco market and experience in leading companies,” said Ari Weber, the company’s owner.

Vladyslav has extensive experience in international companies. During his more than 24 years of work in the tobacco industry in sales, he has gained professional recognition. Previously, Vladyslav held the position of Sales Director at Imperial Tobacco Ukraine, where he was responsible for the company’s key business areas and sales of the company’s products throughout Ukraine.

“I am inspired by working in a dynamically developing company. My goal is to ensure development that meets the high requirements and expectations of customers, partners and employees,” emphasized Vladislav Labazov.

For reference.

DL SOLUTION is a national FMCG distributor company that has been operating in the Ukrainian market since 2023. The company supplies goods in the food and non-food categories, and its brand portfolio includes tobacco products, tobacco-containing products for electronic heating, IQOS and Glo tobacco heating systems, alcoholic and non-alcoholic products, lighters, matches, and batteries. DL SOLUTION’s partners are international and national companies representing global brands known for innovation and cutting-edge industry solutions.

On August 5, the Ukrainian State Postal Service Enterprise Ukrposhta (Kiev) announced its intention to conclude a contract of compulsory insurance of civil liability of owners of motor vehicles (MTPL) with Euroins Ukraine (Kiev).

According to the electronic public procurement system “Prozorro”, the company’s price offer amounted to UAH 24.41 thousand against UAH 68.107 thousand of the expected cost of purchasing services.

The tender was attended by insurance companies Inter-Policy with a price offer of UAH 27.2 thousand, Krajina – UAH 32.2 thousand, Guardian – UAH 32.3 thousand, ESA – UAH 43.9 thousand.

IC “Euroins Ukraine” in 2023 increased premiums by 20,4% compared to 2022 – up to UAH 565 mln and concluded 17% more insurance contracts – more than 662 thousand.

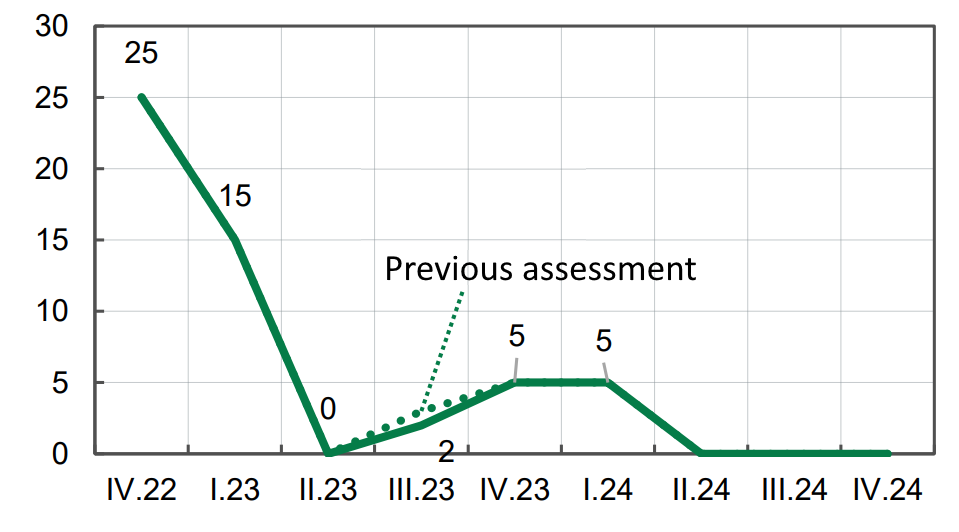

Forecast of power system capacity deficit, %

Source: Open4Business.com.ua

Gross gas production in Ukraine in January-June 2024 amounted to 9.4 billion cubic meters and by the end of the year can grow twice – by 100-200 million cubic meters more than last year’s figure (18.7 billion cubic meters), said Artem Petrenko, executive director of the Association of Gas Producers.

“According to our conservative forecasts for today, Ukraine in 2024 will be able to increase its own production by 100-200 million cubic meters compared to last year’s figure. We are oriented at 18.8 billion cubic meters per year. But this is such a conservative base scenario, which takes into account neither possible positive nor negative aspects,” he said in comments to Energoreforma on the sidelines of the Ukrainian Gas Open 2024 Energy Club, held on Thursday in Kiev.

According to Petrenko’s presentation at the forum, drilling of about 70 wells (150 wells for the whole of 2023) has been started in half a year.

He named the state-owned Ukrgasvydobuvannya as the flagship in this process, noting that private companies are also actively involved in drilling and working to increase production.

“In particular, Smart Energy is now resuming hydrocarbon production at three sites in Kharkiv and Poltava regions. Therefore, I hope that by the end of the year they will add to the total gas production,” said the executive director of the association.

At the same time, he noted that the daily production of private companies fell by 18% compared to last year.