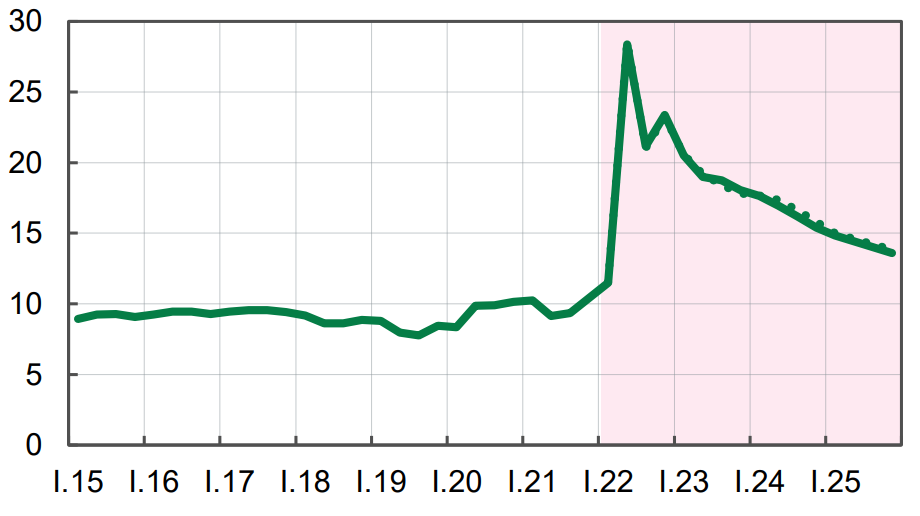

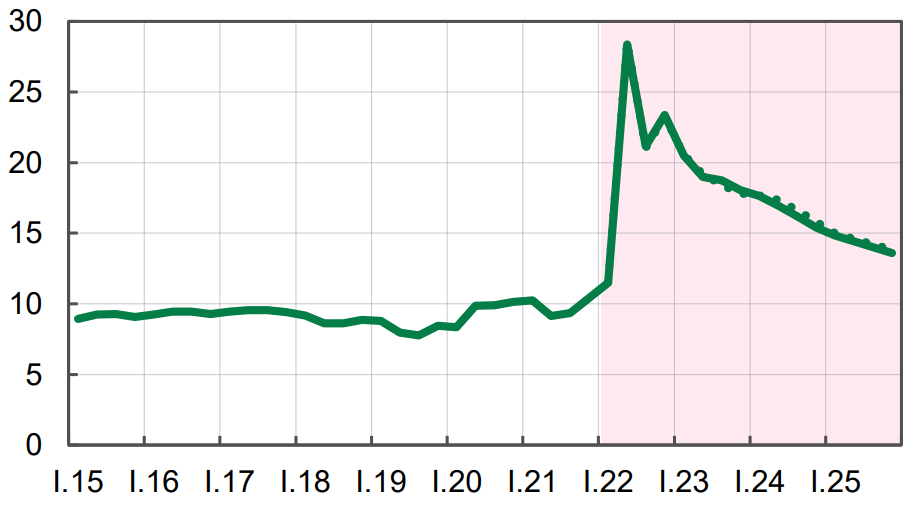

Forecast of unemployment rate in Ukraine according to methodology of international labor organization until 2025

Source: Open4Business.com.ua and experts.news

Since the beginning of 2024 the number of service station-partners of IC “Express Insurance” has increased by 22 stations throughout Ukraine, and as of July 1, 2024 their total number is 83.

As reported in the information of the company, in June 2024 five more new partners in Volyn, Zhytomyr, Cherkassy, Chernovtsy regions and Kiev joined the network of the company.

The company notes that the expansion of the network will allow to provide the best service for customers in a convenient place for them, as well as is an important element of its strategy and a necessary condition for fulfillment of obligations in accordance with the requirements of the new Law on compulsory civil liability insurance of owners of land vehicles.

Express Insurance ALC was founded in 2008 with participation of UkrAVTO Corporation. The company specializes in automobile insurance.

The Kyiv Employment Service has released data on the highest salaries offered by employers in Kyiv. Although the average salary level in vacancies is about 15 thousand hryvnias, some employers are willing to pay much more for highly qualified specialists.

Here are the top 10 best-paid vacancies in the capital:

1. Inspector and special police officer – UAH 125-126 thousand

2. Software engineer – 110 thousand UAH

3. Software engineer – 90 thousand UAH

4. Professional in the organization of information security – 69 thousand UAH

5. Sales manager – 67 thousand UAH

6. Journalist – 54 thousand UAH

7. Combat medic – 51 thousand UAH

8. Editor – 50 thousand UAH

9. Psychologist – 47 thousand UAH

10. Public procurement specialist – 45 thousand UAH

It is interesting that the IT sector, which until recently was the leader in terms of salaries, has now lost ground to the security sector. Employers are ready to pay competitive salaries and create modern working conditions, but expect a high level of professional training of candidates.

Despite the fact that many employers have lowered their requirements for candidates due to labor shortages, this is not the case for highly paid positions. To succeed in your career and earn a high salary, you need to constantly develop your knowledge and skills.

The Capital Employment Service offers effective programs and services to increase the competitiveness of job seekers. An individual approach and consideration of the needs and competencies of each person help to find a prestigious and well-paid job.

Forecast of unemployment rate in Ukraine according to methodology of international labor organization until 2025

Source: Open4Business.com.ua and experts.news

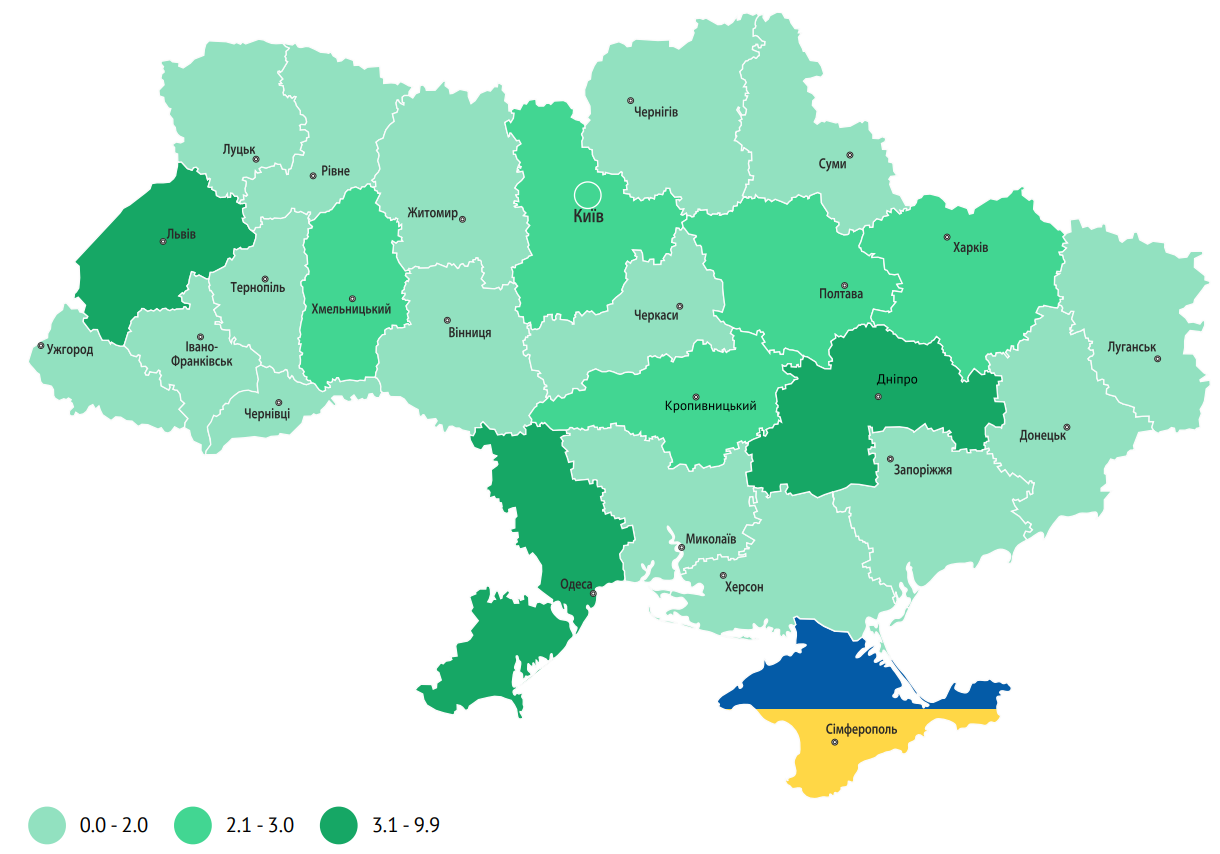

Number of vacancies as of 30.04.2024 (thousand units) according to the data of the state employment center

Source: Open4Business.com.ua and experts.news

The sea corridor created by the Navy has ensured the export of 56 million tons of cargo since August 2023, US Ambassador to Ukraine Brigitte Brink said.

“Incredible Ukraine: in the face of Russia’s continued attacks, Ukraine has sent more than 2,000 ships carrying 56 million tons of products for export… through the Black Sea Humanitarian Corridor,” Brink wrote on social network X on Saturday.

Earlier it was reported that the sea corridor since August 2023 provided exports of 55 million tons of cargo, of which more than half (37.4 million tons) were agro-products.