The State Bureau of Investigation (SBI) has announced a new suspicion of oligarch Konstantin Zhevago and his three accomplices in the case of withdrawal of UAH 519 million from the Finance and Credit Bank.

“Employees of the GBR reported a new suspicion to the former shareholder of the bank JSC “Bank Finance and Credit” Konstantin Zhevago, the former chairman of the board of the bank and his two deputies,” – reported in the Telegram channel of the GBR on Thursday.

According to the Bureau’s information, in May 2007-October 2010, Mr. Zhevago formed a criminal organization. Zhevago formed a criminal organization, which included the chairman, members of the board of JSC Bank Finance and Credit and other persons close to him. “A Ukrainian company controlled by Zhevago received a loan from JSC Bank Finance and Credit, which was done in violation of lending rules. This money was withdrawn to other offshore companies of the oligarch”, – noted in the GBR.

To conceal the illegal origin of money participants of the scheme in 2010-2015. concluded a loan agreement and more than 100 additional agreements to it between the controlled company and the bank. “The additional agreements systematically and unreasonably allowed to increase the credit limit issued by the bank to the oligarch-controlled company without any liquid collateral. Thus, the group members withdrew UAH 519 million from the Bank, which were further legalized by the participants of the scheme”, – stated in the message.

Thus, summarized in the Department, the total loss of JSC “Bank Finance and Credit” due to lending to Zhevago’s company amounted to UAH 1.4 billion.

The GBI has notified Zhevago of suspicion of creation and management of a criminal organization, embezzlement and misappropriation of property, legalization of property obtained by criminal means in a particularly large amount as part of a criminal organization. The ex-chairman of the bank and his two deputies are suspected of participation in criminal organizations, embezzlement and misappropriation of property on a particularly large scale as part of a criminal organization.

Earlier, the GBR notified about suspicion of Zhevago and a number of bank managers on another fact – the organization of embezzlement of $113 million of the financial institution. To date, the property of the suspected oligarch, as well as legal entities associated with him, in particular, the shares of his companies for hundreds of millions of hryvnias – corporate rights of companies, 26 real estate. The property of other legal entities related to the former MP was also arrested. Among other things – 14 property complexes, 21 parts of property complexes, 30 non-residential premises, 10 apartments, a helicopter, a yacht.

Back in October 2020 arrested assets worth more than 300 million UAH were transferred to the National Agency for identification, search and management of assets (ARMA). These are assets in the form of corporate rights, funds and 26 real estate objects – recreational complexes, hotels, residential and commercial premises located in the central part of Kiev, Kharkiv, Poltava, Krivoy Rog with a total area of more than 22 thousand square meters. meters.

The GBI is actively cooperating with the justice, gendarmerie and police authorities of the French Republic in the investigation.

Net sale of dollars by the National Bank of Ukraine (NBU) increased this week to $533.4m from $507.8m a week earlier, according to the regulator’s data.

According to them, the central bank sold $533.6m on the interbank market and bought back $0.15m.

The official hryvnia exchange rate weakened by 37 kopecks during the week, in particular, on Friday the national currency exchange rate fell by 17 kopecks to UAH 39.7206/$$. – to 39.7206 UAH/$1.

In the cash market, the dollar also rose in price during the week: by about 12 cents to UAH 39.95/$1. – up to UAH 39.95/$1, including on Friday – by 6 kopecks.

As evidenced by the data, which the NBU managed to publish for this period, from Monday to Wednesday, the negative balance between the volume of currency purchases and sales by the population increased from $30.2 million to $56.9 million.

Last Friday, May 3, the National Bank announced the largest package of easing of currency restrictions for businesses since the beginning of the full-scale war, which provides for the abolition of all currency restrictions on imports of works and services, provides the ability of businesses to repatriate “new” dividends, provides an opportunity to transfer funds abroad on leasing and rent.

In addition, the new steps of currency liberalization provide for the easing of restrictions in terms of repayment of new foreign loans and interest on “old” foreign loans, as well as easing restrictions for the transfer of foreign currency from representative offices in favor of their parent companies.

As reported, the NBU increased its net foreign exchange interventions on the interbank market in April by 27.7% to $2.283bn, compared to $1.370bn in the same period last year.

On April 24, Ukraine received the second tranche of transitional financing in the amount of EUR1.5 billion (UAH 63.32 billion in hryvnia equivalent) under the European Union’s Ukraine Facility instrument, and the country also received UAH 2.7 billion in grants from international partners last month.

Ukraine’s international reserves in April decreased by 3.1%, or $1.4 billion – to $42 billion 399.5 million. On April 25, the NBU raised their forecast for the end of this year to $43.4 billion from $40.4 billion and to $44.3 billion from $42.1 billion – at the end of next year.

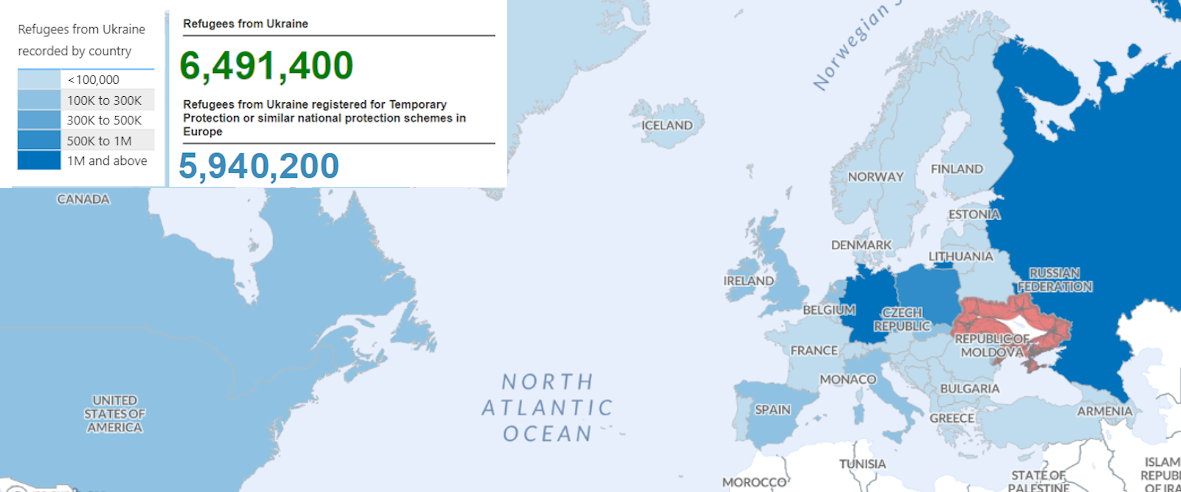

Number of refugees from Ukraine in selected countries as of 31.03.2024

Source: Open4Business.com.ua and experts.news

Population structure of ukraine (data from ukrainian institute of future)

Source: Open4Business.com.ua and experts.news

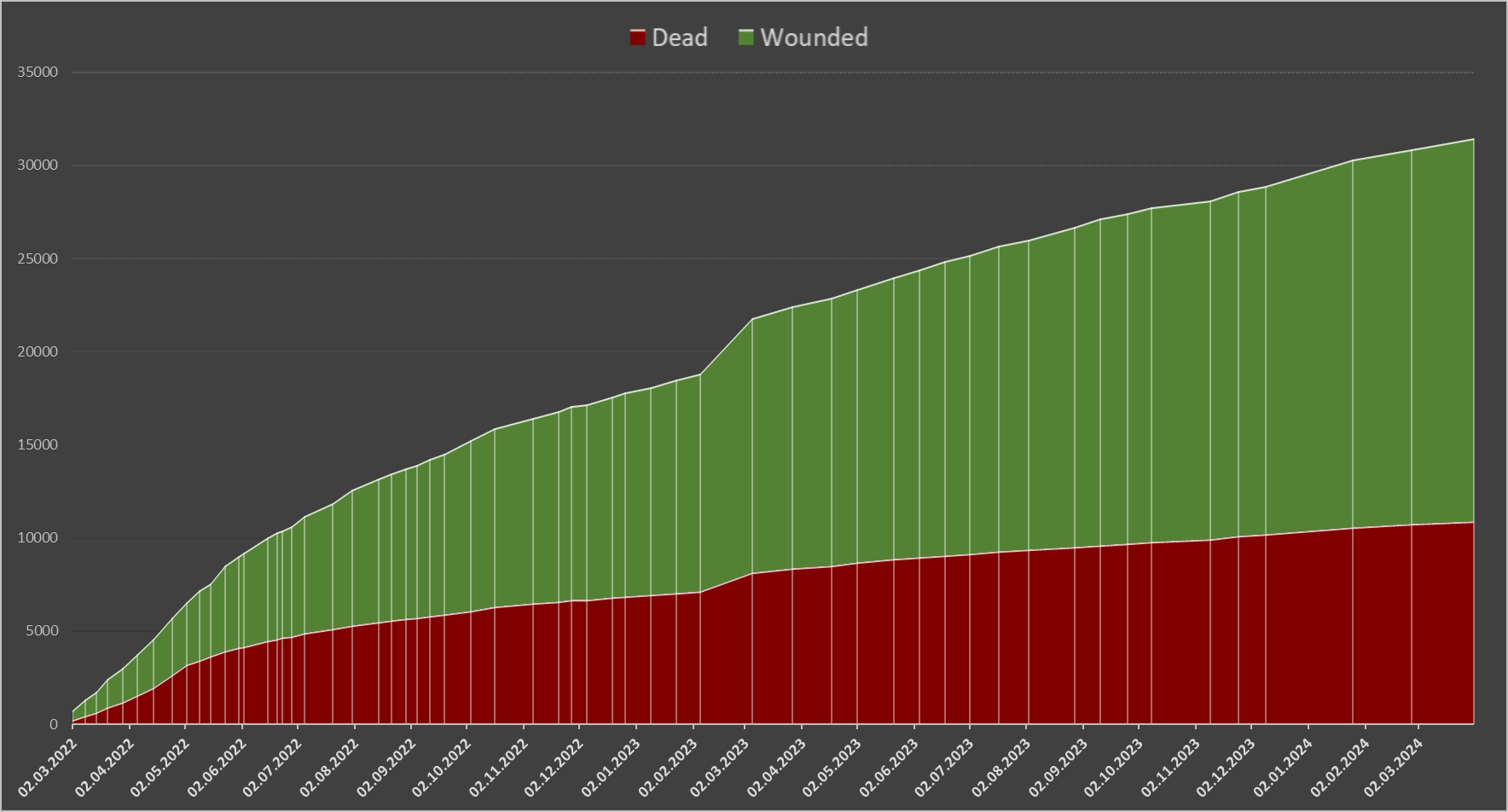

Number of dead and wounded civilians in Ukraine from 24.02.2022 till 31.03.2024 un data

Source: Open4Business.com.ua and experts.news

Ukrainian startups developing climate-friendly technologies can take part in ClimateLaunchpad , the world’s largest international green idea competition looking for business solutions to combat climate change. The deadline for applications is May 26.

The competition is open to newcomers to the cleantech industry with a promising business idea, as well as green startups, small or medium-sized businesses working in the following areas

● Adaptation and sustainability

● Clean energy

● Solutions for cities

Sustainable mobility

● Circular economy

● Water conservation

● Ecological food production

● New discoveries

You can become a member of the ClimateLaunchpad if:

1. You have not started your business yet or your company was registered less than a year ago.

2. You do not yet have a significant customer base.

3. You have not received more than 200,000 euros of investment.

4. The company’s profit from the sale of goods has not exceeded 200,000 euros at the time of application.

5. You speak English sufficient to study with English-speaking coaches and pitch on the international stage.

You can apply for participation until May 26 at the following link: https://bit.ly/CLP_UA_apply

How does the competition work?

Startups from 51 countries participate in the competition, including France, Germany, Switzerland, Colombia, Angola, Turkey, the United States, and Mexico.

Each of the participating countries provides training for the program participants, which allows startups to improve and test their business ideas. Topics include market segmentation, key financial indicators, competitive advantages, pitching preparation, and more.

The startups that win the national selection get a chance to compete at the regional finals of ClimateLaunchpad 2024 and compete for the championship with teams from other countries. The national stage of the competition in Ukraine has been organized by Greencubator since 2016.

For additional questions, please contact ukraine@climatelaunchpad.org