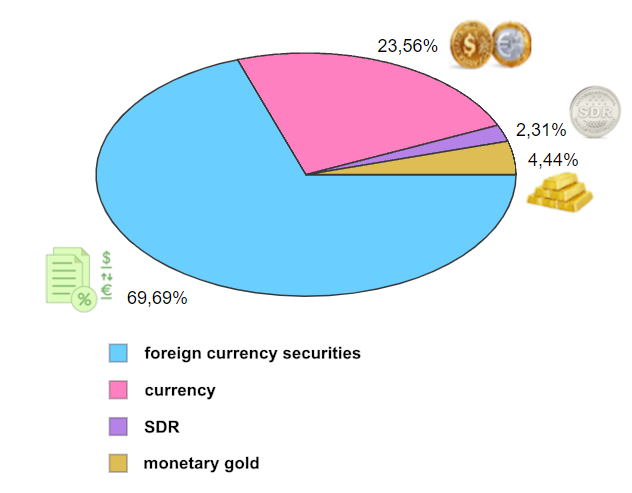

Structure of foreign exchange reserves as of 30.10.2023

Source: Open4Business.com.ua and experts.news

The National Bank of Ukraine (NBU) has included two companies Risk End Life Consulting LLC and Universal Insurance Brokers and Consultants LLC into the State Register of Insurance and Reinsurance Brokers.

According to the NBU website, the decision was made on March 8

Risk End Life Consulting LLC was registered in Kiev in July 2009. The authorized capital is UAH 63 mln.

LLC Insurance Broker “Universal Insurance Brokers and Consultants” was registered in Kiev in March 2010. Authorized capital is UAH 20 th.

According to the NBU data as of March 1, 2024 there were 37 insurance and reinsurance brokers registered in Ukraine.

Insurance company Busin (Kyiv) has collected UAH 293.238 mln of gross premiums in 2023, that is by 10.63% less than a year earlier, the rating agency Standard-Rating reported in the information on updating the credit rating/rating of financial stability of the insurer at the level of “uaAA+” on the national scale on the basis of the analysis of its statements for the specified period.

According to the report, receipts from individuals for this period have grown by 7,19% – to UAH 1,446 mln, and from reinsurers, on the contrary, have decreased by 7,39% – to UAH 43,182 mln.

Insurance payments sent to reinsurers for 2023 decreased by 10.62% compared to 2022 – to UAH 193.951 million. Despite such decrease, the ratio of reinsurers’ participation in insurance premiums remained almost unchanged – at the level of 66.14%.

Net premiums for the year decreased by 10.65% – to UAH 99.287 mln, while earned premiums increased by 30.89% – to UAH 114.479 mln.

For 2023, the company paid UAH 1,317 mln of insurance payments and indemnities to its clients, which is 91,70% more than for 2022. Thus, the level of payments has increased by 0,24 p.p. – to 0,45%.

The financial result from operating activity of IC “Busin” for 2023 has grown to UAH 65,143 mln, and net profit has amounted to UAH 55,218 mln.

Assets of the insurer on January 1, 2024 have decreased by 4,04% – to UAH 586,909 mln, shareholders’ equity has increased by 20,88% – to UAH 243,016 mln, liabilities have decreased by 16,25% – to UAH 343,893 mln, cash and cash equivalents have increased by 25,97% – to UAH 265,873 mln.

According to the information provided by RA IC “Busin”, as of January 1, 2024 has complied with the criteria of liquidity, profitability and quality of insurer assets, solvency and capital adequacy norms, riskiness norms of operations and asset quality norms.

IC Busin was registered in February, 1993. It specializes on risky types of insurance. It is a member of a number of professional and branch associations – League of Insurance Organizations of Ukraine, National Club of Insurance Payouts, International Association of Aviation Insurers (UA), Nuclear Insurance Pool, American Chamber in Ukraine, British Business Club.

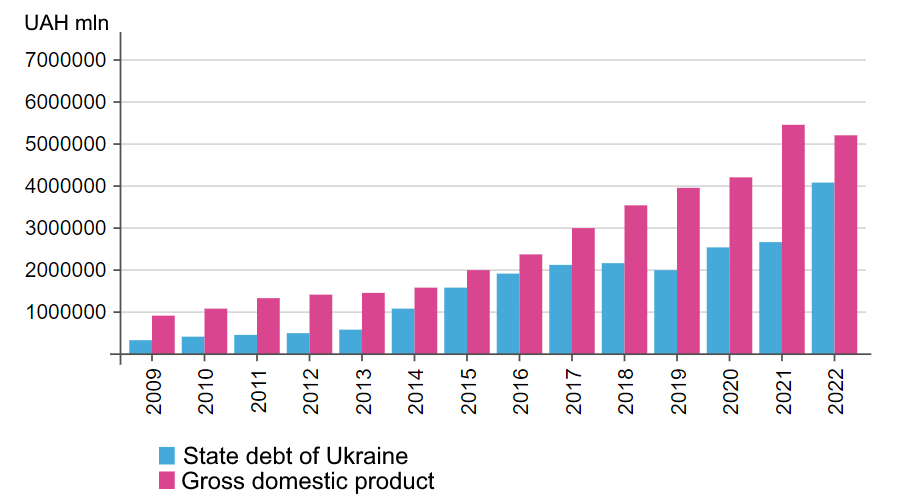

Ukraine’s public debt to GDP ratio from 2009 to 2023 (UAH mln)

Source: Open4Business.com.ua and experts.news

Components of residential and commercial real estate maintenance services in Ukraine have gone up to 20% since the beginning of the war, said Ivan Petyukh, head of R-Class integrated real estate management platform.

“Consumables have risen in price by up to 20%, the cost of maintenance of engineering systems (by licensed third-party companies) by an estimated 10%,” he said.

The main challenges facing the R-Class in 2022-23 include. Petyukh singled out unforeseen disruptions in the supply of electricity, heat and water. In this regard, he said, the company is paying systematic attention to improving energy efficiency and energy independence. In addition to insulation of facades, R-Class specialists ensured and organized uninterrupted power supply of the objects by means of redundancy of electric capacities from different connection lines from the city, installation of additional diesel generators (capacity from 15 to 160 kW), installation of uninterrupted power supply sources (capacity from 12 kW); implemented a backup water supply/water drainage system.

The head of R-Class also noted that the introduction of the latest technologies helps to optimize utility costs and increase the service life of buildings. According to him, automated heat consumption systems that distribute the heat carrier depending on the current demands of the consumer and the outside air temperature, air recovery system, automatic gas analysis system in the parking premises that switches on/off the supply and exhaust ventilation depending on the air pollution, the latest air conditioning systems (VRV systems) that allow heating the premises at the outside temperature down to -15 in addition to the conventional water system allow saving energy resources.

R-Class’ integrated real estate management and development platform, which has been operating on the market since 2008, serves more than 300 thousand square meters of real estate. Among the objects are BC HILLFORT, BC Mikhailovskaya 7, Residential Complex “Pokrovsky Posad”, Residential Complex “Nobel” and others.