When choosing their future home, buyers prefer new-build properties in areas with well-developed infrastructure for shelter, modern fire safety systems, and autonomous energy sources, according to Irina Mikhaleva, CMO Alliance Novobud.

“Over the past three years, the criteria for choosing a home have changed. Buyers have become more practical, demanding in terms of quality, and adapted to the realities of war. They prefer homes in safe regions or areas with developed infrastructure for shelter, modern fire safety systems, and autonomous power sources,” Mikhaleva said.

Alliance Novobud is responding to changes in housing selection criteria by including spaces in its projects for temporary shelters with automatic door opening/closing and video surveillance.

“In our projects in the capital, we offer spacious and secure underground parking lots, provide access to autonomous energy sources for building utilities, and offer well-thought-out apartment layouts that meet the diverse needs of buyers,” said Mikhaleva.

Overall, she said, demand for housing in the capital has changed significantly since 2022. Whereas previously buyers were looking for interesting new projects in the comfort and comfort+ classes, with a wide choice of concepts and areas, they are now focused on affordable options that are nearing completion. The focus is on apartments that are covered by the “єОселя” program or are available on installment plans from the developer.

In contrast, the suburban market remains active: developers are launching new high-quality projects with a wide selection of housing with different concepts and amenities at affordable prices.

According to Mikhalova, several factors are influencing the outflow of buyers from the capital’s market to the suburbs. The main factor is the shortage of finished or nearly finished housing in the currently popular comfort class in the capital, which will only get worse. There are almost no new projects, nor are there any land plots in promising areas of the city. Buyers are also more interested in the more affordable cost of housing in the suburbs and the opportunity to take advantage of the “єОселя” program.

At the same time, suburban projects offer more high-quality options close to green areas, with transport and amenities. There is greater demand for such projects from IDPs from the eastern and southern regions, who prefer quiet, green suburbs.

“In the next year or two, demand in the suburbs will grow steadily, and buyers will be interested in affordable and relatively inexpensive housing formats,” Mikhaleva believes.

Among the trends, the expert also highlighted a rational approach, with buyers opting for smaller square footage. As a result, demand for one- and two-bedroom apartments, which are more affordable and easier to maintain, has increased. At the same time, living spaces that can be used for both residential and remote work remain relevant.

At the same time, she emphasized that the trend of rising prices per square meter will continue due to the growth of prices for the components of the cost of new buildings.

“If the macroeconomic situation remains more or less stable, prices are likely to rise by 5-10% due to inflation and the gradual recovery of the construction industry. Demand from migrants and a shortage of new housing will also drive up prices. In the event of external/internal shocks or instability in the financial markets, current prices may remain unchanged,” she said.

According to the LUN new construction portal, Alliance Novobud was founded in 2006. Since 2010, the company has commissioned 37 buildings and parking lots, and is currently developing nine buildings in the Krona Park II residential complex in Brovary and a premium-class project in the capital, Montreal House.

The Verkhovna Rada Committee on Finance, Tax and Customs Policy has announced a competition for a vacant position on the Council of the National Bank of Ukraine (NBU), setting the deadline for applications as May 22, 2025.

“We had a meeting with the IMF, and they expressed their position on the need to fill the vacant position,” said committee head Danylo Getmantsev during the meeting.

He said that the deadline for accepting applications from candidates for the position of member of the National Bank Council is one month, until 4 p.m. on May 22, 2025.

“We will listen, conduct a selection process, as we always do – openly and transparently,” Getmantsev added.

As reported, in the memorandum of the extended financing program with the IMF, updated after the seventh review, the Ukrainian side noted that it plans to fill the vacant positions in the NBU Council by the end of April 2025.

In addition to the head of the NBU, the National Bank Council has eight other members: four are appointed by the president and four by the Verkhovna Rada for a term of seven years. Currently, Igor Veremiy and Vasily Furman have been appointed under the president’s quota (in June and November 2022), and Vasily Gorbali, Anatoly Barsukov, and Elena Shcherbakova have been appointed under the Verkhovna Rada’s quota (in September 2020 and December 2022).

COMPETITION, member of the NBU Council, VACANCY, Verkhovna Rada Committee

Individual customers of OTP Bank purchased domestic government bonds (OVDP) worth a total of UAH 2.78 billion at the end of the first quarter of 2025. This was announced by Valeria Ovcharuk, product owner at OTP BANK.

She noted that 20% of investments were made in hryvnia OVDPs and 80% in foreign currency. “As we can see, our clients choose a reliable and effective way to preserve and multiply their funds in foreign currency. Currently, individuals see this as the best investment option for their savings. For many, it is important to support the Ukrainian economy in this way, as securities are sold, among other things, to finance the state budget,” emphasized V. Ovcharuk.

In the first quarter, customers bought securities worth a total of UAH 1.29 billion from the Bank’s portfolio, while bonds worth UAH 1.49 billion were purchased directly at auctions held by the Ministry of Finance.

In total, since the launch of the OVDP purchase service in the OTP Bank UA app at the end of 2023, the Bank’s customers – individuals – have purchased OVDPs worth more than UAH 11 billion.

We would like to remind you that you can purchase OVDPs from the Bank’s portfolio or directly at Ministry of Finance auctions via the OTP Bank UA mobile app. In addition, the Bank has recently simplified the procedure for opening securities accounts – this can now be done remotely, with the help of OTP Bank UA, without the need to visit a branch. You can find out more about investing in government bonds through the app at link.

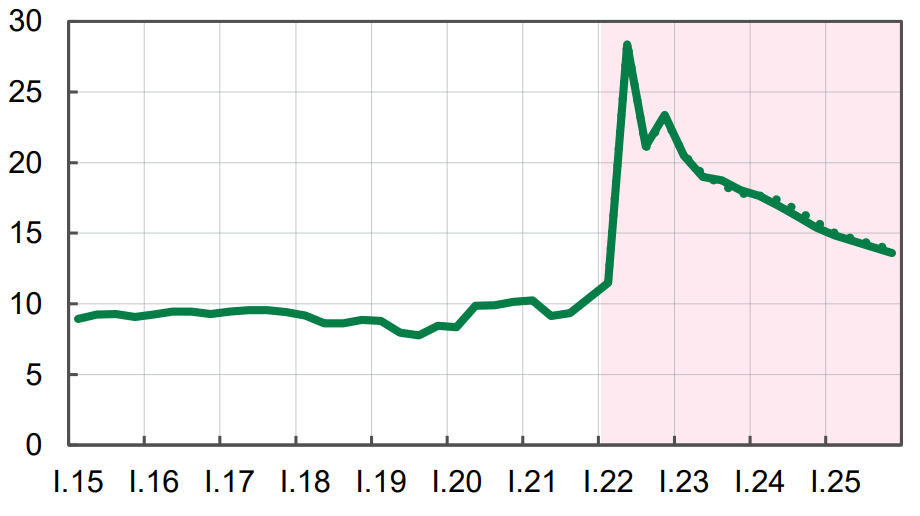

Forecast of unemployment rate in Ukraine according to methodology of International labor organization until 2025