From the beginning of 2021, confectionery products in Ukraine has risen in price by 15% to 20% due to the rise in sugar prices caused by the cartel agreement of its producers and the lack of supply of this product on the domestic market, Head of the Association of producers of confectionery, food concentrates, starch products and coffee in Ukraine (Ukrkondprom) Oleksandr Baldyniuk said during press conferences at Interfax-Ukraine on Thursday.

“In our industry, the rise in sugar prices has led to quite severe economic consequences, which forced us from the beginning of the year to increase the cost of our products by 15% to 20%. We got a situation when the industry reduced production by 25,000 to 26,000 tonnes, or UAH 1.3 billion in monetary terms,” he said.

Baldyniuk said the consequence of the reduction in production was an increase in imports of confectionery products to Ukraine by 20%. The industry also loses out in export positions in the EU, CIS and Central Asia markets. The high price of sugar has led to a situation where the production of caramel in some EU countries is more profitable than in Ukraine.

According to him, over the past 11 months, Ukrainian processing enterprises receive sugar at prices 30% to 40% higher than in Europe, in particular, on the London Stock Exchange over the past month, sugar fell from $459 per tonne to $432 per tonne, while in Ukraine it rose in price from $660 per tonne to $781 per tonne.

The head of Ukrkondprom said that too expensive sugar in Ukraine leads to the fact that Ukrainian producers lose their competitiveness in the domestic and export markets, forcing the industry’s enterprises to cut production and lay off employees.

Baldyniuk said that the crisis situation in the confectionery industry has developed due to the cartel conspiracy of sugar producers and the shortage of its supply on the domestic market.

“Since today the Antimonopoly Committee of Ukraine has initiated a case and is investigating a cartel agreement, we can conclude that it has reason to assume a cartel agreement,” the head of the association said.

According to him, the supply of sugar in Ukraine after the sugar-making season, together with the transition residues from last year, is 1.2 million tonnes with its internal consumption at the level of 1.5 million tonnes. Even taking into account the import of 40,000 tonnes of white sugar from Europe within the existing quota, as well as the import of raw sugar, the deficit of this product is still 60,000 to 70,000 tonnes.

Baldyniuk said the way out of this situation is the adoption by the MPs of bill No. 5673 on the establishment of a tariff quota for the import of white sugar into Ukraine. According to him, a temporary permit for duty-free import of 60,000 tonnes of sugar from the EU will balance supply and demand for it in the country, while not creating losses for the sugar industry.

The Business Activity Expectations Index, calculated by the National Bank of Ukraine (NBU), rose to 51.6 in June from 50.5 in May, according to a survey of enterprises conducted by the National Bank of Ukraine and published on the website of the regulator.

“In June, companies across most of the surveyed sectors reported optimistic expectations of their business performance – the indices of the construction, industrial and services sectors moved above their neutral levels. Meanwhile, companies in the trade sector have reported pessimistic expectations for three months running,” the report says.

“Industrial companies upgraded their optimistic expectations of their business performance amid benign external and internal environments – the sector’s index was 52.5 in June, up from 50.8 in May. Respondents reported much firmer expectations for the amount of manufactured goods, while also remaining upbeat about an increase in the number of new orders, including new export orders,” the bank said.

“Service companies also improved their expectations of their business performance, with the sector’s index moving to 52.3 in June, up from 50.7 in May. Respondents expected an improvement in all performance indicators, expecting most strongly an increase in the amount of services that have been provided, and the services currently being provided,” it said.

“Residential housing and non-residential facility construction companies upgraded their performance expectations most of all. The sector’s index moved up from 49.4 in May to 58.1 in June – the highest figure among the sectors. Respondents expressed strong expectations for the amount of construction work done and the number of new orders, while also reporting intentions to hire more staff for the first time since September 2019,” according to the document.

“In contrast, trading companies were downbeat about their business performance – their index dropped to 48.2 in June, down from 49.9 in May, remaining below the neutral level for three months in a row. Respondents reported dimmer expectations about all performance indicators, such as trade turnover, goods purchased for sale, and staff numbers. Most companies in the sector expected a further decrease in their trade margins,” the report notes.

“Companies across all sectors expect a rise in their selling prices on the back of continued increases in raw material and higher purchase and supplier prices. Staff expectations remain guarded – companies across all sectors, apart from the construction sector, still report no intentions to expand their workforces,” the NBU says.

This survey was carried out from June 3 through June 22, 2021. A total of 316 companies were polled. Of the companies polled, 42.1% are industrial companies, 28.8% companies in the services sector, 24.4% trading companies, and 4.7% construction companies, while 36.1% of the respondents are large companies, 32% medium companies, and 32% small companies.

Land prices and the balance of its supply and demand will be established after 2024, when legal entities (including large agricultural holdings) will be able to buy land, then a full-fledged agricultural land market will appear in Ukraine.

This opinion was expressed to the Interfax-Ukraine agency by the co-founder of the Land Club association of land investors, Oleksandr Kolotilin.

He clarified that all large agricultural holdings with which his organization works intend to buy agricultural land leased by them.

“We work with large agricultural holdings. I can say that all the companies we talked to intend to buy agricultural land that they lease and cultivate. I cannot name them, since many of them are public companies, and they must declare themselves their position and intention to purchase land or plans in 2024. But all large agricultural holdings are making exactly such plans,” Kolotilin said.

According to the data on the Land Club website, the founder of the investment organization is the director general of IMC agricultural holding and the president of the Ukrainian Agribusiness Club, Alex Lissitsa. The project offers investors the purchase of land plots leased by agricultural holdings in order to receive guaranteed rent from them.

Earlier, MHP Financial Director Viktoria Kapeliushna announced that her company was not interested in buying land. She noted that the economic model of the agricultural holding includes work on the leased land, and in the event of a change in its owner, the group of companies will look for other land plots for lease.

A similar opinion was expressed by the owner of KSG Agro agricultural holding, Serhiy Kasyanov. The agricultural holding does not plan to buy land after the opening of the land market, since its activities involve working with leased plots.

Since July 1, the Netherlands has opened an entrance for Ukrainians, Foreign Minister of Ukraine Dmytro Kuleba has said.

“We have just received confirmation that another EU country, the Netherlands, has opened for Ukrainians,” Kuleba said on his Twitter microblog.

According to him, fully vaccinated citizens of Ukraine can again travel freely within the visa-free travel.

Kuleba said the list of recognized vaccines and detailed conditions for entry are contained on the website https://tripadvisor.mfa.gov.ua/.

Earlier it was reported that Austria, from July 1, 2021, resumed entry into the country for Ukrainians for all types of travel.

Initial registrations of new passenger cars in Ukraine in June 2021 increased by 21% compared to the same month in 2020 and by almost 36% compared to the “pre-COVID” June 2019, to 8,800 units,” Ukrautoprom reports.

According to the association’s information on its website, compared to May of this year, the demand for new passenger cars increased by 4%.

The most popular brand in June was Toyota (a year ago – Renault) with 1,296 sold cars and an increase of almost 25%.

Renault ranked second with 986 cars (less by 15% from June 2020).

The third place, as in June last year, was given by Ukrainians to Kia, having purchased 742 new cars – 10% more.

The fourth result is again with Skoda – 609 cars and an increase of 27%, and, like a year ago, Hyundai closes the top five with an increase in registrations by 11%, to 441 units.

In addition, last month, the top ten most popular brands included Nissan, which rose from the 9th in June 2020, with 391 units (more by 68%), and VW, which took the seventh position, managed to move from the 20th position in June last year due to the growth of registrations by 3.7 times, to 384 units.

This is followed by Peugeot – 383 units (more by 17%); Chery – 369 units (129%); Mitsubishi – 367 units (71%).

Ukrautoprom notes that in the first half of this year in Ukraine, the first license plate was received by 48,400 new passenger cars, which is 30% more than in the same period last year.

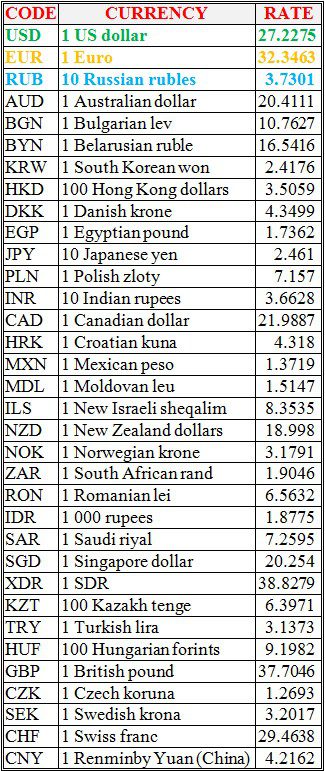

National bank of Ukraine’s official rates as of 01/07/21

Source: National Bank of Ukraine