SkyUp (Kyiv) is launching a campaign to recruit new aircrews.

As reported on the airline’s website on Monday, such vacancies are currently open: aircraft commanders, co-pilots and flight attendants.

“Aviation industry is now passing through hard times. However, we understand that this period will not last forever, and therefore we strive to find the best specialists in our team […] However, in current conditions, this process will be long, but we are preparing in advance: in 2021 we start with the selection of talents in order to be ready to restore the airline’s full-fledged work in the future,” SkyUp CEO Dmytro Seroukhov said.

Personnel recruitment is carried out in the SkyUp principal regions: Kyiv, Kharkiv, Zaporizhia, and Lviv.

The company provides its employees with medical insurance, training at a corporate university and the opportunity to attend external trainings, discounts on tour operator’s offers, high-level hotel accommodation and three meals a day on business trips as well as service tickets.

SkyUp LLC was registered in Kyiv in June 2016. The founder is ACS-Ukraine LLC of Tetiana and Yuriy Alba, who also own the JoinUp! tour operator.

The European Union has approved a humanitarian budget of EUR 1.4 billion, of which EUR 28 million will be allocated to finance projects to overcome the crisis caused by coronavirus (COVID-19) pandemic and climate change in Ukraine, the Western Balkans and the Caucasus. The relevant information was circulated by the European Commission in Brussels on Tuesday. “As global humanitarian needs worsen further due to the consequences of the coronavirus pandemic and the effects of climate change, the European Commission has adopted its initial annual humanitarian budget of EUR 1.4 billion for 2021. This represents an increase of more than 60% compared with the initial humanitarian budget of EUR 900 million adopted last year,” the commission said in a press release.

In addition, EUR 505 million will be allocated to Africa to support people affected by the long-term Lake Chad Basin crisis, impacting Nigeria, Niger, Cameroon, and Chad; those suffering from food and nutrition crisis, worsened by security incidents and community conflicts, in the Sahel (Burkina Faso, Mali, Mauritania, and Niger); and those displaced by armed conflicts in South Sudan, Central African Republic and Horn Of Africa (Somalia and Ethiopia).

Some EUR 385 million of EU humanitarian funding will be allocated to the needs in the Middle East and Turkey to help those affected by the Syria regional crisis, as well as the extremely severe situation in Yemen. Some EUR 180 million in humanitarian assistance will continue to help the most vulnerable populations in Asia and Latin America. In Latin America, this includes those affected by the crises in Venezuela and Colombia.

“The European Union will also continue to provide help in Asian countries such as Afghanistan, where the conflict has been qualified as one of the deadliest conflicts worldwide, and Bangladesh, which is currently hosting almost one million Rohingya refugees from Myanmar. The EU will also allocate EUR 28 million to fund projects addressing crises in Ukraine, Western Balkans and the Caucasus,” the commission said in the statement.

The rest of the funding, EUR 302 million, will be used for EU humanitarian air services and for unforeseen humanitarian crises or sudden peaks in existing crises.

Minister of Foreign Affairs of Ukraine Dmytro Kuleba and Deputy Prime Minister, Minister of Foreign Affairs and Expatriate Affairs of the Hashemite Kingdom of Jordan Ayman Al-Safadi discussed the issue of trade development and the role of Ukrainian exports in strengthening food security in Jordan.

According to the website of the Ukrainian Foreign Ministry on Monday, during a telephone conversation with his Jordanian counterpart, Kuleba spoke in favor of the restoration of the meetings of the joint Ukrainian-Jordanian commission on trade and economic cooperation in 2021.

Al-Safadi, in turn, supported the proposal of his Ukrainian counterpart to send a delegation of Jordanian business to Ukraine to get acquainted with the opportunities that our state provides for mutually beneficial trade and investment.

The parties also discussed the attraction of Jordanian students to study at Ukrainian universities, the development of events in the Middle East and North Africa region, further cooperation between Ukraine and Jordan within the international organizations. The ministers also exchanged invitations to carry out bilateral visits after the improvement of the epidemic situation.

The Office of the National Investment Council under the President of Ukraine proposes to create the State Fund of Funds and the National Investment Fund (NIF) with shares of large state-owned enterprises (SOEs) for holding an IPO, Head of the Office Olha Mahaletska has said.

“Among the initiatives that are proposed to be considered for the National Economic Strategy of Ukraine is the creation of a National Investment Fund for the transformation of state-owned enterprises, the stakes in which will be under its management, into effective and profitable companies, as well as the State Fund of Funds. It will activate the development of the investment fund industry,” she said, presenting the Office’s proposals to the National Strategy until 2030.

The expected effect of the launch of the State Fund of Funds exceeds 1% of GDP, Mahaletska added.

According to her, the State Fund of Funds invests in other funds instead of directly investing in stocks and bonds of companies. The mechanism of operation is the financing of investment funds that have already received investments from a limited list of first-class foreign investors, such as the EBRD and IFC.

The seed capital of the State Fund of Funds will be the national budget of Ukraine (10-20%) and international financial institutions (IFIs, 80-90%).

Earlier, the government of the country considered the possibility of creating a “fund of funds” to support Ukrainian startups on the basis of public-private partnerships. However, instead, in 2019, the Ministry of Finance launched the Ukrainian Startup Fund.

As for the NIF, it is proposed at the first stage to transfer shares of 10-15 large state-owned enterprises to its management, and in the future this number can be increased, Mahaletska said.

According to her, the main task of such an investment fund is to increase the efficiency of state-owned enterprises through the corporatization. In particular, the NIF will be able to appoint its representatives to the company’s supervisory boards.

“The task of the highest level is to prepare the enterprise for an initial public offering of its shares on a stock exchange,” Mahaletska said.

Earlier, Head of the National Securities and Stock Market Commission Tymur Khromaev proposed to create a National Investment Fund, which will include minority stakes in about 20-30 strategic enterprises. The IPO of this fund will increase the investment attractiveness of Ukraine and provide the prerequisites for a successful IPO for these enterprises.

In recent years, the idea of creating a National Welfare Fund has been promoted by the National Securities and Stock Market Commission, citing as an example the successful experience of such a fund in Romania and a number of other countries. However, these proposals were met with no response until recently.

Ovostar Union, one of the leading producers of eggs and egg products in Ukraine, in 2020 reduced sales of eggs by 4% compared to 2019, to 1.104 billion pieces.

According to the group’s report on the Warsaw Stock Exchange, the volume of exports fell more significantly, by 33.5%, to 349 million units, as a result of which the share of exports fell from 46% to 32%.

The average price of eggs in hryvnias increased by 2%, to UAH 1.634 per egg, while in dollar terms decreased by 2%, to $ 0.061.

The company reported that egg production last year increased by 5%, to 1.672 billion pieces, while egg processing decreased by 4%, to 552 million pieces.

Production of liquid egg products decreased by 3%, to 13,504 tonnes, while dry egg products increased by 6%, to 3,161 tonnes.

The volume of sales of dry egg products increased by 17%, to 3,270 tonnes, in particular exports rose by 9.9%, to 2,268 tonnes, but its share decreased from 74% to 69%.

The volume of sales of liquid egg products decreased by 3%, to 13,281 tonnes, in particular exports by 28.7%, to 4,647 tonnes, and its share from 47% to 35%.

The average price of dry egg products increased by 3% in hryvnia terms, to UAH 110.84/kg and fell by 1% in dollar terms, to $ 4.11 per kg.

The average price of liquid egg products decreased by 11% in hryvnia terms, to UAH 32.93 per kg, in dollar terms by 15%, to $ 1.22 per kg.

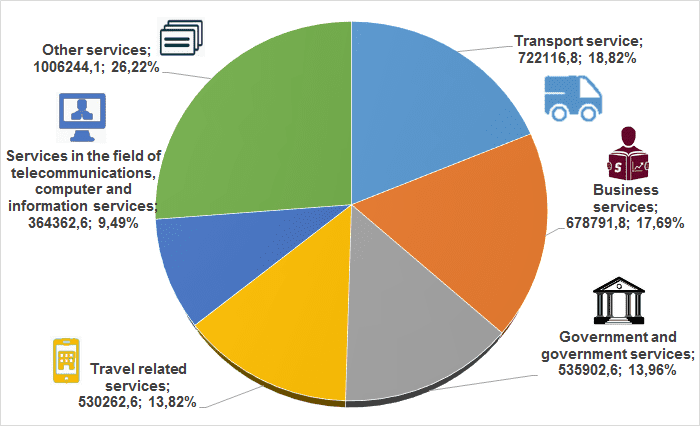

Structure of import of services for 9 months of 2020 (graphically).