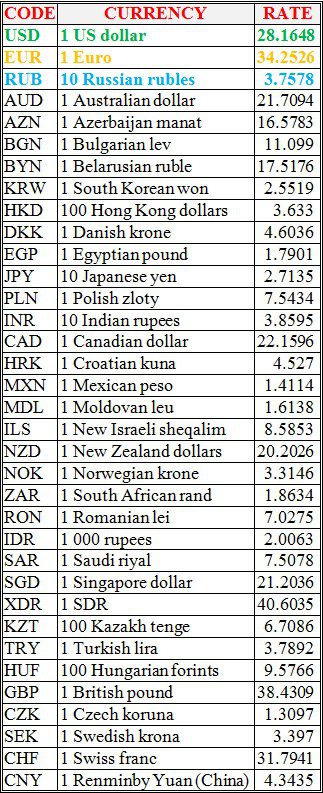

National bank of Ukraine’s official rates as of 25/01/21

Source: National Bank of Ukraine

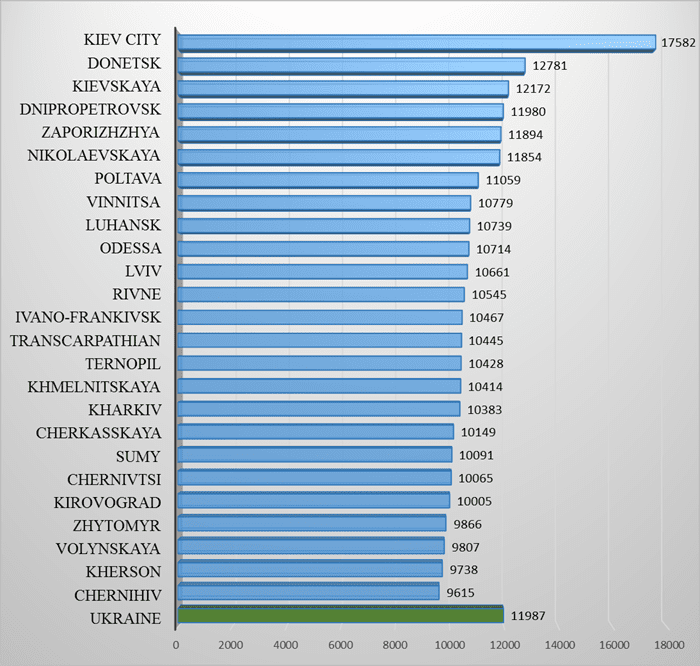

Average monthly wage by region in Nov 2020, UAH.

The introduction of immune passports in Ukraine is not excluded, but it is necessary to calculate why and how it will be carried out, because not all Ukrainians will be able to be vaccinated, said Ukrainian Minister of Health Maksym Stepanov.

“Regarding immune passports, this is a very serious and very delicate discussion. There are international vaccination certificates in the world. They were used, for example, for vaccinations against yellow fever. I do not exclude that something like this could happen. We must not forget that we have a category of citizens who cannot be vaccinated for medical reasons. This is at least allergic reactions from any vaccine. This can have serious consequences for humans,” he said in the air of the Ukraine 24 TV channel.

He also noted that an immune passport will not eliminate all problems.

“Probably, there may be some restrictions. This is a kind of fantasy, when you come to some country and you neither go through self-isolation regime, nor take a test, and if you don’t have immune passport, then you should pass a test. Here exists a discriminatory issue,” added Stepanov.

An immune passport is a document confirming that a person is not contagious with a coronavirus due to the immunity he has received. The introduction of such a document is being discussed in some countries.

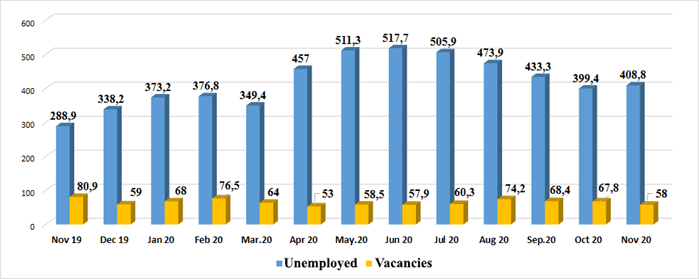

Number of unemployed in Ukraine and job opportunities, Nov 2019-Nov 2020.

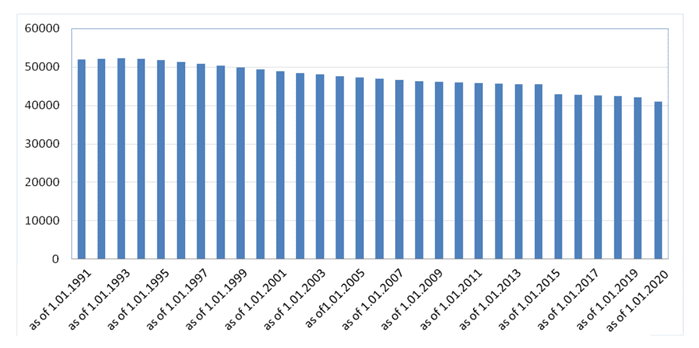

Dynamics of changes in population of Ukraine from 1991-2020.

SSC of Ukraine