Biosphere Corporation has postponed the launch of the diaper production line with Italian equipment for a month, but plans to start the mass production of diapers in May, the corporation’s press service has told Interfax-Ukraine.

“Despite the quarantine and the impossibility of the Italians to visit our factory in Dnipro, our specialists remotely learned how to assemble, understood the process and assembled the equipment within a month. It will be launched a few weeks later than planned, but we are already preparing to launch it,” the press service said.

The corporation invested in Italian equipment for that line, the installation of which was postponed due to quarantine in Italy.

The Biosphere Corporation has been operating in Ukraine for over 20 years. Its products are presented in about 20 markets of Europe and Asia. The product portfolio includes more than 2,000 items.

McDonald’s Ukraine Ltd. (Kyiv), foreign-owned enterprise, which is developing the U.S. fast food restaurant chain McDonald’s in Ukraine, has suspended the recruitment of new employees due to quarantine and aims to maintain the current team.

“The closure of restaurants affected the company’s activity. Most of the business does not work, because restaurants are closed, and food can only be purchased through delivery or McDrive. Since people are the core of our business, we directed all our efforts to maintaining the team, its support and internal communication with employees who do not work forcibly,” the company’s press service told Interfax-Ukraine.

To date, the company’s staff consists of almost 10,000 people, about 60% of them, are now idled due to the closure of restaurants under quarantine. In particular, about 55 restaurants of the U.S. chain are working with delivery partners, or through McDrive. No more than 40% of the company’s staff supports the operation of these restaurants.

“All employees of closed restaurants and those employees, who are over 55 years old, received payments for idle period or got paid leaves. In general, this is almost 60% of the McDonald’s team in Ukraine. Some employees chose unpaid leave to use later annual paid leave for the vacation. In addition, we have suspended recruitment and plan to save the jobs of our employees.”

The McDonald’s restaurant chain has 92 restaurants in 19 cities throughout Ukraine.

Kyiv-based Rauta Group LLC, in cooperation with the Confederation of Builders of Ukraine and the Ukrainian Steel Construction Center, has developed a design of prefabricated mobile hospital, which can be constructed within two weeks.

The company said that a mobile hospital has enough space for accommodation of 72 patients and comfortable conditions for work of medical staff. The construction contains two autonomous zones with wards for patients in moderate and critical condition, as well as an intensive care unit, offices for the chief doctor and head nurse, rest rooms for the staff and other premises.

The hospital structure consists of prefabricated sandwich panels which meet all construction standards, sanitary requirements, safety regulations and energy efficiency standards. The design of the building provides a possibility to use renewable energy sources such as solar panels and heat pumps.

Technologies and materials which are highly resistant to viruses, bacterium and frequent sanitation are used in the structure.

The life-time cycle of such a building is more than 30 years.

General Manager of Rauta Group Andriy Ozeychuk said that the project is highly optimized for using ready-made solutions that can be mounted manually without use of wet processes and welding.

“If necessary, such a modular hospital can be easily disassembled and moved to another region, as well as expanded or converted for other purposes,” he said.

Ozeychuk also stressed that “the project of a domestic company should draw attention of the Health Ministry for systemic response to challenges of the pandemic, as well as for the elimination of negative influence of any epidemics and disasters on Ukrainian citizens in future.”

Rauta Group was set up in 2014. Its core business is the design of constructions, supply and assembly of construction materials. The company has a license for the construction of facilities with medium (CC2) and high (CC3) consequences.

According to the unified state register, the owner of a 100% stake in the statutory capital of the company is Andriy Ozeychuk.

The statutory capital of the company amounts to UAH 388,600.

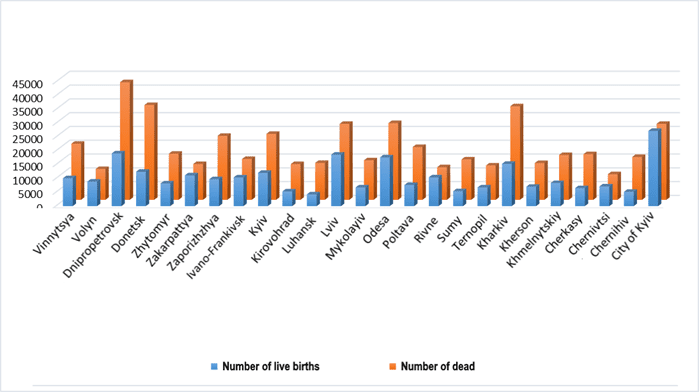

Ratio of fertility and mortality by region as of of Jan 31, 2020

Ukrposhta JSC and the Chinese international logistics operator Cainiao Network, part of the Alibaba Group, launch cargo flights to Ukraine.

Such cooperation will reduce the delivery time of orders from AliExpress under quarantine. Air routes started from the cities with the largest Cainiao distribution centers in Europe, the Ukrposhta press service said on Thursday.

According to the company, the partners in organizing flights are Eleron Airlines, AirBaltic and the national postal operator of Latvia. Regular flights (with a carrying capacity of five tonnes) are carried out by AN-26 aircraft to Lviv, where the parcels undergo customs clearance, sorting and will be delivered to recipients in Ukraine. At the first stages, the aircraft will arrive in Lviv twice a week, but the schedule will be revised later depending on the load.

Ukrposhta also reports that the delivery of parcels will be transferred to non-contact mode – all AliExpress orders worth up to $2 will be delivered to the mailbox (in good order). Home delivery options for more expensive items will be carried out either by a courier or a postman.

The Ukrainian postal operator added that in the first quarter of 2020, Ukrposhta delivered over 4 million items from AliExpress, an increase of 26% compared to the same quarter of the previous year. Among the most popular categories of goods that Ukrainians ordered in March were: electronics, accessories, clothing and household goods.

Ukrainian insurance companies in 2019 received UAH 21.632 billion in insurance premiums from individuals, which is 17.4%, or UAH 3.201 billion, more than in 2018, Oleksandr Zaletov, a member of the National Commission for the State Regulating the Financial Services Market, has told Interfax-Ukraine.

According to him, in 2019 the top ten most popular insurance services among the Ukrainian population included life insurance with UAH 4.491 billion (20.8% more), OSAGO insurance with UAH 4.297 billion (11.9% more), KASKO insurance with UAH 4.280 billion (18.9% more), medical insurance with UAH 1.624 billion (24.3% more), accident insurance with UAH 1.392 billion (9.3% more), insurance in the Green Card system with UAH 1.316 billion (36.5% more), property insurance with UAH 1.214 million (8.5% more), insurance of tourists with UAH 1.187 billion (52.1% more), health insurance with UAH 595 million (37.7% more) and financial risk insurance with UAH 436 million (20.4% more).

In his opinion, the growth of insurance services provision to the population, unlike the previous years, is not due to exchange rate differences, but, first of all, to the growing demand for insurance among citizens who travel actively, take care of their health and their loved ones, and also think about providing “financial airbag” in the old age. Thus, for example, in 2019 the number of insured under life insurance programs increased by 52.4%, under travel insurance by 49.3%, under the Green Card system by 50.3%, under KASKO by 67.2%, voluntary insurance of vehicle owners’ civil liability by 39.9%.

He also said that in 2019 insurance companies made insurance payments to the population in the amount of UAH 6.618 billion, which is 11.9%, or UAH 705 million more than in 2018.