The T.B.Fruit group of companies, the largest fruit and berry processor in Ukraine, in 2019 occupied 10% of the world juice market, increasing its share, founder of T.B.Fruit Taras Barschovsky has said.

“It was 8-9% [the share in the world juice market in 2018], depending on the season and consumption. In August, we launch a new plant in Poland, the share will increase significantly,” he told Interfax-Ukraine.

According to Barschovsky, after the launch of the plant in Poland, the group’s share in the world juice market will increase to 12-14%.

According to him, in 2019 T.B.Fruit increased juice production compared to 2018 by 10%.

As reported, T.B.Fruit on May 30, 2019 announced the start of construction of the eighth plant of the fruit and berry processing group in Brzostowiec (Poland), investments in which will amount to EUR45 million.

According to the group, its capacity for processing apples will amount to 300,000 tonnes, strawberry 10,000 tonnes, cherry some 6,000 tonnes, raspberry some 12,000 tonnes, and currant some 7,000 tonnes per year.

T.B.Fruit is a vertically integrated international group of companies with a closed production cycle (growing raw materials, processing, transportation).

The group of companies was created in July 2011 after combining all the assets of businessman Taras Barschovsky.

The deficit of Ukraine’s balance of foreign trade in 2019 totaled $3.63 billion, which is 41.5% less than in 2018 ($6.21 billion) and this is linked to the sharp improvement of trade in services with Russia, the State Statistics Service has reported. Last year, exports of goods and services increased 11.2% to $63.68 billion, while imports – only 6%, to $67.31 billion.

The main improvement was thanks to an increase in the surplus in trade in services by 63.4% to $8.71 billion: their exports jumped by 30.9%, to $15.24 billion, while imports by only 3.5%, to $6.53 billion

At the same time, in particular, the export of Russian services grew at once by 85.3% to $6.18 billion, while their imports from Russia – only by 4.4%, to $0.29 billion. This is probably due to a payment of $2.9 billion, which Gazprom transferred to Naftogaz at the end of the year as part of the execution of the award of the Arbitration Institute of the Stockholm Chamber of Commerce in a dispute between the companies on their transit contract.

At the same time, last year in trade in goods, imports grew faster than exports. In general, over the year, deliveries to Ukraine increased 6.3%, to $60.78 billion, while supplies from Ukraine – 5.8%, to $50.06 billion. As a result, the deficit of trade in goods increased 8.8%, to $10.72 billion.

According to the State Statistics Service, last year there were negative trends in trade with the EU: export growth slowed to 3.9% from 14.3% a year earlier, while imports – to 7.5% from 12.7%, resulting in a deficit in trade with the EU, which expanded by 31.5%, to $4.56 billion.

The export of Ukrainian goods to the EU in 2019, in particular, increased 3%, to $ 20.75 billion, while the import of European goods to Ukraine grew 7.7%, to $24.99 billion.

As reported, the deficit of Ukraine’s balance of foreign trade in 2018 amounted to $5.83 billion, which is 2.3 times worse than in 2017. In 2018, exports of goods and services grew by 8.6%, imports – by 14.3%.

Rauta Group LLC (the Rauta trademark, Kyiv), which designs and assembles pre-fabricated houses, in 2019 doubled sales of Ruukki sandwich panels, while in general the market of imported panels in Ukraine showed a 10% decline.

“The total consumption of imported sandwich panels in Ukraine decreased from 1.01 million square meters in 2018 to 0.91 million square meters in 2019. Industry experts attribute this result to a temporary slowdown in the investment activities of developers due to the general economic situation in country,” Rauta reported.

Thus, the share of Rauta of the market of imported sandwich panels has doubled, to 4.4%.

“Given the current trends in increasing the energy efficiency of commercial buildings, we expect further growth in sales of sandwich panels,” Rauta director Andriy Ozeichuk said.

At the same time, according to him, one of the challenges this year could be the introduction of regulation No. 305, which will significantly affect this market.

“In the long run, the appearance of declarations and self-regulatory organizations will create the prerequisites for the mass application of sandwich panels that comply with State Standards of Ukraine EN 14509 with the highest possible energy efficiency and durability,” the company said.

Ukraine in January 2020 imported 560.66 million kWh of electricity, which makes up 3.7% of the total electricity volume supplied to the country’s energy system, the press service of Ukrenergo has said. Thus, major imports of 449.73 million kWh (80.2%) were supplied to the Burshtyn Energy Island. In particular, 329.11 million kWh (73.18% of the total imports into this trade zone) was imported from Slovakia, which is 2.1 times more than the average monthly indicator in this direction in 2019. Imports from Hungary amounted to 97 million kWh (21.57%), Romania some 23.62 million kWh (5.25%).

“The growth in electricity imports from Slovakia is due to an increase from 400 MW to 600 MW of the capacity of interstate sections between Ukraine and Slovakia from the end of November 2019,” the report says.

In turn, imports to the country’s united energy system amounted to 110.9 million kWh (19.8% of the total imports), of which 93 million kWh (83.86%) were from Belarus, 17.9 million kWh (16.14%) from Russia.

Commenting on measures to ensure the operational safety of the energy system, Ukrenergo noted that in January imports to the united energy system were limited to 475.8 million kWh. The volume of restrictions from the Russian Federation amounted to 374.6 million kWh, from Belarus, respectively, 101.2 million kWh.

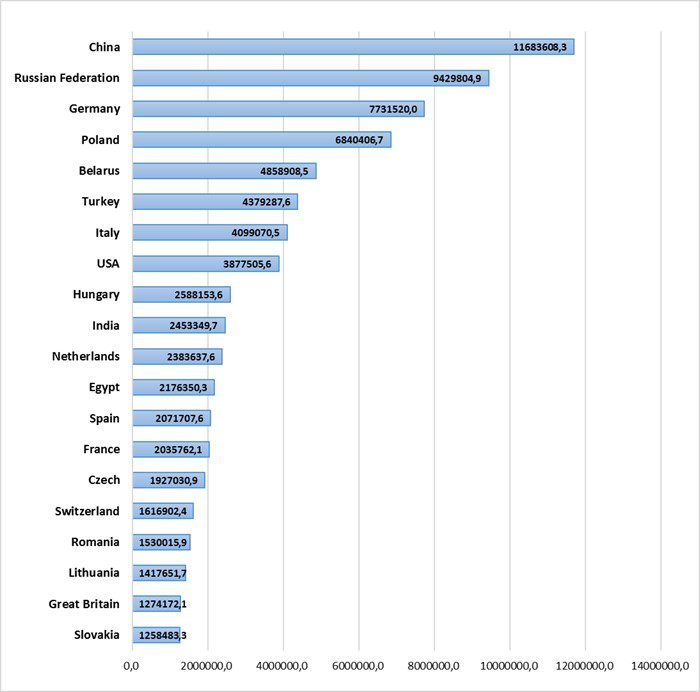

Top 20 countries Ukraine has posted the highest surplus of trade in goods in Jan-Nov 2019 (thousands Usd)

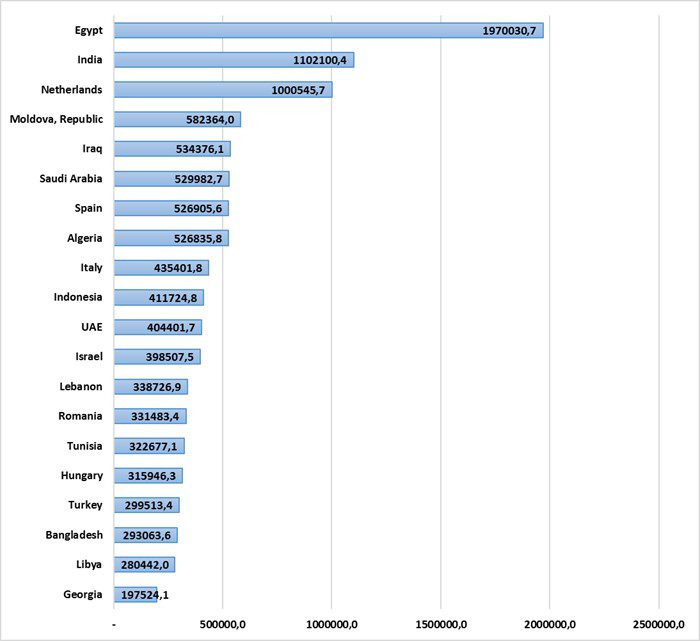

Top 20 countries of Ukraine’s foreign trade partners for 11 months of 2019 (thousand Usd)