The international financial service NovaPay (TM NovaPay) will issue a series of “L” bonds with a total nominal value of UAH 100 million, which will be the 12th such series in the overall bond issuance program.

As noted in the SMIDA information disclosure system, the issuer is again a subsidiary of NovaPay, NovaPay Credit LLC, and the decision was approved by the general meeting of participants on July 16.

According to the announcement, the bonds are planned to be placed among an unspecified group of persons through a public offering, without the involvement of an underwriter, with a nominal value of UAH 1,000.

The company notes that there are currently 10 series of bonds in circulation – from “A” to ‘J’, each with a total nominal value of UAH 100 million, with the exception of series “I”, whose total nominal value is UAH 90 million. It is stated that the total nominal value of NovaPay Credit LLC securities in circulation at the time of the decision is 506.7% of the company’s authorized capital.

The funds raised are planned to be used for lending operations to individuals and legal entities – 80% and 20%, respectively.

NovaPay was founded in 2001 as an international financial service provider, part of the Nova Group (“Nova Poshta”), providing online and offline financial services at Nova Poshta branches. According to the website, the company employs about 13,000 people in more than 3,600 Nova Poshta branches throughout Ukraine. According to the National Bank of Ukraine, the company accounts for about 35% of the total volume of domestic money transfers.

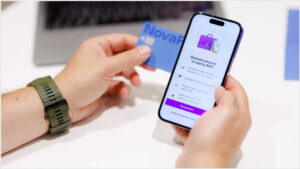

NovaPay was the first non-bank financial institution in Ukraine to receive an extended license from the NBU in 2023, which allowed it to open accounts and issue cards, and was also the first non-bank to launch its own financial app with a wide range of financial services at the end of last year.

As reported, in 2023, NovaPay made three public issues of interest-bearing bonds of series “A”, “B” and “C”, and last year issued six more series of bonds – “D”, “E”, “F”, “G”, ‘H’ and “I”, and this year, another series “J,” all for UAH 100 million. Also this year, a decision was made to issue bonds of series “K” for UAH 100 million. Securities of all series, except for ‘B’ and “I,” are used for the REPO program as an alternative to bank deposits, They are available for purchase in the NovaPay mobile app, while bonds of series “B” and “I” are offered for sale to institutional clients, with interest income paid quarterly.

According to the prospectuses, the bonds of the last four series were issued for three years. The nominal interest rate on them is 17% per annum, while for the previous three it was 18%.

According to the prospectus, NovaPay Credit plans to increase its interest income to UAH 802.1 million this year and to UAH 1 billion 515.1 million next year, and to receive UAH 518.9 million and UAH 1 billion 30.6 million in net profit, respectively.

Last year, the company’s net profit grew to UAH 89.2 million from UAH 40.3 million a year earlier, with revenue increasing to UAH 285.6 million from UAH 95.6 million.

Cattle slaughter volumes in June 2025 amounted to 9.1 thousand tons, which is 5 thousand tons less (-34%) compared to May 2025 and 600 tons less (-6%) compared to June 2024, according to the Milk Producers Association (MPA).

The industry association noted that in January-June 2025, cattle slaughter in Ukraine amounted to 83.7 thousand tons, which is 5 thousand tons less (-6%) than in the same period last year. In June 2025, enterprises produced 70% of beef from the total slaughter volume, and private households produced 30%.

Cattle slaughter volumes at agricultural enterprises in June amounted to 6.4 thousand tons, which is 500 tons more (+8%) than in May 2025 and 1.5 thousand tons more (+31%) than in June 2024. In January-June 2025, cattle slaughter volumes at agricultural enterprises amounted to 38.6 thousand tons, which is 1 thousand tons more (+3%) than in the same period last year.

In private households, cattle slaughter in June amounted to 2.7 thousand tons, which is 5 thousand tons (-65%) less than in May of this year and 2.1 thousand tons (-44%) less than in June 2024. In January-June 2025, cattle slaughter in private households amounted to 45.1 thousand tons, which is 6.4 thousand tons (-12%) less than in the same period last year.

The total slaughter of farm animals, including not only cattle but also pigs, sheep, and poultry, in January-June 2025 amounted to 1.13 million tons, which is 5% less than in the same period last year. The most significant increase in slaughter volumes was recorded by agricultural enterprises in Zakarpattia (+227%), Zaporizhia (+38%), Kharkiv (+32%), Mykolaiv (+27%), and Chernivtsi (+19%) regions.

State-owned PrivatBank (Kyiv) received UAH 17.9 billion in net profit in April-June 2025, which is 7.1%, or UAH 1.1 billion, more than a year ago, when net profit amounted to UAH 16.7 billion.

The bank’s pre-tax profit amounted to UAH 22.7 billion, which is 7.6%, or UAH 1.6 billion, more than in the second quarter of 2024.

According to the report, PrivatBank’s net interest income increased by 20.2% compared to the second quarter of 2024, to UAH 19.2 billion, while net commission income increased by 8.4%, to UAH 6.9 billion.

Net income from foreign exchange transactions for the reporting period increased by 4.9% to UAH 1.46 billion. In the second quarter of 2025, PrivatBank significantly reduced losses from foreign currency revaluation to UAH 306 million, compared to UAH 1.1 billion in the same period last year.

At the same time, employee compensation expenses increased by 31.9% to UAH 3.8 billion, while other operating and administrative expenses increased by 23.7% to UAH 2.9 billion.

Funds in accounts of individuals in the second quarter of 2025 increased by 12.7%, or UAH 73.5 billion, to UAH 654.7 billion, and the number of individual customers increased to 18.04 million.

The volume of PrivatBank’s loans and advances remained stable overall, but their structure changed significantly. In particular, the bank reduced its investments in NBU deposit certificates by 35.1%, from UAH 112.2 billion in the second quarter of 2024 to UAH 72.8 billion in the second quarter of 2025. At the same time, term deposits with other banks increased 10.4 times, from UAH 3.8 billion to UAH 44.3 billion.

It is noted that PrivatBank’s loan portfolio grew by 26.8% to UAH 130.1 billion, and the number of the bank’s business clients increased from 918,000 to 930,000.

At the same time, PrivatBank’s total assets for the second quarter of 2025 increased by 3.9%, or UAH 29.1 billion, to UAH 781.9 billion compared to the first quarter.

As of June 30, 2025, PrivatBank had 1,170 separate divisions registered in the State Register of Banks. Of these, 9 are branches, 1 is a representative office, and 1,160 are offices belonging to various classification groups. Of these branches, 65 are temporarily closed, including 19 in the Luhansk region, 15 in the Donetsk region, 21 in the Zaporizhzhia region, and 10 in the Kherson region.

According to the National Bank of Ukraine, as of April 1, 2025, PrivatBank ranked first in terms of total assets among 60 banks, with UAH 945.4 billion, or 25.2% of the market.

On July 24, the Ministry of Energy of Uzbekistan, the State Oil Company of Azerbaijan (SOCAR), and Uzbekneftegaz signed a production sharing agreement (PSA).

The document provides for geological exploration and further production of hydrocarbons in investment blocks of the Ustyurt oil and gas region.

Within the framework of the PSA, 3D seismic exploration is planned to be carried out on an area of at least 1,000 square kilometers. If a commercial deposit is discovered, the parties will proceed to its development and production.

“The partnership with SOCAR reflects New Uzbekistan’s strategic desire to diversify its sources of investment and introduce best international practices. The Ustyurt region has high potential, and the signing of the PSA opens up new horizons for its effective development. We are confident that this project will be an important driver of technological progress and economic growth,” said Minister of Energy Dzhurabek Mirzamahmudov.

“The signing of this agreement is evidence of our long-term strategy for the development of the energy sector in Central Asia and the Caspian region. SOCAR is enthusiastic about implementing the project, applying its accumulated experience and advanced technological solutions,” said SOCAR President Rovshan Najaf.

Uzbekneftegaz Chairman Bakhodir Sidikov said the agreement would strengthen the company’s position as a “reliable and innovation-oriented partner open to international cooperation and large-scale investments.”

In May 2018, Uzbekneftegaz SOCAR and BP Exploration (Caspian Sea) signed a memorandum proposing that the companies consider joint geological exploration of the Aralmore, Samsko-Kosbulak, and Baiterek investment blocks in the Ustyurt district.

Regular local elections in Ukraine, which according to electoral law should have taken place on the last Sunday of October this year simultaneously across the country, will not be held, according to the Central Election Commission.

“The date of such elections shall be set by the Verkhovna Rada of Ukraine no later than 90 days before the day of voting. In connection with the full-scale armed aggression of the Russian Federation in Ukraine, martial law has been introduced, during which no elections shall be organized or held. Therefore, the decision to schedule regular local elections has not been made by parliament,” the CEC said in a statement on its website.

In view of this, the CEC states that there are no grounds for submitting candidates to local territorial election commissions or for forming new territorial election commissions at various levels to prepare and conduct local elections in Ukraine.

The CEC also drew the attention of local political party organizations, which are responsible for submitting candidates to the TEC, that the prerequisite for submitting nominations is the adoption by the Verkhovna Rada of Ukraine of a decision on the appointment of regular local elections and the determination of the date for their conduct.

“If it weren’t for Russia’s aggression and the terrible war it started against Ukraine, we would now be entering the period of preparation and organization of regular local elections. In particular, in accordance with the requirements of the electoral law, local branches of political parties would have the opportunity to submit nominations for the new composition of territorial election commissions. However, during the period of martial law, no elections are organized or held, so the members of the TEC, whose composition was formed during the regular local elections on October 25, 2020, continue to exercise their powers until the formation of the new composition of the relevant territorial election commission,” explained Commission member Serhiy Postyvy.

The plants of the Ostchem nitrogen holding, which unites the nitrogen businesses of Group DF, produced 849,900 tons of mineral fertilizers in January-June 2025, down 7.47% from the same period in 2024, when 918,500 tons of fertilizers were produced, according to a press release issued by the holding on Monday.

According to the report, Cherkasy Azot produced 567,100 tons of products in the first half of the year, which is 21% less than last year. Rivneazot increased production by 40.9% to 282,700 tons from 200,700 tons last year.

The overall decline in production at the holding company was explained by forced equipment shutdowns at Azot in Cherkasy in the first quarter of 2025, as well as unstable energy supplies. During this period, the holding company redistributed production loads between plants and increased fertilizer production at Rivneazot.

“Our priority remains the stable supply of fertilizers to Ukrainian farmers, even in the most difficult times. The success of spring and autumn field work depends on this. In wartime, technological flexibility, adaptability, and non-standard management decisions are paramount for us as a manufacturer. In addition, we continue to invest in production stability and energy efficiency,” said Ostchem Production Director Serhiy Pavliuchuk.

The holding company specified that the production structure has changed slightly compared to last year. In the first half of the year, ammonium nitrate was the most produced product, with 355,700 tons. Last year, this figure was 362,900 tons. UAN came in second place with a production volume of 308,900 tons. In this segment, the share of Ukrainian production remains high due to the logistical advantages of Ukrainian manufacturers. Urea came in third with 138,300 tons (183,600 tons last year). A small share of production falls on VAS – 16,200 tons and ammonia – 22,600 tons.

The release notes that against the backdrop of declining domestic production, the flow of uncontrolled cheap imports into Ukraine continues to grow: in the first half of the year, 1.5 million tons of traditional fertilizers (nitrogen and complex) were imported into Ukraine, including 828,000 tons of nitrogen fertilizers. At the same time, imports of ammonium nitrate amounted to 190,000 tons (176,600 tons last year), urea – 379,600 tons (311,300 tons), and UAN – 61,490 tons (50,800 tons).

“For the first time, the volume of urea imports has more than doubled the volume of Ukrainian production, which is an alarming signal for the entire industry and requires systemic solutions,” Ostchem concluded.

Ostchem is a nitrogen holding company owned by Dmitry Firtash’s Group DF, which brings together the largest mineral fertilizer producers in Ukraine.

Since 2011, it has included Rivneazot and Cherkasy Azot, as well as Severodonetsk Azot and Stirol, which are not operating and are located in the occupied territories.

Cherkasy Azot (Cherkasy, Ukraine) is one of Ukraine’s largest chemical companies. Its design production capacity is 962,700 tons of ammonia per year, 970,000 tons of ammonium nitrate per year, 891,600 tons of urea per year, and 1 million tons of UAN per year.

PJSC Rivneazot is one of the largest chemical companies in Western Ukraine. On April 12, 2024, Group DF and South Korea’s Hyundai Engineering signed an agreement to build a chemical hub in Rivne. The project involves the construction of plants for the production of green ammonia and hydrogen based on renewable energy sources, as well as new enterprises and production sites for the production of nitrogen fertilizers and chemical derivatives.