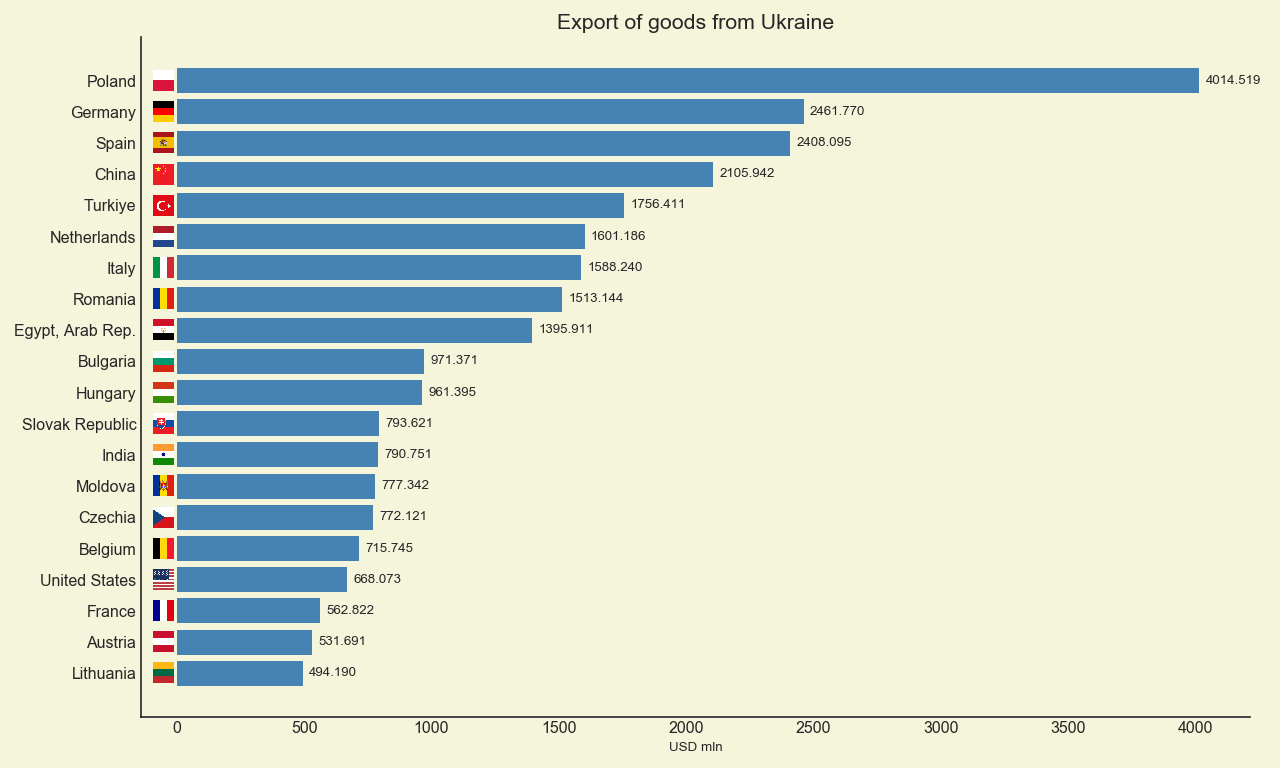

Geographical structure of Ukraine’s foreign trade (exports) in January-October 2024, million USD

Source: Open4Business.com.ua

“On March 6, Kyivteploenergo announced a tender for compulsory motor liability insurance, according to the Prozorro e-procurement system.

The tender was also announced for services related to compensation for damage and negative consequences of transportation of dangerous goods by rail for CHPP-5 and CHPP-6, compulsory personal insurance against accidents in transport, compulsory liability insurance of subjects of transportation of dangerous goods.

The total expected cost of services procurement is UAH 3.913 mln.

The last day for submitting an application for participation is March 14.

US President Donald Trump’s administration plans to revoke the temporary legal status of some 240,000 Ukrainians fleeing the conflict with Russia, potentially putting them on a fast-track deportation path, Reuters reported on Thursday, citing senior officials and three sources familiar with the matter.

The publication writes that this is part of a broader effort by the Trump administration to revoke the legal status of more than 1.8 million migrants who are allowed to enter the United States under temporary humanitarian programs launched during the Biden administration.

It was previously reported that in January, the U.S. Citizenship and Immigration Services announced the suspension of the United for Ukraine program for Ukrainians fleeing war in the U.S. due to the January 20, 2025 executive order “Securing Our Borders.”

China’s Ping An Insurance is the most expensive brand among the world’s insurance companies for the ninth consecutive year, according to an annual study by consultancy Brand Finance.

Its value remained virtually unchanged over the year ($33.6 billion), while the brand value of German insurer Allianz increased by 9% (to $26.75 billion), allowing it to slightly close the gap.

Third place goes to France’s AXA ($19.83 billion, up 20%), which pushed China Life Insurance ($18.32 billion, up 5%) into fourth place. Rounding out the top five is Italy’s Generali ($16.98 billion, up 47%).

There are four U.S. brands in the top 10: Allstate Corp – $15.95 billion, GEICO – $15 billion, MetLife Inc. – $14.59 billion and Progressive Corp. – $14.24 billion. Between them, China’s PICC ($15 billion) ranks eighth.

The fastest growing brand was Japan’s Nissay/Nippon Life Insurance, whose value almost doubled (+94%) and reached $9.2 bln. This was due to the company’s expansion outside the local market, including through the purchase of a 20% stake in the U.S. company Corebridge Financial.

The total value of the top 100 insurance brands for 2024 grew 9%, according to the report. Meanwhile, U.S. brands rose in value by 12%, with the result that they now account for a quarter of the total value.

Ukrainian car fleet in February this year was replenished with almost 17 thousand imported from abroad used cars, which is 5% less than in February last year, reported “UkrAvtoprom” in the Telegram channel.

At the same time, compared to January-2025, the demand for such cars increased by more than 21%.

According to the report, the average age of used cars that switched to Ukrainian registration in February amounted to 9.5 years.

According to “UkrAvtoprom”, the largest share in the segment of imported second hand cars with a large gap belongs to gasoline cars – 46%. Next come diesel cars – 23%, electric cars – 22%, hybrids – 5% and cars with SBB – 4%.

The leader of this segment of the car market is Volkswagen Golf – 900 registrations.

The top five most popular models are also Renault Megane – 653 units, Skoda Octavia – 592 units, Volkswagen Tiguan – 490 units, Audi Q5 – 449 units.

In total, in January-February, the first registration in Ukraine passed almost 31 thousand used cars, which is 10% less than in the same period in 2024.

As reported, in 2024 the demand for used foreign cars increased by 4% by 2023 – up to 222.1 thousand units, which amounted to 75% of the passenger car market.

At the same time, in February the Ukrainian car fleet was replenished with 17.8 thousand used cars from abroad – one third more than in February-2023.

Sales of new passenger cars in February this year decreased by 20% compared to the same month of 2023 – to 4.8 thousand units, AUTO-Consulting reports.

According to the report on the group’s website, the biggest drop occurred in the segment of so-called “budget cars” – by almost 54%, also the sales of cars of medium price range decreased by 20%.

In February, the leadership was held by Toyota, but the second place was taken by Skoda with 8.4% of the market. Finishing third in February was Renault.

”Interestingly, four of the top 10 automobile brands in February showed growth, but in the end the market still lost 20%,” the report states.

AUTO-Consulting emphasizes that the decline in the electric car segment was more widespread than the overall decline in the market for new passenger cars – demand for them decreased by 37%, and their share amounted to only 15.6% against 20% in February-2024.

According to analysts, compared to January this year, sales of new passenger cars increased (by 5.3%), but at the end of January-February decreased by 13.6% compared to the two months of 2024.

“So, we have a negative result in the auto market for two months so far. This has already brought about changes among the top 20 automobile brands as well. The car market is still moving along the trend of 2017,” the report said.

As reported, according to AUTO-Consulting, in 2024, sales of new passenger cars in Ukraine increased by 9.8% to 2023 – up to 71.3 thousand units.