The volume of global debt, including liabilities of governments, households, financial and non-financial companies, increased by $7.2 trillion to a record $318.4 trillion in 2024, according to the Institute of International Finance (IIF).

However, the report notes that the growth was significantly lower than in 2023, when debt increased by $16 trillion due to the monetary policy of the U.S. Federal Reserve.

The debt-to-GDP ratio rose 1.5 percentage points to 328% last year due to a slowdown in the global economy. The rise in the ratio was recorded for the first time in four years, i.e. since the COVID-19 pandemic.

About 65% of the growth in global debt in 2024 was in emerging markets, primarily China, India, Saudi Arabia and Turkey. In mature markets, debt accumulation was mainly in the US, UK, Canada and Sweden.

The public sector accounted for almost two-thirds of the increase in debt. Global government debt has surpassed $95.3 trillion, up from $70 trillion in the run-up to the pandemic in 2019.

IIF forecasts global government debt to increase by more than $5 trillion in 2025, mainly due to increased borrowing by the US, PRC, India, France and Brazil.

Total debt in emerging markets grew by $4.5 trillion in 2024 and reached an all-time high of 245% of GDP. These nations need to repay a record $8.2 trillion in liabilities this year, with about 10% of that debt denominated in foreign currencies.

“We expect the pace of global debt accumulation to slow further, especially in the first half of 2025,” the report said. – With global economic policy uncertainty at a record high – above that seen at the peak of the pandemic – and borrowing costs still high, a more cautious stance by borrowers is likely to curb private sector demand for credit.”

Earlier, the Experts Club think tank analyzed the level of debts of the world’s countries to their GDP, video analysis is available in the dynamics from 1950 to 2023, –

https://www.youtube.com/shorts/oT_5cTOnM8k

Issue #2 – February 2025

The purpose of this review is to provide an analysis of the current situation on the Ukrainian currency market and a forecast of the hryvnia exchange rate against key currencies based on the latest data. We analyze current conditions, market dynamics, key influencing factors, and likely scenarios.

February 2025 brought relative stability to the Ukrainian currency market without any sharp jumps, but some trends continue to form the backdrop for future changes. After the January increase in demand for foreign currency, which was typical for the beginning of the year, the situation has gradually leveled off. The hryvnia maintains a balance between internal factors, including the NBU’s monetary policy and the balance of payments, and external factors, including the US Federal Reserve’s decisions, the ECB’s policy, and general trends in international markets.

Analysis of the current situation

The hryvnia remains stable within a narrow range

In early February, the hryvnia exchange rate against the US dollar and the euro tended to decline, but after February 13, the situation stabilized. The dollar on the cash market was in the range of 41.40-42.00 UAH/$, while the euro fluctuated between 43.00-44.00 UAH/€. The bid-ask spread for the dollar remained in the range of 50-60 kopeks, and for the euro it was 60-70 kopeks, indicating a balance between supply and demand.

The depreciation in the first half of the month was caused by several key factors

Ø Increased supply of cash currency – banks imported significant amounts of dollars, which created a temporary oversupply in the market: according to the NBU, the volume of cash dollars imported into Ukraine amounted to $1.316 billion, and cash euros – the equivalent of $450 million, which allows to meet market demand.

Ø The NBU continued to pursue a policy of restraining exchange rate fluctuations by using interventions. An additional factor was the seasonal decline in demand for foreign currency after the holidays.

However, the second half of February brought some changes. Despite the absence of pressure on the hryvnia from global FX market factors, the dollar continued to strengthen on international markets, thanks to strong US economic data and the Fed’s tightening monetary policy rhetoric. The euro, which had been falling in the first half of the month, returned to growth on February 13 and subsequently stabilized after the ECB announced that it might support the economy. These processes drove some appreciation of the euro against the hryvnia.

Dollar exchange rate forecast

Short-term forecast (2-4 weeks)

The dollar is expected to remain in the range of UAH 41.50-42.20/$. The main factors that will influence the market will be the NBU’s decision on the key policy rate on March 6 and the US Federal Reserve’s policy. The expected increase in the NBU’s discount rate may temporarily strengthen the hryvnia, while its maintenance at the current level will allow the exchange rate to fluctuate within the specified range.

Medium-term forecast (2-4 months)

The hryvnia may gradually weaken in the spring, especially if the foreign trade deficit grows. If the current level of key macroeconomic indicators and reserves is maintained, the NBU will be able to control the hryvnia exchange rate, but the average forecast corridor for the dollar will shift to UAH 42.50-44.00/$. The main risks remain possible delays in international financial assistance and an increase in the budget deficit.

Long-term outlook (6+ months)

By the end of the year, the dollar may reach UAH 44.50-45.50/$, especially if economic growth remains low. At the same time, the easing of the US Federal Reserve’s policy in the second half of the year may create preconditions for some stabilization of the exchange rate. However, even in this scenario, the hryvnia remains within the range of the projected average annual exchange rate.

Euro exchange rate forecast

Short-term forecast (2-4 weeks)

The euro is likely to remain in the range of UAH 43.30-44.20/€ with periodic corrections depending on fluctuations in the euro/dollar pair on the global market. If the dollar continues to strengthen, the euro may approach the lower end of the forecast range.

Medium-term forecast (2-4 months)

If the European economy stagnates and the Fed tightens its policy, the euro may fall to 42.50-43.50 UAH/€. At the same time, if the ECB signals its intention to support economic growth, the euro may remain relatively stable.

Long-term outlook (6+ months)

The euro has the potential for a moderate decline in 2025, especially if the ECB continues to ease policy. In this case, the hryvnia may remain relatively stable against the euro or even strengthen slightly.

Recommendations for businesses and investors

In the short term, businesses can focus on the current stability of the hryvnia and continue to diversify their currency risks.

An increase in the share of dollar assets may be advisable, especially if the Fed does not change its tightening policy.

Private investors should take a balanced approach to foreign exchange transactions. Investments in euros may not bring quick short-term profits due to the weakness of the European economy, but the dollar remains a reliable tool for preserving capital.

In the long term, the main risk to the hryvnia exchange rate is a possible increase in the budget deficit and rising inflationary pressures in Ukraine. Savings should be kept in hard currency or diversified into assets less sensitive to exchange rate fluctuations.

This material was prepared by the company’s analysts and reflects their expert, analytical professional judgment. The information provided in this review is for informational purposes only and should not be construed as a recommendation for action.

The Company and its analysts make no representations and assume no liability for any consequences arising from the use of this information. All information is provided “as is” without any additional warranties of completeness, obligations of timeliness or updates or additions.

Users of this material should make their own risk assessments and informed decisions based on their own evaluation and analysis of the situation from various available sources that they consider to be sufficiently qualified. We recommend that you consult an independent financial advisor before making any investment decisions.

REFERENCE

KYT Group is an international multi-service product FinTech company that has been successfully operating in the non-banking financial services market for 16 years. One of the company’s flagship activities is currency exchange. KYT Group is one of the largest operators in this segment of the Ukrainian financial market, is among the largest taxpayers, and is one of the industry leaders in terms of asset growth and equity.

More than 90 branches in 16 major cities of Ukraine are located in convenient locations for customers and have modern equipment for the convenience, security and confidentiality of each transaction.

The company’s activities comply with the regulatory requirements of the NBU. KYT Group adheres to EU standards, having a branch in Poland and planning cross-border expansion to European countries.

Private companies are building new terminals in deep-water ports despite the surplus of transshipment capacity in 2024-2025 marketing year (MY), said Yuriy Vaskov, former deputy minister of development of grommads, territories and infrastructure (Ministry of Development).

“Regarding seaports today we have a surplus of transshipment capacity, but it is a difficult 2024-20525 marketing year … Even in the period of surplus capacity, several companies are building new terminals in deep-water ports, grain terminals. But, unfortunately, still do not have the opportunity to build their own berthing facilities on the lands of the water fund,” he said at the conference ‘Agro Sector 2025: Challenges and Opportunities in the New Realities’, organized by the analytical center We Build Ukraine on Thursday.

According to Vaskov, to increase the flow of private investment in the construction of port infrastructure, changes in legislation are needed, in particular, government decisions that will regulate the issue of construction on water fund lands.

“Tens, maybe even hundreds of millions of dollars now cannot be invested, I emphasize, in private business solely because of the uncertainty of this procedure,” Vaskov emphasized.

The National Bank of Ukraine (NBU) has fined PJSC USK Knyazha Vienne Insurance Group (“Knyazha VIG”, Kiev) for UAH 2.057 million for violation of the legislation on protection of the rights of consumers of financial services, defined by the Civil Code of Ukraine and the laws of Ukraine “On electronic commerce”, “On insurance”, “On financial services and financial companies”.

According to the website of the NBU, the relevant decision of the Committee for supervision and regulation of non-banking financial services markets made on February 24, 2025, based on the results of a scheduled inspection of the company.

In addition, the regulator applied to the company a measure of influence in the form of imposing a fine of UAH 40 thousand for providing it with reporting files with inaccurate reporting indicators for the first half of 2024.

The company is obliged to pay the fines within a month after the decision comes into force.

In addition, the regulator sent the company a written warning for violation of requirements to: the management system of the insurer, the protection of the rights of consumers of financial services, the regulation of the activities of participants of the market of non-banking financial services, the activities of separate subdivisions.

IC “Knyazha VIG” is obliged to eliminate violations, and also the reasons and the conditions promoting their commitment, till April 25.

IC Knyazha VIG is a part of NFG Vienna Insurance Group Ukraine, the main shareholder of which is Vienna Insurance Group AG Wiener Versicherung Gruppe (Austria).

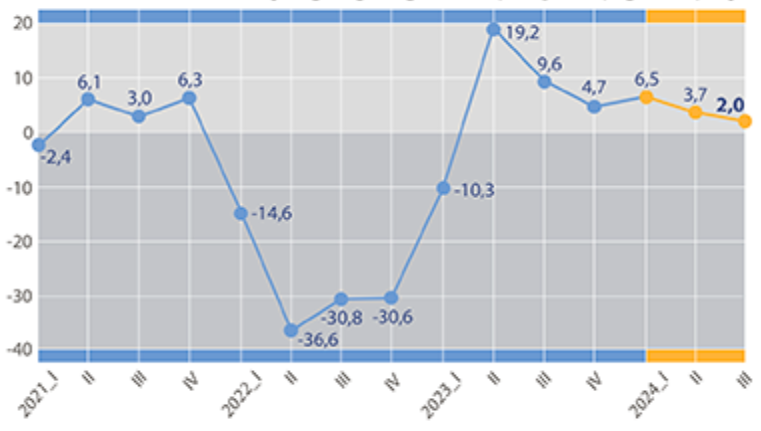

Real GDP percentage changes over previous period in 2014-2024

Source: Open4Business.com.ua