Vienna, 31 July 2024 — The ICMPD is growing with another member: Ireland is the 21st Member State to join ICMPD’s work in finding innovative solutions to regional migration challenges. Ireland’s accession is the latest after Germany (2020), Greece (2021), and the Netherlands (2023) joined the ICMPD in recent years.

“Global migration is increasingly complex and multifaceted. Ireland cannot go it alone; effective migration policy cannot be developed or implemented in isolation. Ireland becoming a member of the International Centre for Migration Policy Development is very welcome, and brings a wealth of expertise which will be an invaluable resource to Irish policymakers,” Irish Minister for Justice Helen McEntee TD, said.

Ireland and the ICMPD have been working together for the past 20 years, collaborating on a number of migration governance projects through research. These include studies around irregular migration and trends and outcomes of regularisation policies, as well as analysis of various policy implementation (MIrreM); evaluating the framework and practice of the Common European Asylum System (CEASEVAL); and producing evidence to support policy in the EU on complementary pathways to admit adult refugees through technical and vocational skills (REF-VET), among many others.

Furthermore, Ireland also holds an active role in migration dialogues supported by the ICMPD, such as the Budapest Process and Prague Process; as well as developing a guide to integrate recently arrived migrants in the region (SPRING); policy research, information sharing, and capacity-building on the Medical Country of Origin (MedCOI) initiative; and in developing methods and strategies to assist survivors of trafficking, sexual abuse, and exploitation of children particularly those committed using online channels (HEROES).

“We are happy to welcome Ireland as our newest Member State. ICMPD’s Member States represent a group of countries highly relevant to and uniquely positioned in tackling issues around migration; and Ireland has been an active stakeholder in these efforts. As a Member State, Ireland will further strengthen the strategic dimension of our engagement with the broader European Union and beyond,” said the ICMPD Director-General Michael Spindelegger.

“Beyond being a destination country for migrants, Ireland’s active collaboration with the ICMPD and the country’s experience in responding to various migration themes, will strengthen our possibilities to respond jointly and more effectively to the opportunities and challenges, and work towards improved migration systems at the regional level,” Mr Spindelegger added.

The ICMPD was founded on the initiative of Austria and Switzerland in 1993, when the migration reality in Europe was dramatically altered by the political changes in Eastern Europe and the Balkan conflicts. The ranks of its Member States saw their first growth in the 1990s with the addition of Hungary in 1995 and Slovenia in 1998. Czechia then followed in 2001; Sweden, Poland and Bulgaria in 2003; Portugal and Croatia in 2004; and Slovakia in 2006.

Romania and Serbia were the next to join in 2011 followed by Bosnia and Herzegovina in 2012 and North Macedonia in 2015. Malta and Türkiye both joined in 2018 followed by Germany in 2020 and Greece in 2021.

Investment banking firm Capital Times (Kyiv) has revised its macro forecast for 2024-2025, worsening its expectations of economic growth by 2.0 percentage points (pp) to 3.1% and inflation by 2.6 pp. – To 9.0%.

“We assume that the cooling economy will lead to negative real GDP in Ukraine in Q4 2024g and Q1 2025. Improvement of the forecast is possible subject to the implementation of mechanisms of budgetary stimulation of the economy, which was announced by representatives of the authorities,” the company said in a press release on Wednesday.

According to it, forecasts of GDP growth and inflation for next year are also worsened by 1.3 pp. – To 2.9% and 7.0% respectively.

It is indicated that Capital Times analysts record signs of economic slowdown and attribute them to a smaller flow of external financial assistance, as well as internal mobilization processes. Among other reasons were cited problems with electricity supply, strengthening trade and budget deficits.

The nominal GDP estimate was cut by 2.2% to $188.3 billion for this year and 1.8% to $205.7 billion for next year.

The company noted that while inflation reached its lowest levels in Q2 2024, there was a sharp acceleration in consumer and industrial inflation in June due to higher electricity prices.

“In the pre-war years, businesses gradually shifted the cost of utility bills to the consumer, but in wartime, there is not enough resource for businesses to cover the additional costs. Therefore, the business immediately lays the growth of production costs in the prices,” the analysts explained.

According to the updated forecast, Capital Times worsened expectations of the average official exchange rate for this year to UAH 40.5/$1 from UAH 39/$1 in the previous forecast, and for the end of the year – to UAH 42.5/$1 from the previously forecasted UAH 41/$1. Analysts are also more pessimistic about the possible trajectory of the hryvnia in 2025: the average annual official exchange rate is forecast at 43.7 UAH/$1, and 45.2 UAH/$1 at the end of the year, while earlier they expected the average exchange rate in 2025 at 42 UAH/$1.

“The accumulation of structural problems with budget financing and decreasing financial support from partners stipulate a gradual devaluation of the Ukrainian hryvnia during 2024. The devaluation trend is very strong and we anticipate hryvnia weakness in the second half of this year,” the release said.

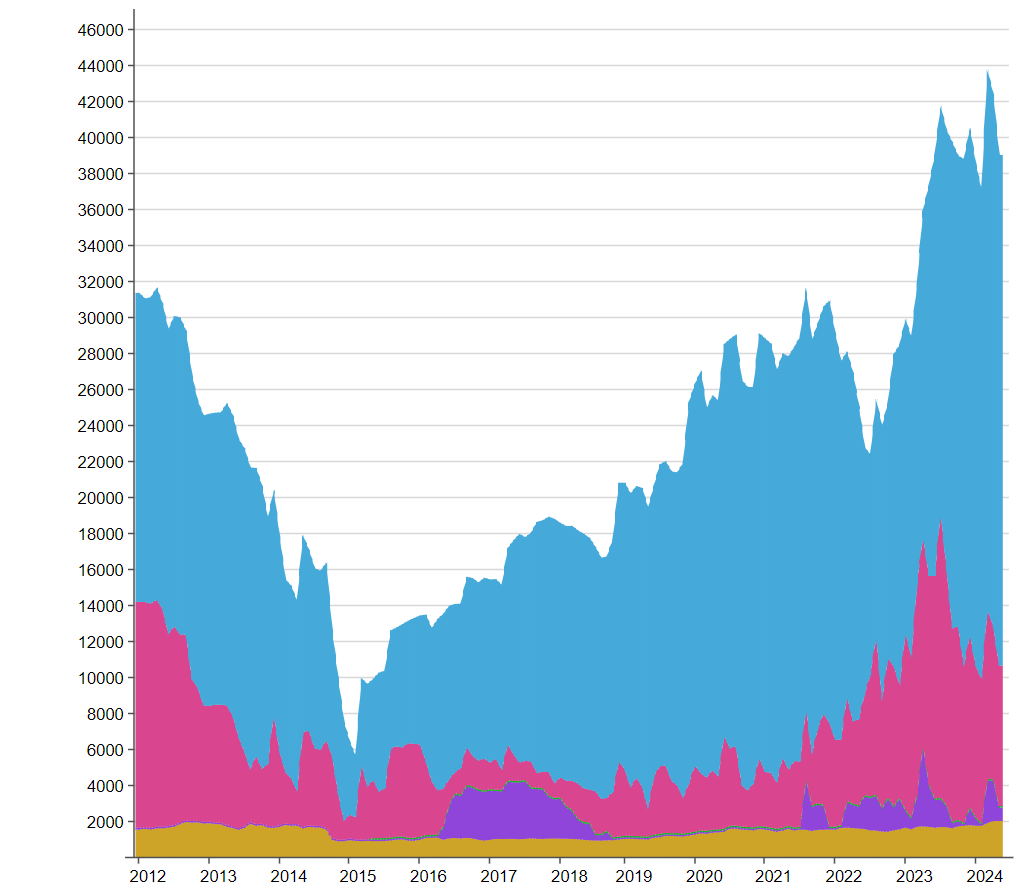

At the same time, analysts improved their forecast for Ukraine’s foreign exchange reserves for this year from $38 bln to $41.5 bln, worsening it for next year from $42 bln to $40 bln.

A positive aspect of the updated macro forecast is the gradual narrowing of the negative trade balance from $37.7bn last year to $36.8bn this year and $35.4bn next year.

Analysts believe that agreement on a plan to restructure external debt, agreements with European partners on the Ukraine Facility program, implementation of the Extraordinary Revenue Acceleration Loans mechanism of providing Ukraine with $50bn, secured by future revenues from frozen Russian assets, and full IMF support are factors that will reduce Ukraine’s dependence on US aid in the coming years, offsetting the risks of the US election results.

“No significant changes on the front, despite a palpable excess of enemy forces. In the second half of the year, we assume more positive news for Ukraine, including progress in the liberation of territories. However, we see 2027-2028 as the base scenario for the end of the war,” Capital Times summarized.

Capital Times, GDP, Ukraine

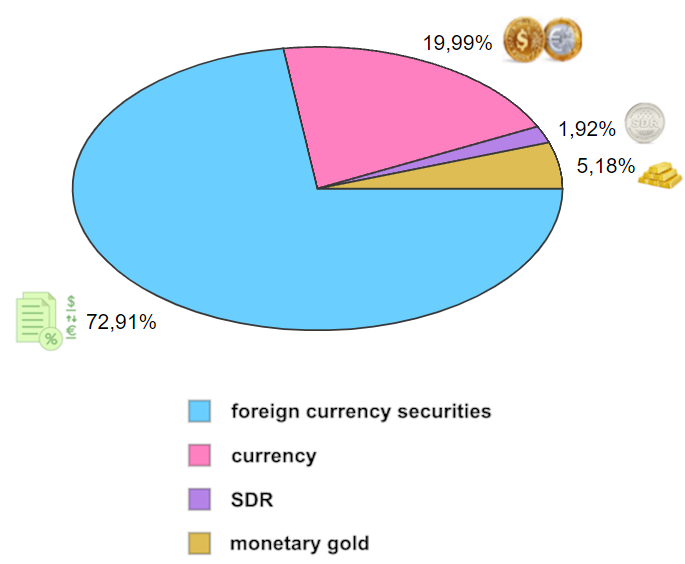

Dynamics of reserves of Ukraine from 2012 to 2024, million USD

Source: Open4Business.com.ua

The United States Agency for International Development (USAID) has launched a new GROW project to support Ukrainian credit unions, according to the USAID website.

“Through a partnership with the World Council of Credit Unions, USAID will expand support for Ukrainian credit unions, enabling them to provide more loans to businesses and individual entrepreneurs,” the report said.

The initiative begins this month and will last for the next four years. The initial investment of resources will be $5 million.

The GROW project will work closely with credit unions in Ukraine to create products and partnerships that will maximize credit union outreach to Ukrainians and positively impact local communities and local economies. The project will also increase access to finance for Ukrainians seeking to start their own businesses and businesses wishing to expand their operations, particularly for micro, small and medium enterprises, cooperatives and agro-producers in rural areas of the country.

In addition, the project will support Ukraine’s long-term priorities for further integration and EU accession, in particular harmonization of the regulatory framework for credit unions with relevant EU requirements.

Since the beginning of 2024, the clients of JSC OTP BANK – individuals – have purchased domestic government bonds for a total amount of UAH 3.1 billion.

The number of transactions in the first half of the year amounted to 1897, which is 137% more than in the same period of 2023.

Investments in domestic government bonds in 2024 were made in two ways: customers purchased bonds directly at auctions of the Ministry of Finance through the OTP Bank UA app or from the Bank’s own portfolio, also using the app.

During the first and second quarters, securities totaling UAH 2.8 billion in equivalent were purchased at the Ministry of Finance auctions.

Total sales from the Bank’s portfolio by the end of the second quarter amounted to UAH 305 million in equivalent.

We remind you that the service for purchasing government bonds from its own portfolio in the OTP Bank UA application was launched two months ago, at the end of May 2024.

“Investing in domestic government bonds is not only an opportunity to support Ukraine’s financial stability in times of war, but also a good opportunity to diversify your savings and earn additional income in both hryvnia and foreign currency. Moreover, the repayment of funds is fully guaranteed by the state, so it is also a guarantee of the safety of savings. We offer our customers different ways to invest – they can buy government bonds directly from the auction or at any convenient time from the Bank’s portfolio, with the best rate, maturity, in the chosen currency, 24/7,” said Valeria Ovcharuk, product owner of OTP BANK.

In total, since the beginning of the full-scale invasion, OTP Bank’s individual clients have invested more than UAH 11.5 billion in government bonds in equivalent.

To learn more about investing in government bonds through the OTP Bank UA app, please follow the link.

International macrofinancial assistance to Ukraine (forecast to 2025 in billion USD)

Source: Open4Business.com.ua